Indonesia Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel and Region, 2025-2033

Indonesia Vegan Cosmetics Market Overview:

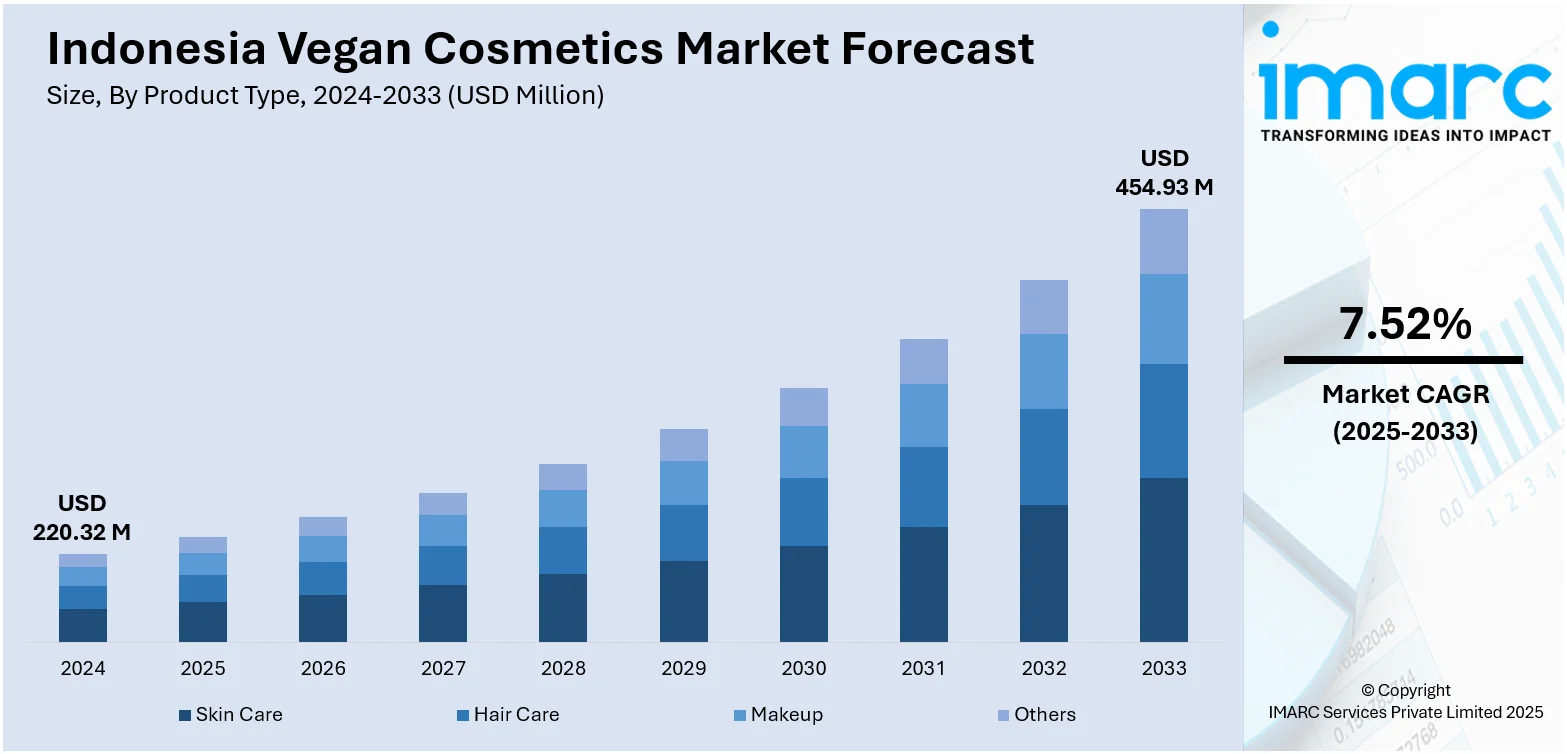

The Indonesia vegan cosmetics market size reached USD 220.32 Million in 2024. Looking forward, the market is expected to reach USD 454.93 Million by 2033, exhibiting a growth rate (CAGR) of 7.52% during 2025-2033. The market is fueled by the nation's young, urban demographic who prefer cruelty‑free, plant‑based goods. Widespread use of locally produced natural ingredients like coconut oil, turmeric, and plant extracts and overt endorsement from beauty vloggers and social media encourages speed of awareness and legitimacy, rendering vegan-friendly products into the mainstream market. Growth of e‑commerce platforms and retail chains provides widespread accessibility, allowing consumers across major cities and smaller towns to discover and shop Indonesian vegan beauty brands, which collectively reinforces the Indonesia vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 220.32 Million |

| Market Forecast in 2033 | USD 454.93 Million |

| Market Growth Rate 2025-2033 | 7.52% |

Indonesia Vegan Cosmetics Market Trends:

Integration of Tropical Botanicals and Cultural Beauty Traditions

In Indonesia, vegan cosmetics are increasingly infused with locally treasured tropical botanicals deeply rooted in cultural beauty traditions. Ingredients such as coconut oil, sacha inchi oil, turmeric, aloe vera, and Indonesian indigenous flowers including jasmine and frangipani are often used in vegan products that show both wellness and heritage. Formulators draw on ancient beauty knowledge like coconut hair care rituals and turmeric face masks, and transform them into cruelty-free, plant-based serums, creams, and body oils. This cultural appeal wins the trust of Indonesian consumers who prize natural authenticity and promotes local entrepreneurship by utilizing indigenous raw materials. Use of coconut oil, which pervades Indonesian kitchens and cuisine, as the base for vegan lip balms or makeup removers creates a sense of familiarity. At the same time, the use of turmeric or ginger extract in skin-soothing tonics appeals to beauty-oriented consumers in pursuit of chemical-free products. By combining native beauty wisdom with contemporary vegan beauty ideals, companies produce products that are both cutting edge and supremely rooted in Indonesian identity, further contributing to the Indonesia vegan cosmetics market growth.

To get more information on this market, Request Sample

Youth‑Led Digital Discovery and Influencer Evangelism

Indonesia's young, digitally literate population is driving the rise of vegan cosmetics through social media discovery and influencer evangelism. Planks like Instagram, TikTok, YouTube, and local ones like Shopee Beauty and Tokopedia feature influential beauty vloggers showcasing vegan skincare routines and methods utilizing plant-derived skincare products. They highlight openness of ingredients, cruelty-free testing, and responsible production, winning the trust and making others aware, particularly millennials and Gen Z in Jakarta, Surabaya, and Bandung. Their content also positions vegan beauty as an extension of a larger eco-friendly lifestyle, highlighting refillable packaging, sustainable sourcing, and embossments of halal certification. According to industry reports, in early 2025, Indonesia had 356 million active cellular mobile connections, representing 125% of the overall population. Nonetheless, keep in mind that certain connections might only offer services like voice and SMS, while others may lack internet access. Additionally, at the beginning of 2025, Indonesia had 212 million internet users, with online penetration reaching 74.6%. Apart from this, peer-to-peer recommendations from user-generated content reinforce word-of-mouth endorsements throughout urban and suburban territories, positioning vegan beauty as aspirational yet attainable. Social media trends also create viral interest in domestically produced Indonesian vegan brands, propelling demand for clean beauty. This colorful digital community not only increases visibility but also creates community, driving consumer experimentation and loyalty to plant-based beauty products.

Retail Transformation: From Concept Boutique Stores to E‑Commerce Sites

The Indonesian retail environment is transforming to meet and upscale vegan cosmetics through both offline and online channels. In big cities, spa-beauty stores and wellness boutiques edit Indonesian vegan and cruelty-free lines alongside natural and organic offerings, providing consumers with experiential discovery. These stores tend to feature Indonesian vegan brands next to international clean beauty brands, showcasing halal-certified, plant-based formulas, and eco-friendly packaging. Meanwhile, top e-commerce sites like Shopee, Tokopedia, and Lazada offer special vegan beauty drops and hand-curated selections that feature local startup brands. Beauty-oriented pop-up bazaars and mall shows frequently feature vegan sections, allowing shoppers to sample products directly and interact with brand narratives around sustainable sourcing and local ingredient procurement. Product lines offered for hot, humid weather conditions like light vegan sunscreens, matte vegan BB creams, and non-comedogenic facial mists, are on the rise. The combination of experiential retail and e-commerce is making vegan cosmetics mainstream from niche in Indonesia's fast-paced beauty market.

