Industrial Fasteners Market Size, Share, Trends and Forecast by Raw Material, Product, Type, Application, and Region, 2025-2033

Industrial Fasteners Market Size and Share:

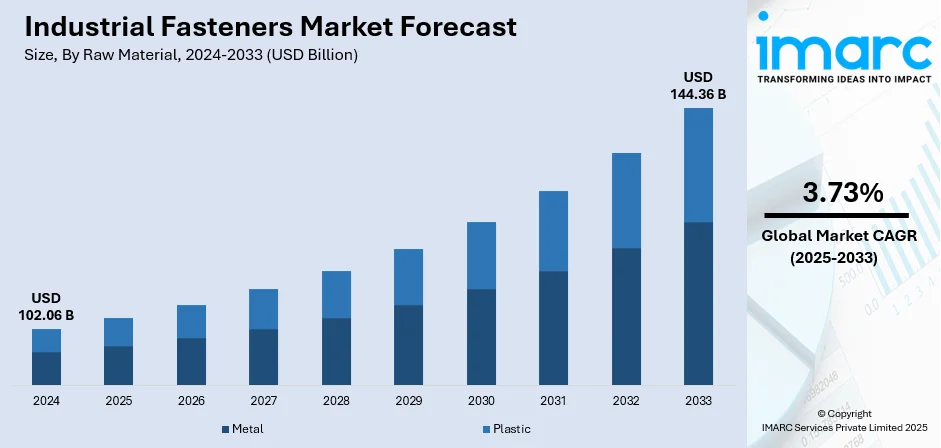

The global industrial fasteners market size was valued at USD 102.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 144.36 Billion by 2033, exhibiting a CAGR of 3.73% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 44.7% in 2024. The market is fueled by increasing demand from the automotive, aerospace, and construction sectors where durability, safety, and reliability are essential. Increased infrastructure development and urbanization add fuel to consumption, while advances in materials and coatings boost performance, corrosion resistance, and shelf life. Changing trends toward lightening fasteners for vehicle and air fuel efficiency also propel industrial fasteners market share. Furthermore, greater focus on sustainability and accuracy engineering propels innovation so that fasteners comply with changing industry standards, performance specifications, and worldwide supply chain requirements effectively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 102.06 Billion |

|

Market Forecast in 2033

|

USD 144.36 Billion |

| Market Growth Rate 2025-2033 | 3.73% |

One major driver in the industrial fasteners market is the rapid growth of the automotive and aerospace industries, which demand high-performance fastening solutions to ensure safety, durability, and precision. As vehicles and aircraft increasingly rely on lightweight materials like aluminum and composites, manufacturers require specialized fasteners capable of withstanding extreme stress, vibration, and environmental conditions. This rising demand for advanced fasteners boosts innovation in design, coatings, and materials to enhance performance and corrosion resistance. Additionally, the global push toward electric vehicles and fuel-efficient aircraft further accelerates the need for reliable, lightweight fastening systems, making this sector a key growth driver.

To get more information on this market, Request Sample

The U.S. is a major contributor to the industrial fasteners industry with a market share of 83.80% fueled by its robust manufacturing sector, high-tech adoption, and mass-scale demand in the automotive, aerospace, construction, and defense industries. Focused on precision-engineered, durable, and high-quality fasteners, the U.S. market is focused on innovation, such as lightweight material use and corrosion-resistant coatings to address changing industry demands. In addition, the nation's drive for infrastructure modernization, complemented by consistent growth in electric vehicles and aircraft manufacturing, stimulates fastener usage. Strict standards and regulations for quality also keep U.S. producers at the forefront of the industry, pushing the region as a hub for local consumption and overseas exports.

Industrial Fasteners Market Trends:

Growth of Automotive and Aerospace Industries

The automotive and aerospace sectors is a key industrial fasteners industrial fasteners market trend. With increasing production of vehicles and aircraft worldwide, the demand for reliable fastening solutions has surged. Modern vehicles, including electric vehicles (EVs), require lightweight yet durable fasteners to support advanced designs and improve fuel efficiency. Similarly, aerospace applications demand high-strength, vibration-resistant, and corrosion-proof fasteners that can withstand extreme environmental conditions. The emphasis on safety, efficiency, and sustainability in these industries has accelerated innovation in fastening technologies, including the development of titanium, stainless steel, and coated fasteners. Furthermore, as global mobility rises, the expansion of fleets and aftermarket services continues to drive steady demand for replacement fasteners. This makes the automotive and aerospace sectors vital growth engines in shaping the size, scope, and technological advancement of the industrial fasteners market outlook.

