Indonesia Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Booking Channel, Financing Providers, and Region, 2026-2034

Indonesia Used Car Market Summary:

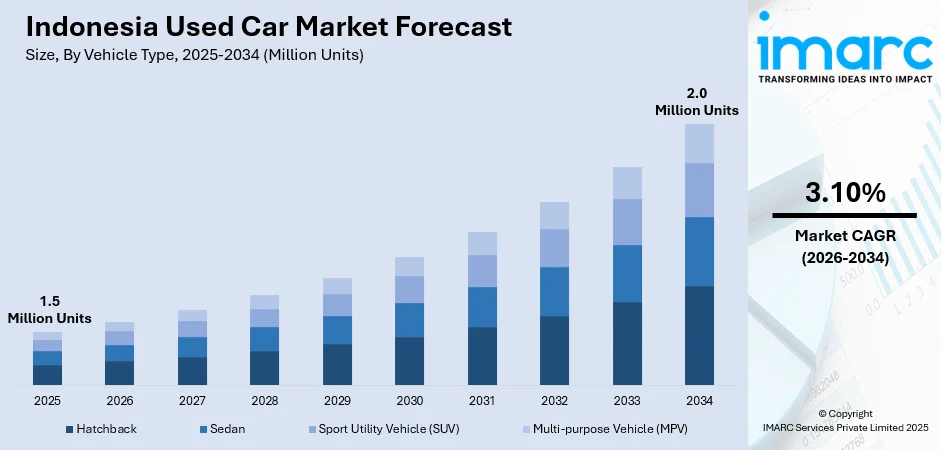

The Indonesia used car market size reached 1.5 Million Units in 2025 and is projected to reach 2.0 Million Units by 2034, growing at a compound annual growth rate of 3.10% from 2026-2034.

The Indonesia used car market is experiencing sustained growth, driven by the expanding middle-class population seeking cost-effective personal mobility solutions. The archipelago's rapid urbanization and limited public transportation infrastructure in many regions continue to bolster demand for pre-owned vehicles. Digital transformation across online marketplaces has revolutionized the buying experience, offering enhanced transparency and convenience. Furthermore, accessible financing options from banks and non-banking financial institutions have widened vehicle ownership opportunities for Indonesian households seeking affordable transportation alternatives.

Key Takeaways and Insights:

- By Vehicle Type: Multi-purpose vehicle (MPV) dominates the market with a share of 36% in 2025, owing to Indonesia's cultural preference for seven-seater family vehicles, offering flexible seating configurations and spacious interiors suitable for multigenerational households and extended family travel needs.

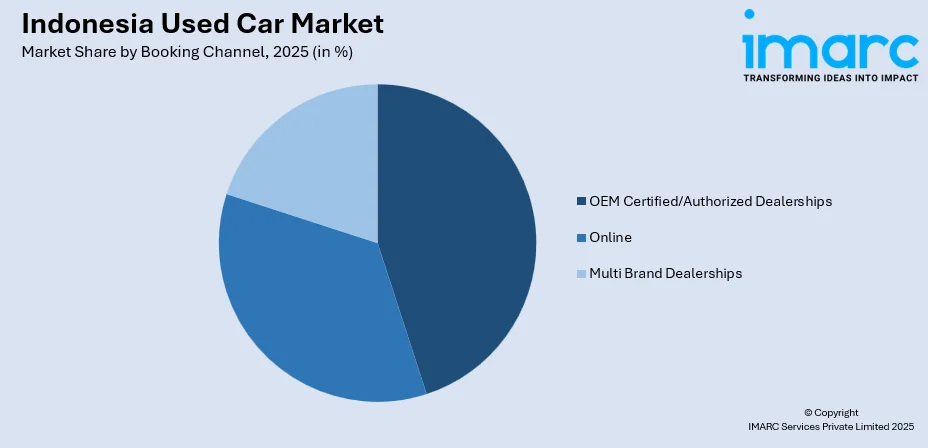

- By Booking Channel: OEM certified/authorized dealerships lead the market with a share of 40% in 2025, driven by consumer trust in quality assurance programs, comprehensive vehicle inspections, extended warranty offerings, and documented service histories that reduce purchasing risk.

