Industrial Hose Market Size, Share, Trends and Forecast by Material, Wire Type, End Use Industry, and Region, 2025-2033

Industrial Hose Market Size and Share:

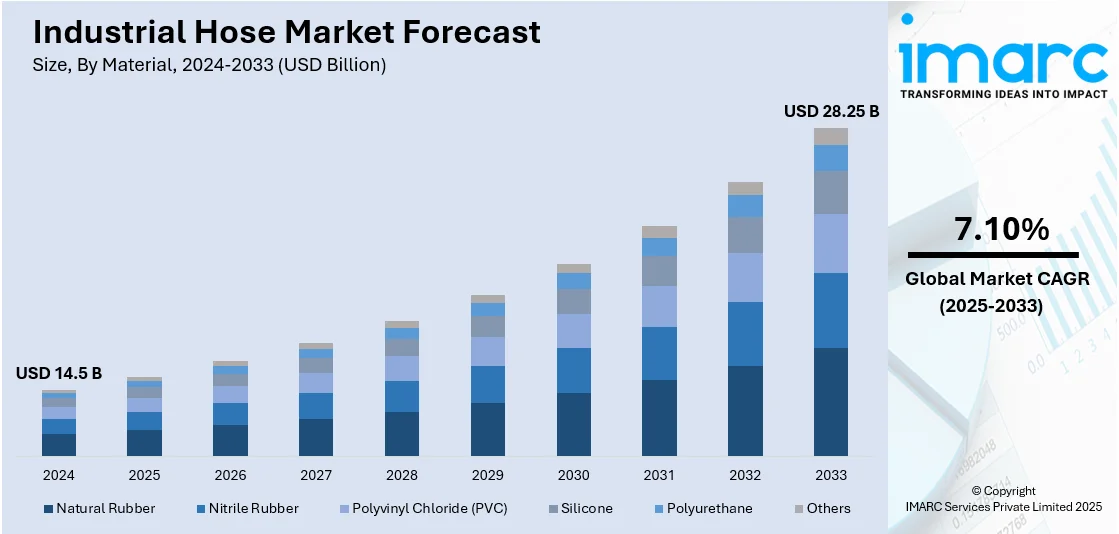

The global industrial hose market size was valued at USD 14.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.25 Billion by 2033, exhibiting a CAGR of 7.10% during 2025-2033. Asia-Pacific currently dominates the market in 2024. The market is seeing remarkable growth, supported by demand from industries such as oil & gas, building, and chemicals. Innovation in hose materials, manufacturing processes, and customization opportunities is enhancing performance and safety and feeding further market growth. Furthermore, industrial hose market share continues to increase as industries embrace these innovations for more durable and efficient solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 28.25 Billion |

| Market Growth Rate (2025-2033) | 7.10% |

The industrial hose industry is experiencing robust growth as demand is rising from diversified industries, including construction, automobile, oil and gas, food and beverage, and chemicals. With global expansions of industries, the demand for multi-functional, long-lasting, and high-performing hoses also increases. More specifically, the construction industry has a critical dependency on industrial hoses for applications from water and concrete transportation to operating heavy machinery. The oil and gas sector also keeps the growth going, with industrial hoses playing a critical role in the transportation of crude oil, chemicals, and gases under high pressure. With increasing industrial output in developing economies, the demand is likely to face continuous pressure.

The United States has been one of the leading market disruptors due to technological advancements in industrial hose production. The nation has led the way in the creation of new technologies for producing hoses, resulting in enhanced performance, longevity, and efficiency. Automation of manufacturing processes, including robotics and precision mold construction, enabled faster production without compromising quality levels. This allows producers to satisfy growing demand for more demanding application hoses in industries such as automotive, oil & gas, and construction. In addition, the US market has witnessed tremendous advances in material science, with producers emphasizing producing hoses that provide enhanced heat, chemical, and abrasion resistance.

