Industrial Nailers and Staplers Market Size, Share, Trends and Forecast by Product Type, Operation, End Use, and Region, 2025-2033

Industrial Nailers and Staplers Market Size and Share:

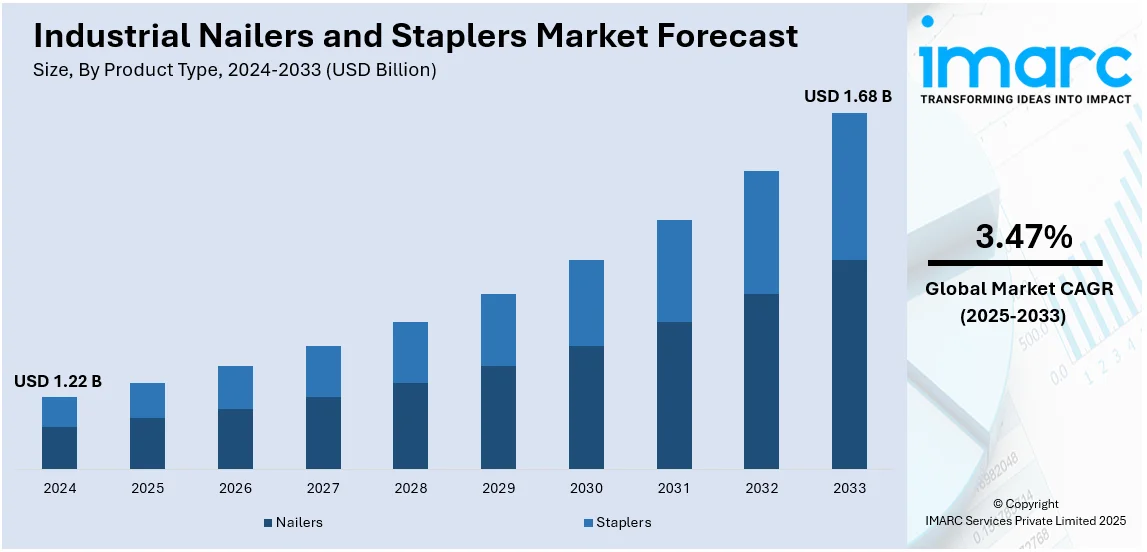

The global industrial nailers and staplers market size was valued at USD 1.22 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.68 Billion by 2033, exhibiting a CAGR of 3.47% from 2025-2033. North America currently dominates the market, holding a market share of over 38.5% in 2024. The booming construction industry, the rising infrastructure development projects, the increasing focus on automation and efficiency in industries, and the growing demand for furniture and upholstery products represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.22 Billion |

|

Market Forecast in 2033

|

USD 1.68 Billion |

| Market Growth Rate (2025-2033) | 3.47% |

The industrial nailers and staplers market growth is driven by an increased demand in construction, furniture, and packaging industries. Rising urbanization and infrastructure development have intensified the need for efficient fastening tools in framing, flooring, and roofing applications. The shift toward automated manufacturing in the furniture sector has further fueled demand for pneumatic and cordless tools, improving productivity and reducing labor costs. Additionally, the expansion of e-commerce and sustainable packaging solutions has boosted the adoption of industrial staplers for securing corrugated boxes and wooden crates. Manufacturers are prioritizing lightweight materials, ergonomic designs, and battery-powered advancements to enhance user safety and comply with industry standards, contributing to the increase of industrial nailers and staplers market share.

In the United States, market growth is driven by expanding construction activities, infrastructure modernization, and stringent building codes. The rising popularity of DIY home improvement projects has increased demand for cordless and pneumatic nailers among professionals and consumers. For instance, in March 2024, SENCO, announced a partnership with Homes For Our Troops (HFOT) to help build custom-adapted homes for severely injured post-9/11 veterans, assisting in their transition to homeownership. Additionally, advancements in high-speed fastening technologies have improved efficiency in woodworking, upholstery, and modular construction. The push for energy-efficient and low-noise tools is shaping product innovations, aligning with environmental and occupational safety regulations, representing one of the key industrial nailers and staplers market trends. As industrial automation expands, demand for precise, high-performance fastening solutions continues to strengthen across multiple.

