Industrial Robotics Market Report by Type (Articulated Robots, Cartesian Robots, SCARA Robots, Cylindrical Robots, Parallel Robots, and Others), Function (Soldering and Welding, Materials Handling, Assembling and Disassembling, Painting and Dispensing, Milling, Cutting and Processing, and Others), End Use Industry (Automotive, Electrical and Electronics, Chemical, Rubber, and Plastics, Machinery and Metals, Food and Beverages, Precision and Optics, Pharmaceutical, and Others), and Region 2025-2033

Global Industrial Robotics Market:

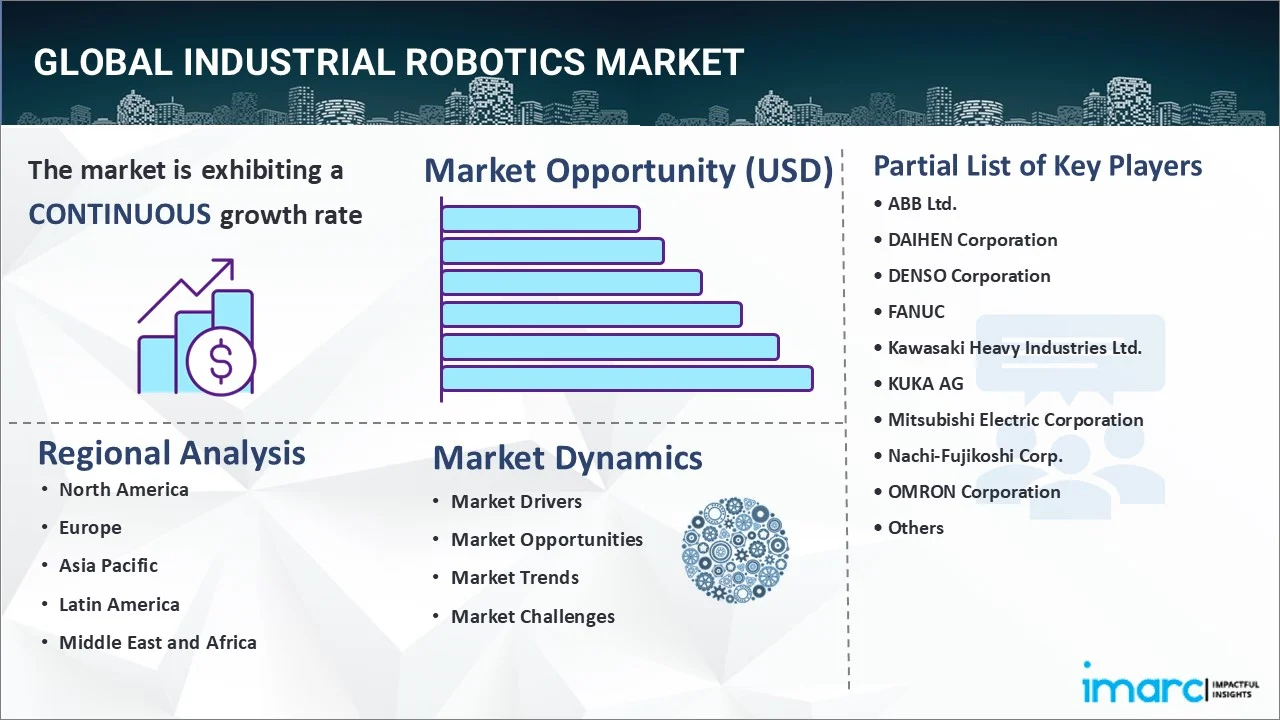

The global industrial robotics market size reached USD 19.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 52.7 Billion by 2033, exhibiting a growth rate (CAGR) of 11.47% during 2025-2033. Bolstering growth of the automotive industry, the rising product adoption across the food and beverage (F&B) industry, and ongoing product innovations and technological advancements represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.8 Billion |

| Market Forecast in 2033 | USD 52.7 Billion |

| Market Growth Rate 2025-2033 | 11.47% |

Industrial Robotics Market Analysis:

- Major Market Drivers: Expansion of the automotive industry, rising integration of advanced technologies such as AI and big data solutions, ongoing advancements in smart factory systems, etc., are propelling the market growth. Moreover, rapid advancements in robotics technology have enhanced the production output, safety, and flexibility in the human environment, thereby contributing to the industrial robotics market demand.

