Indonesia Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2026-2034

Indonesia Private Equity Market Overview:

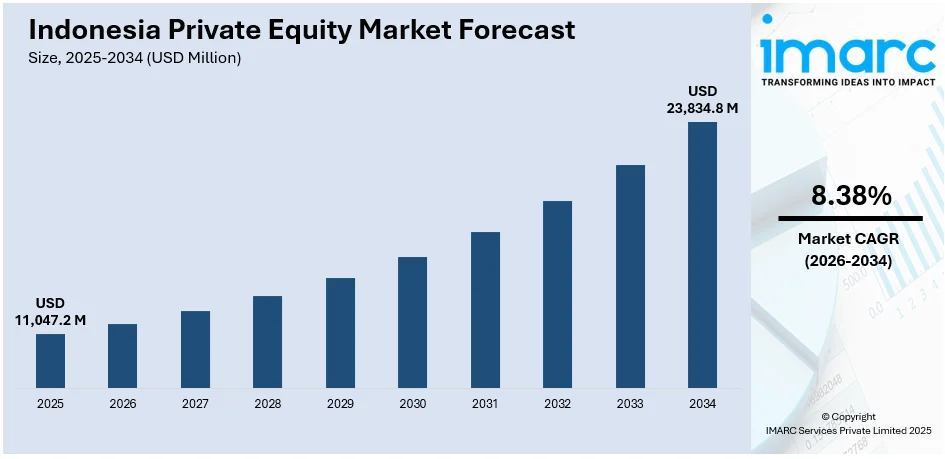

The Indonesia private equity market size reached USD 11,047.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 23,834.8 Million by 2034, exhibiting a growth rate (CAGR) of 8.38% during 2026-2034. A growing middle class, rising digital penetration, and robust GDP growth attract private equity investment. Economic diversification, infrastructure development, and startup innovation further increase deal opportunities. Regulatory reforms and supportive FDI policies enhance Indonesia private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11,047.2 Million |

| Market Forecast in 2034 | USD 23,834.8 Million |

| Market Growth Rate 2026-2034 | 8.38% |

Indonesia Private Equity Market Trends:

Digital Economy Investments

The digital economy is driving a surge in private equity activity in Indonesia, particularly in sectors like e-commerce, fintech, and digital health. With one of the largest internet-user bases in Southeast Asia, Indonesia offers immense scale for tech-enabled services. Private equity firms are investing in early and growth-stage companies that capitalize on mobile-first consumer behavior. Indonesia’s digital economy, guided by the “Making Indonesia 4.0” plan, is targeting leadership in Southeast Asia by 2030. Important programs include the “100 Smart Cities” initiative and a national AI strategy running from 2020 to 2045. The digital economy is forecasted to surpass $130 billion by 2025, supported by 79.5% internet penetration and a predominantly young population. Both e-commerce and fintech sectors are expanding quickly, with fintech digital payments projected to grow by 15% by 2025. The digital boom continues to be a key driver of Indonesia private equity market growth.

To get more information on this market Request Sample

Rise in ESG-Oriented Investment

Environmental and social impact considerations are becoming integral to investment strategies in the Indonesia private equity market. Firms are increasingly adopting ESG frameworks to mitigate risks, enhance brand value, and meet investor expectations. Investments in clean energy, sustainable agriculture, and inclusive finance are gaining momentum. Regulatory encouragement and stakeholder awareness are pushing general partners to prioritize long-term sustainability over short-term returns. ESG-compliant portfolios also offer better access to institutional capital, making them more competitive. The alignment of private equity with sustainable development goals is poised to elevate Indonesia private equity market growth. For instance, Indonesia’s new sovereign wealth fund, Danantara, launched in February 2025, operates with a commercial focus, targeting large-scale domestic projects with strong returns and job creation potential. Backed by an initial $20 billion pledge, it aims to invest in sectors like AI, natural resources, and food security. Unlike other funds, Danantara doesn’t require investment partners and prioritizes risk management. It has already attracted interest from global investors and may expand into overseas investments after its first year.

Indonesia Private Equity Market Segmentation:

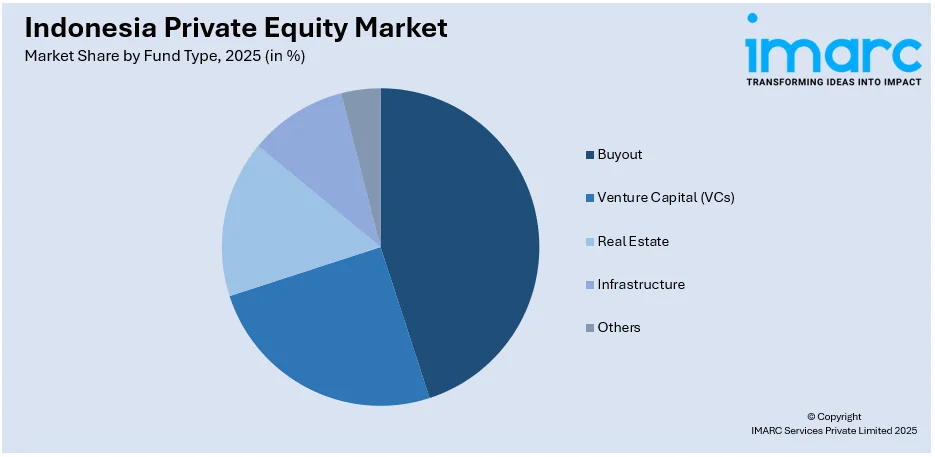

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2026-2034. Our report has categorized the market based on fund type.

Fund Type Insights:

Access the comprehensive market breakdown Request Sample

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Private Equity Market News:

- In December 2024, Mayapada Healthcare Group secured a $157 million strategic growth investment from Bain Capital to expand its premium hospital network across Indonesia. The funding will support scaling operations, technology adoption, and meeting rising healthcare demand. With seven hospitals and plans for expansion, Mayapada aims to improve patient outcomes and accessibility.

- In November 2024, Intudo Ventures raised $125 million across two funds to support Indonesian startups and renewable energy projects. The $75 million Intudo Ventures IV will focus on sectors like consumer products, aquaculture, horticulture, and deep tech, aiming for significant ownership stakes in 14–18 companies. The $50 million fund will invest in downstream natural resources and renewable energy, leveraging Indonesia's position in the global nickel and cobalt markets. The firm has attracted investors from the U.S., Europe, Asia, and the Middle East, including Orient Growth Ventures and Black Kite Capital.

Indonesia Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia private equity market on the basis of fund type?

- What is the breakup of the Indonesia private equity market on the basis of region?

- What are the various stages in the value chain of the Indonesia private equity market?

- What are the key driving factors and challenges in the Indonesia private equity market?

- What is the structure of the Indonesia private equity market and who are the key players?

- What is the degree of competition in the Indonesia private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia private equity market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia private equity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)