Industrial and Institutional Cleaning Chemicals Market Size, Share, Trends and Forecast by Product, Raw Material, End Use, and Region, 2025-2033

Industrial and Institutional Cleaning Chemicals Market Size and Share:

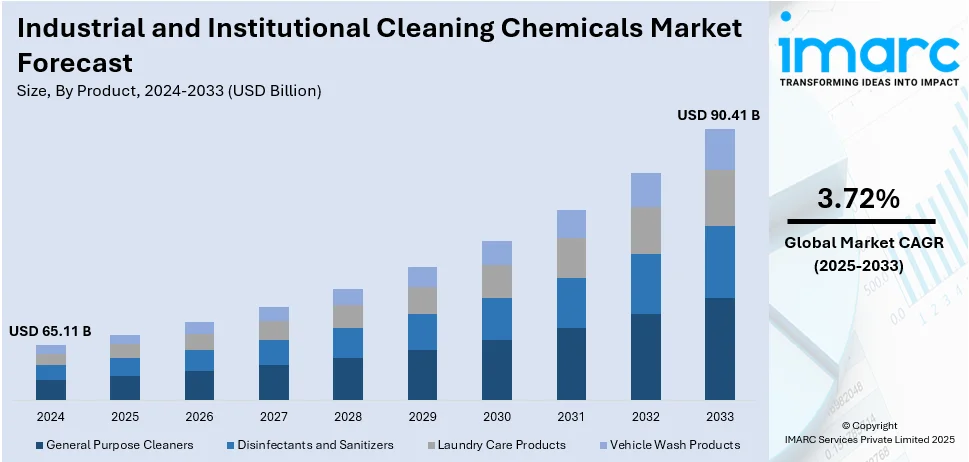

The global industrial and institutional cleaning chemicals market size was valued at USD 65.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 90.41 Billion by 2033, exhibiting a CAGR of 3.72% during 2025-2033. North America currently dominates the market, holding a significant market share of over 33.8% in 2024. The growing public awareness regarding health and hygiene, the implementation of stringent government safety regulations and standards, and the rising demand from the healthcare industry are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 65.11 Billion |

| Market Forecast in 2033 | USD 90.41 Billion |

| Market Growth Rate (2025-2033) | 3.72% |

The escalating consumer awareness and concerns regarding hygiene and cleanliness in commercial, industrial, and institutional settings are primarily driving the market growth. Concurrent with this, governments and regulatory bodies enforce strict regulations regarding cleanliness and hygiene standards, mandating the use of specific cleaning chemicals in various sectors. This is further generating an increasing demand for industrial and institutional cleaning chemicals. In addition to this, extensive focus on infection control across various sectors, particularly in healthcare establishments, to prevent the spread of various diseases is fueling the demand for specialized cleaning chemicals and disinfectants. Moreover, ongoing advancements in chemical formulations and cleaning technologies, resulting in the development of more efficient and effective products, thereby impacting the industrial and institutional cleaning chemicals market demand optimistically.

The United States represents a notable share of the global industrial and institutional cleaning chemicals industry, driven by stringent hygiene regulations, rising demand for sustainable cleaning solutions, and the expansion of commercial and industrial sectors. Growth is supported by increasing adoption of eco-friendly formulations, advancements in surfactants, and strict compliance requirements in healthcare, food processing, and hospitality industries. Leading manufacturers focus on bio-based ingredients and innovative disinfectants to meet evolving regulatory standards. The market is further influenced by high consumption in janitorial services and institutional maintenance, reinforcing steady demand across commercial establishments and industrial facilities. For instance, in January 2025, Brenntag, a major distributor of ingredients and chemicals globally, expanded its distribution agreement with Kao Chemicals Europe, one of the leading industrial cleaning ingredients provider, for the U.S. market.