- Key Market Trends: The rising adoption of collaborative robots, emergence of smart manufacturing solutions, and increasing penetration of Industry 4.0 trends, are expected to escalate the market growth. Moreover, industrial robots are being integrated with additive manufacturing (3D printing) technologies to enable new manufacturing processes. Robotic 3D printers can produce complex and customized parts with high precision and speed, thereby further stimulating the market growth.

- Competitive Landscape: Some of the leading industrial robotics market companies are ABB Ltd., DAIHEN Corporation, DENSO Corporation, FANUC, Kawasaki Heavy Industries Ltd., KUKA AG, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., OMRON Corporation, Panasonic Corporation, Seiko Epson Corporation, Universal Robots A/S (Teradyne Inc.), Yamaha Motor Co. Ltd., and Yaskawa Electric Corporation., among many others.

- Geographical Trends: According to the report, Asia Pacific accounted for the largest market share. Asia Pacific is witnessing rapid industrialization, particularly in countries like China, India, Japan, South Korea, and Taiwan. The region's expanding manufacturing base, driven by factors such as rising labor costs, increasing demand for consumer goods, and government initiatives to promote industrial growth, is fueling the demand for industrial robotics.

- Challenges and Opportunities: High initial investment, shortage of skilled workforce, complex integration, and safety concerns are some of the challenges that the market is facing. However, the growing demand for automated solutions across various industries presents significant industrial robotics market recent opportunities for the industrial robotics market. Industries seeking to improve productivity, quality, and efficiency are increasingly turning towards robotic technology to achieve these goals.

Industrial Robotics Market Trends:

Increasing Adoption of Industry 4.0

The rising adoption of Industry 4.0 is one of the key factors adding to the growth in the industrial robotics market. Industry 4.0 emphasizes the use of automation and connectivity to streamline manufacturing processes. Industrial robots play a crucial role in this by automating repetitive tasks such as assembly, welding, and material handling. These robots are connected to a network, enabling them to communicate with other machines, sensors, and control systems in the factory. For instance, in February 2024, KUKA AG launched its KR FORTEC industrial robot. This latest industrial robot has an extended arm with a reach of 145 inches (368.3 cm) and a payload capacity of up to 529 pounds (240 kg). According to KUKA, its compact design makes it ideal for activities like handling and spot welding. This speedy robot tackles everything with low energy consumption. Moreover, Industry 4.0 promotes the concept of human-robot collaboration, where humans and robots work together seamlessly to perform tasks more efficiently. Collaborative robots (cobots) equipped with advanced safety features can work alongside human workers in close proximity, handling repetitive or physically demanding tasks while humans focus on more complex activities. This collaboration improves productivity, safety, and job satisfaction. For instance, in February 2024, Figure, a California-based firm that develops autonomous humanoid robots, signed a commercial agreement with U.S. BMW Manufacturing Co. to deploy general-purpose robots in automobile manufacturing facilities. Figure's humanoid robots automate difficult, risky, or tedious activities throughout the manufacturing process, freeing up employees to focus on complex skills and processes, as well as continual development in production efficiency and safety. These factors are thereby contributing to the industrial robotics market share.

Growing Deployment in Automotive Manufacturing

Industrial robots are extensively used for welding in automotive manufacturing. They perform spot welding, arc welding, and laser welding of car body components with high precision and repeatability. Robotic welding systems ensure consistent welding quality and productivity, contributing to the structural integrity of vehicles. For instance, in December 2023, Volvo Cars used more than 1,300 ABB industrial robots to help create its next generation of electric vehicles. Volvo planned to deploy ABB's latest IRB 6710, 6720, and 6730 industrial robots for a number of operations, including spot welding, riveting, dispensing flow drilling, and more. It would utilize these robots at its factories in Torslanda, Sweden, and Daqing, China. The robots are part of ABB's new modular industrial robots, which include interchangeable linkages that allow users to simply adjust the size and reach of each model. The robots are designed for payloads ranging from 150kg to 310kg, with a reach between 2.5m and 3.2m. In addition, robots are employed in automotive paint shops for painting car bodies with precision and efficiency. Automated painting systems apply primer, basecoat, and clearcoat layers evenly, ensuring a flawless finish. Robotic paint systems can handle various paint types and colors, minimizing waste and reducing environmental impact. For instance, in May 2023, BMW launched the world’s first automobile factory to employ an end-to-end digitalized and automated process for inspecting, processing, and marking painted vehicle surfaces in standard production. Artificial intelligence-controlled robots process each vehicle separately to ensure it meets objective quality criteria. This results in more stable operations, shorter lead times, and consistently good vehicle surface quality. Data kept in the cloud also allows for better examination of the sources of surface finish problems. These factors are bolstering the industrial robotics market revenue.

