Indonesia Plastic Food Tray Market Size, Share, Trends and Forecast by Resin Type, and Region, 2026-2034

Indonesia Plastic Food Tray Market Summary:

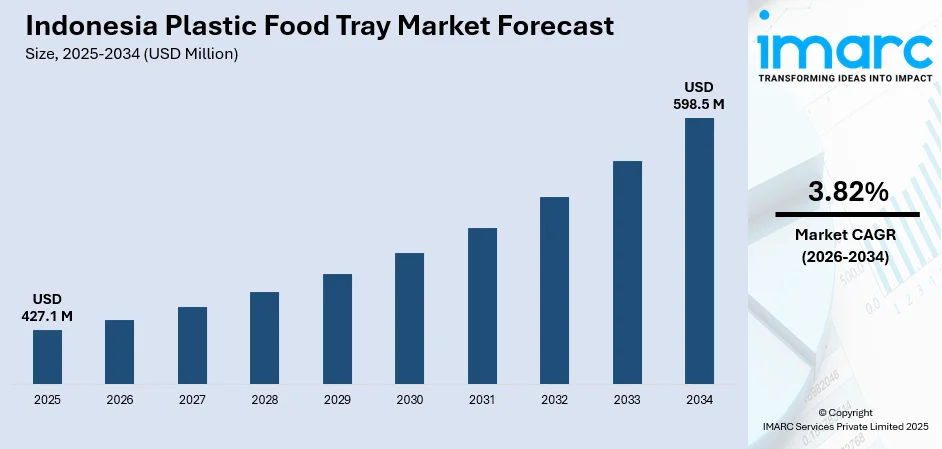

The Indonesia plastic food tray market size was valued at USD 427.08 Million in 2025 and is projected to reach USD 598.47 Million by 2034, growing at a compound annual growth rate of 3.82% from 2026-2034.

The Indonesia plastic food tray market is experiencing steady growth driven by the country’s rapidly expanding foodservice industry, rising urbanization, and increasing consumer demand for convenient and hygienic food packaging solutions. Growing adoption of ready-to-eat meals, expansion of online food delivery platforms, and proliferation of quick-service restaurants are reinforcing the need for durable, cost-effective food trays. Additionally, evolving government regulations on food safety and packaging standards are encouraging innovation in tray design and material composition, supporting the Indonesia plastic food tray market share.

Key Takeaways and Insights:

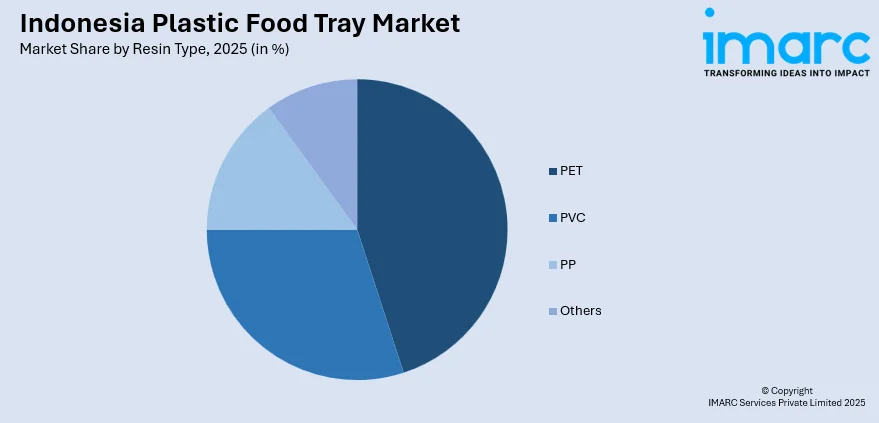

- By Resin Type: PET dominates the market with a share of 42% in 2025, driven by its superior transparency, high barrier properties, lightweight nature, and cost-effectiveness for food-grade packaging applications.

- By Region: Java leads the market with a share of 45% in 2025, supported by the concentration of foodservice establishments, manufacturing facilities, and urban population centers along the Jakarta-Bandung-Surabaya corridor.

