Industrial Aerators Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Industrial Aerators Market Size and Share:

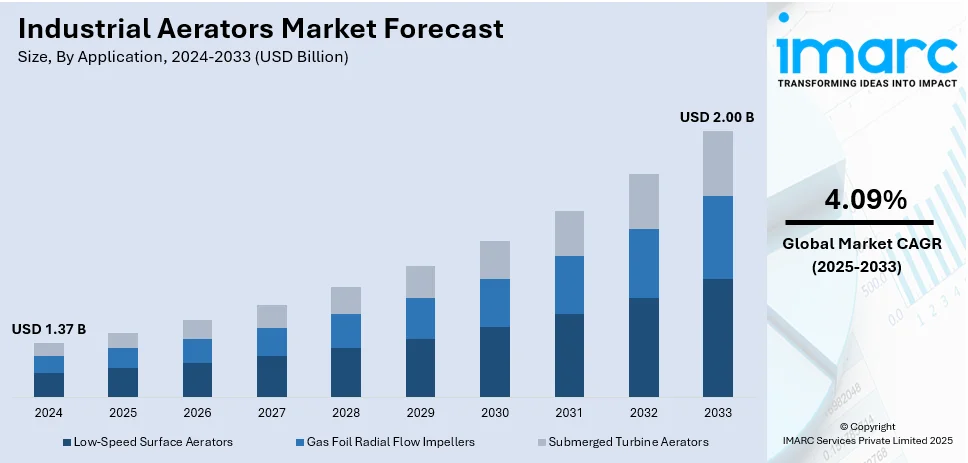

The global industrial aerators market size was valued at USD 1.37 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.00 Billion by 2033, exhibiting a CAGR of 4.09% from 2025-2033. Asia Pacific currently dominates the market, holding a industrial aerators market share of over 33.2% in 2024. The implementation of environmental regulations, rising water scarcity across the globe, rapid technological advancements and the growing emphasis on reducing energy consumption represent some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.37 Billion |

| Market Forecast in 2033 | USD 2.00 Billion |

| Market Growth Rate (2025-2033) | 4.09% |

One major driver in the industrial aerators market is the increasing focus on wastewater treatment across industries. Stringent environmental regulations and rising concerns over water pollution have led to greater adoption of aeration technologies in municipal and industrial wastewater facilities. Aerators play a crucial role in enhancing oxygen transfer efficiency, promoting biological treatment, and reducing harmful contaminants. Growing industrialization, particularly in emerging economies, has further fueled demand for effective wastewater management solutions. Additionally, advancements in aeration technology, including energy-efficient and high-performance aerators, are driving market growth by improving operational efficiency and reducing energy consumption in treatment plants.

In the United States, the primary drivers in the industrial aerators market are efficient wastewater treatments in a number of sectors; municipal, F&B, and manufacturing. Strict environmental regulations and water quality regulations force industries to use high technology aeration solutions for proper management of effluents. Moreover, the surge in the sustainable and energy-efficient environment leads to an increasing demand for the energy-efficient aerators, for example, fine bubble diffusers and mechanical aerators. Furthermore, rising industrial water reclamation and water management practices also create a large requirement for aerators to be used for industrial wastewater applications, thus stimulating the industrial aerators market growth.

Industrial Aerators Market Trends:

Implementation of Environmental Regulations

The implementation of various government laws and standards to protect the environment, particularly water bodies, from industrial pollution is creating a positive outlook for the market growth. Moreover, the introduction of favorable policies, leading to a surge in the demand for efficient wastewater treatment technologies, is providing a thrust to the market growth. Global investment in clean technology manufacturing increased by 50% in 2023 to USD 235 Billion, according to the International Energy Agency, as more focus is being placed on sustainability and clean technology solutions. Along with this, the widespread utilization of industrial aerators, as they ensure the breakdown of organic matter and reduce the levels of harmful substances in wastewater, is positively impacting the market growth. In addition to this, the widespread product adoption in various industries, like chemicals, pharmaceuticals, and food processing, due to the heightened introduction of regulations is favoring the market growth. Furthermore, the introduction of substantial fines, legal actions, and damage to an organization's reputation due to failure to comply with regulations is also providing a considerable boost to the market growth.

