Indonesia Textiles Market Size, Share, Trends and Forecast by Application, Material, Process, and Region, 2026-2034

Indonesia Textiles Market Size and Share:

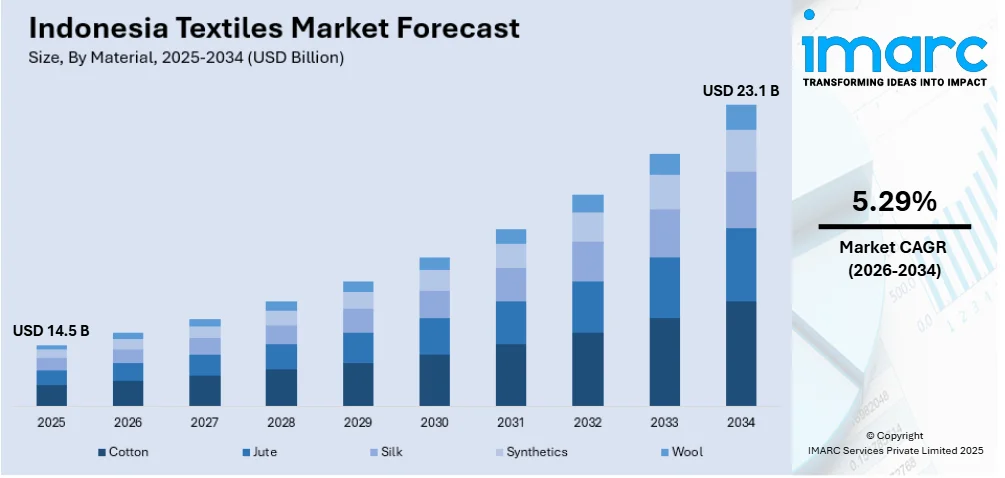

The Indonesia textiles market size was valued at USD 14.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 23.1 Billion by 2034, exhibiting a CAGR of 5.29% during 2026-2034. The market is driven by increasing domestic consumption and inflating disposable incomes across urban areas. Additionally, supportive government policies, such as tax incentives and investment in industrial zones, are attracting both local and foreign manufacturers. Also, Indonesia’s competitive labor costs, expanding e-commerce sector, and shifting global sourcing strategies are some of the important factors augmenting Indonesia textiles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.5 Billion |

| Market Forecast in 2034 | USD 23.1 Billion |

| Market Growth Rate (2026-2034) | 5.29% |

The market is driven by rising domestic demand for apparel, fueled by a large and youthful population with increasing fashion consciousness. Indonesia, the world's fourth most populous country with more than 270 million people and a median age of 30 years, offers a vast base of young consumers actively shaping fashion trends and preferences. This demographic advantage supports consistent demand for textiles and garments. Moreover, the country’s cost-effective labor force continues to attract foreign investment in textile manufacturing. Also, government support through favorable policies, tax incentives, and industrial zoning further bolsters sector development. Besides, Indonesia’s participation in regional trade agreements enables competitive export access to international markets.

To get more information on this market Request Sample

Additionally, the growth of e-commerce platforms is extending the market reach and facilitating direct-to-consumer sales. As per industry reports, about 212 million internet users are in Indonesia as of early 2025, with an online penetration rate of 74.6%. Digital channels are playing a critical role in transforming retail distribution. Consumers increasingly prefer online shopping for apparel due to convenience, variety, and promotional pricing, which is encouraging textile brands and manufacturers to invest in digital marketing. Apart from this, the rising adoption of automation and digital textile printing technologies is improving production efficiency and product variety. Furthermore, increased collaboration between manufacturers and global brands is enhancing quality standards and boosting export competitiveness. Besides this, significant investment in textile infrastructure, including industrial parks and logistics networks, supports supply chain optimization.

Indonesia Textiles Market Trends:

Expanding Urbanization and Its Influence on Apparel Demand

Indonesia’s rapidly advancing urbanization is reshaping consumer behavior across its textiles sector. As per industry estimates, 59.63% of the population of Indonesia lives in urban areas, equating to 170,361,295 individuals as of May 2025. As more people migrate to urban areas, there is a heightened need for textiles in the form of clothing, home furnishings, and industrial applications. Moreover, the influx of middle-income urban dwellers has fueled interest in fashion-forward, convenience-driven clothing, including fast fashion and athleisure. Urban consumers are also more exposed to global fashion trends via digital platforms, encouraging domestic and international brands to localize offerings and boost retail footprints in urban centers. Moreover, urbanization is enabling easier access to distribution and e-commerce logistics, allowing for streamlined product availability, which is supporting the Indonesia textiles market growth. Urban concentration is further intensifying retail competition, pushing innovation in fabric aesthetics, sustainability, and marketing. Consequently, urbanization is not only amplifying demand but also redefining product standards across the sector.

