Indonesia Prepaid Cards Market Size, Share, Trends and Forecast by Card Type, Purpose, Vertical, and Region, 2025-2033

Market Overview:

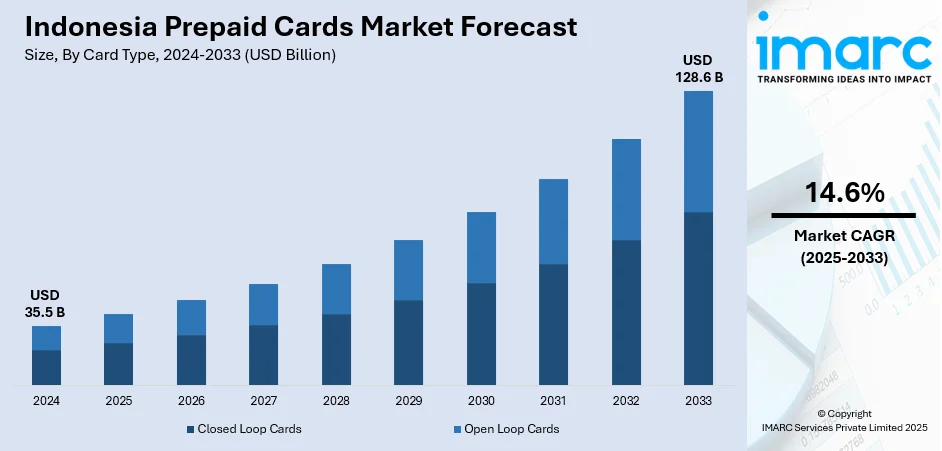

The Indonesia prepaid cards market size reached USD 35.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 128.6 Billion by 2033, exhibiting a growth rate (CAGR) of 14.6% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 128.6 Billion |

| Market Growth Rate (2025-2033) | 14.6% |

A prepaid card is also known as "stored-value card” that uses preloaded transaction funds. These cards do not require any bank account to be linked as they can be used by anyone irrespective of their credit rating, income, status, or someone holding the bank account. Some prepaid cards cannot be reloaded and are disposed after their value is used up. On the other hand, reloadable prepaid cards can be refilled with funds.

To get more information on this market, Request Sample

Indonesia has witnessed tremendous development in the e-commerce industry, pushing the younger population to use the internet payment platform. Younger population prefer card as their payment method over others which is driving the adoption of prepaid cards in the country. Moreover, the growing use of POS (Point of Service), EDC terminals and ATM facilities in Indonesia have motivated retailers to use electrical payment methods that encourage consumers to use prepaid cards. The government has also pushed the Prepaid Cards Market through numerous projects focusing cashless economy such as the cashless toll road scheme in 2017. However, there is also some reduction in average transaction values as large numbers of customers entered the cashless payment system and increasing numbers of banks that have exacerbated Indonesia's prepaid industry.

IMARC Group’s latest report provides a deep insight into the Indonesia prepaid cards market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Indonesia prepaid cards market in any manner.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indonesia prepaid cards market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on card type, purpose and vertical.

Breakup by Card Type:

- Closed Loop Cards

- Open Loop Cards

Open loop cards currently dominate the market, holding the largest share.

Breakup by Purpose:

- Transportation

- Gas/Fuel

- Food and Beverages

- Others

Transportation segment currently dominate the market, holding the largest share.

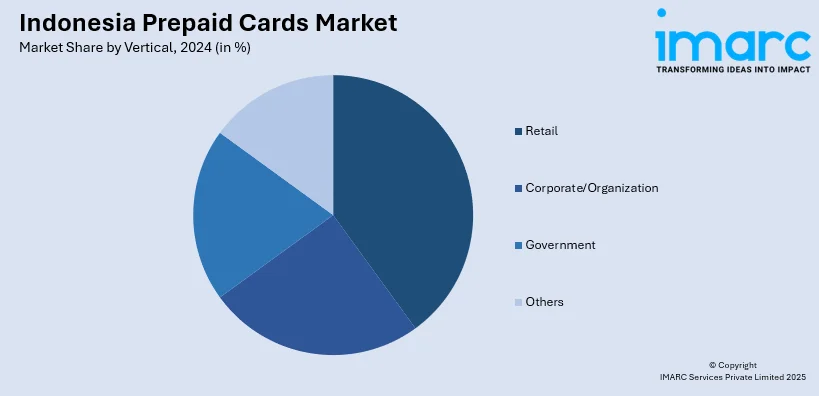

Breakup by Vertical:

- Retail

- Corporate/Organization

- Government

- Others

Amongst these, corporate/organization currently represent the leading segment accounting for majority of the market share.

Breakup by Region:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Amongst these, Java region accounts for the highest market share.

Competitive Landscape:

The report has also examined the competitive landscape of the Indonesia prepaid cards market. Some of the major players include:

- Mandiri Bank

- Bank DKI

- Bank Negara Indonesia

- Bank Central Asia

- Bank Rakyat Indonesia

- Bank BNI

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Card Type, Purpose, Vertical, Region |

| Region Covered | Java, Kalimantan, Sumatra, Sulawesi, Others |

| Companies Covered | Mandiri Bank, Bank DKI, Bank Negara Indonesia, Bank Central Asia, Bank Rakyat Indonesia and Bank BNI |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indonesia prepaid cards market was valued at USD 35.5 Billion in 2024.

We expect the Indonesia prepaid cards market to exhibit a CAGR of 14.6% during 2025-2033.

The growing prominence of cashless economy system as it offers high security and ease of transaction to the consumers is primarily driving the Indonesia prepaid cards market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of prepaid cards for administering cashless transactions and mitigating the transmission of the coronavirus infection via conventional cash-based payment methods.

Based on the card type, the Indonesia prepaid cards market can be segmented into closed loop cards and open loop cards. Currently, open loop cards hold the majority of the total market share.

Based on the purpose, the Indonesia prepaid cards market has been divided into transportation, gas/fuel, food and beverages, and others. Among these, transportation currently exhibits a clear dominance in the market.

Based on the vertical, the Indonesia prepaid cards market can be categorized into retail, corporate/organization, government, and others. Currently, corporate/organization accounts for the largest market share.

On a regional level, the market has been classified into Java, Sumatra, Kalimantan, Sulawesi, and others, where Java currently dominates the Indonesia prepaid cards market.

Some of the major players in the Indonesia prepaid cards market include Mandiri Bank, Bank DKI, Bank Negara Indonesia, Bank Central Asia, Bank Rakyat Indonesia, Bank BNI, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)