Indonesia Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and Region, 2025-2033

Indonesia Used Cooking Oil Market Overview:

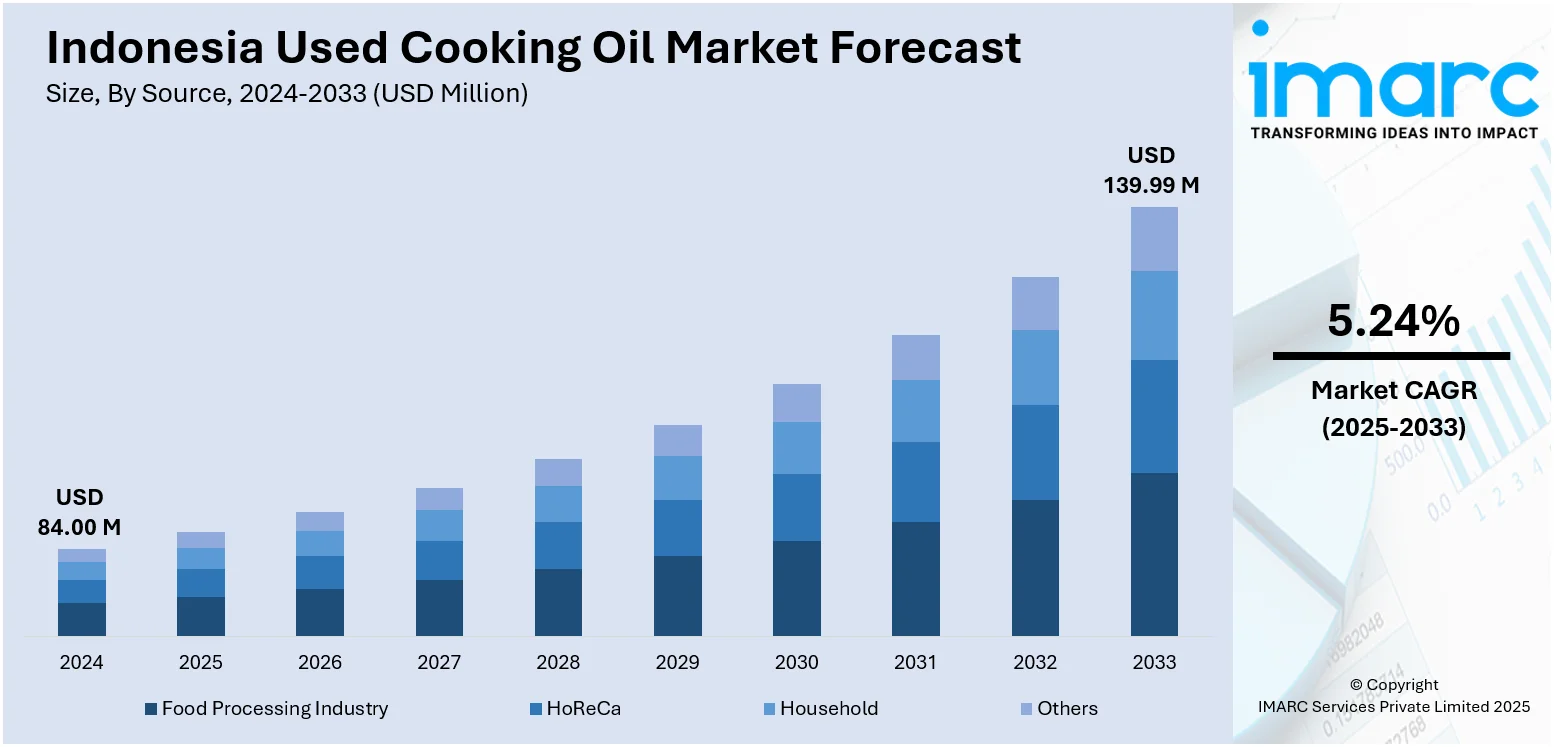

The Indonesia used cooking oil market size reached USD 84.00 Million in 2024. The market is projected to reach USD 139.99 Million by 2033, exhibiting a growth rate (CAGR) of 5.24% during 2025-2033. The high volume of waste oil generated from excessive utilization of palm oil presents a significant opportunity for collection, recycling, and conversion into valuable products, such as biodiesel. Besides this, the growing need to reduce carbon emissions in aviation is contributing to the expansion of the Indonesia used cooking oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 84.00 Million |

| Market Forecast in 2033 | USD 139.99 Million |

| Market Growth Rate 2025-2033 | 5.24% |

Indonesia Used Cooking Oil Market Trends:

