Industrial Explosives Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2025-2033

Industrial Explosives Market Size and Share:

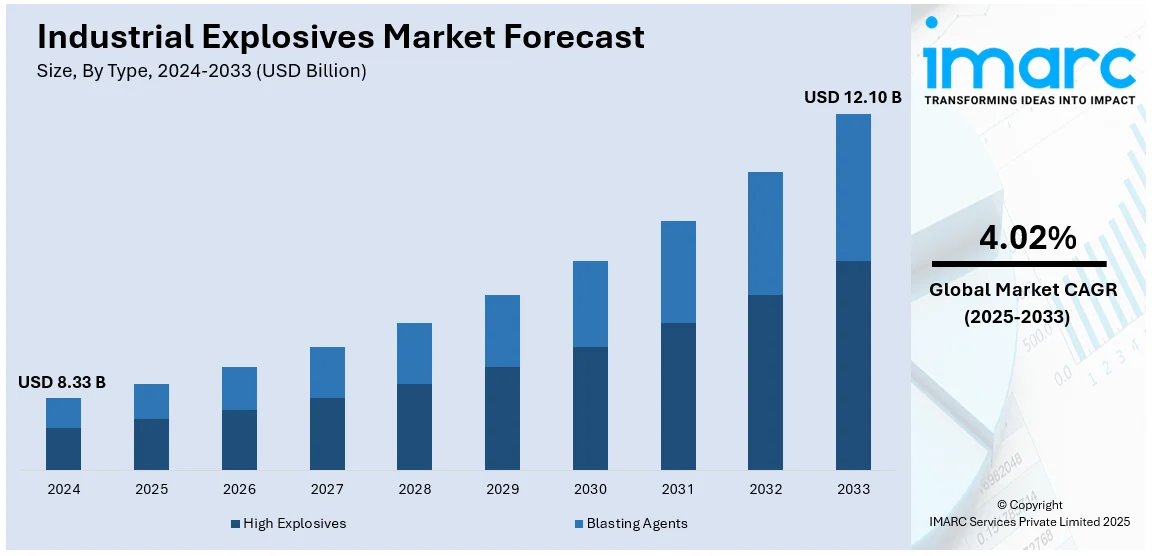

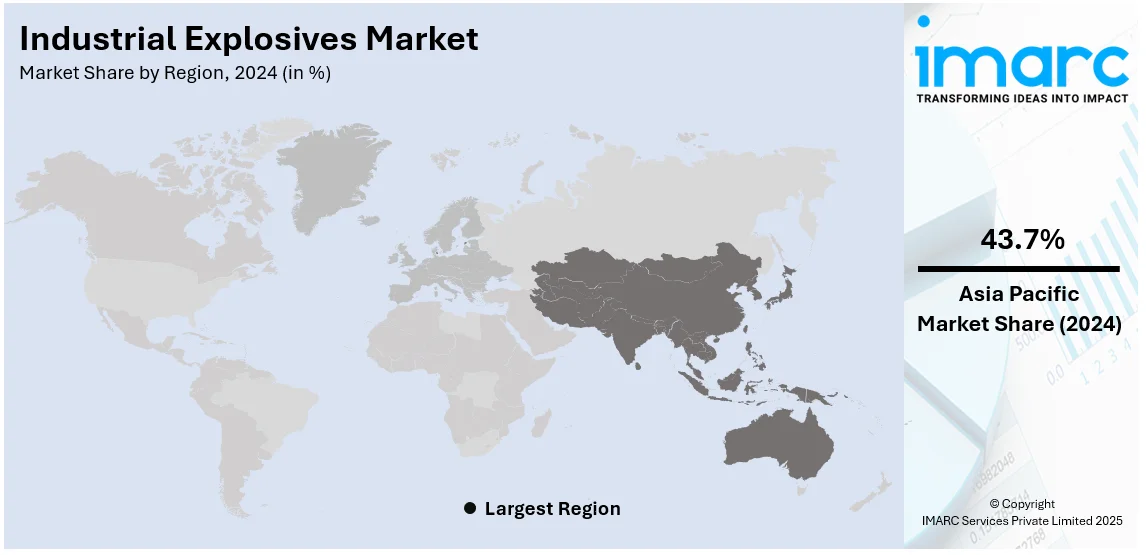

The global industrial explosives market size was valued at USD 8.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.10 Billion by 2033, exhibiting a CAGR of 4.02% during 2025-2033. Asia Pacific currently dominates the market in 2024, holding a significant share of over 43.7%. The expanding mining operations, growing infrastructure projects, rising demand for energy resources, advancements in blasting technologies, increasing metal extraction, stringent safety standards, adoption of eco-friendly explosives, and government investments in resource exploration are some of the factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.33 Billion |