- By Financing Providers: Banks comprise the largest segment with a market share of 48% in 2025, reflecting their well-established regulatory frameworks, competitive interest rates, extensive branch networks, and flexible loan tenure options that cater to diverse buyer profiles.

- By Region: Java represents the largest region with 60% share in 2025, driven by the concentration of Indonesia's population in Jakarta, Surabaya, and Bandung metropolitan areas, higher disposable incomes, developed infrastructure, and greater access to financing services.

- Key Players: Key players drive the Indonesia used car market by expanding digital platforms, improving certified pre-owned programs, and strengthening nationwide distribution networks. Their investments in technology-enabled inspections, affordable financing partnerships, and seamless documentation processes boost consumer confidence and accelerate market formalization. Some of the key players operating in the market include BMW AG, Auto Value, Caroline.id, Diamond Smart Auto, Mobil88, OLX Indonesia (Astra International), PT Mercedes-Benz Distribution Indonesia, and PT Tunas Ridean Tbk.

To get more information on this market Request Sample

In Indonesia, the market is propelled by a convergence of economic, demographic, and technological factors reshaping consumer mobility preferences. The nation's expanding middle-class population demonstrates increasing purchasing power while seeking cost-effective transportation alternatives to premium-priced new vehicles. In 2024, 66.35% of Indonesia’s population consisted of the middle class and those approaching middle-class status, accounting for 81.49% of household expenditures. Rapid urbanization across major cities has intensified demand for personal mobility as public transportation infrastructure remains underdeveloped in numerous regions. The digital revolution has fundamentally transformed transaction dynamics, with online platforms enabling comprehensive price comparisons, vehicle history verification, and seamless financing integration. Internet penetration has accelerated consumer adoption of digital marketplaces for vehicle discovery and purchase. Financial accessibility has improved substantially through bank partnerships offering competitive auto loan products.

Indonesia Used Car Market Trends:

Digital Marketplace Revolution Transforming Consumer Buying Behavior

The Indonesia used car market is experiencing a profound digital transformation as online platforms become the primary vehicle discovery channel. Platform operators are integrating inspection services, financing options, and documentation processing into unified digital ecosystems, significantly reducing transaction friction. These technological advancements enable comprehensive price comparisons, vehicle condition assessments, and financing pre-approvals, empowering consumers with unprecedented transparency and convenience throughout the purchase journey. This shift is accelerating market formalization, increasing buyer confidence, and expanding participation from first-time and digitally savvy consumers across Indonesia.

Rising Consumer Preferences for Affordable Personal Mobility Solutions

Indonesian consumers increasingly prioritize value-oriented mobility solutions, as new vehicle prices remain beyond reach for many households. The structural affordability advantage of pre-owned vehicles, combined with expanding urban population requiring personal transportation, drives sustained market demand. In 2024, the urban population in Indonesia accounted for 59.2% of the total population, as per the World Bank collection of development indicators. Budget-conscious buyers particularly favor vehicles aged three to five years that offer optimal balance between depreciation savings and remaining service life, while gig economy professionals seek reliable transportation for delivery and ride-sharing operations.

Expansion of Certified Pre-Owned Programs Enhancing Market Formalization

Certified pre-owned programs are gaining significant traction, as quality-conscious consumers seek professional assurance for vehicle purchases. These programs typically feature rigorous multi-point inspections, refurbishment processes, and extended warranty coverage that substantially reduce buyer risk. In Indonesia, automaker-backed and dealer-led certified pre-owned initiatives are helping standardize pricing and documentation practices across the fragmented used car market. These programs also improve access to financing and insurance by offering verified vehicle histories and assured quality benchmarks.

Market Outlook 2026-2034:

The Indonesia used car market is positioned for sustained expansion throughout the forecast period, supported by favorable demographic trends, improving financial accessibility, and ongoing digital transformation. The nation's urbanization trajectory, with over 60% of the population expected to reside in urban areas, will continue to drive the demand for personal transportation solutions. The market size was estimated at 1.5 Million Units in 2025 and is expected to reach 2.0 Million Units by 2034, reflecting a compound annual growth rate of 3.10% over the forecast period 2026-2034. Strategic investments in digital infrastructure, certified pre-owned programs, and innovative financing solutions will accelerate market formalization while expanding geographic reach beyond Java into emerging tier-two and tier-three cities across the archipelago.