Rising Integration of Additive Manufacturing and 3D Printing

The integration of additive manufacturing (AM) and 3D printing technologies is a significant driver of growth in the industrial robotics market. Industrial robots are equipped with extrusion or deposition heads to precisely deposit material layer by layer in additive manufacturing processes. This allows for the creation of complex geometries and customized parts. Robots can deposit materials such as thermoplastics, metals, ceramics, wires, and composites, depending on the application requirements. For instance, in November 2023, ADDitec, an advanced metal additive manufacturing innovator, launched AMDroid laser-wire DED deployable robotic system. This deployable system is designed for various materials, including titanium. The technology is tailored to produce a high deposition rate, establishing a new standard for mass production and manufacturing excellence. These factors are thereby contributing to the market demand. Moreover, industrial robots are used in construction-scale 3D printing to build large structures, such as walls, panels, and architectural elements. These robots use specialized deposition technologies, such as concrete or polymer extrusion, to print structures directly on-site, offering benefits in terms of speed, cost, and design freedom. For instance, in January 2024, RIC Technology launched its latest RIC-M1 PRO compact modular robotic arm printer at the World of Concrete (WOC) 2024, in the 3D construction industry. With a larger footprint than previous machines, improved automation, and an intelligent material distribution system, according to the company, this new robotic printer is a cost-effective, time-saving, and labor-saving solution to the worldwide housing need. These factors are positively influencing the industrial robotics market forecast.

Industrial Robotics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial robotics market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type, function, and end use industry.

Breakup by Type:

- Articulated Robots

- Cartesian Robots

- SCARA Robots

- Cylindrical Robots

- Parallel Robots

- Others

Articulated robots dominate the market

The report has provided a detailed breakup and analysis of the industrial robotics market based on the type. This includes articulated, cartesian, SCARA, cylindrical, parallel, and other robots. According to the industrial robotics market report, articulated robots represented the largest segment.

An articulated robot is a type of industrial robot characterized by a series of joints (or axes) that allow it to move in multiple directions. These robots typically consist of a series of rigid segments, called links, connected by joints. The joints are powered by electric motors or pneumatic actuators, allowing the robot to articulate and perform various tasks. These robots typically have multiple degrees of freedom (DOF), allowing them to move in three-dimensional space. The number of axes can vary, ranging from 3 to 6 or more, depending on the robot's design and application requirements. For instance, in October 2023, Yuil Robotics Co., a South Korean business that manufactures industrial robots, announced the development of a gigantic plant spanning approximately 25,740 square meters in Incheon's Cheongna International City by 2024, with operations planned to begin in 2025. The expansion is aimed to meet the rising demand for mass manufacture of heavy-duty robots, such as articulated robots and orthogonal robots weighing more than 100 kg.

Breakup by Function:

- Soldering and Welding

- Materials Handling

- Assembling and Disassembling

- Painting and Dispensing

- Milling, Cutting and Processing

- Others

Materials handling hold the largest share in the market

A detailed breakup and analysis of the industrial robotics market based on the function has also been provided in the report. This includes soldering and welding, materials handling, assembling and disassembling, painting and dispensing, milling, cutting and processing, and others. According to the report, materials handling accounted for the largest market share.

According to the industrial robotics market outlook, material handling is one of the most common and fundamental applications of industrial robotics across various industries. Industrial robots are used to pick up items from one location and place them in another. This could involve moving components from one part of a production line to another, transferring products from conveyor belts to packaging stations, or loading/unloading items from pallets or bins. For instance, in April 2024, ESCATEC, a Penang-based provider of electronic manufacturing services, used material handling robots on the factory floor of its Malaysian plants.

Breakup by End Use Industry:

- Automotive

- Electrical and Electronics

- Chemical, Rubber, and Plastics

- Machinery and Metals

- Food and Beverages

- Precision and Optics

- Pharmaceutical

- Others

Electrical and electronics accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the industrial robotics market based on the end use industry. This includes automotive, electrical and electronics, chemical, rubber, and plastics, machinery and metals, food and beverages, precision and optics, pharmaceutical, and others. According to the report, electrical and electronics represented the largest segment.