|

Market Forecast in 2033

|

USD 12.10 Billion |

| Market Growth Rate (2025-2033) | 4.02% |

The global market is primarily driven by the increasing demand for efficient mining and construction activities worldwide. Moreover, increasing infrastructure development projects, especially in emerging economies, are acting as the primary growth-inducing factors for the market. Moreover, the rapid utilization of explosives in quarrying and tunneling operations is facilitating market expansion. As per ICRA, India's mining and construction equipment (MCE) industry is projected to expand significantly over the next 5-7 years, aiming for 70-80% localization, which could save approximately USD 3 Billion annually in foreign exchange. The industry has reached 136,000-unit sales in FY2024 and is expected to become a USD 25 Billion market by 2030. Achieving these targets will require developing a robust supply chain ecosystem and leveraging government incentives. In addition, ongoing technological advancements for precision blasting and higher safety standards are further augmenting the market on a global level. Besides, the augmenting demand for metals and minerals is driving industrial explosives adoption in mining, ensuring the market continues growing at a strong pace.

The United States stands out as a key regional market, driven by the increasing energy resources demand, mainly in the form of oil and gas exploration. Notably, On October 22, 2024, S&P Global Ratings reported that U.S. data centers will raise natural gas demand by 3 to 6 billion cubic feet per day by 2030 to support growing energy needs. This demand will primarily impact natural gas fields in Texas and the Southeast, driving midstream energy sector expansion. In addition, the rise in the usage of sophisticated blasting technologies in mining processes for improving the effectiveness of mining processes is stimulating growth in the industry. Also, the increasing number of large-scale infrastructure projects that involve highways and railroads are increasingly fostering the demand. Moreover, ongoing innovations related to environmentally friendly and low-emission explosives through strict safety rules and regulatory compliances. Apart from this, growing investments in military and defense sectors, is further creating a positive outlook for the market.

Industrial Explosives Market Trends:

Increasing Demand for Mining Activities

The industrial explosives market is growing significantly due to the increasing demand for mining activities, especially in minerals such as gold, coal, and precious metals. According to the U.S. Geological Survey's (USGS) Mineral Commodity Summaries 2022, the global production of industrial minerals did not exhibit a uniform increase across all commodities. For instance, the production of certain minerals, such as zirconium mineral concentrates, remained essentially unchanged in 2021 compared to 2020. However, the USGS reported that the value of nonfuel mineral production in the United States increased by USD 3.6 Billion in 2022, reaching a total of USD 105.2 Billion, highlighting a positive growth trend in some sectors. The demand for explosives in mining is closely linked to the extraction of minerals such as gold, coal, and lithium. With global infrastructure development projects in full swing, there is a constant requirement for raw materials, which is fueling the demand for industrial explosives. These explosives are also crucial in cracking rocks and ores in massive extraction operations, including open-pit and underground mines. Moreover, the increasing number of people across the globe has led to massive urbanization, therefore, demand for building material has increased in turn, stimulating mining activities. Notably, there is a significant upsurge of mining activities especially in the regions of Asia-Pacific, where major mining activities can be seen in nations such as China and India. As exploration deepens more complex and distant regions, more advanced and efficient explosives technologies would be required and thus continue sustaining the growth trend in the industrial explosives sector.

Technological Advancements in Explosive Materials

There is a remarkable shift in the industrial explosives market towards technological innovations that increase the efficiency, safety, and environmentally friendly character of explosives for mining and construction work. Traditional explosives have always been the subject of discussion due to concerns related to their safety and the negative environmental effects such as dust and toxic emissions. Advanced emulsions, bulk explosives, and water-based solutions, for instance, have greatly diminished the issues mentioned above. These newer explosive materials are not only much more energetic in terms of yield, which increases the productivity, but also reduce adverse side effects. For instance, some of the newer formulations minimize the release of toxic gases while others are even more stable and safer to handle. The U.S. Army Research Laboratory (ARL) has been involved in developing safer explosive materials to reduce hazards during handling and transportation. For example, ARL researchers have synthesized a new method for producing 2,4-diamino-6-nitropyrimidine (DAG), a key component in explosives. This method is safer and more cost-effective, minimizing potential explosion and combustion hazards during production The environmentally friendly explosives development is especially critical in markets where environmental regulations are very strict and force companies to adopt these new technologies. As demand for cleaner, safer, and more effective explosive solutions increases, technological advancements will remain one of the core trends shaping the market.