Indonesia Used Car Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Multi-purpose Vehicle (MPV) |

36% |

|

Booking Channel |

OEM Certified/Authorized Dealerships |

40% |

|

Financing Providers |

Banks |

48% |

|

Region |

Java |

60% |

Vehicle Type Insights:

- Hatchback

- Sedan

- Sport Utility Vehicle (SUV)

- Multi-purpose Vehicle (MPV)

Multi-purpose vehicle (MPV) dominates with a market share of 36% of the total Indonesia used car market in 2025.

The multi-purpose vehicle (MPV) segment maintains commanding market presence in Indonesia due to deeply embedded cultural preferences for vehicles accommodating extended families. Indonesian households traditionally comprise multiple generations living together, creating sustained demand for seven-seater configurations offering flexible passenger and cargo capacity. The segment benefits from favorable historical tax regulations that exempt minibuses from luxury goods taxation, establishing MPVs as mainstream family transportation. MPV dominance extends into the used car segment where depreciation benefits make family-friendly models accessible to budget-conscious households.

The practical utility for school transportation, family gatherings during religious holidays, and daily commuting needs reinforces sustained demand. Sliding door configurations and spacious interiors appeal particularly to multigenerational households navigating congested urban environments. Additionally, Japanese brands commanding market leadership have cultivated robust spare parts availability and service networks, ensuring affordable maintenance that enhances total cost of ownership appeal for value-oriented used car buyers seeking reliable family transportation.

Booking Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- OEM Certified/Authorized Dealerships

- Multi Brand Dealerships

OEM certified/authorized dealerships lead with a share of 40% of the total Indonesia used car market in 2025.

OEM certified/ authorized dealerships command significant market share through quality assurance programs that differentiate professional operations from fragmented, informal channels. These authorized networks provide comprehensive multi-point vehicle inspections, refurbishment services, documented service histories, and extended warranty coverage that substantially reduce buyer risk. Standardized evaluation criteria and transparent certification labels further enhance buyer confidence and simplify comparison across offerings. This structured approach supports consistent vehicle quality and strengthens the overall credibility of organized used car channels in Indonesia.

The trust advantage offered by OEM certified channels particularly appeals to first-time used car buyers navigating purchase decisions with limited technical expertise. Professional dealerships integrate financing partnerships, insurance products, and aftersales support into streamlined transaction experiences. Major OEM certified operations concentrate in Jakarta, Bandung, Surabaya, and other metropolitan centers where higher income concentrations support premium service models. Additionally, manufacturer relationships ensure genuine parts availability and authorized service centers that preserve vehicle value and performance throughout the ownership period, justifying price premiums over informal market alternatives.

Financing Providers Insights:

- OEMs

- Banks

- Non-Banking Financial Companies

Banks exhibit a clear dominance with a 48% share of the total Indonesia used car market in 2025.

Banking institutions maintain market leadership in used car financing through extensive branch networks, regulated lending frameworks, and competitive interest rates. Major players have strategically expanded auto loan portfolios to capture growing used vehicle demand. PT Bank Central Asia Tbk’s (BCA) motor vehicle loan portfolio broadened to Rp 65.3 Trillion in 2024, recording 14.8% year-over-year growth that underscores sustained financing appetite. This expansion reflects banks’ confidence in asset quality and rising consumer willingness to finance used vehicle purchases.

Bank dominance reflects consumer preference for transparent lending terms, established regulatory protections, and straightforward ownership structures compared to leasing alternatives. Digital transformation has accelerated loan processing, with online channels accounting for increasing application volumes as banks implement electronic know-your-customer (KYC) verification and artificial intelligence (AI)-powered credit scoring. Furthermore, strategic partnerships between banks and digital automotive platforms enable embedded financing solutions that streamline purchase journeys for tech-savvy consumers seeking seamless transaction experiences.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Java represents the leading region with a 60% share of the total Indonesia used car market in 2025.