Industrial Nailers and Staplers Market Trends:

Rising Infrastructure Development and Automation in Industrial Processes

The global industrial nailers and staplers market is bolstered by the booming construction industry and the rising infrastructure development projects, including residential and commercial buildings, bridges, and roads. According to reports, worldwide infrastructure spending will grow from USD 4 trillion per year in 2012 to more than USD 9 trillion per year by 2025. Moreover, the increasing focus on automation and efficiency in industries such as manufacturing and woodworking is propelling the adoption of industrial nailers and staplers to streamline production processes, increase productivity, and reduce manual labor, further supporting industrial nailers and staplers market demand.

Expanding Demand Across Multiple Industries and Advancements in Technology

Additionally, the growing demand for furniture and upholstery products, rapid urbanization, and inflating disposable incomes are creating significant growth for the market. Furthermore, the need for quick and precise fastening solutions in the automotive and aerospace sectors and the increasing emphasis on product customization and personalization are contributing to industrial nailers and staplers market growth. For instance, global automotive investment flows saw a 62% increase in 2022 compared to 2020. Other key drivers include the rapidly evolving packaging industry, various technological advancements, the development of innovative and ergonomic nailers and staplers, and stringent safety regulations and standards, presenting remunerative growth opportunities for the market.

Growing Adoption of Cordless and Pneumatic Technologies

The industrial nailers and staplers market is witnessing a shift toward cordless and pneumatic models, driven by the need for efficiency, mobility, and reduced manual effort. Advancements in lithium-ion battery technology have improved the performance of cordless nailers, making them a preferred choice for construction, furniture, and woodworking industries. Pneumatic tools, known for their high-speed operation and durability, continue to dominate large-scale applications. Manufacturers are focusing on lightweight, ergonomic designs with enhanced safety features, ensuring compliance with industry regulations. For instance, in June 2024, Milwaukee Tool announced the expansion of its cordless finish nailer lineup with the M12 FUEL™ 18 Gauge Compact Brad Nailer, featuring a lightweight, compact design for tight spaces while delivering the power to sink nails into hardwoods. The demand for low-noise, energy-efficient solutions is also shaping product innovation in the market, influencing the industrial nailers and staplers market outlook.

Industrial Nailers and Staplers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial nailers and staplers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, operation, and end use.

Analysis by Product Type:

- Nailers

- Staplers

Nailers stand as the largest product type in 2024, holding around 72.2% of the market, due to their versatility, efficiency, and reliability in various applications. These tools are widely used in construction, woodworking, and manufacturing, providing fast and accurate fastening solutions. The growing demand for automation in industries, coupled with the need for durable and high-performance tools, further contributes to nailers' market leadership. Additionally, technological advancements, such as improved ergonomics and enhanced safety features, have made nailers more appealing to both professionals and businesses. Consequently, nailers maintain a significant market share in the industrial fastening segment.

Analysis by Operation:

- Pneumatic

- Electric

- Gas-Powered

Pneumatic stand as the largest operation in 2024, holding around 47.6% of the market because of their superior power, efficiency, and reliability. Powered by compressed air, pneumatic nailers offer consistent performance, making them ideal for heavy-duty applications in industries such as construction and manufacturing. These tools are valued for their durability, speed, and ability to work continuously without the need for extensive downtime or recharging. Furthermore, pneumatic systems are cost-effective, reducing the need for frequent maintenance, which drives their widespread adoption in industrial environments, ensuring their dominance in the market.