As per the industrial robotics market overview, robots are used to assemble electronic components onto printed circuit boards (PCBs) with high precision and efficiency. They can pick and place components such as resistors, capacitors, integrated circuits (ICs), and connectors onto PCBs at high speeds, ensuring accurate placement and soldering. Moreover, industrial robots equipped with vision systems and sensors inspect electronic components and PCBs for defects and quality issues. They detect missing components, misalignments, soldering defects, and other anomalies, ensuring that only defect-free products proceed to the next stage of production. For instance, in February 2024, Rainbow Robotics, a robot platform firm, signed a memorandum of understanding (MOU) with Schaeffler and the Korea Electronics Technology Institute (KETI) to collaborate on the development of AI-mobile dual-arm robots.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Russia, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for industrial robotics. Some of the factors driving the Asia Pacific industrial robotics market included the growing product demand from the automotive and F&B industries, continuous product innovations, and the advent of smart factories. Asia Pacific is witnessing rapid industrialization, particularly in countries like China, India, Japan, South Korea, and Taiwan. The region's expanding manufacturing base, driven by factors such as rising labor costs, increasing demand for consumer goods, and government initiatives to promote industrial growth, is fueling the demand for industrial robotics. Moreover, as labor costs rise, manufacturers in Asia Pacific are turning to automation to enhance efficiency and productivity. Industrial robots enable companies to streamline production processes, reduce cycle times, and maintain consistent product quality. This increased efficiency helps companies remain competitive in both domestic and international markets. For instance, in February 2024, ABB Ltd announced to combine artificial intelligence with robotics across many sectors in China to maintain strong growth.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global industrial robotics market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- ABB Ltd.

- DAIHEN Corporation

- DENSO Corporation

- FANUC

- Kawasaki Heavy Industries Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- OMRON Corporation

- Panasonic Corporation

- Seiko Epson Corporation

- Universal Robots A/S (Teradyne Inc.)

- Yamaha Motor Co. Ltd.

- Yaskawa Electric Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Industrial Robotics Market Recent Developments:

- May 2024: ABB Robotics launched the IRB 7710 and IRB 7720, which consist of 16 new versions and are intended for a wide range of applications, including automotive, logistics, foundry, machinery manufacture, construction, and agricultural industries.

- May 2024: Comau introduced its new S-Family of small but strong robots at Automate 2024, North America's premier automation show.

- April 2024: ESCATEC, a Penang-based provider of electronic manufacturing services, used material handling robots on the factory floor of its Malaysian plants.

Industrial Robotics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Articulated Robots, Cartesian Robots, SCARA Robots, Cylindrical Robots, Parallel Robots, Others |

| Functions Covered | Soldering and Welding, Materials Handling, Assembling and Disassembling, Painting and Dispensing, Milling, Cutting and Processing, Others |

| End Use Industries Covered | Automotive, Electrical and Electronics, Chemical, Rubber, and Plastics, Machinery and Metals, Food and Beverages, Precision and Optics, Pharmaceutical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., DAIHEN Corporation, DENSO Corporation, FANUC, Kawasaki Heavy Industries Ltd., KUKA AG, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., OMRON Corporation, Panasonic Corporation, Seiko Epson Corporation, Universal Robots A/S (Teradyne Inc.), Yamaha Motor Co. Ltd., Yaskawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial robotics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global industrial robotics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial robotics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial robotics market was valued at USD 19.8 Billion in 2024.

IMARC estimates the industrial robotics market to exhibit a CAGR of 11.47% during 2025-2033.

The rising demand for automation in manufacturing processes, advancements in robotics technology and AI integration, labor shortage and increasing need for efficient operations, growing adoption in industries like automotive and electronics, and cost reduction and improved production quality through robotics are the primary factors driving the industrial robotics market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the industrial robotics market include ABB Ltd., DAIHEN Corporation, DENSO Corporation, FANUC, Kawasaki Heavy Industries Ltd., KUKA AG, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., OMRON Corporation, Panasonic Corporation, Seiko Epson Corporation, Universal Robots A/S (Teradyne Inc.), Yamaha Motor Co. Ltd., Yaskawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)