Advancements in Manufacturing Technologies and Materials

Technological innovation is a key driver transforming the industrial fasteners market, with advances in automation, robotics, and 3D printing significantly enhancing production efficiency, precision, and cost-effectiveness. U.S. manufacturers installed 44,303 industrial robots in 2023, a 12% increase over the previous year, reflecting growing adoption of automated processes in fastener manufacturing. Innovations in materials, including lightweight alloys, stainless steel, titanium, and composite-based fasteners, have broadened applications across automotive, aerospace, marine, and construction industries, offering superior strength-to-weight ratios, corrosion resistance, and durability. Surface treatments and coatings, such as zinc plating and organic finishes, further extend service life and reduce maintenance. As industries prioritize energy efficiency, safety, and sustainability, manufacturers are developing smart and customized fastening solutions. This technological progress enhances product quality, meets evolving customer demands, and ensures long-term industrial fasteners market growth.

Rising Infrastructure Development and Construction Activities

Infrastructure development is a primary force driving the industrial fasteners market. Urbanization, population expansion, and government expenditure on upgrading infrastructure like roads, bridges, railways, airports, and commercial structures have led to a significant boost in demand for dependable fastening products. Industrial fasteners are critical to the provision of structural integrity, safety, and durability to construction activities since they keep concrete, steel, and other material pieces together. Additionally, the trend towards smart cities and green building construction has generated demand for high-performance fasteners with corrosion protection, long lifecycles, and suitability with emerging construction methods. Emerging markets in Asia-Pacific, Africa, and Latin America are particularly seeing rapid expansion in construction activities, which is driving increased consumption of fasteners. Furthermore, in established markets such as North America and Europe, construction refurbishment and maintenance of aging infrastructure remain a consistent source of demand. This industry is still a cornerstone in the facilitation of the long-term development of the fasteners industry.

Industrial Fasteners Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial fasteners market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on raw material, products, type, and application.

Analysis by Raw Material:

- Metal

- Plastic

Based on the industrial fasteners market forecast, the metal fasteners account for the majority of shares of 91.0% driven by their superior strength, durability, and reliability across a wide range of applications. Industries such as automotive, aerospace, construction, and heavy machinery rely heavily on metal fasteners to ensure structural integrity and long-term performance under high stress, vibration, and extreme environmental conditions. Metals like steel, stainless steel, aluminum, and titanium are commonly used due to their resistance to corrosion, heat, and wear, making them suitable for demanding environments. Additionally, continuous innovations in alloys, surface coatings, and heat treatments further enhance the performance of metal fasteners. Their unmatched versatility and cost-effectiveness reinforce their dominance as the preferred material in global industrial fastening solutions.

Analysis by Products:

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-Threaded Fasteners

- Aerospace Grade Fasteners

Externally threaded fasteners hold the majority of shares of 45.8% in the industrial fasteners market due to their critical role in providing strong, durable, and reliable joints across diverse applications. Products such as bolts, screws, and studs are widely used in automotive, aerospace, construction, and machinery sectors because they allow secure assembly while offering easy installation and removal for maintenance or repairs. Their versatility, availability in numerous sizes and materials, and compatibility with different nuts and washers make them indispensable in both light and heavy-duty operations. Advancements in coatings and materials have enhanced their corrosion resistance and strength, supporting use in harsh environments. This widespread adoption and adaptability solidify externally threaded fasteners as the dominant market segment globally.

Analysis by Type:

- Bolts

- Nuts

- Screws

- Washers

- Rivets

- Others

According to the industrial fasteners market analysis, the screws represent the majority share in the industrial fasteners market owing to their versatility, ease of use, and wide applicability across industries such as automotive, construction, electronics, and machinery. Unlike other fasteners, screws provide strong holding power through threaded designs, ensuring secure joints and easy assembly or disassembly when needed. Their availability in a wide range of sizes, materials, and coatings makes them suitable for both light-duty and heavy-duty applications, from delicate electronic devices to large-scale infrastructure projects. Additionally, advancements in corrosion resistance, self-tapping, and specialty screws have expanded their functionality and durability in challenging environments. The continuous demand for reliable, cost-effective, and adaptable fastening solutions solidifies screws as the dominant product segment in the global market.