Industrial and Institutional Cleaning Chemicals Market Trends:

Rising Focus on Hygiene and Sanitation

One of the industrial and institutional cleaning chemicals market trends is the growing emphasis on hygiene and sanitation across various sectors. With rising awareness about the importance of maintaining clean and germ-free environments, businesses and institutions are placing greater importance on cleanliness to ensure the well-being and safety of employees, customers, patients, and visitors. This, in turn, is propelling demand for cleaning chemicals that can efficiently eliminate dirt, grime, bacteria, viruses, and other contaminants. On the basis of Canadian Nosocomial Infection Surveillance Program (CNISP) data, there were 687,000 healthcare-associated infections (HAIs) across the United States acute care hospitals that resulted in around 72,000 patient deaths during hospital stays. National and state governments are stepping up measures to curb HAIs by promoting the use of surface disinfectants and implementing different regulatory guidelines. Besides this, the escalating concerns about the risks of cross-contamination in shared spaces, including offices and public buildings, are further contributing to the market growth. In addition to this, industries such as healthcare, hospitality, and food processing are particularly stringent in their cleaning practices, necessitating the use of specialized cleaning chemicals.

Stringent Government Regulations and Standards

Government regulations and standards play a crucial role in driving the demand for industrial and institutional cleaning chemicals. Regulatory bodies across the globe impose stringent guidelines to ensure cleanliness, hygiene, and safety in commercial, industrial, and institutional spaces. These regulations cover various aspects such as workplace safety, food safety, healthcare-associated infections, environmental impact, and chemical safety. Compliance with these regulations often requires the use of specific cleaning chemicals that meet the prescribed standards. For example, healthcare facilities must follow rigorous cleaning protocols to prevent healthcare-associated infections, and food processing plants must maintain strict cleanliness standards to ensure the safety and quality of food products. United States Department of Agriculture (USDA) and the Food and Drug Administration (FDA) have been leading institutions in sanitizing chemical requirements in food service. Restaurants, food processing plants, cafes, and kitchens all adopt extreme sanitizing procedures to prevent situations such as botulism food poisoning or gastroenteritis infections, with equipment and surfaces thoroughly cleaned up to the highest levels. The need to adhere to these regulations creates a consistent demand for industrial and institutional cleaning chemicals.

Technological Advancements and Innovations

Technological advancements and innovations, such as the formulation of chemicals with improved cleaning properties, enhanced disinfection capabilities, faster action, and safer handling, is a pivotal industrial and institutional cleaning chemicals market trend that drive the growth and evolution in this industry. Moreover, the growing shift towards the development of green cleaning chemicals that are biodegradable, non-toxic, and have minimal impact on the environment is aiding in market expansion. Apart from this, ongoing advancements in cleaning equipment and technologies, such as automated systems and robotics, are catalyzing the demand for compatible cleaning chemicals. Furthermore, the advent of novel digital solutions, such as smart sensors, the Internet of Things (IoT) integration, and data analytics, to facilitate better monitoring and management of cleaning processes are impelling the market growth. One of the best examples of innovation in this area is Procter & Gamble's introduction of Microban-24 in February 2020, a disinfectant that was capable of killing 99% of flu and cold viruses. This product alone made USD 200 Million in sales up to mid-November 2020, demonstrating the increasing need for effective and trustworthy disinfectants.

Industrial and Institutional Cleaning Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial and institutional cleaning chemicals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, raw material, and end use.

Analysis by Product:

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

General purpose cleaners lead the market with around 35.8% of market share in 2024. This is attributed to their versatility, cost-effectiveness, and widespread use across multiple industries. These cleaners are formulated to remove dirt, grease, and contaminants from various surfaces, making them essential in commercial establishments, healthcare facilities, and food service environments. Their demand is further supported by evolving hygiene standards and stringent regulatory requirements, particularly in sectors requiring high sanitation levels. Advancements in formulation technologies have led to the development of concentrated, biodegradable, and low-VOC general-purpose cleaners that offer improved performance while minimizing environmental impact. In addition to this, manufacturers are increasingly focusing on multi-functional products that combine disinfecting, degreasing, and deodorizing properties to enhance efficiency and reduce the need for multiple cleaning agents. The continuous growth in commercial and industrial activities, combined with increasing awareness of hygiene and sustainability, further reinforces the strong market position of general-purpose cleaners.