Industrial Hose Market Trends:

Rising Demand for Advanced Cooling Solutions

The industrial hose market has been progressively changing with the rising demand for sophisticated cooling solutions, especially in high-technology sectors like data centers. As digital infrastructure expands further across the world, the demand for dependable, power-efficient cooling systems has grown more intense. The trend to upgrade to specialty hoses for these applications has widely influenced the market. In April 2025, Continental launched its DataGuard and FlexCool premium hoses, designed specifically for data centers. These hoses provide better flexibility, durability, and thermal stability, ensuring the consistent functioning of electronic components by avoiding overheating and hardware damage. They minimize energy expenses, reduce carbon footprints, and enhance operational efficiency, making them a must for contemporary cooling systems. As the emphasis on minimizing operational expenses and maximizing system performance increases, the demand for high-performance hoses in data centers is growing at a fast pace. The adaptability and toughness of hoses such as the DataGuard and FlexCool not only improve cooling effectiveness but also underpin the demand for less environmentally taxing, more cost-saving alternatives. As high-density IT infrastructure becomes increasingly prevalent in industries, these hoses have become invaluable in heat load management.

Technological Advancements in Cooling Efficiency

Technological innovation in industrial hose designs is contributing significantly to the solution of the increasing needs for effective cooling systems in different industries. The trend is moving towards hoses that are more flexible, have greater flow capacity, and are more compatible, which provide optimized performance in high-pressure applications. In March 2025, Gates introduced the Data Master MegaFlex hose, a large-diameter cooling hose engineered for high-flow liquid cooling systems in data centers. This new hose features greater flexibility, with up to 75% tighter minimum bend radius over typical large-diameter hoses, for easier installations and more design flexibility. The hose's capability to handle high thermal loads and provide consistent coolant flow makes it an essential part in high-density server applications. As demands for digital infrastructure and data storage rise, these hoses become more necessary for heat management and operational efficiency in cooling systems. The availability of hoses such as the Data Master MegaFlex illustrates how industry leaders are addressing the changing needs of the market with high-performance products. Through enhancing the process of installation and system efficiency, these innovations not only optimize cooling performance but also decrease long-term operational expense, driving the growth of the industrial hose market further.

Global Industrialization and Sector Expansion

The global industrial hose market is witnessing robust growth, primarily driven by rapid Industrialization. According to the United Nations Industrial Development Organization, industry sectors across the world experienced an increase of 2.3% in 2023, reflecting the constant trend of the growth of industry. One key driver of such growth is the growing application of industrial hoses consisting of PVC material, which find extensive use in construction for transporting fluids. The PVC industry is worth USD 47.0 Billion in 2024 and is predicted to grow at a 3.6% CAGR between 2025 and 2033, says IMARC Group. These hoses are extremely important in terms of preventing freezing and condensation of the fluid, as well as keeping the core temperature inside the pipes. Apart from this, the increased demand for chemical hoses is further contributing to the market's strength. In the drug industry, where Europe's production had come to Euro 44 Billion in 2023 from Euro 36 Billion in 2021, industrial hoses are gaining usage in processes such as vacuum conveying and pelleting machines. Pharmaceutical industry growth is anticipated to boost the demand for industrial hoses further. In addition, the industrialization of farming activities, with hydraulic hoses being a core component of equipment such as harvesters and tractors, is also aiding in market growth. The ongoing demand from the automobile industry for hoses to boost engine efficiency and fuel economy is another major growth driver.

Industrial Hose Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial hose market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, wire type, and end use industry.

Analysis by Material:

- Natural Rubber

- Nitrile Rubber

- Polyvinyl Chloride (PVC)

- Silicone

- Polyurethane

- Others

As per industrial hose market outlook, in 2024, the polyurethane segment led the industrial hose market, driven by its superior abrasion resistance, flexibility, and durability. Polyurethane hoses are highly resistant to wear and tear, making them ideal for industries like construction, mining, and manufacturing where heavy-duty applications are common. Their lightweight nature, combined with resistance to chemicals, oils, and extreme temperatures, further enhances their appeal. Polyurethane hoses also offer excellent tensile strength, making them suitable for long-term use in challenging environments. The growing demand for versatile, high-performance hoses in various industrial sectors is driving the segment's dominance.