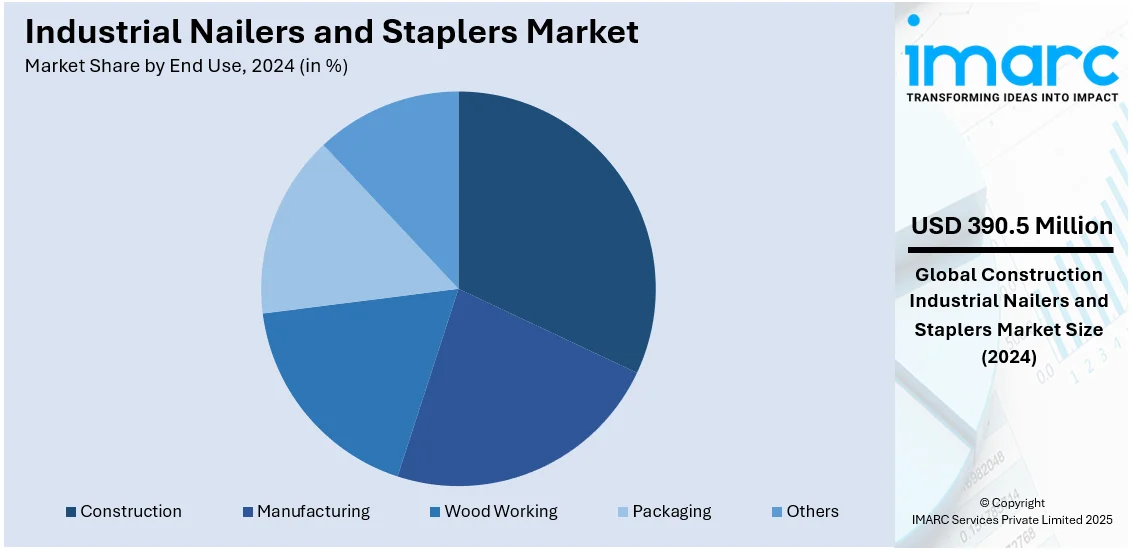

Analysis by End Use:

- Construction

- Manufacturing

- Wood Working

- Packaging

- Others

Construction stands as the largest end use in 2024, holding around 32.0% of the market, driven by the growing demand for fast, efficient, and precise fastening solutions in building projects. Nailers and staplers are essential tools in framing, roofing, flooring, and other structural tasks, enabling increased productivity and labor cost savings. The rapid urbanization and expansion of infrastructure projects worldwide further fuel the adoption of these tools. Their ability to streamline processes and ensure high-quality results positions the construction sector as the dominant driver of the industrial nailers and staplers market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.5%, driven by strong construction activity, advanced manufacturing, and a well-established woodworking industry. The United States and Canada are witnessing increased demand due to infrastructure modernization, residential and commercial construction, and stringent building regulations. Additionally, the region's high adoption of automation and power tools in industries such as furniture production, automotive, and packaging further strengthens market growth. The presence of key manufacturers and continuous technological advancements, including ergonomic and cordless fastening tools, contributes to North America's dominance, positioning it as a key driver of global market expansion and shaping industrial nailers and staplers market trends.

Key Regional Takeaways:

United States Industrial Nailers and Staplers Market Analysis

In 2024, United States accounted for 88.90% of the market share in North America. The growing industrial nailers and staplers adoption due to growing investment in infrastructure is a key factor driving market expansion. For instance, in a series of bills passed by Congress, over USD 1.2 Trillion will be spent between 2021 and 2030 to modernize aging U.S. infrastructure. The rising construction of commercial and residential buildings has accelerated the demand for high-performance fastening tools, enhancing efficiency in framing, roofing, and flooring applications. The growth in industrial nailers and staplers adoption is further influenced by the expansion of public infrastructure, including roads, bridges, and transportation networks, requiring durable and efficient fastening solutions. The demand for industrial nailers and staplers adoption due to growing investment in infrastructure is also driven by advancements in fastening technology, improving precision and speed. The market's expansion is supported by an increasing focus on sustainable building materials, which require specialized fastening tools to ensure structural integrity. The widespread use of prefabricated and modular construction methods further promotes the industrial nailers and staplers adoption due to growing investment in infrastructure. Increasing automation in construction projects, and reducing labor-intensive tasks, contributes to the rising need for efficient fastening solutions.