Analysis by Raw Material:

- Chlor-Alkali

- Surfactant

- Phosphates

- Biocides

- Others

Surfactant leads the market with around 29.2% of the industrial and institutional cleaning chemicals market share in 2024. These compounds enhance the cleaning efficiency of formulations by reducing surface tension, allowing water and active ingredients to penetrate dirt and grease more effectively. Surfactants are widely used in detergents, disinfectants, degreasers, and specialty cleaners across industries like healthcare, hospitality, and manufacturing. The market is witnessing a shift toward bio-based and sustainable surfactants, driven by regulatory pressures and the growing demand for environmentally friendly cleaning solutions. Innovations in amphoteric, non-ionic, and anionic surfactants are improving performance characteristics such as foaming, emulsification, and wetting ability, making them indispensable in high-performance cleaning products. As the demand for effective and eco-friendly cleaning chemicals rises, surfactants continue to be a critical component in ensuring product efficiency and compliance with evolving environmental standards.

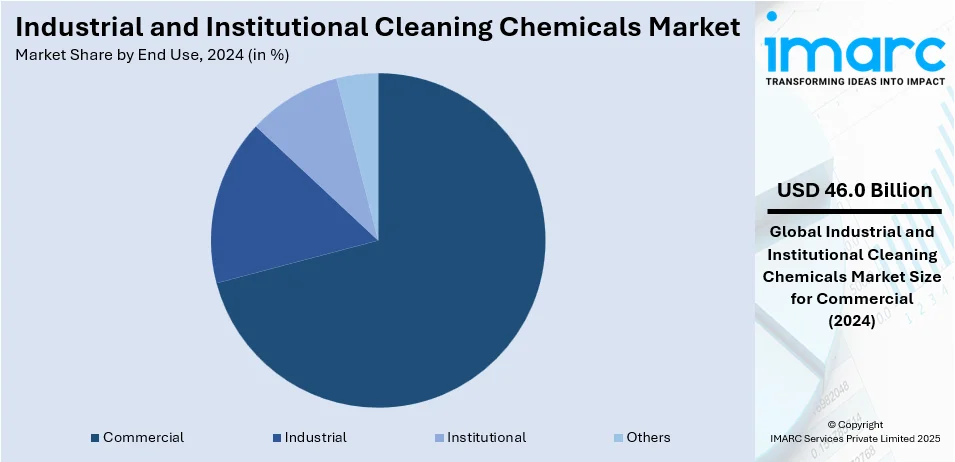

Analysis by End Use:

- Commercial

- Industrial

- Institutional

- Others

Commercial leads the market with around 70.6% of market share in 2024, due to its extensive cleaning requirements across office spaces, retail establishments, hotels, and food service facilities. Businesses prioritize high hygiene standards to maintain a safe and sanitary environment for employees and customers, driving consistent demand for cleaning solutions. The sector’s growth is supported by increasing regulations, particularly in hospitality and food service industries, where sanitation is critical to operational compliance. The rise of green cleaning initiatives and sustainable facility management practices has further fueled the adoption of advanced cleaning formulations. Cleaning service providers and facility management companies are key consumers in this segment, demanding efficient, cost-effective, and environmentally responsible solutions. Furthermore, as urbanization and commercial infrastructure expand globally, the need for effective cleaning chemicals in maintaining hygiene and safety standards continues to strengthen the market position of the commercial end-use sector.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.8%. North America leads the global industrial and institutional cleaning chemicals market due to strict regulatory standards, high sanitation awareness, and strong demand from healthcare, food processing, and commercial sectors. Government agencies, including the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA), enforce stringent hygiene and safety regulations, driving the adoption of advanced cleaning solutions. The region’s high commercial infrastructure development and expanding hospitality and healthcare industries, along with heavy investments, further contribute to market growth. For instance, as per government of Canada's 2024 report, around USD 200 billion has been invested to enhance healthcare services in the last 10 years. Beside this, in July 2024, government allocated USD 47 Million to aid health workforce across the nation. Furthermore, increasing preference for eco-friendly and sustainable cleaning chemicals has also spurred innovation in bio-based and low-VOC formulations. With technological advancements, rising industrialization, and growing concerns over workplace hygiene, North America remains the dominant market, characterized by strong consumer demand and regulatory-driven product development.