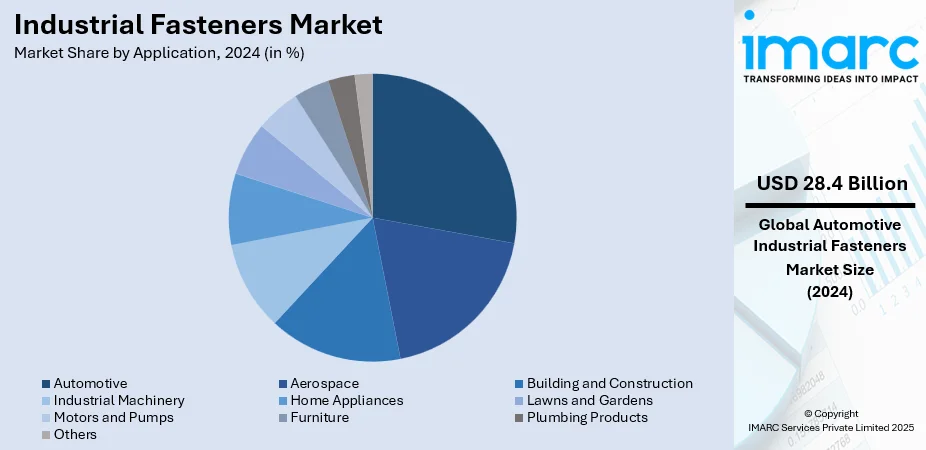

Analysis by Application:

- Automotive

- Aerospace

- Building and Construction

- Industrial Machinery

- Home Appliances

- Lawns and Gardens

- Motors and Pumps

- Furniture

- Plumbing Products

- Others

The automotive sector dominates industrial fasteners market demand with a market share of 27.8% due to its high-volume production requirements and critical reliance on fastening solutions for safety, durability, and performance. Every vehicle, from passenger cars to commercial trucks, uses thousands of fasteners in assembling engines, body panels, interiors, and electronic systems. The shift toward lightweight vehicles and electric mobility has further increased demand for advanced fasteners that offer strength while reducing weight, improving fuel efficiency, and supporting battery integration. Additionally, growing global vehicle sales, aftermarket services, and replacement needs sustain steady consumption. Strict safety and quality standards in automotive manufacturing also drive continuous innovation in coatings, materials, and designs, making the sector the largest and most influential end-user of industrial fasteners worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific is the leading region with a market share of 44.7% due to its rapidly expanding automotive, aerospace, construction, and manufacturing industries. Countries like China, India, Japan, and South Korea serve as major production hubs, driving large-scale demand for reliable and cost-effective fastening solutions. Massive infrastructure development projects, fueled by urbanization and government investments, further accelerate market growth. Additionally, the presence of low-cost raw materials and labor enhances manufacturing competitiveness, making the region a global supplier of fasteners. Rising adoption of advanced technologies, lightweight materials, and corrosion-resistant coatings also supports innovation. With continuous industrialization and export-oriented growth, Asia Pacific maintains its position as the dominant region in the global industrial fasteners market.

Key Regional Takeaways:

North America Industrial Fasteners Market Analysis

The industrial fasteners market in North America is fueled by high demand from the automotive, aerospace, construction, and heavy machinery industries, backed by a strong manufacturing base and technological innovation. The region also enjoys high levels of infrastructure expenditure, with ongoing projects in transportation, energy, and commercial construction driving steady consumption of fasteners. Automotive and aerospace markets, especially in the United States, drive high demand for lightweight, high-performance fasteners that address fuel efficiency, emission reduction, and high safety requirements. Additionally, the trend towards electric cars and advanced-generation aircraft opens up new possibilities for innovative fastening technologies with increased strength and corrosion resistance. There is also a market drivers' emphasis on sustainable practices such as eco-friendly coatings and recyclable materials. The competition is stiff, with producers focusing on quality, customization, and supply chain effectiveness to satisfy varied customer needs. Generally, North America is still a central point of innovation and production of industrial fasteners, with consistent growth opportunities underpinned by technological and industrial growth.