- Key Players: The Indonesia plastic food tray market features a moderately competitive landscape with multinational packaging corporations competing alongside established domestic converters. Companies are differentiating through automation investments, recycled-content integration, geographic expansion, and customized tray solutions to capture growing demand from institutional and foodservice segments.

To get more information on this market, Request Sample

The Indonesia plastic food tray market is advancing as the country’s food and beverage ecosystem undergoes a structural transformation driven by urbanization, digitalization, and institutional demand. The expansion of modern retail formats, including branded mini-marts penetrating secondary cities, is replacing traditional wet-market stalls and increasing demand for bar-coded, barrier-packaged trays. Urban households are increasingly allocating larger portions of their food budgets to prepared meals, with the gap between urban and rural spending most pronounced along Indonesia’s most densely populated corridors. For instance, in January 2025, Indonesia launched the Free Nutritious Meals (MBG) program with an IDR 71 trillion (USD 4.3 billion) budget, targeting 82.9 million recipients including schoolchildren and pregnant women, instantly expanding institutional demand for standardized food trays across thousands of serving points nationwide. This convergence of private consumption growth and government-backed programs is creating diversified demand channels for tray manufacturers.

Indonesia Plastic Food Tray Market Trends:

Growing Adoption of Sustainable and Recyclable Tray Materials

The Indonesia plastic food tray market is witnessing an accelerating shift toward sustainable packaging solutions as environmental awareness rises among consumers and regulatory bodies. Manufacturers are progressively incorporating recycled PET content into food tray production, responding to government mandates and consumer preferences for eco-friendly alternatives. For instance, in April 2024, Klöckner Pentaplast launched the first food packaging tray made entirely from recycled PET derived exclusively from post-consumer trays through its Tray2Tray closed-loop initiative, demonstrating the commercial viability of circular tray-to-tray recycling. This trend is encouraging domestic converters to invest in recycled-content capabilities and explore bioplastic alternatives.

Expansion of Online Food Delivery and Takeaway Packaging Demand

The rapid growth of digital food ordering platforms is significantly driving demand for tamper-proof and durable plastic food trays across Indonesia. Super-apps such as GrabFood, ShopeeFood, and GoFood have expanded deep into metropolitan and secondary cities, creating sustained volumes for delivery-compatible tray formats. For instance, in 2024, online food and beverage spending in Indonesia reached USD 12.9 billion, making it the largest e-commerce category in the country, with GrabFood capturing approximately 47% of the delivery market share. This expansion is elevating technical requirements for trays, including stackability, leak resistance, and microwave compatibility, driving the Indonesia plastic food tray market growth.

Strengthening Food Safety Regulations and Packaging Standards

Indonesia’s food packaging regulatory environment is becoming more rigorous, encouraging manufacturers to enhance tray designs, material quality, and production practices. Strengthening packaging standards and trade protection measures are aimed at safeguarding domestic producers while reinforcing food contact safety requirements. These policy shifts are influencing raw material sourcing strategies and cost structures for tray converters. As compliance expectations rise, manufacturers are increasingly focusing on material innovation, improved quality control systems, and differentiated product offerings that meet regulatory requirements, supporting higher standards and long-term competitiveness within the plastic food tray market.

Market Outlook 2026-2034:

The Indonesia plastic food tray market is positioned for sustained growth over the forecast period, supported by expanding institutional feeding programs, modern retail penetration, and rising food delivery volumes. Increasing investment in domestic PET recycling infrastructure and tray manufacturing automation is expected to improve cost competitiveness and supply chain resilience. The growing emphasis on circular packaging solutions and government-backed sustainability targets will encourage adoption of recycled-content and bioplastic trays. The market generated a revenue of USD 427.08 Million in 2025 and is projected to reach a revenue of USD 598.47 Million by 2034, growing at a compound annual growth rate of 3.82% from 2026-2034.