Demographic Advantage and Rising Consumption Potential

Indonesia’s demographic structure positions it as a powerful consumption engine for the textiles market. As of 2025, the country accounts for 3.47% of the global population, with an annual population growth rate of 0.79%, according to industry reports. This demographic weight is coupled with a youthful median age and expanding middle class, which together are catalyzing steady growth in textile and apparel demand. The growing working-age population is fueling an appetite for functional, appropriate workwear, and affordable fashion, while rising disposable incomes are enabling aspirational purchases across both domestic and international brands. Consumer preferences are increasingly shaped by lifestyle changes, social media trends, and brand visibility, prompting a higher frequency of garment purchases. Manufacturers and retailers are targeting this consumption momentum by expanding product lines and retail penetration in semi-urban and tier-2 cities. The sheer scale and youth-driven nature of Indonesia’s population ensures long-term demand resilience and evolving consumption sophistication across the textile value chain.

Growing Emphasis on Sustainability and Circular Fashion Practices

The shift towards environmental sustainability is creating a positive Indonesia textile market outlook. As one of the largest contributors to global textile exports, Indonesia faces scrutiny regarding its water usage, dye pollution, and fabric waste. Responding to these challenges, textile producers are gradually integrating eco-friendly practices, including organic cotton sourcing, closed-loop dyeing, and waste-minimizing production techniques. Several companies have begun investing in recycling initiatives, biodegradable fibers, and cleaner technologies to align with global ESG standards. On October 3, 2024, Global Fashion Agenda (GFA) held a ceremony at Alila SCBD in Jakarta to officially launch the Circular Fashion Partnership: Indonesia is a new project that aims to help stakeholders create a circular textile sector in the region. The alliance is a collaboration between significant companies. It is supported by the H&M Foundation and individual donations. To achieve scalability, the groups encouraged more brands, manufacturers, trash handlers, recyclers, and government officials to join the collective action campaign. Moreover, global apparel brands sourcing from Indonesia are demanding improved transparency and environmental compliance from local suppliers. These factors are collectively fostering a gradual shift toward circular fashion models and redefining value propositions across the textile value chain in the country.

Indonesia Textiles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indonesia textiles market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on application, material, and process.

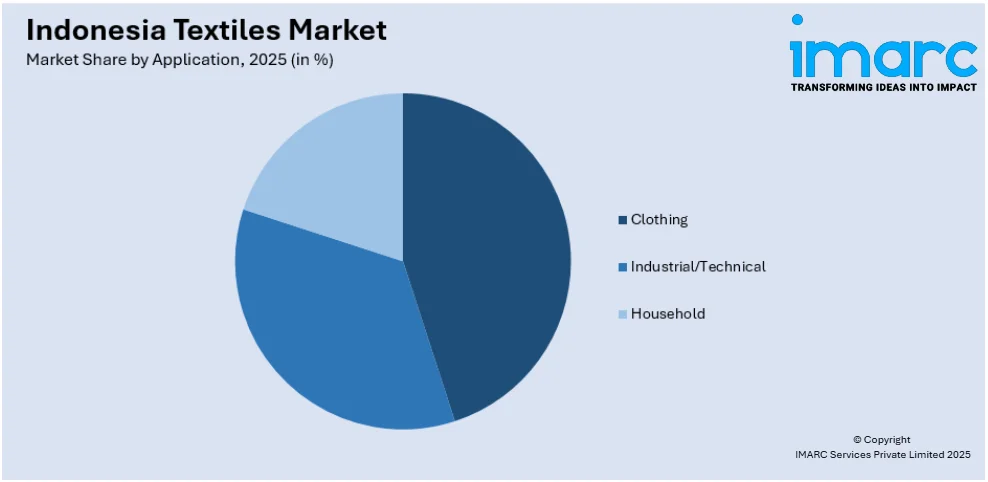

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Clothing

- Industrial/Technical

- Household

Clothing leads the industry, with a high contribution given the strong domestic demand and high export profile of the country. Indonesia is a major world supplier of apparel with large production centers in West Java and Central Java. Increasing incomes and rapid urbanization have increased local fashion consumption, and free trade agreements have enhanced access to global markets. The industry comprises mass-market production and high-end batik production, a national symbol. Automation and sustainability investments have kept Indonesian clothing competitive, particularly in the wake of post-pandemic changes in sourcing.