Rising Water Scarcity Across the Globe

The rising water scarcity across the globe, promoting the need for efficient water management and conservation practices, is providing a thrust to the market growth. Moreover, the growing stress over the availability of freshwater due to factors like climate change, overexploitation of water resources, and increasing population, prompting industries to adopt sustainable water management practices, is creating a positive outlook for the market growth. In 2020, an estimated 2.4 billion people lived in water-stressed countries, of which almost 800 million lived in high and critically high water-stressed countries. According to United Nations Statistics Division (UNSD), improving water-use efficiency is one key to reducing water stress. This growing concern is fueling the demand for advanced water treatment technologies. Along with this, the growing adoption of industrial aerators, as they ensure that the water is sufficiently oxygenated, is favoring the market growth. In line with this, the widespread adoption of industrial aerators for water treatment and recycling in sectors like mining, textiles, and agriculture, where large volumes of water are required, is catalyzing the industrial aerators market demand.

Rapid Technological Advancements

The continuous development in aeration technology, enhancing the efficiency, cost-effectiveness, and environmental compatibility of aerators, is creating a positive outlook for the market growth. During Equip Exposition trade show in October 2023, Z Turf Equipment added a new addition to its arsenal, the Z-Aerate 50 stand-on aerator. This new aerator can aeration up to four acres an hour while applying granular material; this is what the industry trend does - improve efficiency in operations. Along with this, the introduction of more energy-efficient aerator systems incorporating energy-saving technologies, such as high-efficiency motors and optimized aeration patterns, which reduce overall energy consumption, is providing a considerable boost to the market growth. Apart from this, the integration of smart technology and automation in aerators to allow real-time monitoring and adjustment of aeration levels based on specific requirements is anticipated to drive the market growth. Furthermore, rapid innovations in the design and materials used in aerators, such as the development of fine bubble diffusers, which produce smaller bubbles, leading to significant improvements in oxygen transfer efficiency, are offering remunerative growth opportunities in the industrial aerators market outlook.

Industrial Aerators Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial aerators market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

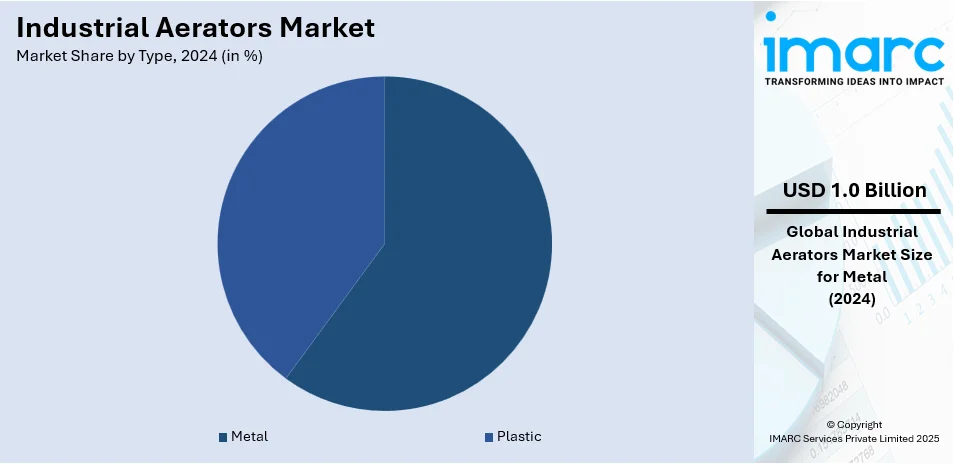

Analysis by Type:

- Metal

- Plastic

The metal segment dominates the market growth, accounting for 60.2% of the industrial aerators market share, primarily due to the extensive use of aerators in metal processing industries. Metal manufacturing processes, such as steel and aluminum production, require efficient wastewater treatment systems to handle the large volumes of water used during operations. Industrial aerators are crucial in these sectors for oxygenating wastewater and supporting biological treatment processes, ensuring compliance with environmental regulations. Additionally, the metal industry’s focus on improving sustainability, reducing water usage, and recycling wastewater drives the demand for high-performance aeration systems. The continuous industrial growth and increasing regulations around wastewater management further contribute to the dominance of the metal segment in the aerators market.

Analysis by Application:

- Low-Speed Surface Aerators

- Gas Foil Radial Flow Impellers

- Submerged Turbine Aerators

Low-speed surface aerators lead market growth due to their cost-effectiveness and energy efficiency in wastewater treatment applications. These aerators are widely used in large-scale industrial and municipal treatment plants for surface aeration, where they provide optimal oxygen transfer by agitating the water surface. Their design minimizes energy consumption, making them ideal for continuous operation in various sectors, including metal, food and beverage, and municipal wastewater treatment. The ability to handle varying flow conditions and their relatively low maintenance requirements further drive their popularity, contributing significantly to market expansion, especially in regions focused on sustainable, low-energy solutions.

Analysis by End User:

- Municipal

- Aquaculture

- Industrial

- Pulp and Paper Manufacturing

- Petrochemical

- Textile

- Pharmaceutical

- Food and Beverages

- Oil and Gas

- Mining

- Others

The industrial sector dominates the market growth for industrial aerators due to the high demand for efficient wastewater treatment solutions across various industries, including manufacturing, food and beverage, pharmaceuticals, and chemicals. Industries generate large volumes of wastewater, requiring effective aeration systems to meet stringent environmental regulations and ensure the proper treatment of effluents before discharge. Industrial aerators help optimize oxygen transfer in wastewater treatment processes, enhancing treatment efficiency and reducing operational costs. The growing focus on sustainability, water conservation, and recycling further drives the adoption of aerators, supporting the continued dominance of the industrial sector in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the industrial aerators market forecast, Asia Pacific holds the leading position in the industrial aerators market with a 33.2% market share due to rapid industrialization and urbanization across key economies like China, India, and Japan. The region's growing manufacturing, chemical, and food processing sectors generate large volumes of wastewater, driving the need for effective aeration systems. Additionally, increasing environmental awareness and stringent regulatory frameworks are prompting industries to adopt advanced wastewater treatment solutions. The region's emphasis on water conservation, industrial wastewater recycling, and the rising demand for energy-efficient aerators further contribute to Asia Pacific's dominant position in the global market.

Key Regional Takeaways:

North America Industrial Aerators Market Analysis

The North American industrial aerators market is experiencing growth driven by increasing industrial activities, particularly in sectors such as food and beverage, chemicals, and pharmaceuticals, which require effective wastewater treatment solutions. Stringent environmental regulations across the U.S. and Canada are compelling industries to adopt advanced aeration technologies to meet water quality standards and ensure responsible wastewater management. The region's focus on sustainability and water conservation further promotes the adoption of energy-efficient aeration systems, such as fine bubble diffusers and surface aerators. Additionally, the growing demand for industrial wastewater recycling and circular economy practices supports the market's expansion. Technological innovations aimed at improving aerator performance, reducing operational costs, and extending service life are also fueling market growth. Moreover, the increasing infrastructure investments in wastewater treatment plants and municipal projects contribute to the rising demand for industrial aerators in North America, positioning the region as a significant player in the global market.