Europe Industrial Nailers and Staplers Market Analysis

The growing industrial nailers and staplers adoption due to growing packaging due to growing food and beverage industries is a significant factor influencing market growth. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. The rising demand for sustainable and durable packaging solutions has led to increased usage of efficient fastening tools to improve packaging efficiency. The expansion of automated packaging lines in food and beverage industries has enhanced the need for industrial nailers and staplers adoption due to growing packaging due to growing food and beverage industries, ensuring faster sealing and secure carton assembly. The emphasis on food safety regulations and compliance requires reliable fastening solutions, further supporting industrial nailers and staplers adoption due to growing packaging due to growing food and beverage industries. The increasing popularity of eco-friendly and recyclable packaging materials necessitates specialized fastening techniques, strengthening market expansion. The growth of ready-to-eat food products and beverages demands innovative packaging solutions, driving the demand for industrial nailers and staplers adoption due to growing packaging due to growing food and beverage industries.

Asia Pacific Industrial Nailers and Staplers Market Analysis

The growing industrial nailers and staplers adoption due to growing investment in automotive that requires quick and precise fastening solutions is a crucial driver of market expansion. According to India Brand Equity Foundation, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000 - December 2023. The automotive sector's emphasis on lightweight materials and improved assembly efficiency has increased the reliance on advanced fastening tools to enhance production processes. The growth in industrial nailers and staplers adoption due to growing investment in automotive that requires quick and precise fastening solutions is further supported by the expansion of electric vehicle manufacturing, where high-speed and precise fastening is essential for assembling battery components and lightweight structures. The increasing adoption of automation in vehicle assembly lines accelerates the demand for industrial nailers and staplers adoption due to growing investment in automotive that requires quick and precise fastening solutions. The rising integration of composite materials in vehicle bodies requires specialized fastening techniques, reinforcing market expansion.

Latin America Industrial Nailers and Staplers Market Analysis

The growing industrial nailers and staplers adoption due to growing the growing demand for furniture and upholstery products, rapid urbanization, and inflating disposable incomes is shaping market trends. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. The increasing preference for modern and durable furniture requires efficient fastening solutions, driving industrial nailers and staplers adoption due to growing the growing demand for furniture and upholstery products, rapid urbanization, and inflating disposable incomes. The expansion of residential and commercial spaces supports market demand, as furniture manufacturers seek high-performance tools for precise and quick assembly. The rapid growth of the upholstery sector enhances industrial nailers and staplers adoption due to growing the growing demand for furniture and upholstery products, rapid urbanization, and inflating disposable incomes. The rising spending power of consumers fosters investments in high-quality furniture, further driving the demand for advanced fastening solutions.

Middle East and Africa Industrial Nailers and Staplers Market Analysis

The growing industrial nailers and staplers adoption due to growing construction industry is a primary factor propelling market expansion. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. The rise in residential and commercial building projects strengthens industrial nailers and staplers adoption due to growing construction industry, as construction professionals seek efficient fastening solutions for framing, roofing, and structural assembly. The demand for high-speed fastening tools is driven by increasing infrastructure projects, requiring durable and precise solutions. The emphasis on cost-effective and labor-efficient construction techniques accelerates industrial nailers and staplers adoption due to growing construction industry. The market is further supported by growing investments in tourism-related infrastructure, increasing the need for high-performance fastening tools. The expansion of prefabricated and modular construction methods boosts industrial nailers and staplers adoption due to growing construction industry.

Competitive Landscape:

The global industrial nailers and staplers market is characterized by strong competition, fueled by automation, technological progress, and growth in construction and manufacturing industries. Manufacturers aim for cordless technology, pneumatic performance, and ergonomic forms to maximize functionality and user friendliness. For instance, in November 2024, Everwin Pneumatic introduced the MCN65 Metal Connector Nailer. The tool's exceptional power-to-weight ratio, enhanced safety features, and simplified maintenance contributed to its receipt of the PTIA Award. Woodworking, furniture, packaging, and construction sectors exhibit high demand in the market, fueling intense competition among the existing players as well as local players. Additionally, businesses target energy efficiency, long-term durability, and intelligent connectivity in order to create a unique differentiation in products. Furthermore, mergers and acquisitions as well as capacity growth are driving competition, enabling companies to consolidate market presence as well as respond to growing industrial automation and changing consumer tastes.