Indonesia Plastic Food Tray Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Resin Type |

PET |

42% |

|

Region |

Java |

45% |

Resin Type Insights:

- PET

- PVC

- PP

- Others

PET dominates the market with a share of 42% of the total Indonesia plastic food tray market in 2025.

PET (polyethylene terephthalate) has established itself as the preferred resin type for plastic food trays in Indonesia due to its exceptional combination of transparency, barrier properties, and cost efficiency. The material’s high melting point, low brittleness, and excellent moisture and gas barrier characteristics make it particularly suitable for packaging fresh produce, ready-to-eat meals, and protein products. PET trays provide superior product visibility on retail shelves, supporting brand differentiation in Indonesia’s competitive food retail environment. The growing availability of food-grade recycled PET from domestic recyclers is further strengthening PET’s position as the material of choice.

The PET segment is gaining momentum as Indonesia strengthens its domestic recycled PET infrastructure. Growing investment in local recycling facilities is improving the availability of food-grade rPET materials, supporting the use of recycled content in plastic food tray manufacturing. Partnerships between beverage producers, packaging companies, and recycling specialists are helping to establish closed-loop systems for PET recovery and reuse. These developments are reducing reliance on imported recycled resin, stabilizing raw material supply, and enabling manufacturers to meet sustainability goals while maintaining food safety standards across packaging applications.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Java leads the market with a 45% share of the total Indonesia plastic food tray market in 2025.

Java’s dominance in the Indonesia plastic food tray market is underpinned by its concentration of the country’s largest urban centers, manufacturing hubs, and the most developed foodservice infrastructure. The island hosts the Jakarta-Bandung-Surabaya economic corridor, which represents the highest density of restaurants, quick-service outlets, catering services, and modern retail chains in the country. Urban households in this corridor allocate significantly higher proportions of their food budgets to prepared meals compared to other regions, creating robust and recurring demand for food tray packaging solutions.

The region benefits from proximity to plastic resin producers and packaging converters, enabling efficient supply chains and cost-effective sourcing for food tray manufacturers. Ongoing expansion of international and domestic foodservice brands across major urban centers is increasing demand for standardized, delivery-ready packaging formats. Well-developed logistics systems and a strong digital food delivery ecosystem further support high volumes of takeaway and home-delivered meals. Together, these factors are sustaining strong demand for durable, lightweight plastic food trays suited for modern foodservice and e-commerce-driven consumption patterns.

Market Dynamics:

Growth Drivers:

Why is the Indonesia Plastic Food Tray Market Growing?

Rapid Expansion of the Foodservice and Quick-Service Restaurant Industry

Indonesia’s foodservice sector is experiencing robust expansion, directly driving demand for plastic food trays across multiple service channels. The country’s growing middle-class population, rising disposable incomes, and increasing preference for dining out are fueling the proliferation of restaurants, cafes, and quick-service outlets nationwide. The Indonesia foodservice market size reached USD 50.3 Billion in 2025. The market is projected to reach USD 129.5 Billion by 2034, exhibiting a growth rate (CAGR) of 11.08% during 2026-2034, surpassing pre-pandemic levels and establishing itself as the largest foodservice market among ASEAN member states. The expansion of international restaurant chains into secondary cities, alongside the growth of local food entrepreneurs, is creating diversified and sustained demand for cost-effective, hygienic tray packaging solutions that meet both operational efficiency and food safety requirements.

Government-Backed Institutional Feeding Programs

Large-scale government nutrition initiatives are creating new and stable demand channels for standardized plastic food trays in Indonesia. Nationwide institutional feeding programs require consistent, hygienic, and cost-efficient food distribution solutions that can be deployed at scale. The centralized preparation and distribution of meals through public kitchens increases the need for uniform tray designs that support portion control, stacking, and efficient handling. This predictable, recurring demand provides manufacturers with greater production visibility, enabling improved capacity utilization and operational planning while reinforcing the role of plastic food trays in large-scale public food service operations.