Rising applications in aircraft industry

With the growing need to reduce carbon emissions in aviation, the demand for alternative fuels that meet sustainability and performance standards is rising rapidly in Indonesia. Used cooking oil is emerging as a key feedstock for producing sustainable aviation fuel (SAF) due to its lower lifecycle emissions and compatibility with existing jet engines. In Indonesia, this trend is encouraging the development of refining technologies and partnerships between energy companies and aviation stakeholders to scale up the production of SAF using used cooking oil. Companies are investing in advanced bio-refineries to convert used cooking oil into certified SAFs for commercial flights. In July 2025, Pertamina produced bioavtur from used cooking oil at its Cilacap refinery in Indonesia. The state-owned energy company targeted a test flight in mid-August as it started manufacturing its new SAF derived from used cooking oil, utilizing a bioavtur synthesis method for which it created the ‘Red and White catalyst.’ The expansion of SAF production is not only enhancing Indonesia’s position in the global green energy market but also driving consistent demand for used cooking oil, encouraging better waste management practices and supporting the country’s transition to a low-carbon circular economy.

To get more information on this market, Request Sample

Increasing palm oil utilization

Large-scale palm oil usage is impelling the Indonesia used cooking oil market growth. As one of the world’s major producers and consumers of palm oil, Indonesia relies heavily on this oil for household cooking, food processing, and commercial foodservice operations. As per the USDA, in Indonesia, palm oil output is expected to increase by 3% to 47 Million Tons during the 2025-26 season. The widespread and routine utilization of palm oil across homes, restaurants, street vendors, and industrial kitchens results in the consistent production of large quantities of used cooking oil. This high volume of waste oil presents a significant opportunity for collection, recycling, and conversion into valuable products, such as biodiesel. The affordability and accessibility of palm oil make it the preferred choice among industries and individuals, thereby ensuring a continuous flow of used cooking oil into the market. In response, collection networks, recyclers, and biodiesel producers are targeting palm oil-rich waste streams to secure raw material. Additionally, the environmental and health concerns associated with the repeated or improper use of cooking oil have led to better disposal practices and encouraged regulatory support for collection systems. As palm oil employment remains high and continues to grow alongside population and urbanization trends, it is fueling the expansion of the market in Indonesia by sustaining a steady and reliable supply base.

Indonesia Used Cooking Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source and application.

Source Insights:

- Food Processing Industry

- HoReCa

- Household

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes food processing industry, HoReCa, household, and others.