The report provides a comprehensive analysis of the competitive landscape in the industrial nailers and staplers market with detailed profiles of all major companies, including:

- Aerosmith Fastening Systems

- APACH Industrial Co. Ltd.

- BASSO Industry Corporation

- BeA GmbH

- Dorking S.A.

- Everwin Pneumatic

- Grex Power Tools

- Kaymo Fastener Company

- Makita Corporation

- Meite USA LLC

- Panrex Industrial Co. Ltd.

- Raimund Beck KG

- Stanley Black & Decker Inc.

Latest News and Developments:

- February 2025: Makita has launched the DBN900 18V LXT Framing Nailer, offering improved ease of use and flexibility. Unlike pneumatic models, it eliminates the need for compressors and air lines, reducing setup time. With no gas cartridges required, it also lowers costs and maintenance.

- February 2025: HiKOKI Power Tools has launched a new range of cordless nailers, eliminating the need for gas cartridges, hoses, or compressors. Built with an air-spring drive system, these nailers offer a pneumatic-like feel with cordless convenience. The lineup includes models like the NR1890DCA Clipped Head Framing Nailer and NV1845DA Coil Nailer, designed for precision and durability.

- October 2024: DeWalt has launched the new Trak-It C6 Gas Concrete Nailer, replacing the Trak-It C5 model. United Tool and Fastener is among the first to carry this next-generation tool. The C6 Nailer is compatible with Cordless Concrete Nailer (CCN) fasteners, enhancing versatility.

- October 2024: Bosch Power Tools unveils over 30 new tools, including hand tools and specialized press tools for plumbers, marking a brand-first expansion. The launch features 18V cordless innovations like angled finish nailers, a brad nailer, and a crown stapler for seamless system integration. Notable additions include an IP65-rated 360° Green-Beam Laser and utility knives with tool-free blade changes for jobsite efficiency.

- April 2024: DEWALT, a Stanley Black & Decker brand, unveiled the 20V MAX* XR® Brushless Cordless Framing Nailers, featuring an innovative flywheel for faster shooting. The lightweight nailers enhance jobsite efficiency by eliminating ramp-up time and removing compressor and hose setup hassles. They offer extended battery performance, enabling pros to install up to 530 sqft of subflooring per charge.

Industrial Nailers and Staplers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Nailers, Staplers |

| Operations Covered | Pneumatic, Electric, Gas-Powered |

| End Uses Covered | Construction, Manufacturing, Wood Working, Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aerosmith Fastening Systems, APACH Industrial Co. Ltd., BASSO Industry Corporation, BeA GmbH, Dorking S.A., Everwin Pneumatic, Grex Power Tools, Kaymo Fastener Company, Makita Corporation, Meite USA LLC, Panrex Industrial Co. Ltd., Raimund Beck KG, Stanley Black & Decker Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial nailers and staplers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global industrial nailers and staplers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial nailers and staplers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial nailers and staplers market was valued at USD 1.22 Billion in 2024.

IMARC estimates the global industrial nailers and staplers market to reach USD 1.68 Billion in 2033, exhibiting a CAGR of 3.47% during 2025-2033.

The market is primarily driven by the ongoing growth in construction and manufacturing sectors, advancements in tool technology, and increasing demand for efficient and durable fastening solutions. Additionally, rising automation, labor cost reduction, and infrastructure development further propel market expansion.

North America currently dominates the market, holding a market share of over 38.5% in 2024. This leadership is driven by strong demand in construction, manufacturing, and automotive sectors. Technological advancements, significant infrastructure investments, and the presence of major industry players contribute to the region's market dominance.

Some of the major players in the industrial nailers and staplers market include Aerosmith Fastening Systems, APACH Industrial Co. Ltd., BASSO Industry Corporation, BeA GmbH, Dorking S.A., Everwin Pneumatic, Grex Power Tools, Kaymo Fastener Company, Makita Corporation, Meite USA LLC, Panrex Industrial Co. Ltd., Raimund Beck KG, Stanley Black & Decker Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)