Java dominates the market owing to concentrated population density, developed economic infrastructure, and established automotive ecosystems. Jakarta's metropolitan area commands premium used vehicle valuations, with average ticket prices exceeding national norms by significant margins. The island hosts majority of Indonesia's manufacturing operations, generating substantial trade-in flows and supporting robust dealer networks across Bekasi, Bandung, Surabaya, and surrounding industrial corridors. The regional concentration reflects broader economic dynamics, as Java accommodates a large urban population with high per capita income and mature financial services infrastructure.

Jakarta specifically demonstrates elevated private car ownership at 1,077 vehicles for every 1,000 residents in 2024. Dense dealership presence from both OEM certified networks and multi-brand operations ensures comprehensive market coverage, while well-developed road infrastructure, including the Trans-Java Toll Road, facilitates efficient vehicle logistics and customer accessibility. Furthermore, proximity to automotive manufacturing centers ensures superior spare parts availability and service network coverage that enhances used vehicle value retention.

Market Dynamics:

Growth Drivers:

Why is the Indonesia Used Car Market Growing?

Expanding Middle-Class Population Seeking Affordable Mobility Solutions

Indonesia's expanding middle-class population serves as a fundamental growth catalyst for the used car market, creating sustained demand for cost-effective personal transportation alternatives. New vehicle pricing remains prohibitive for many households due to substantial taxation, including import duties and luxury goods levies that elevate retail costs beyond accessible thresholds. Used vehicles offer compelling value propositions, enabling families to achieve mobility aspirations at significantly reduced price points while benefiting from depreciation that diminishes most dramatically during initial ownership years. The widening gap between escalating new car prices and gradual household income growth structurally favors pre-owned alternatives. Additionally, Indonesia's 5.03% GDP growth in 2024 demonstrates continued economic momentum that expands the addressable consumer base capable of financing vehicle purchases. The broadening middle class increasingly prioritizes vehicle ownership as a symbol of economic stability and lifestyle improvement, further reinforcing long-term demand for used cars across urban and semi-urban regions.

Rapid Urbanization Driving Personal Transportation Demand

Rapid urbanization is a key factor driving personal transportation demand and supporting growth of the Indonesia used car market. Expanding urban population in major cities is increasing daily commuting needs, while urban sprawl pushes residential areas farther from employment hubs, making private vehicles a practical necessity. Public transportation networks, although improving, often lack comprehensive coverage and flexibility, encouraging households to seek affordable personal mobility solutions. Used cars offer a cost-effective entry point for first-time vehicle buyers, young professionals, and middle-income families adapting to urban lifestyles. Rising congestion and time sensitivity further strengthen preference for private transport over shared options. Additionally, urbanization fuels growth of service-based employment and small businesses that depend on reliable mobility, increasing demand for pre-owned vehicles. Together, these factors position used cars as an accessible, flexible, and economical transportation choice within Indonesia’s rapidly urbanizing landscape.

Digital Platform Innovations

Digital transformation across automotive retail channels has fundamentally enhanced used car market accessibility, transparency, and transaction efficiency. Indonesia's internet penetration exceeding 79.5% in 2024 has accelerated consumer adoption of online platforms for vehicle discovery, comparison, and purchase facilitation. Leading digital marketplaces have reshaped traditional buying journeys by offering detailed vehicle listings, standardized condition assessments, transparent pricing benchmarks, and integrated financing options. Growing adoption among younger, tech-savvy consumers is accelerating the shift towards technology-enabled purchasing experiences. Platform operators increasingly combine inspection services, documentation handling, and delivery logistics into seamless end-to-end processes that reduce transaction friction. AI-driven pricing tools and vehicle grading systems further enhance transparency by standardizing quality evaluations and minimizing price inconsistencies. Additionally, partnerships between digital platforms and financial institutions enable embedded financing solutions, simplifying credit approvals and supporting faster purchase decisions.

Market Restraints:

What Challenges the Indonesia Used Car Market is Facing?