Key Regional Takeaways:

United States Industrial and Institutional Cleaning Chemicals Market Analysis

In 2024, the United States accounted for 93.20% of the market share in North America. According to the Bureau of Labor Statistics, in 2022 US customers on an average spent USD 169.83 on cleaning and laundry products, which reflects the growing demand for cleaning products in institutional and household markets. According to American Hospital Association statistics, as of January 2024, the U.S. had approximately 6,120 hospitals, and 84% of them were community hospitals. These healthcare institutions are responsible significantly for the demand for industrial and institutional cleaning chemicals because high standards of hygiene and safety are very important in the prevention of healthcare-associated infections. Cleanliness and sanitization being emphasized in most industries, encompassing hospitality, healthcare, and food processing, also account for the market. Moreover, with regulations changing, companies are more and more investing in cleaning products that meet safety and environmental requirements, which in turn drives the demand for high-end cleaning chemicals. This, coupled with rising consumer expenditure on cleaning products, is driving the growth of the industrial and institutional cleaning chemicals market in the United States.

Europe Industrial and Institutional Cleaning Chemicals Market Analysis

According to IKW statistics, the German Cosmetic, Toiletry, Perfumery and Detergent Association, household cleaning products across Germany generated around USD 1.37 Billion in the year 2023, up by 0.8% from 2022. This indicates the increasing need for cleaning products in the European market, driven by heightened consciousness about sanitation and hygiene in residential and institutional settings. Growing consumer spend on domestic cleaning chemicals, along with shifting standards and regulations, has encouraged innovations in the industrial and institutional cleaning chemicals market. In addition, adoption of strict hygiene measures in sectors like healthcare, food processing, and hospitality also enhances demand for cleaning chemicals that offer safety and compliance. The shift towards green and sustainable cleaning products is also gaining momentum, as consumers increasingly look for biodegradable and non-toxic chemicals. All these aspects together promote the growing size of the European industrial and institutional cleaning chemicals market.

Asia Pacific Industrial and Institutional Cleaning Chemicals Market Analysis

As per UNFPA, the Asia-Pacific region has a heterogeneous population of approximately 4.3 billion individuals from various walks of life, gender, age, ethnicity, and sexual orientation. The region also accounts for 60% of the global population, as per NIH, and comprises some of the most populated nations across the globe. The large and heterogeneous population is responsible for a higher demand for industrial and institutional cleaning chemicals in different industries. While urbanization keeps widening, the requirement for improved sanitation in commercial, industrial, and institutional areas has increased tremendously. Strict hygiene measures in healthcare, food processing, and hospitality segments also fuel market expansion. Finally, the enhanced focus on sustainability and green measures has prompted improvements in biodegradable and toxin-free cleaning agents, further improving their usage at home and institutionally. Growing recognition of the significance of hygiene and safety is driving the demand for high-end cleaning chemicals in the Asia-Pacific region.

Latin America Industrial and Institutional Cleaning Chemicals Market Analysis

There was a total of 7,191 hospitals functioning in Brazil in 2022, as per industry reports. The increasing number of health facilities itself indicates the demand for industrial and institutional cleaning chemicals in the country. As healthcare infrastructure increases and there is greater emphasis on hygiene, the requirement for cleaning chemicals to provide clean and safe environments within hospitals is on the rise. Moreover, the increasing awareness of healthcare-associated infections and infection control is also boosting demand for quality cleaning solutions further. Beyond healthcare, other segments such as food processing, hospitality, and manufacturing in Latin America are also helping to fuel industrial and institutional cleaning chemicals market growth. Strict standards and regulations in multiple industries are encouraging businesses to employ good cleaning procedures, which themselves drive the market for specialized cleaners. The Latin American market will keep growing as hygiene and security become top priority in public as well as private sectors.

Middle East and Africa Industrial and Institutional Cleaning Chemicals Market Analysis

According to the research by the Organization for Economic Cooperation and Development (OECD) on Africa's Urbanization Dynamics 2020, the continent will witness the fastest urbanization rate by 2050. The rapid urbanization is fuelling the demand for industrial and institutional cleaning chemicals in the Middle East and Africa. With growing cities and the development of industries, there is an increased need for high-tech cleaning chemicals in commercial, residential, and institutional buildings. Besides, stringent hygiene practices in the healthcare, food processing, and hospitality sectors are driving the adoption of specialty cleaning chemicals. The Middle East and Africa region also witness a transition towards sustainability, which has encouraged the development and application of green and biodegradable cleaning chemicals. Additionally, the boom in infrastructure projects, including new hospitals, hotels, and office buildings, adds to the demand for efficient and effective cleaning chemicals as well. All of these developments are taking the regional industrial and institutional cleaning chemicals market collectively to growth.