The industrial and technical applications in Indonesia are slowly increasing, spurred by the growing demand from industries such as automotive, construction, agriculture, and healthcare. Applications range from geotextiles to filtration fabrics, protective wear, and insulation materials. Government-sponsored programs of infrastructure development are a primary impetus, especially for nonwoven products and reinforcements. Domestic production of technical textiles to lower dependence on imports is being promoted by the nation's emphasis on manufacturing competitiveness. Also, joint ventures with overseas companies and incentives under Indonesia's industrial master plan are promoting advancement in this segment.

Households constitute a reliable segment of the market, including items such as bed sheets, towels, curtains, and upholstery. Increased middle-class incomes and growing real estate projects have generated demand for home furnishings. Domestic producers supply both domestic and foreign markets, mainly to the United States and the European market. Indonesian traditional weaving and dyeing processes give value in higher-end segments, particularly in handmade or artisanal types. Online retail expansion is also driving household textile sales, although the segment is price-sensitive. The market demand is driven by durability, beauty, and eco-friendliness preferences.

Analysis by Material:

- Cotton

- Jute

- Silk

- Synthetics

- Wool

Cotton dominates the market, with extensive application in apparel, home textiles, and industrial goods. Its popularity is due to breathability, comfort, and applicability to Indonesia's tropical climate. Indonesia imports vast amounts of raw cotton from the United States, Brazil, and Australia, with little cultivation locally. Spinning and weaving industries are largely dependent on cotton, with the main processing centers located in Java. Cotton apparel, such as T-shirts, shirts, and traditional batik, constitutes a majority of domestic and export production. Sustainable cotton sourcing is on the rise, with certifications such as BCI becoming increasingly popular among exporters.

Jute plays critical roles in specialty areas such as green packaging, sacks, and interior decor. Though not a chief apparel textile fiber, jute is prized for its biodegradability and lower cost in industrial applications. Indonesia imports most jute fiber, which comes predominantly from Bangladesh, for manufacturing. The product is used in farm packaging and, more recently, in marketing green product lines. The increasing demand for environmentally friendly, reusable bags, particularly from conscientious consumers and enterprises, is supporting modest expansion. The implementation of government initiatives to minimize plastic usage has also promoted jute-based product innovation.

Silk is a minor but culturally important segment in the market, frequently linked with conventional clothing and high-end fashion. Although Indonesia does not produce silk in volume, local silk weaving culture in places such as South Sulawesi continues to be recognized for its quality, particularly in songket and sarong manufacturing. Silk is worn in ceremonial robes and high-end batik forms. The demand is largely regional and seasonal, owing to weddings, religious festivals, and high fashion. Niche designers and cultural preservation initiatives are ensuring the continued pertinence of silk in the face of a largely cotton-centric market.

Analysis by Process:

- Woven

- Non-woven

Woven fabrics are the cornerstone of the market. It plays a major part in all clothing, home furnishings, and traditional wear. Weaving is a deeply entrenched practice in the nation, particularly in batik and ikat fabric production. Industrially, woven fabrics are favored due to their durability and versatility in apparel production, from casual to formal wear. Important textile clusters in West and Central Java support large-scale weaving operations for domestic consumption as well as export. With growing interest in innovation and quality, woven textiles are finding more use of synthetic blends and functional finishes to suit global fashion norms.

Non-woven fabrics account for a smaller but increasingly prominent portion of the Indonesian market, which is primarily fueled by the needs of healthcare, hygiene, and industrial applications. The fabric, manufactured without conventional weaving or knitting, is employed in medical masks, wipes, insulation, filtration layers, and crop coverings. The COVID-19 pandemic greatly spurred domestic manufacturing of non-wovens, particularly for personal protective equipment. As applications in industry continue to grow, the government has been promoting investment in non-woven manufacturing capacity. The segment is set for long-term growth, especially with increased focus on functional, disposable, and environmentally friendly solutions.

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Java is a significant region in the market, accounting for most of the country's production, employment, and exports. Major provinces like West Java, Central Java, and East Java have large manufacturing clusters with spinning, weaving, dyeing, and garment units integrated into them. The area enjoys improved infrastructure, access to a skilled workforce, and proximity to ports such as Tanjung Priok. Urban centers such as Bandung and Semarang are established centers for both conventional batik and contemporary textile manufacturing. According to the Indonesia textiles market report, the implementation of state initiatives, such as industrial estates and tax breaks, will continue to entice local and overseas investments towards Java, further cementing the region's leadership in the market.