Analysis by Wire Type:

- Wire Braided

- Spiral Wire

Wire braided industrial hose provides high-pressure resistance and durability. These hoses are commonly used in hydraulic systems and heavy machinery across industries such as oil & gas, automotive, and construction. The wire braided design ensures superior performance under extreme conditions, making it suitable for applications requiring high burst pressure and flexibility. The demand for wire braided hoses is driven by industries requiring hoses with reinforced strength and resistance to external forces, vibrations, and abrasions, particularly in critical applications with high pressure and temperature variations.

Spiral wire-reinforced hoses are highly resistant to crushing and kink, making them ideal for use in industries like construction, mining, and material handling. The ability to withstand high pressures and maintain structural integrity in tough, high-stress applications makes spiral wire hoses a preferred choice for hydraulic and pneumatic systems. Additionally, these hoses are essential in the transportation of aggressive materials, including oils, chemicals, and gases, boosting their demand in diverse industrial applications.

Analysis by End Use Industry:

- Automotive

- Infrastructure

- Oil and Gas

- Pharmaceuticals

- Food and Beverages

- Water and Wastewater

- Mining

- Chemicals

- Agriculture

- Others

In 2024, the automotive segment led the industrial hose market driven by the growing demand for high-performance hoses used in manufacturing, assembly lines, and vehicle maintenance. Industrial hoses in the automotive sector are crucial for fluid transfer, cooling systems, and air brake systems. The shift towards electric vehicles (EVs) and automation in manufacturing further boosted the demand for advanced hoses that ensure reliability, efficiency, and longevity in systems exposed to high pressures and temperatures. As automotive manufacturers invest in more robust and efficient production lines, the need for specialized hoses designed for critical functions continues to grow.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia Pacific led the industrial hose market, driven by rapid industrialization, urbanization, and robust demand from key sectors like construction, automotive, oil & gas, and chemicals. Countries such as China, India, and Japan are seeing an expansion in manufacturing capacities, infrastructure projects, and industrial applications, resulting in increased demand for high-performance hoses. Additionally, the region benefits from competitive manufacturing costs, innovation in hose technology, and investments in infrastructure. The Asia Pacific's focus on enhancing its industrial capabilities, combined with its strategic position in the global supply chain, continues to fuel the industrial hose market growth.

Key Regional Takeaways:

United States Industrial Hose Market Analysis

The growth of key end-use industries, such as oil and gas, chemicals, construction, food and beverage, and agriculture, primarily drives the industrial hose market in the United States. These sectors heavily rely on specialized hose systems for fluid and material transfer. In December 2023, US oil production averaged 13.3 Million barrels per day, with natural gas production at 128.8 Billion cubic feet per day, as reported by the Energy Information Administration (EIA). The ongoing development of shale oil infrastructure, particularly in areas like the Permian Basin, is increasing the demand for high-pressure and heat-resistant hoses used in drilling and hydraulic fracturing. The construction sector is also contributing to market growth, with infrastructure projects and commercial developments boosting the need for hoses used in concrete pumping, dewatering, and air handling. The US Census Bureau reports that construction spending reached USD 2,196.1 Billion in March 2025. Stricter environmental regulations and safety standards are prompting industries to invest in advanced hose systems resistant to abrasion, chemicals, and extreme temperatures. Besides, the emphasis on domestic manufacturing and supply chain resilience is boosting the demand for customized hose solutions tailored to specific industrial needs.