Competitive Landscape:

The market is intensely competitive, with the presence of several key players operating in the market. These market players are implementing numerous growth strategies to strengthen their market position and broaden their customer base. In addition to these strategies, these companies are constantly aspiring to differentiate themselves from their competitors by introducing innovative products and solutions. This creates a favorable industrial and institutional cleaning chemicals market outlook for the market during the forecasted period. Some of the strategies adopted by prominent players include mergers and acquisitions, partnerships, collaborations, and new product launches. For instance, in June 2024, Solenis, a prominent specialty chemicals company, announced strategic acquisition of Lilleborg, a leading provider of professional cleaning solutions. Besides this, the increasing awareness about workplace hygiene is resulting in an increase in the demand for industrial and institutional cleaning equipment and products, which is expected to bolster the market growth in the coming years.

The report provides a comprehensive analysis of the competitive landscape in the industrial and institutional cleaning chemicals market with detailed profiles of all major companies, including:

- 3M Company

- BASF SE

- Clariant AG

- Croda International Plc

- Dow Inc.

- Eastman Chemical Company

- Henkel AG & Co. KGaA

- Lanxess AG

- Sasol Limited

- Solvay

- STEPAN Company

- The Procter & Gamble Company

Latest News and Developments:

- March 2024: TruArc Partners, a middle-market private equity company, finalized the purchase of Meyer Laboratory, Inc., a business that specializes in the distribution as well as manufacturing of cleaning chemicals for institutional and industrial purposes.

- May 2023: BASF started a new supercomputer at its Ludwigshafen site to replace the existing one to support its R&D initiatives. With 3 petaflops of computing power, the new supercomputer has more capacity and computing power for complex modeling, virtual experiments, and simulations.

- May 2023: Dow and New Energy Blue announced a collaboration to create bio-based ethylene from renewable agricultural residues to counter carbon emissions from plastic production.

- March 2023: Speciality chemicals manufacturer Croda India, a subsidiary of UK-based Croda International Plc, established a new production unit at Dahej in Gujarat with an investment of Rs 500 crore in the first phase.

Industrial and Institutional Cleaning Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | General Purpose Cleaners, Disinfectants and Sanitizers, Laundry Care Products, Vehicle Wash Products |

| Raw Materials Covered | Chlor-Alkali, Surfactant, Phosphates, Biocides, Others |

| End Uses Covered | Commercial, Industrial, Institutional, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, BASF SE, Clariant AG, Croda International Plc, Dow Inc., Eastman Chemical Company, Henkel AG & Co. KGaA, Lanxess AG, Sasol Limited, Solvay, STEPAN Company, The Procter & Gamble Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial and institutional cleaning chemicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global industrial and institutional cleaning chemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial and institutional cleaning chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial and institutional cleaning chemicals market was valued at USD 65.11 Billion in 2024.

IMARC estimates the industrial and institutional cleaning chemicals market to reach USD 90.41 Billion by 2033, exhibiting a CAGR of 3.72% during 2025-2033.

The market is driven by stricter hygiene regulations, amplifying awareness of workplace sanitation, and intensifying need key sectors like food processing, healthcare, and hospitality sectors. Enhancements in eco-friendly formulations, automation in cleaning processes, and growing industrialization further bolster market growth, improving efficacy and sustainability.

North America currently dominates the industrial and institutional cleaning chemicals market, accounting for a share exceeding 33.8%. This dominance is fueled by strict regulatory standards, high demand from healthcare and food industries, advanced cleaning technologies, and strong adoption of eco-friendly formulations across commercial and industrial sectors.

Some of the major players in the industrial and institutional cleaning chemicals market include 3M Company, BASF SE, Clariant AG, Croda International Plc, Dow Inc., Eastman Chemical Company, Henkel AG & Co. KGaA, Lanxess AG, Sasol Limited, Solvay, STEPAN Company, The Procter & Gamble Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)