Surge in Online Food Delivery and Ready-to-Eat Meal Consumption

Rapid expansion of Indonesia’s digital food delivery ecosystem is significantly increasing demand for durable and functional plastic food trays. Wider adoption of digital payments and affordable delivery services has extended online meal ordering beyond major cities, reshaping everyday food consumption habits. Longer delivery routes and higher order volumes are raising performance expectations for food packaging, requiring trays that offer improved stackability, leak resistance, and compatibility with hot and cold foods. In response, manufacturers are focusing on design innovation and material performance to differentiate their offerings and meet the evolving needs of delivery-focused foodservice operators.

Market Restraints:

What Challenges the Indonesia Plastic Food Tray Market is Facing?

Increasing Environmental Regulations and Anti-Plastic Sentiment

The increasing environmental interests about plastic waste is causing an increase in governmental regulations and changing consumer preferences toward sustainable versions. The determination of the Indonesian government to mitigate the threat of marine plastic contamination, coupled with planned plastic excise taxes under Presidential Regulation No. 73/2023, is introducing compliance costs and the likelihood of rising costs to several traditional manufacturers of plastic trays. Such a regulatory environment can limit the market growth of traditional plastic trays.

Volatility in Raw Material Costs and Import Dependency

The plastic food tray market in Indonesia is struggling with the unstable price of resin, as well as the sourcing of raw materials that are imported. Monthly price fluctuations of spot resin can be expressed in high percentage margins under fixed price contracts of tray converters. The suggested tariffs on imported polypropylene copolymer should stabilize the supply levels in the country, but will also lead to higher input costs, which will leave manufacturers relying on imported resins uncertain about their future.

Competition from Alternative Packaging Materials

There is an increasing competition with other forms of packaging, like the paper food tray, among the plastic food tray market, biodegradable containers, and reusable food packaging systems. The increasing consumer demand for green products, especially among younger and urbanized consumers, is giving foodservice operators a reason to consider alternatives to plastic. The willingness to pay more for sustainable substitutes is slowly reducing, and the traditional adoption of plastic trays will face a challenge in the competition in the long run.

Competitive Landscape:

The Indonesia plastic food tray market has a moderately fragmented competitive environment where both global packaging giants and local plastic converters co-exist. Global players have the advantage of sourcing materials from across the globe and using advanced multilayer tray technology to target the high-margin chilled meal and protein packaging market. Local players compete based on localized production advantages, quick turnaround times, and customized cavity tooling designed to meet local foodservice needs. The competitive battleground is shifting towards investments in production automation, recycling capabilities, and design for recyclability compliance. Collaborations between plastic food tray converters and upstream resin suppliers are also on the rise as companies look to optimize their cost structures and develop sustainable material supply chains.

Recent Developments:

- In February 2025, Indonesia’s Anti-Dumping Committee put forward a proposal to impose import duties on polypropylene co-polymer shipments from five countries, with tariff rates set within a defined range to address dumping concerns. This measure is designed to protect domestic resin producers and may reshape input cost dynamics for plastic food tray manufacturers operating in the Indonesian market.

Indonesia Plastic Food Tray Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | PET, PVC, PP, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indonesia plastic food tray market size was valued at USD 427.08 Million in 2025.

The Indonesia plastic food tray market is expected to grow at a compound annual growth rate of 3.82% from 2026-2034 to reach USD 598.47 Million by 2034.

PET represents the largest market share at 42% in 2025, driven by its superior transparency, high barrier properties, lightweight nature, cost-effectiveness, and growing availability of food-grade recycled PET from expanding domestic recycling infrastructure.

Key factors driving the Indonesia plastic food tray market include the rapid expansion of the foodservice industry, government-backed institutional feeding programs, surge in online food delivery platforms, rising packaged food consumption, and increasing modern retail penetration across secondary cities.

Major challenges include increasing environmental regulations and anti-plastic sentiment, volatility in raw material costs and import dependency, competition from alternative sustainable packaging materials, and compliance pressures from evolving food contact safety standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)