Indonesia Sportswear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2025-2033

Indonesia Sportswear Market Overview:

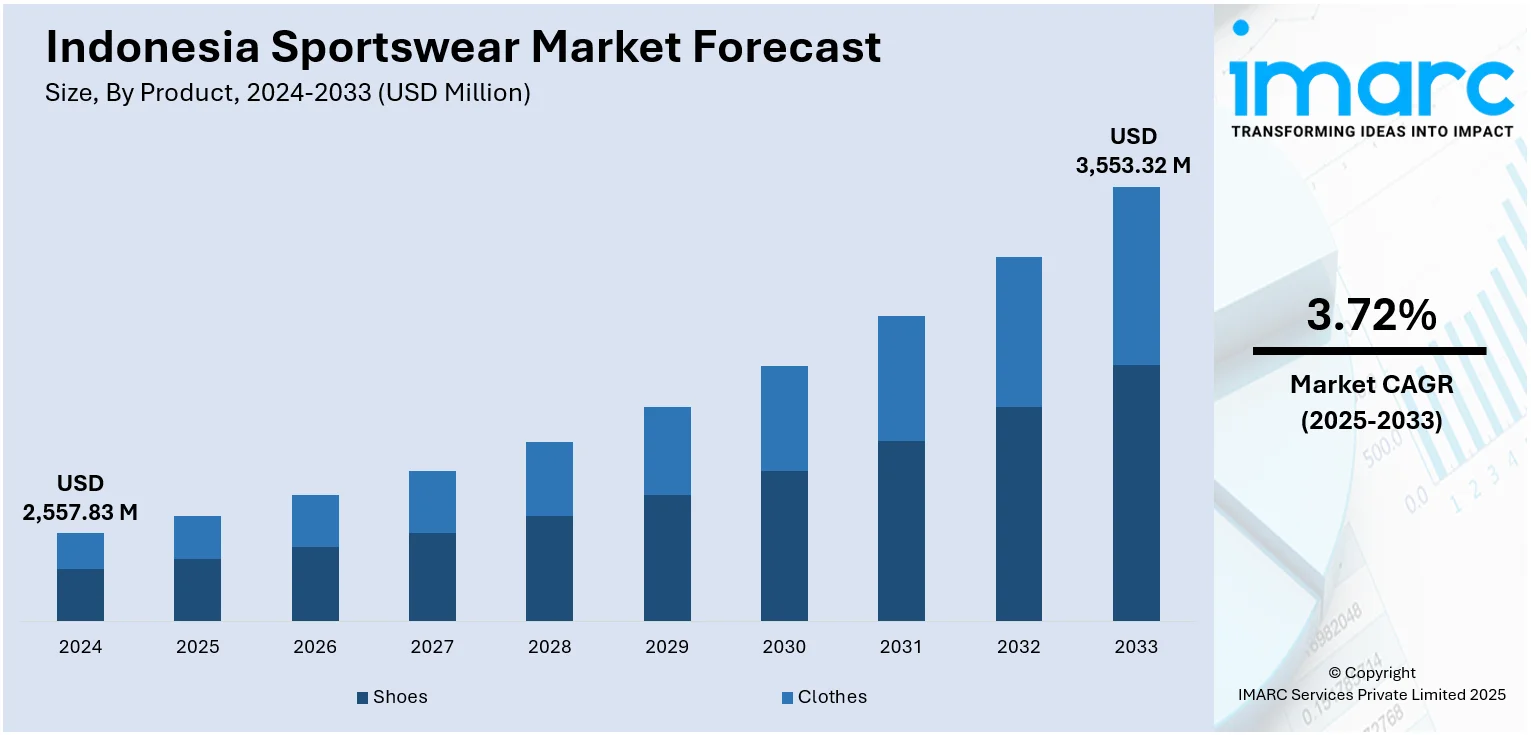

The Indonesia sportswear market size reached USD 2,557.83 Million in 2024. Looking forward, the market is expected to reach USD 3,553.32 Million by 2033, exhibiting a growth rate (CAGR) of 3.72% during 2025-2033. The market is witnessing robust growth, fueled by increasing fitness awareness, rising urbanization, and the growing influence of athleisure fashion. Expanding middle-class income and digital retail access are also driving consumer demand. Both international and domestic brands are competing actively to strengthen their presence in the evolving Indonesia sportswear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,557.83 Million |

| Market Forecast in 2033 | USD 3,553.32 Million |

| Market Growth Rate 2025-2033 | 3.72% |

Indonesia Sportswear Market Trends:

Youth-Centric Demographics and Lifestyle Shifts

Indonesia's populous and young population contributes in a major way to the sportswear industry. With a median age of under 30 years, younger Indonesians are adopting image-conscious and active lifestyles heavily influenced by pop culture, sports idols, and social media fashions. This age group places great importance on self-expression, frequently opting for branded sportswear as both a style choice and a signifier of personal identity. Involvement in school athletic programs, neighborhood-oriented sports events, and youth-based activities like skateboarding, futsal, and cycling has experienced significant growth. These changes in lifestyle generate stable demand for trendy, functional, and comfortable clothing. Sportswear companies are taking advantage of this demographic change by introducing youth-focused marketing campaigns, social media influencer partnerships, and product lines catering to the tastes of Indonesia's young consumers.

To get more information on this market, Request Sample

Government-Led Sports Development and Infrastructure Investment

The Indonesian government’s ongoing investments in national sports development and athletic infrastructure are positively impacting the Indonesia sportswear market growth. Initiatives aimed at enhancing grassroots sports programs, building new stadiums and training facilities, and supporting national athletes have contributed to a growing sports culture. Events like the National Sports Week (PON) and regional athletic tournaments encourage participation across age groups and regions, indirectly promoting sportswear adoption. Additionally, government campaigns that promote physical activity in schools, workplaces, and communities are creating a culture of daily movement and active engagement. With increased visibility of competitive and recreational sports, consumers are purchasing specialized athletic apparel and gear for both performance and daily use, thereby strengthening the country’s sportswear consumption patterns.

Expansion of Offline Retail and Experiential Brand Spaces

Despite the growth of online retail, Indonesia's sportswear market is also being driven by the rapid expansion of physical stores and immersive brand experiences. Leading global and local sportswear brands are opening flagship outlets, concept stores, and pop-up experiences in major cities and emerging urban centers. These retail environments offer personalized customer service, product customization, and trial zones, enhancing brand engagement and trust. Shopping malls remain central to Indonesia’s retail culture, making in-store purchases and brand interaction a key part of the consumer journey. These physical touchpoints are especially effective in reaching consumers who prefer tactile experiences or are new to the sportswear category. This strategic expansion of offline presence complements online channels and drives greater brand penetration across diverse customer segments.

Indonesia Sportswear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, distribution channel, and end user.

Product Insights:

- Shoes

- Clothes

The report has provided a detailed breakup and analysis of the market based on the product. This includes shoes and clothes.