High Interest Rate Environment Constraining Consumer Financing Capacity

Elevated interest rate environments pose significant constraints on consumer financing capacity and vehicle affordability in Indonesia. Monetary tightening increases borrowing costs, placing added pressure on automotive sales momentum. As a large share of vehicle purchases relies on financing arrangements, higher interest rates directly translate into increased monthly repayment obligations. This reduces affordability for budget-conscious consumers and delays purchase decisions, particularly in the used car segment where buyers are highly sensitive to changes in loan terms and total ownership costs.

Fragmented Market Structure Limiting Quality Assurance Standards

In Indonesia, the used car market remains substantially fragmented with unorganized dealers comprising majority of market volume. This informal structure creates challenges regarding vehicle quality verification, documentation authenticity, and consumer protection. Many traditional dealerships operate without standardized inspection protocols or warranty coverage, creating asymmetric information that disadvantages buyers lacking technical expertise. Market formalization efforts face resistance from established informal networks.

Geographic Distribution Challenges Beyond Primary Urban Markets

Indonesia's archipelagic geography creates significant logistics challenges for used car distribution beyond Java's concentrated market infrastructure. Outer islands face limited dealer presence, higher transportation costs, and reduced access to financing services. Vehicle inspection networks and certified pre-owned programs primarily concentrate in major metropolitan centers, leaving secondary markets underserved. Infrastructure constraints, including port capacity and road quality in remote regions, impede efficient inventory movement across the dispersed island geography.

Competitive Landscape:

The Indonesia used car market exhibits a fragmented competitive structure comprising established OEM certified dealerships, technology-driven digital platforms, multi-brand dealer networks, and numerous independent operators. Major players differentiate through quality assurance programs, integrated financing partnerships, and digital capabilities that enhance customer experience. Strategic consolidation continues as established automotive conglomerates acquire digital platforms to create vertically integrated ecosystems combining inspection, financing, insurance, and aftersales services. Competition intensifies around certified pre-owned programs that command premium positioning through warranty coverage and documented vehicle histories. Digital platforms leverage technology investments, including AI-powered pricing, virtual inspections, and embedded financing, to capture market share from traditional channels. The competitive landscape rewards scale advantages through expanded inventory access, superior financing terms, and nationwide distribution reach.

Some of the key players include:

- BMW AG

- Auto Value

- Caroline.id

- Diamond Smart Auto

- Mobil88

- OLX Indonesia (Astra International)

- PT Mercedes-Benz Distribution Indonesia

- PT Tunas Ridean Tbk

Recent Developments:

- In May 2025, Astra, a conglomerate based in Indonesia, and Toyota, an automotive company from Japan, are enhancing their strategic alliance and broadening their cooperation in the used car market via a collaboration in PT Astra Digital Mobil (ADMO). Toyota Motor Asia (Singapore) Private Limited. Ltd. (TMA) obtained a 40% share in ADMO. This collaboration strengthened the firms’ dedication to innovation, accessibility, and providing reliable mobility solutions to every Indonesian.

Indonesia Used Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Units |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, Sport Utility Vehicle (SUV), Multi-purpose Vehicle (MPV) |

| Booking Channels Covered | Online, OEM Certified/Authorized Dealerships, Multi Brand Dealerships |

| Financing Providers Covered | OEMs, Banks, Non-Banking Financial Companies |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | BMW AG, Auto Value, Caroline.id, Diamond Smart Auto, Mobil88, OLX Indonesia (Astra International), PT Mercedes-Benz Distribution Indonesia, PT Tunas Ridean Tbk, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indonesia used car market reached a volume of 1.5 Million Units in 2025.

The Indonesia used car market is expected to grow at a compound annual growth rate of 3.10% from 2026-2034 to reach 2.0 Million Units by 2034.

Multi-purpose vehicle (MPV) dominated the market with a share of 36%, driven by cultural preferences for seven-seater family vehicles and flexible seating configurations suitable for multigenerational Indonesian households.

Key factors driving the Indonesia used car market include expanding middle-class population seeking affordable mobility, rapid urbanization increasing personal transportation demand, and digital platform innovations aimed at enhancing market accessibility and transparency.

Major challenges include elevated interest rates constraining financing capacity, fragmented market structure limiting quality assurance standards, geographic distribution challenges beyond Java, insufficient inspection standardization, and limited consumer protection frameworks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)