Expansion in Emerging Economies

The industrial explosives market is showing major growth in developing economies owing to their growth and increasing pace in industrialization, urbanization, and infrastructure development works. Developing geographies of the Asia-Pacific region, Africa, and Latin America show high and brisk economic development activity, hence rapidly boosting the trend of construction mining and quarrying. In 2023, the World Bank reported that countries such as India and China are expanding their mining and infrastructure development projects, which directly impacts the demand for industrial explosives. China, as the world’s largest coal producer, is a significant consumer of industrial explosives. However, the International Energy Agency (IEA) has projected a decline in China's thermal non-power coal demand through the end of 2027, which may influence the demand for explosives in coal mining. Furthermore, in Africa and Latin America, countries are building infrastructure, thus increasing the demand for explosives in the construction and mining industries. These markets often do not have the same strict environmental laws as the developed world, thus allowing for traditional explosive materials to be used while acclimating to new, more energy-efficient technologies. As these economies continue to grow, the need for industrial explosives grows with it, making emerging markets a major driver of overall market expansion around the world.

Industrial Explosives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global industrial explosives market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type and end use industry.

Analysis by Type:

- High Explosives

- Blasting Agents

- Ammonium Nitrate Fuel Oil (ANFO)

- Water Gel Explosives

- Emulsions

- Nitrogen Explosives

- Others

Blasting agents lead the market in 2024. This dominance can be attributed to its extensive usage in mining, quarrying, as well as in construction. Their high safety margin compared to primary explosives makes them the preferred choice for large-scale operations. Besides, cost-effectiveness and ease of handling further improve their usage across industries. Additionally, the increasing demand for coal and minerals globally is propelling the use of blasting agents in mining applications. The market dominance is also supported by continuous advancement in formulations to improve efficiency and minimize the environmental impact.

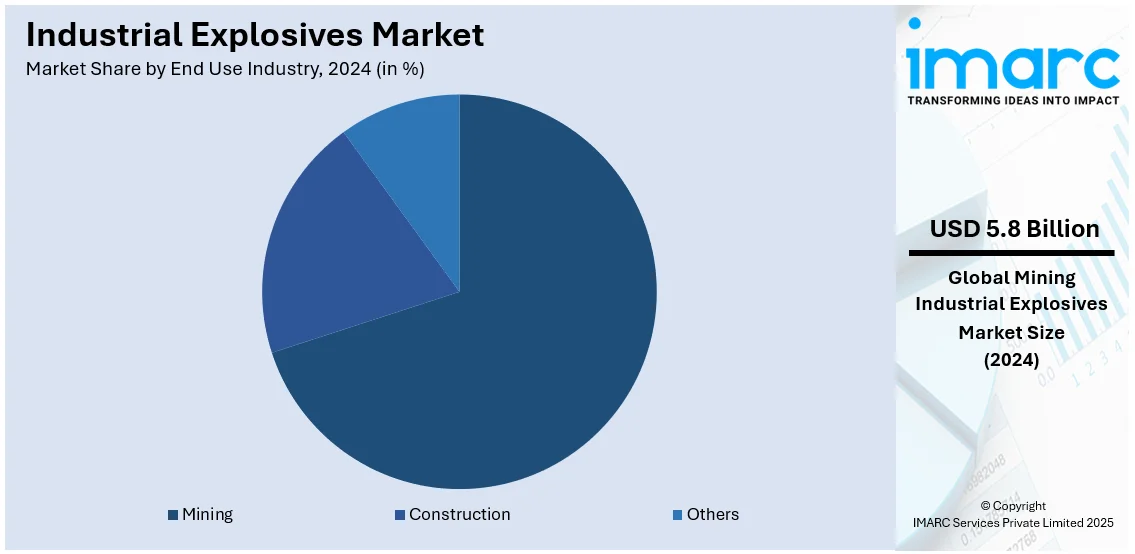

Analysis by End Use Industry:

- Mining

- Metal Mining

- Non-metal Mining

- Quarrying

- Construction

- Others

Mining leads the market in 2024 with a significant share of 70.0%. The dominance is due to the rising demand for minerals, metals, and energy resources across various industries, such as manufacturing and energy. There is increased demand for efficient processes of extraction of minerals and metals during surface and underground mining, which leads to a high penetration of these industrial explosives in industries. Moreover, ongoing advancement in blasting techniques that increase accuracy and reduce waste also helps in increased penetration of these products in markets. In addition, the global shift toward sustainable energy has increased demand for essential minerals, making mining the leading application segment within the industrial explosives market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share, holding a share of over 43.7%. Rapidly growing mining and construction industries due to the fast-paced urbanization and industrialization in countries such as China, India, and Australia is majorly contributing to the market in the region. The rich mineral resources available in the region and increasing metal demand are contributing to increased explosives demand in the mining sector. Also, growing infrastructure development projects such as roadways, railways, and dams are adding substantial growth to the market. Moreover, favorable policies of the government and investments in the growth of industries further support the uptake of industrial explosives, thereby maintaining Asia Pacific as the market leader.

Key Regional Takeaways:

United States Industrial Explosives Market Analysis

The industrial explosives market in the U.S. is booming with demand from mining, construction, and defense sectors. The U.S. Geological Survey (USGS) estimated ammonia production, a critical component in many explosives, to be 14,000 thousand metric tons in 2023. Ammonia is mainly used in fertilizers, but around 12% of its production is used for various industrial purposes, such as explosives. The U.S. mining industry will continue to lead the list as the largest explosives consumer, in addition to coal, metals, and aggregates material demand. Investments in military operations, infrastructure projects, and construction or demolition of other large-scale infrastructure developments also fuel industrial explosives demand. These front-runners such as Dyno Nobel and Orica are continuously on the path to innovation in newer, safer explosives. Stringent safety regulations as well as rapid technological advancement have been creating constant growth in the U.S. market while further cementing its global supremacy.

Europe Industrial Explosives Market Analysis

Europe's ammunition market is rapidly growing as the continent strategically invests in its production capacity. The European Commission has channeled €513 Million (USD 567.3 Million) through the ASAP Regulation for 31 projects aimed at raising ammunition production and readiness. The money will catalyze another €1.4 Billion (USD 1.5 Billion) from industry co-financing. ASAP is targeting the supply chain bottlenecks which is three-quarters of funding is to go to explosives and powder. The program will add more than 10,000 tons of powder annually and more than 4,300 tons of explosives. By the end of 2025, Europe will be able to produce 2 million units of ammunition shells annually. As of January 2024, the annual production capacity for 155 mm shells in Europe had already surpassed 1 Million units, as per reports. The program also supports the construction of new production capacities, ensuring faster and more responsive ammunition and missile supplies for Europe's defense industry.

Asia Pacific Industrial Explosives Market Analysis

Industrial explosives market in the Asia Pacific region is witnessing growth mainly due to the increased mining activities. This is also evident in the development of Mali coming in partnership with China's Norinco to establish its first civil explosives plant for production towards the mining and quarrying industries. Mali imported USD 5.2 Million explosives and pyrotechnics into the country during the second quarter of 2023 to foster the increased demand from the growing mining industry. With this new plant, Mali is planning to assume complete control over explosives production that shall aid its mining industry that employs industrial explosives for the extraction of valuable minerals, such as gold, manganese, and lithium. The project, under the agreement, will be owned 51% by Mali and 49% by Norinco, with the Chinese firm financing it fully and offering expertise. The plant will be completed within 12 months and promote local employment as well as propel the economy of Mali and the region.

Latin America Industrial Explosives Market Analysis

In Latin America, mining serves as the cornerstone of the industrial explosives market, playing a vital role in the region’s economy, with Brazil exemplifying this significance According to an industry report, in 2022, Brazil's mining sector paid approximately USD 1.36 Billion in royalties (CFEM) and around USD 16.72 Billion in total taxes, reflecting the importance of mining to the national economy. The Brazilian mining sector is one of the world's largest producers and uses explosives as a primary extraction tool for its iron ore, gold, and bauxite. Furthermore, the Brazilian Federal Government recently stated that Saudi Arabian mining company Ma'aden was investing USD1.55 Billion into the country to be used on geological mapping, research, and mineral exploitation in the country to further develop its mining resources. Growing the capital expenditure to this industry in terms of investment hints at continued upward trends of the demand for industrial explosives both within Brazil and by the whole of Latin America in the foreseeable future.