Asia Pacific Industrial Hose Market Analysis

The Asia Pacific industrial hose market is expanding due to the rapid industrialization and infrastructure development across countries like China, India, Japan, and Southeast Asia. The industrial manufacturing sector in India, for instance, showed a 5.2% growth in November 2024, as noted by the Press Information Bureau (PIB). Increasing investments in construction and mining projects are driving the demand for heavy-duty hoses used in material handling, dewatering, and fuel transfer. Additionally, the thriving automotive and chemical industries in the region require flexible, durable hoses for fluid conveyance and cooling systems. The region also benefits from the availability of low-cost raw materials and labor, further promoting local hose production. Moreover, stricter environmental and safety regulations are increasing the demand for advanced hoses that resist abrasion, high pressure, and extreme temperatures, meeting the needs of a variety of industrial applications. These developments are contributing to the growth of the industrial hose market in Asia Pacific, which is expected to continue expanding as industrial activities intensify across the region.

Europe Industrial Hose Market Analysis

In Europe, the industrial hose market is growing due to technological advancements, regulatory compliance, and ongoing industrial activities in sectors like manufacturing, chemicals, pharmaceuticals, automotive, and food processing. The region’s focus on environmental sustainability and workplace safety is driving the demand for hoses that meet strict EU standards for emissions, chemical handling, and hygiene. The automotive industry, particularly in electric vehicle (EV) production, is generating new requirements for hoses that are resistant to heat and chemicals. In 2023, the European Union saw 2.4 Million new electric car registrations, representing 22.7% of all new cars, according to the European Environment Agency. The region is also investing in automation and smart manufacturing, further increasing the demand for advanced hose systems with real-time monitoring for leak detection and pressure control. The growth of infrastructure renovation projects and renewable energy initiatives, particularly in wind and bioenergy, is also contributing to increased hose demand for high-pressure and corrosive applications. For instance, Europe installed 16.4 GW of new wind power capacity in 2024, bringing the total to 285 GW. These factors are shaping the future of the industrial hose market in Europe.

Latin America Industrial Hose Market Analysis

The expansion of energy projects, industrial diversification, and rising infrastructure needs are driving the industrial hose market in Latin America. The growth of the renewable energy sector, particularly wind and solar energy, is significantly contributing to the demand for durable hoses capable of handling high-pressure fluids and abrasive materials. In Brazil and Chile, for example, wind and solar energy accounted for 21% of electricity generation in 2023, a substantial increase from previous years, according to industry reports. This growth in renewable energy is spurring the need for robust hoses in hydraulic systems, cooling, and maintenance operations. Furthermore, advancements in hose materials and a growing focus on preventive maintenance are encouraging industries to invest in high-performance hose systems designed to withstand harsh operating conditions. As industrial activities continue to expand and diversify across the region, the demand for specialized hoses is expected to rise, further driving market growth in Latin America.

Middle East and Africa Industrial Hose Market Analysis

The industrial hose market in the Middle East and Africa is witnessing growth driven by strong activity in oil and gas, construction, and mining sectors, all of which require reliable hose solutions for fluid transfer, fuel handling, and material transport. Major oil-producing nations like Saudi Arabia and the UAE are expanding both upstream and downstream operations, increasing the need for hoses that can withstand high temperatures and chemical exposure. In 2023, Saudi Arabia's oil production averaged 9.5 Million barrels per day, according to the Energy Information Administration (EIA). In Africa, mining and infrastructure development in countries like South Africa and Nigeria are further boosting the demand for industrial hoses, particularly for dewatering, slurry handling, and compressed air systems. The increasing concern over water scarcity across the region is also prompting investments in irrigation and water transfer solutions, driving the demand for durable hose products. As industries continue to grow and diversify, the Middle East and Africa’s industrial hose market is poised for continued expansion.

Competitive Landscape:

Ongoing advancements in industrial hose materials, manufacturing techniques, and integration strategies are driving growth in the industrial hose market. Companies are focusing on improving durability, flexibility, and performance to meet the diverse needs of industries like construction, oil & gas, and chemicals. Firms compete by offering high-performance, customizable hoses with enhanced resistance to extreme conditions, corrosion, and wear. Strategic partnerships, global expansion, and product innovation are accelerating industrial hose adoption. According to industrial hose market forecast, demand is expected to grow as industries prioritize safety, operational efficiency, and sustainability, prompting increased investment in advanced, reliable hose solutions.