Sumatra serves a prominent role in the Indonesian textile sector, with operations focusing on raw material procurement and small-scale manufacturing. The region is a contributor to cotton blending and natural fiber processing due to its agro-base. Certain provinces like North Sumatra have small-sized weaving and garment units serving the local market. Sumatra also acts as an outlet for ready-made textile products shipped from Java. Infrastructure constraints and lower industrial density have limited large-scale textile development. Still, ongoing economic diversification efforts, including industrial estate planning in regions like Lampung and Riau, may offer future opportunities for textile sector expansion.

Kalimantan has a notable presence in the industry, with its contribution to national industrial decentralization schemes. Predominantly famous for natural resources and mines, the area does not have extensive textile infrastructure. Strategic plans to relocate the capital to East Kalimantan and develop new urban-industrial areas are expected to bring investment in light manufacturing, including textile industries. The domestic market for apparel and domestic textiles is supplied primarily through redistribution from Java. Some indigenous groups have traditional weaving traditions, with cultural value but limited commercial volume. Supportive industrial policy will be needed to achieve any significant textile industry expansion in the region.

Sulawesi possesses a niche but culturally rich positioning in the market, primarily through traditional weaving and silk production. High-quality silk weaving, particularly found in areas like Sengkang in South Sulawesi, is used in traditional wear like baju bodo. Industrial-scale textile activities are rare, but local craftsmanship is central to maintaining Indonesia's cultural heritage. The region's textile products are largely sold in local markets, with occasional shipment of handmade fabrics. Economic development in cities such as Makassar is creating rising demand for finished textiles, which opens prospects for small-scale manufacturing and textile retail growth in the coming years.

Competitive Landscape:

The competitive dynamics of the market are influenced by a combination of large-scale players and many small to mid-size firms, each serving various product segments and end-user industries. The industry enjoys access to natural resources in abundance, skilled human resources, and favorable government policies, but is increasingly pressured by regional players with lower production costs. Players are differentiated through product innovation, digitalization, and vertical integration, especially in spinning, weaving, dyeing, and finishing. Sustainability and compliance with global standards are ever more important, especially for firms exporting to global fashion and home furnishing companies. According to the Indonesia textiles market forecast, the sector will see consistent growth in the coming years, propelled by the growing opportunities for exports and modern manufacturing processes. Volatility in raw material prices, fluctuations in global demand, and variations in trade policies also shape market dynamics. Domestic consumption also remains on the rise, fueled by an expanding middle class and an increasing fashion retail industry.

The report provides a comprehensive analysis of the competitive landscape in the Indonesia textiles market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: ECI Elastic inaugurated a new office in Indonesia and also hosted a product launch event. By establishing a local base in Indonesia, ECI Elastic aims to strengthen partnerships and better serve the region's growing textile sector.

- March 2025: Nanshan Fashion signed a joint venture agreement for the launch of an apparel manufacturing and processing project in Indonesia. The 160,000-unit project, which has a proposed land area of 26.78 mu (mu is an alternate version of “acre” and is equal to 666.67 square meters), is situated in the Galang Batang SEZ, Kepulauan Riau.

- October 2024: Led by Global Fashion Agenda in partnership with Rantai Tekstil Lestari (RTL) Indonesia, the Circular Fashion Partnership launched in Jakarta. It is a collaborative initiative aimed at establishing a sustainable and circular textile industry in Indonesia. The initiative also aligns with Indonesia's Circular Economy Roadmap and National Action Plan, emphasizing textile waste management as a priority sector.

- October 2024: Jakarta-based Busana Apparel Group officially joined the International Textile Manufacturers Federation (ITMF) as a corporate affiliate. As a result of joining ITMF, Busana Apparel will now have access to various insightful information, statistics, and surveys relevant to the textile sector.

Indonesia Textiles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Clothing, Industrial/Technical, Household |

| Materials Covered | Cotton, Jute, Silk, Synthetics, Wool |

| Process Covered | Woven, Non-woven |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia textiles market from 2020-2034.

- The Indonesia textiles market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia textiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The textiles market in Indonesia was valued at USD 14.5 Billion in 2025.

The growth of the Indonesia textiles market is driven by rising domestic demand for apparel, expanding export opportunities due to trade agreements, government incentives promoting local manufacturing, availability of low-cost labor, increasing investment in textile machinery and digital printing technologies, and shifting global sourcing preferences as companies seek alternatives to China for diversified supply chains and competitive production costs.

The textiles market in Indonesia is projected to exhibit a CAGR of 5.29% during 2026-2034, reaching a value of USD 23.1 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)