Middle East and Africa Industrial Explosives Market Analysis

Significant investment in the mining and industrial explosives industries in the Middle East and Africa, with some of the greatest investment seen in South Africa-a major player in the global mining industry, which is positively affecting the market. Platinum Group Metals topped mining revenue for South Africa in 2023 at 370 billion South African rand (USD 19.61 Billion), demonstrating strength in the country's production of critical minerals. In addition, copper and lithium remain significant, commanding more than 70% of the volume in 2023 as per reports, and these resources have huge demand arising, which cannot be extracted without industrial explosives. The Investing in African Mining Indaba conference, which took place in Cape Town in 2023, discussed mining as a means of Africa's future, with South African President Cyril Ramaphosa pointing out that the continent has huge potential for energy transition. This increased attention towards mineral resources coupled with global increases in the consumption of PGMs, copper, and lithium is going to further increase demand for industrial explosives in the region.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of numerous established players and emerging firms striving to gain market share. The major companies are focusing on developing innovative and sustainable products, such as low-emission and environmentally friendly explosives, to meet stringent safety and environmental regulations. Moreover, strategic partnerships, mergers, and acquisitions are prominent as firms aim to expand their geographical reach and enhance their technological capabilities. Additionally, investments in research and development to improve blasting efficiency and safety standards are intensifying competition, driving the market's dynamic growth.

The report provides a comprehensive analysis of the competitive landscape in the industrial explosives market with detailed profiles of all major companies, including:

- AECI Limited

- Austin Powder Company

- EPC Groupe

- Incitec Pivot limited

- Irish Industrial Explosives Limited

- Keltech Energies Ltd.

- NOF Corporation

- Orica Limited

- Sigdo Koppers S.A.

- Solar Industries India Limited

Recent Developments:

- December 2024: Solar Industries India Ltd, a leading industrial explosives manufacturer, announced INR 2,039 Crore (USD 235.61 Million) in export orders for advanced defense products. Deliveries are scheduled over four years, reflecting strong global demand.

- September 2024: Dyno Nobel secured five-year contract renewals with Peabody in the U.S. and Australia. Leveraging in-country manufacturing, Dyno Nobel ensures cost certainty, reliable bulk explosives supply, and advanced technology solutions supporting Peabody's mining operations.

- July 2024: Austin Powder secured a strategic investment from American Industrial Partners (AIP) to accelerate growth, expand innovations, and enhance global operations. AIP’s support will bolster Austin’s expertise in industrial explosives and blasting solutions while maintaining its safety-focused heritage and customer-centric values.

- July 2024: AECI is advancing plans to use green ammonia for producing low-carbon explosives, targeting Australia, Europe, and North America. The company aims to double profitability to R6.4 billion by 2026, driven by restructuring efforts, green initiatives, and international market expansion.

- May 2024: Orica planned to introduce the world’s first lead-free electronic blasting system range at its Gyttorp, Sweden, plant. Utilizing lead-free NPED technology, the range includes eDev™ II Neo, uni tronic™ 600 Neo, and i-kon™ III Neo, complying with EU REACH regulations, ensuring sustainability and innovation.

Industrial Explosives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Use Industries Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AECI Limited, Austin Powder Company, EPC Groupe, Incitec Pivot limited, Irish Industrial Explosives Limited, Keltech Energies Ltd., NOF Corporation, Orica Limited, Sigdo Koppers S.A., Solar Industries India Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial explosives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global industrial explosives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the industrial explosives industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial explosives market was valued at USD 8.33 Billion in 2024.

The industrial explosives market is projected to exhibit a CAGR of 4.02% during 2025-2033, reaching a value of around USD 12.10 Billion by 2033.

The market is driven by the rising number of mining activities, expanding construction projects, increasing demand for metals, advancements in blasting technologies, considerable growth in infrastructure development, increasing adoption of eco-friendly explosives, enhanced safety regulations, and rising investments in energy resource exploration.

Asia-Pacific currently dominates the market, accounting for a share of around 43.7%. The dominance is driven by rapid industrialization, increasing mining activities, infrastructure development, rising urbanization, government initiatives, and advancements in blasting technologies.

Some of the major players in the global industrial explosives market include AECI Limited, Austin Powder Company, EPC Groupe, Incitec Pivot limited, Irish Industrial Explosives Limited, Keltech Energies Ltd., NOF Corporation, Orica Limited, Sigdo Koppers S.A. and Solar Industries India Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)