Indonesia Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

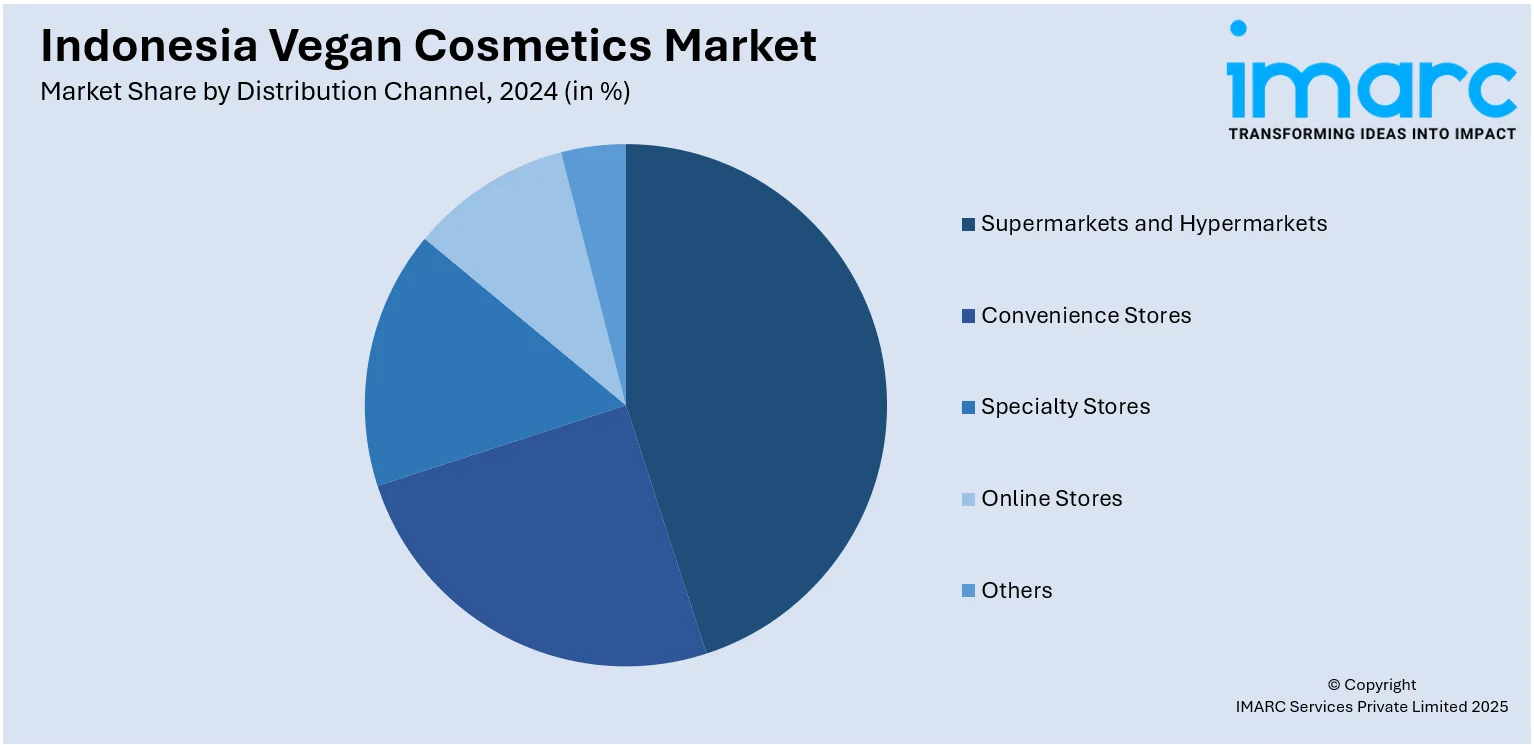

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Vegan Cosmetics Market News:

- In July 2024, the Indonesian vegan cosmetics company Esqa obtained US$ 4 Million in a Series B investment round led by Unilever Ventures. Following a USD 6 million Series A round in 2022, Esqa has now raised a total of USD 10 Million in investment.

Indonesia Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia vegan cosmetics market on the basis of product type?

- What is the breakup of the Indonesia vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Indonesia vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Indonesia vegan cosmetics market?

- What are the key driving factors and challenges in the Indonesia vegan cosmetics market?

- What is the structure of the Indonesia vegan cosmetics market and who are the key players?

- What is the degree of competition in the Indonesia vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)