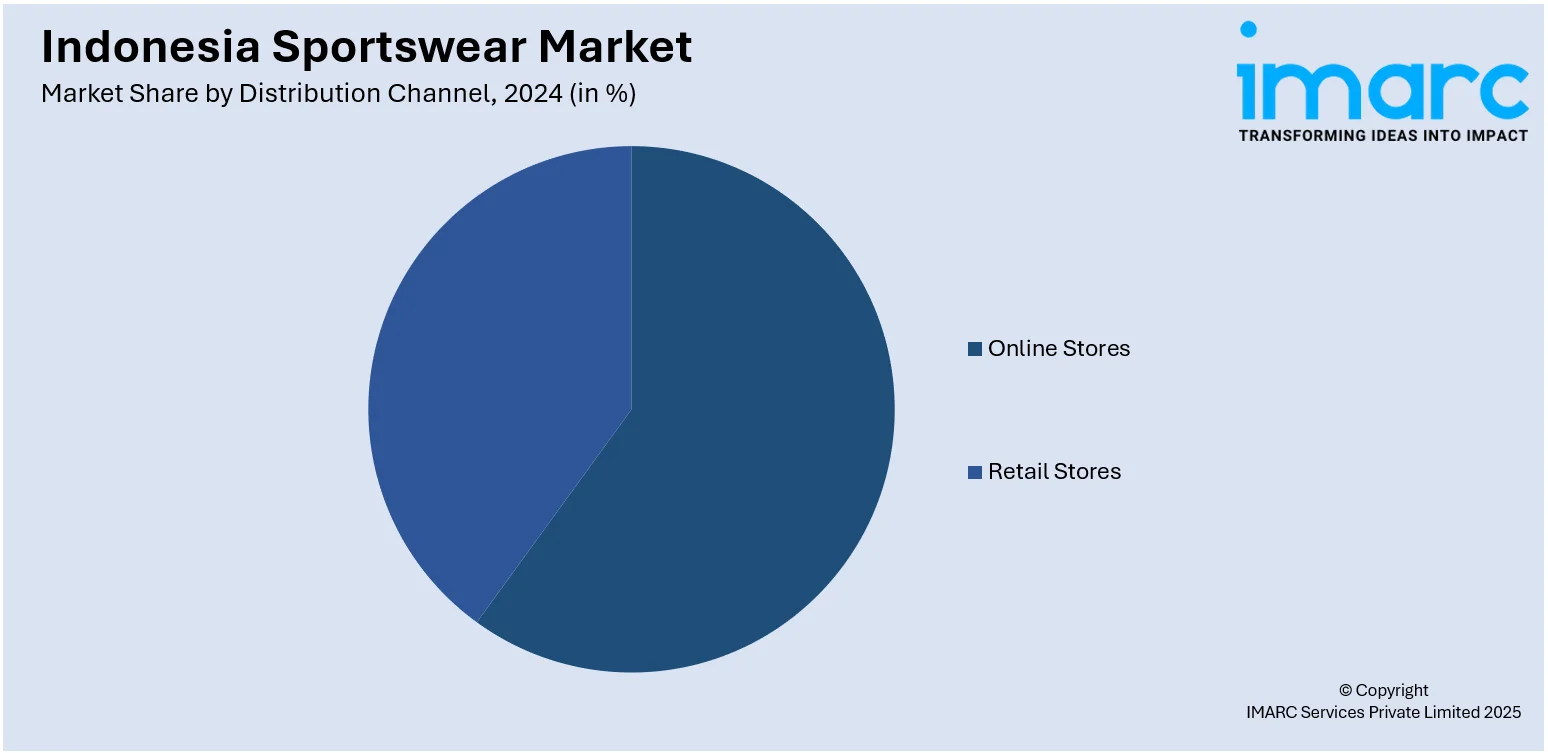

Distribution Channel Insights:

- Online Stores

- Retail Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores and retail stores.

End User Insights:

- Men

- Women

- Kids

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and kids.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Sportswear Market News:

- In March 2025, Frasers Group made headlines by strengthening its partnership with MAP Active, a subsidiary of Indonesian lifestyle giant PT Mitra Adiperkasa Tbk, to launch flagship Sports Direct outlets across India and Southeast Asia. This expanded collaboration with the prominent regional sports and fashion player will enable Sports Direct to deepen its presence in Indonesia and venture into five additional markets. The long-term vision under this agreement includes the strategic rollout of more than 350 stores across the region, aligning with the brand’s ambitious growth plans.

- In December 2024, Canada and Indonesia officially signed a Comprehensive Economic Partnership Agreement in Jakarta after three years of negotiations. Scheduled to come into effect in 2026, the deal will see Canada liberalize 90.5% of its tariffs on Indonesian goods, covering trade valued at $1.4 billion. Key Indonesian exports to Canada include footwear and garments.

Indonesia Sportswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shoes, Clothes |

| Distribution Channels Covered | Online Stores, Retail Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia sportswear market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia sportswear market on the basis of product?

- What is the breakup of the Indonesia sportswear market on the basis of distribution channel?

- What is the breakup of the Indonesia sportswear market on the basis of end user?

- What is the breakup of the Indonesia sportswear market on the basis of region?

- What are the various stages in the value chain of the Indonesia sportswear market?

- What are the key driving factors and challenges in the Indonesia sportswear market?

- What is the structure of the Indonesia sportswear market and who are the key players?

- What is the degree of competition in the Indonesia sportswear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia sportswear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia sportswear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia sportswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)