Indonesia Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Indonesia Steel Tubes Market Overview:

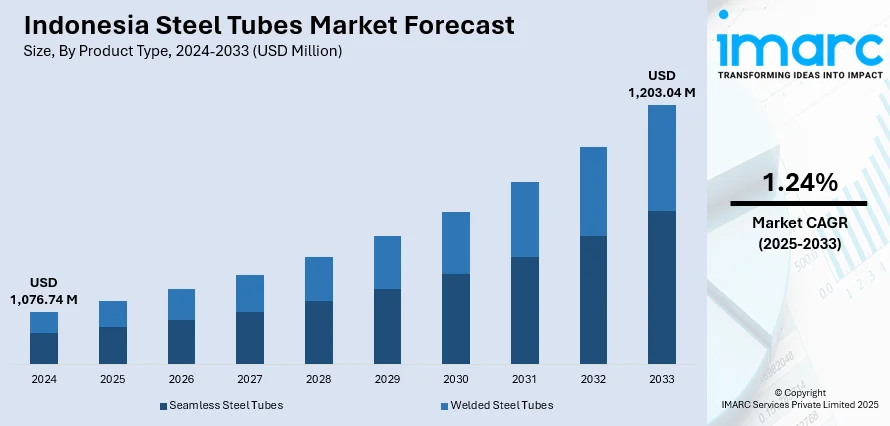

The Indonesia steel tubes market size reached USD 1,076.74 Million in 2024. The market is projected to reach USD 1,203.04 Million by 2033, exhibiting a growth rate (CAGR) of 1.24% during 2025-2033. The market is building momentum amid rising demand from energy, infrastructure, and industrial sectors. Growth is powered by expanding oil & gas pipelines, power plant installations, and construction frameworks, which drive uptake across both welded and seamless tube types. Urban development and manufacturing expansion are triggering innovation in high-strength and coated steel products. Competition remains fragmented with regional producers and global players adapting to quality and sustainability requirements. Strategic investments in capacity and technology are shaping the evolving landscape of Indonesia steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,076.74 Million |

| Market Forecast in 2033 | USD 1,203.04 Million |

| Market Growth Rate 2025-2033 | 1.24% |

Indonesia Steel Tubes Market Trends:

Infrastructure-Led Domestic Tube Demand

In November 2024, Indonesia began construction of Southeast Asia’s largest seamless steel pipe factory in Cilegon, Banten, aimed at increasing domestic tube production and reducing reliance on imports for gas infrastructure. This milestone reflects a strategic shift toward domestic capacity in support of the nation’s expanding gas and oil pipeline network. The new facility, with an annual capacity of millions of tonnes, directly targets industrial needs in energy infrastructure. Demand for seamless tubes is rising, particularly among pipeline and gas network developers seeking reliable supply and compliance with national standards. This project also aligns with broader governmental priorities laid out during ISSEI 2025, which reinforce value‑added domestic steel production. As new tubing capacity comes online, Indonesia’s supply chain is becoming less dependent on imports and more oriented toward local fabrication tailored to industrial specifications. Interested buyers report growing preference for certified, domestically produced tubes as pipeline projects progress. These developments illustrate the foundations for Indonesia steel tubes market growth in support of energy infrastructure and downstream industrial expansion.

To get more information on this market, Request Sample

Policy Tightens Import Monitoring Measures

In May 2025, Indonesia’s Coordinating Ministry announced a review of antidumping regulations designed to prevent a surge of imported steel products that could undercut local manufacturing. This action underscores concern about potential flooding of the domestic steel tube market with low-cost imports from overcapacity regions. Through policy adjustments, authorities aim to protect domestic tube producers by introducing safeguards and reinforcing national standard enforcement. At ISSEI 2025, policymakers reiterated support for trade protections and the expansion of Indonesian National Standard (SNI) certification requirements for tubing products. This effort is being paired with fiscal incentives and gas pricing reforms to strengthen competitiveness of local fabrication. Buyers in infrastructure and energy sectors are increasingly looking for SNI‑certified tubes with traceable origins. By tightening import screening and promoting homegrown quality assurance measures, Indonesia is shaping a more resilient domestic tube ecosystem. These regulatory shifts serve as anchor points for understanding ongoing Indonesia steel tubes market trends in a shifting trade context.

Manufacturing Momentum Supports Tube Supply

Indonesia’s crude steel production reached million tonnes in 2024, making the country the 14th-largest steel producer globally and providing a stronger foundation for domestic tube manufacturing. This production growth is enabling the industry to move further downstream, with increased investment in welded and seamless tubing capacity. Domestic tube fabricators are now better positioned to meet demand from a range of sectors, including construction, gas networks, transport, and industrial equipment. Much of this shift is supported by strategic policy backing particularly around Indonesia National Standard (SNI) compliance and a renewed focus on infrastructure development as part of long-term national programs. The new seamless pipe facility in Banten is a key example of how production capacity is being scaled up with an eye on quality and consistency. These structural changes are helping align raw steel production with local end-user requirements, reducing import dependency and supporting value-added manufacturing. As downstream capabilities expand, domestic producers are becoming more competitive regionally while meeting evolving standards and specifications in priority sectors.

Indonesia Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

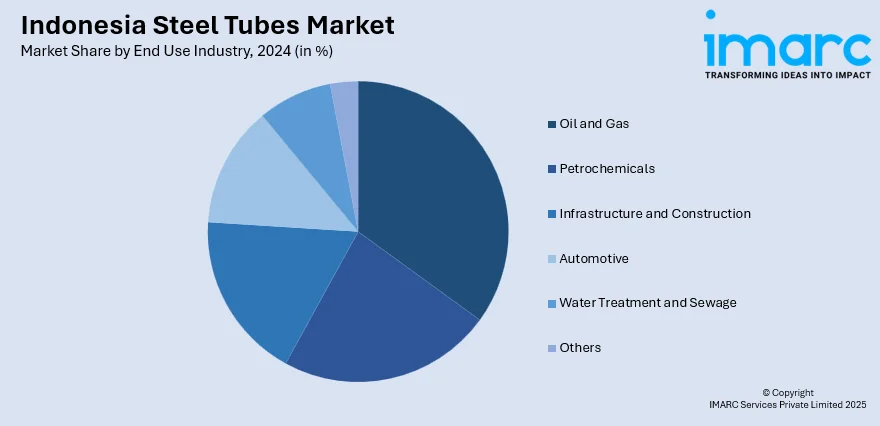

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Steel Tubes Market News:

- September 2024: PT Inerco Global International and PT Artas Energi Petrogas, have entered a strategic partnership to establish Southeast Asia’s first seamless pipe manufacturing facility in Cilegon, Banten. Located within the Krakatau Steel industrial complex, the plant aims to reduce the country’s dependence on imported seamless steel tubes by supplying domestic demand from the oil and gas sector. With a production capacity of 250,000 tonnes per year and a targeted increase in local content, the project reflects Indonesia’s pursuit of self‑sufficiency, industrial advancement, and value addition.

Indonesia Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Type Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia steel tubes market on the basis of product type?

- What is the breakup of the Indonesia steel tubes market on the basis of material type?

- What is the breakup of the Indonesia steel tubes market on the basis of end use industry?

- What is the breakup of the Indonesia steel tubes market on the basis of region?

- What are the various stages in the value chain of the Indonesia steel tubes market?

- What are the key driving factors and challenges in the Indonesia steel tubes market?

- What is the structure of the Indonesia steel tubes market and who are the key players?

- What is the degree of competition in the Indonesia steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)