The report provides a comprehensive analysis of the competitive landscape in the industrial hose market with detailed profiles of all major companies, including:

- Colex International Ltd.

- Continental AG

- Eaton Corporation plc

- Flexaust Inc. (Schauenburg Gruppe)

- Gates Corporation

- Kuriyama of America Inc.

- Kurt Manufacturing

- NORRES

- Parker-Hannifin Corporation

- RYCO Hydraulics (Manuli Rubber Industries S.p.A.)

- Transfer Oil S.p.A.

- Trelleborg AB (publ)

Latest News and Developments:

- April 2025: Danfoss Power Solutions introduced the Synflex by Danfoss 3TMH thermoplastic hydraulic hose. With its optimal resilience and consistency, the hose has been developed to enhance the functionality of various material handling equipment, including boom lifts, scissor lifts, and telehandlers.

- March 2025: Gates Corporation introduced a breakthrough large-diameter industrial hose tailored for data center cooling systems. Engineered to manage the intense thermal loads of high-density server environments, this hose enhances fluid flow and thermal efficiency.

- February 2025: ContiTech, a division of Continental, launched a hydraulics project tailored to the heavy-duty vehicle industry in the United States and Canada. The Continental aftermarket hydraulics program is expected to deliver a comprehensive assortment of hydraulic hoses and fittings designed for the harsh conditions that heavy-duty trucks encounter.

- January 2025: Alfotech announced the launch of ACQUA/ADT-K, its drinking water hose that is both KTW-BWG and KTW certified. The ACQUA/ADT-K drinking water hose is certified for use in food applications and is composed of technopolymer (TPE), featuring an extra inner layer of high-strength textile for reinforcement. The hose is also resistant to weather and ozone and contains no substances or components derived from animals.

Industrial Hose Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Natural Rubber, Nitrile Rubber, Polyvinyl Chloride (PVC), Silicone, Polyurethane, Others |

| Wire Types Covered | Wire Braided, Spiral Wire |

| End Use Industries Covered | Automotive, Infrastructure, Oil and Gas, Pharmaceuticals, Food and Beverages, Water and Wastewater, Mining, Chemicals, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Colex International Ltd., Continental AG, Eaton Corporation plc, Flexaust Inc. (Schauenburg Gruppe), Gates Corporation, Kuriyama of America Inc., Kurt Manufacturing, NORRES, Parker-Hannifin Corporation, RYCO Hydraulics (Manuli Rubber Industries S.p.A.), Transfer Oil S.p.A. and Trelleborg AB (publ) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial hose market from 2019-2033.

- The industrial hose market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial hose industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial hose market was valued at USD 14.5 Billion in 2024.

The industrial hose market is projected to exhibit a CAGR of 7.10% during 2025-2033, reaching a value of USD 28.25 Billion by 2033.

Key factors driving the industrial hose market include increased demand across industries like construction, mining, oil & gas, and chemicals, growing infrastructure development, advancements in hose materials for enhanced durability, and rising safety standards, along with innovations in manufacturing technology and customization options.

In 2024, Asia Pacific dominated the industrial hose market, driven by rapid industrialization, growing construction and manufacturing sectors, and increased demand from industries like oil & gas, chemicals, and agriculture. The region also benefits from robust infrastructure development and expanding infrastructure projects.

Some of the major players in the global industrial hose market include Colex International Ltd., Continental AG, Eaton Corporation plc, Flexaust Inc. (Schauenburg Gruppe), Gates Corporation, Kuriyama of America Inc., Kurt Manufacturing, NORRES, Parker-Hannifin Corporation, RYCO Hydraulics (Manuli Rubber Industries S.p.A.), Transfer Oil S.p.A., Trelleborg AB (publ), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)