United States Industrial Fasteners Market Analysis

United States is witnessing significant industrial fasteners due to growing industrialization across multiple sectors such as automotive, aerospace, and manufacturing. For instance, GM plans to invest USD 4 Billion in its U.S. manufacturing plants. The expansion of production capacities and integration of automated assembly lines have led to increased demand for precision fasteners to ensure operational efficiency. Rising investments in infrastructure modernization and advanced manufacturing technologies are driving the need for reliable fastening components. The focus on reshoring manufacturing and government incentives to boost domestic production further fuel market growth. In addition, the presence of well-established supply chains and logistics networks enhances availability and distribution, supporting rising consumption. Technological advancements in fastening tools and customization capabilities also contribute to their rising use in industrial applications.

Asia Pacific Industrial Fasteners Market Analysis

Asia-Pacific is experiencing a sharp rise in industrial fasteners adoption driven by the growing small and medium-sized enterprises (SMEs) segment. According to the India Brand Equity Foundation, under Pradhan Mantri Mudra Yojana (PMMY), in FY25 (until 21st February 2025), Rs. 4.14 lakh crore (USD 47.6 Billion) was sanctioned under 4.2 crore Mudra loans to non-corporate and non-farm MSES. With a surge in SME-led manufacturing activities, demand for cost-effective and efficient fastening solutions has increased substantially. SMEs are expanding across sectors such as electronics, machinery, and consumer goods, resulting in higher consumption of industrial fasteners in assembly and production processes. As SMEs seek scalable and reliable inputs to enhance productivity and meet export standards, fasteners become indispensable. Government support schemes, easy access to raw materials, and favourable trade policies further encourage SMEs to adopt industrial fasteners.

Europe Industrial Fasteners Market Analysis

Europe shows continuous expansion in industrial fasteners usage due to growing industrialization in automotive, railways, construction, and mechanical engineering sectors. For instance, industrial production in the Euro Area increased 3.70 percent in May of 2025 over the same month in the previous year. Investments in high-performance machinery and renewable energy infrastructure are stimulating the use of durable fasteners. The revival of heavy industries and modernization of existing plants demand high-quality fastening systems for safety and structural integrity. Strict compliance with industrial safety standards and environmental regulations is encouraging the use of certified fasteners. Local manufacturers are adopting automation and robotics in production, increasing precision and consistency in fastener demand. Expansion of cross-border trade within the region also requires standardized components, fueling demand. Collaborative research between industries and universities is leading to innovations in fastening technologies.

Latin America Industrial Fasteners Market Analysis

Latin America is witnessing a steady rise in industrial fasteners adoption driven by rapid urbanization and inflating disposable income levels. For instance, by the end of 2025, 315 Million people is expected to live in Latin America’s large cities, where the per-capita GDP is estimated to reach USD 23,000. Expanding urban infrastructure and rising consumer purchasing power are supporting the growth of domestic manufacturing, which, in turn, is boosting demand for fasteners. As cities grow and households upgrade, demand for products requiring fastening solutions rises across multiple industries.

Middle East and Africa Industrial Fasteners Market Analysis

Middle East and Africa are observing increasing industrial fasteners adoption due to growing construction projects across commercial and industrial segments. For instance, the UAE’s building sector is set for a dynamic 2025, with over USD 600 Billion worth of active projects shaping the country’s skyline. Large-scale developments in real estate, infrastructure, and energy sectors require robust fastening solutions to support long-term structural integrity. The need for corrosion-resistant and high-strength fasteners has intensified as construction activities expand across diverse climatic conditions.

Competitive Landscape:

The market is extremely competitive and diversified, with many global, regional, and local players competing based on product quality, innovation, and cost. The firms place significant emphasis on research and development to develop sophisticated fastening solutions with enhanced strength, durability, and corrosion resistance, serving various industries like automotive, aerospace, construction, and electronics. Competition also focuses on providing tailored solutions and having extensive distribution networks to penetrate broader markets. Moreover, sustainability and environmentally friendly manufacturing methods are becoming differentiators. Fierce price wars, as well as the increasing presence of low-cost manufacturers in emerging economies, fuel relentless innovation, mergers, and alliances to gain market share and geographical reach.