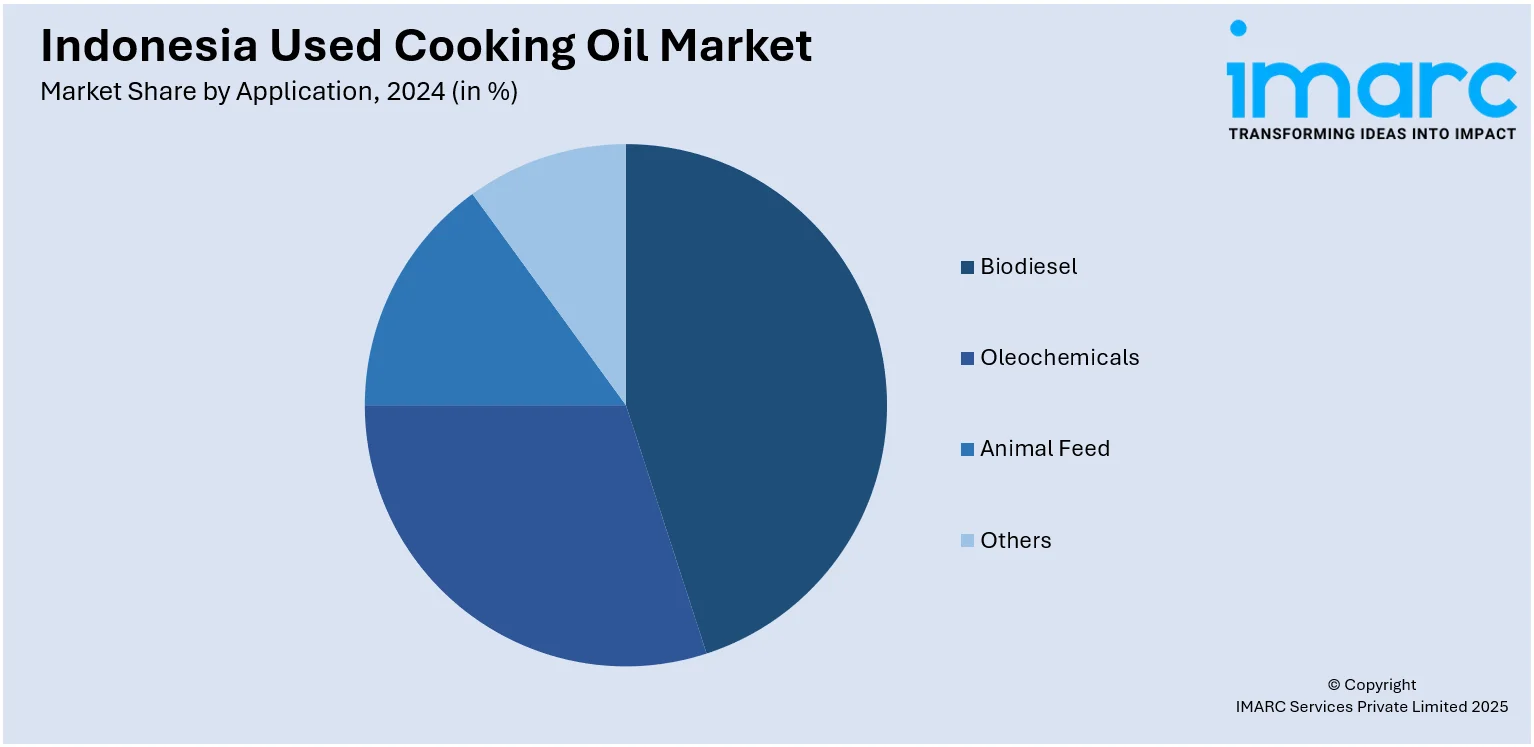

Application Insights:

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes biodiesel, oleochemicals, animal feed, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Used Cooking Oil Market News:

- In July 2025, Alfamart Indonesia invested Rp16.2 Billion in PT Noovoleum Indonesia Investama, a company focused on recycling used cooking oil. Through this agreement, Alfamart secured expenditure prospects in conjunction with collaborative business synergy.

- In January 2025, Kilang Pertamina Internasional planned to deliver its initial certified SAF in Indonesia, utilizing used cooking oil as the feedstock. KPI announced that its Green Refinery Cilacap could process 6,000 Barrels of used cooking oil daily to produce hydrotreated vegetable oil and SAF, with a total output projected to be around 300,000 Kiloliters annually.

Indonesia Used Cooking Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Food Processing Industry, HoReCa, Household, Others |

| Applications Covered | Biodiesel, Oleochemicals, Animal Feed, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia used cooking oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia used cooking oil market on the basis of source?

- What is the breakup of the Indonesia used cooking oil market on the basis of application?

- What is the breakup of the Indonesia used cooking oil market on the basis of region?

- What are the various stages in the value chain of the Indonesia used cooking oil market?

- What are the key driving factors and challenges in the Indonesia used cooking oil market?

- What is the structure of the Indonesia used cooking oil market and who are the key players?

- What is the degree of competition in the Indonesia used cooking oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia used cooking oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia used cooking oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia used cooking oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)