United States Industrial Aerators Market Analysis

According to the United States Department of Health and Human Services, an estimated 30 million adults in the United States were lactose intolerant as of 2020. Due to this trend, plant-based dairy alternatives have become popular among America's lactose intolerant consumers. With increased demand for efficient and sustainable processes in the F&B industry, the upward trend has impacted the U.S. industrial aerators market. Aeration plays an important role in a number of different applications for F&B processes, like fermentation and brewing as well as wastewater treatments. Increasing demand for energy-efficient and cost-effective aeration systems in the production process of F&B is another driving factor for this market. Increased regulatory forces on food processing to reduce their environmental footprint, such as stricter standards on wastewater treatment, are compelling the sector to be enhanced aerators. Innovations in aeration technology, such as energy-efficient motors and automated systems, are further supporting market growth by optimizing performance and minimizing operational costs in the F&B sector.

Europe Industrial Aerators Market Analysis

The Europe industrial aerators market is driven by increasing demand for efficient wastewater treatment solutions across municipal and industrial sectors. Stricter environmental regulations and sustainability initiatives are pushing industries to adopt advanced aeration technologies for improved oxygen transfer efficiency and reduced energy consumption. The food and beverage, chemical, and pharmaceutical industries are witnessing rising adoption of aerators to enhance effluent treatment processes, ensuring compliance with stringent discharge norms. Technological advancements, including energy-efficient diffused aeration systems and automated controls, are enhancing operational efficiency and cost-effectiveness. The growing focus on circular economy principles is further encouraging wastewater recycling, driving aerator adoption. Additionally, expanding industrialization and infrastructure development are stimulating demand for aeration systems in new and existing wastewater treatment facilities. Key market players are investing in research and development to introduce high-performance aerators with improved durability and lower maintenance requirements, further supporting market expansion across Europe.

Asia Pacific Industrial Aerators Market Analysis

The textile industry in India is expected to grow at a CAGR of 8.9% in the forecast period 2023-32; the industry is expected to reach USD 23.32 Billion in 2032 from USD 10.78 Billion in 2023, according to IBEF. This growth in the textile sector gives a substantial thrust to the Asia Pacific industrial aerators market. Textile industry, being water-intensive, uses most of its processes through aeration systems for proper treatment of wastewater, dyeing processes, and water usage. As textile demand grows, particularly in India, the need for high-efficiency, energy-efficient aerators in water management, thereby satisfying the environment requirements of these countries, also grows. Industrial aerators have an important role to play in the enhancement of water quality, optimizing the processes involved, and achieving the desired regulatory standards in wastewater discharge. The advancement of aeration technology in automated systems and energy-saving aerators also aids in market growth. The growth in industry in the Asia Pacific region, coupled with a shift toward more sustainable textile production, puts industrial aerators at the forefront of market expansion.

Latin America Industrial Aerators Market Analysis

The top oil-producing nation in Latin America is Brazil, holding the largest recoverable ultra-deep oil reserves globally, while 97.6% of Brazil's oil production is coming from offshore sources, ITA says. Rising exploration and production of offshore oil and gas drives growth for Latin America industrial aerators. The oil and gas industry, especially offshore operations, demands highly efficient wastewater treatment solutions to manage the large volumes of water used in exploration and drilling activities. Industrial aerators are essential for treating produced water, enhancing oxygen transfer, and meeting stringent environmental regulations for water discharge. The emphasis on sustainability in oil and gas operations is increasingly encouraging energy-efficient aeration systems, as they will reduce operational costs along with environmental impact. Technological advances, such as automated aerators and real-time monitoring, enable the industry to manage water more efficiently and sustainably. The growth of Brazil's offshore oil production fuels the growing demand for advanced aeration solutions in Latin America.