The report provides a comprehensive analysis of the competitive landscape in the industrial fasteners market with detailed profiles of all major companies, including:

- Acument Global Technologies Inc.

- ATF Inc.

- Hilti Corporation

- Howmet Aerospace Inc.

- Kova Fasteners Private Limited

- LISI SA

- MacLean-Fogg Company

- MISUMI Group Inc.

- MW Industries Inc.

- Nifco Inc.

- Precision Castparts Corp.

- SFS Group AG

- Stanley Black & Decker Inc.

Latest News and Developments:

- July 2025: Gabriel India entered the industrial fastener segment by forming a joint venture with Korea’s JINHAP, investing approximately USD 3.2 Million for a 51% stake, aiming to generate USD 24 Million in revenue by 2030 and support OEM localisation efforts.

- May 2025: B&F Fastener Supply rebranded as BFirst Industrial following its 2023 acquisition of Northern States Supply, signaling growth and expanded capabilities in industrial fastener distribution. The move reflected a unified strategy to enhance service offerings and strengthen its position as a full-service industrial supply partner.

- April 2025: Huyett launched an extensive new line of industrial fasteners, adding over 60,000 threaded products including bolts, screws, nuts, washers, and anchors to its catalog. The move strengthened its service to distributors with flexible quantities, quick response times, and hard-to-find industrial fastener options.

- April 2025: Hillman launched its next generation Power Pro® industrial fasteners with a dual thread design that enabled 30% faster wood engagement and improved installation efficiency. The advanced fasteners debuted at the International Builders’ Show 2025 in Las Vegas, highlighting Hillman’s continued innovation in industrial fastener performance.

- March 2025: Italian firm Fontana Gruppo acquired a 60% stake in Nashik-based industrial fastener maker Right Tight Fasteners for nearly USD 120 Million, marking one of the largest foreign investments in India’s auto parts sector and expanding its presence in the Asian market.

Industrial Fasteners Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Metal, Plastic |

| Products Covered | Externally Threaded Fasteners, Internally Threaded Fasteners, Non-Threaded Fasteners, Aerospace Grade Fasteners |

| Types Covered | Bolts, Nuts, Screws, Washers, Rivets, Others |

| Applications Covered | Automotive, Aerospace, Building and Construction, Industrial Machinery, Home Appliances, Lawns and Gardens, Motors and Pumps, Furniture, Plumbing Products, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acument Global Technologies Inc., ATF Inc., Hilti Corporation, Howmet Aerospace Inc., Kova Fasteners Private Limited, LISI SA, MacLean-Fogg Company, MISUMI Group Inc., MW Industries Inc., Nifco Inc., Precision Castparts Corp., SFS Group AG and Stanley Black & Decker Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial fasteners market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global industrial fasteners market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial fasteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial fasteners market was valued at USD 102.06 Billion in 2024.

The industrial fasteners market is projected to exhibit a CAGR of 3.73% during 2025-2033, reaching a value of USD 144.36 Billion by 2033.

Key drivers of the industrial fasteners market include rising demand from automotive, aerospace, and construction industries, coupled with expanding infrastructure projects. Advancements in materials and coatings enhance durability and corrosion resistance, while lightweight fasteners support fuel efficiency. Growing sustainability initiatives and precision engineering further accelerate innovation and global market growth.

Asia Pacific currently dominates the industrial fasteners market, accounting for a share of 44.7% due to rapid industrialization, urbanization, and large-scale infrastructure projects. Strong automotive, aerospace, and manufacturing bases in countries like China, India, and Japan drive demand. Additionally, cost-effective production, abundant raw materials, and rising exports strengthen the region’s leadership in global fastener consumption.

Some of the major players in the industrial fasteners market include Acument Global Technologies Inc., ATF Inc., Hilti Corporation, Howmet Aerospace Inc., Kova Fasteners Private Limited, LISI SA, MacLean-Fogg Company, MISUMI Group Inc., MW Industries Inc., Nifco Inc., Precision Castparts Corp., SFS Group AG and Stanley Black & Decker Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)