Middle East and Africa Industrial Aerators Market Analysis

The petrochemical industry accounts for 22% of the United Arab Emirates' manufacturing sector, with local production meeting 60% of domestic plastic demand, according to NIP. This significant growth in the petrochemical sector is a key driver for the Middle East and Africa industrial aerators market. The petrochemical industry, which is heavily water-dependent, requires efficient wastewater treatment solutions for processes such as refining, chemical production, and plastics manufacturing. The industry aerators have been very essential in managing the water quality, providing effective oxygenation, and achieving environmental standards set for the release of wastewater. As the petrochemical industries are expanding within the region, especially in the UAE, there is an increased demand for energy-efficient and cost-effective advanced aeration systems that are environment-friendly. Besides, technological changes, including the use of automated aerators and real-time monitoring, are also adding to the efficient operation of the industry. The petrochemical industry of the Middle East and Africa is expected to see growing demands for industrial aerators, since there is a focus on sustainable manufacturing practices.

Competitive Landscape:

The leading companies are heavily investing in research and development (R&D) to innovate and improve their aerator products. It includes the development of more energy-efficient models, integrating smart technology for better control and monitoring, and creating designs that are more effective in various industrial applications. Besides this, major firms are diversifying their product range to cater to different industries and applications by introducing new models of aerators with varying capacities, materials, and technologies to suit different environmental conditions and wastewater treatment requirements. Along with this, several companies are expanding their global presence by setting up new manufacturing units, sales offices, and distribution channels. Furthermore, they are forming strategic partnerships and collaborations with other companies, research institutions, and technology firms to leverage mutual strengths for product development, technology sharing, and expanding market reach.

The report provides a comprehensive analysis of the competitive landscape in the industrial aerators market with detailed profiles of all major companies, including:

- Aeration Industries International, LLC (Newterra Corporation)

- Airmaster Aerator LLC

- Fluence Corporation Limited

- Otterbine Barebo Inc.

- SPX Flow, Inc

- Sulzer Ltd

- VaraCorp, LLC

Latest News and Developments:

- October 2023: Unveil of the Z-Aerate 50 stand-on aerator during the Equip Exposition trade show as the newest member of the Z Turf Equipment family. This new aerator can do up to four acres per hour with the application of granular material.

- June 2023: Xylem, Inc., acquired Pure Technologies, an advanced aeration and mixing solutions provider for wastewater treatment plants. With this acquisition, Xylem solidifies its presence in the aeration market while gaining access to Pure Technologies' innovative technologies and expertise.

- April 2023: Sulzer and Siemens Large Drive Application entered into a partnership to provide an integrated solution that will aim at increasing equipment reliability and lowering operational costs. The collaboration, based on the combined expertise of both companies, is expected to provide an advanced digital value proposition for operators of large centrifugal pumps.

Industrial Aerators Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Metal, Plastic |

| Applications Covered | Low-Speed Surface Aerators, Gas Foil Radial Flow Impellers, Submerged Turbine Aerators |

| End Users Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aeration Industries International, LLC (Newterra Corporation), Airmaster Aerator LLC, Fluence Corporation Limited, Otterbine Barebo Inc., SPX Flow, Inc, Sulzer Ltd, VaraCorp, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial aerators market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global industrial aerators market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial aerators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial aerators market was valued at USD 1.37 Billion in 2024.

The industrial aerators market was valued at USD 2.00 Billion in 2033 exhibiting a CAGR of 4.09% during 2025-2033.

Key factors driving the industrial aerators market include stringent environmental regulations, the growing need for efficient wastewater treatment, industrial expansion, and a focus on sustainability. Additionally, advancements in energy-efficient aeration technologies and the rising demand for wastewater recycling in sectors like manufacturing, food processing, and chemicals further propel market growth.

Asia Pacific currently dominates the market due to the rapid industrialization and urbanization in major economies such as China, India, and Japan which have led to increased wastewater generation, particularly from the manufacturing, chemical, and food processing sectors.

Some of the major players in the industrial aerators market include Aeration Industries International, LLC (Newterra Corporation), Airmaster Aerator LLC, Fluence Corporation Limited, Otterbine Barebo Inc., SPX Flow, Inc, Sulzer Ltd, VaraCorp, LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)