Influenza Vaccine Market Size, Share, and Trends by Vaccine Type, Technology, Age Group, Route of Administration, Region, and Forecast 2025-2033

Influenza Vaccine Market Size and Trends:

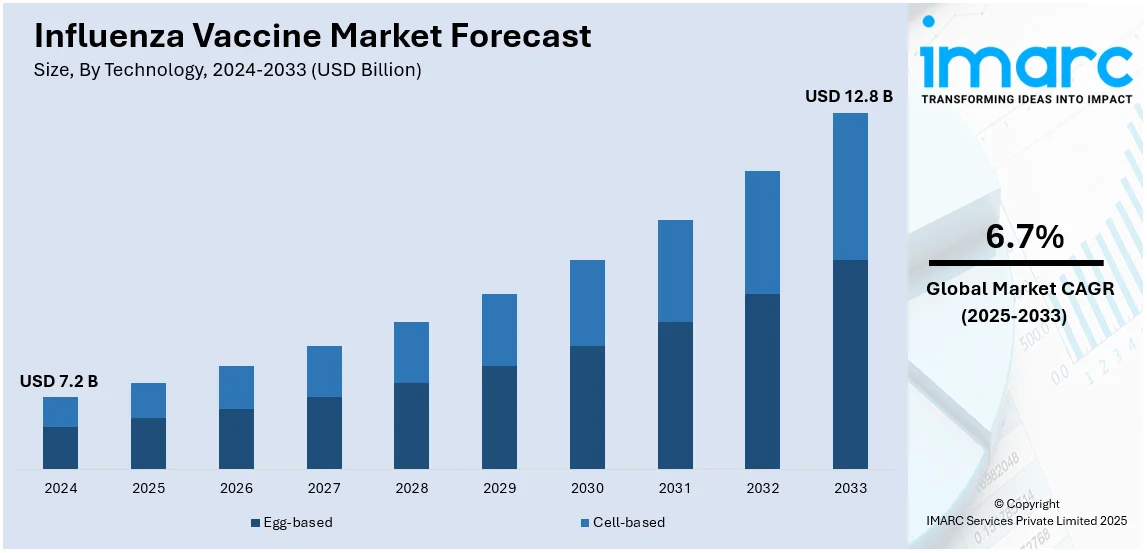

The global influenza vaccine market size was valued at USD 7.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.8 Billion by 2033, exhibiting a CAGR of 6.7% from 2025-2033. North America currently dominates the market, holding a market share of over 53.4% in 2024. Some of the key factors supporting the influenza vaccine market growth include the launch of many positive initiatives by government bodies to support vaccination programs, increasing cases of influenza and seasonal outbreaks, and more effective and broadly protective influenza vaccines.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.2 Billion |

|

Market Forecast in 2033

|

USD 12.8 Billion |

| Market Growth Rate (2025-2033) | 6.7% |

The global influenza vaccine market is witnessing growth on account of several factors, factors such as rising awareness regarding the seasonal flu and increasing healthcare spending. The increasing elderly population who are more prone to complications arising from flu infections is also another driving factor. Governments worldwide are channeling resources into vaccination programs. This in turn contributes positively toward the growth of the market. The COVID-19 pandemic reinforced the rationale for preventive medicine, thus increasing the uptake of flu vaccines, as many people began to understand the importance of prevention over treatment. With new ways of developing vaccines such as mRNA-based vaccines, safety, and efficiency of vaccines have improved. Moreover, due to the rising number of influenza strains, and the requirement that individuals be vaccinated every year, there is perpetual demand. The rise of health care facilities particularly in developing countries is likely to increase further the usage and acceptance of vaccines.

The United States has emerged as a key regional market for influenza vaccines. As of November 2024, the US has distributed 134.19 million doses of the flu vaccine for the 2024-25 season. Vaccine supply in the U.S. largely depends on private manufacturers, with projections for a total of 148 million doses of influenza vaccine for the current season. This increasing supply reflects the growing demand within the influenza vaccine market in the U.S. market, driven by the need to prevent seasonal outbreaks, particularly among high-risk populations such as the elderly and those with chronic conditions. The influenza vaccine market in the U.S. continues to expand, bolstered by innovations in vaccine technology, such as quadrivalent and mRNA vaccines, and supported by government vaccination programs. With ongoing improvements in vaccine accessibility and efficacy, manufacturers are responding to higher demand projections, positioning the market for continued growth.

Influenza Vaccine Market Trends:

Increasing Seasonal Influenza Outbreaks and Pandemics

The rising cases of seasonal influenza are elevating the hospitalization rates. For example, there were 31 million cases of influenza in the United States during the 2022-2023 flu season. Moreover, there were 4,977 number of deaths caused by influenza during the 2021-2022 flu season. In addition to this, a large part of the population in the United States failed to get vaccinated. Additionally, in 2021-2022, only 37% of those aged 18 to 49 years received a flu vaccination, which was much lower as compared to children and the elderly. As such, the elevating focus among healthcare organizations on highlighting the importance of influenza vaccinations is bolstering the market growth. For instance, in February 2023, the World Health Organization (WHO) announced the recommendations for the viral composition of influenza vaccines for the 2023-2024 influenza season. The announcement was made at an information session at the end of a 4-day meeting on the composition of influenza virus vaccines.

The Rising Awareness Towards Influenza Vaccination

The growing prevalence of seasonal influenza is primarily bolstering the market growth. For example, the global flu data that was published in February 2022 mentioned that an estimated 1 billion individuals worldwide were infected by seasonal influenza. In line with this, the report also stated that out of those 1 billion, about 3 to 5 million people had a severe case of flu every year. Furthermore, according to the data published by WHO in December 2022, 5%-15% of the population was affected by influenza in the European region. Similarly, the Plos One Journal article published in July 2021 mentioned that approximately 5%-10% and 20%-30% of new cases of influenza infections occurred among children and adults annually. The elevating cases of the influenza virus are increasing awareness among individuals towards influenza vaccination, which is providing a positive outlook to the overall market growth. Besides this, healthcare organizations are launching campaigns to provide information regarding the benefits of immunization, thereby driving the demand for influenza vaccines. For example, a healthcare survey conducted in June 2022 by Sanofi reported that pharmacists and physicians recommended Centers for Disease Control and Prevention (CDC) to provide vaccines like Fluzone high dose quadrivalent, for people who’re 65 and older, for the treatment of influenza. The growing inclination among individuals of all age groups will continue to propel the influenza vaccine market share over the forecasted period.

The Growing Support from Government Bodies

Government agencies around the world are partnering with leading companies to facilitate R&D work in the development of influenza vaccines. According to the statistics of the influenza vaccine market, in September 2021, the Centers for Disease Control and Prevention (CDC) joined a broad interagency partnership led by the Biomedical Advanced Research and Development Authority (BARDA) that funded the advanced development of new influenza vaccines. In addition, government bodies are streamlining and upgrading the procedure of license approvals, which is contributing to the growth in demand in the flu vaccine market. For instance, in July 2022, the U.S. FDA sanctioned the appeal from GlaxoSmithKline for the license Fluarix, which is a quadrivalent flu vaccine. To this effect, the government is spending on clinical trials and R&D work on the development of flu vaccines. For example, during March 2022, Australia's governmental entities spent more than USD 100 Million for seasonal influenza vaccination against individuals under high risk. In addition to this, giant health-care corporations are significantly investing in the release of innovative advanced therapies in terms of vaccines, thus also influencing positively in the case of the influenza vaccine market outlook.

Influenza Vaccine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global influenza vaccine market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on the vaccine type, technology, age group, route of administration, and region.

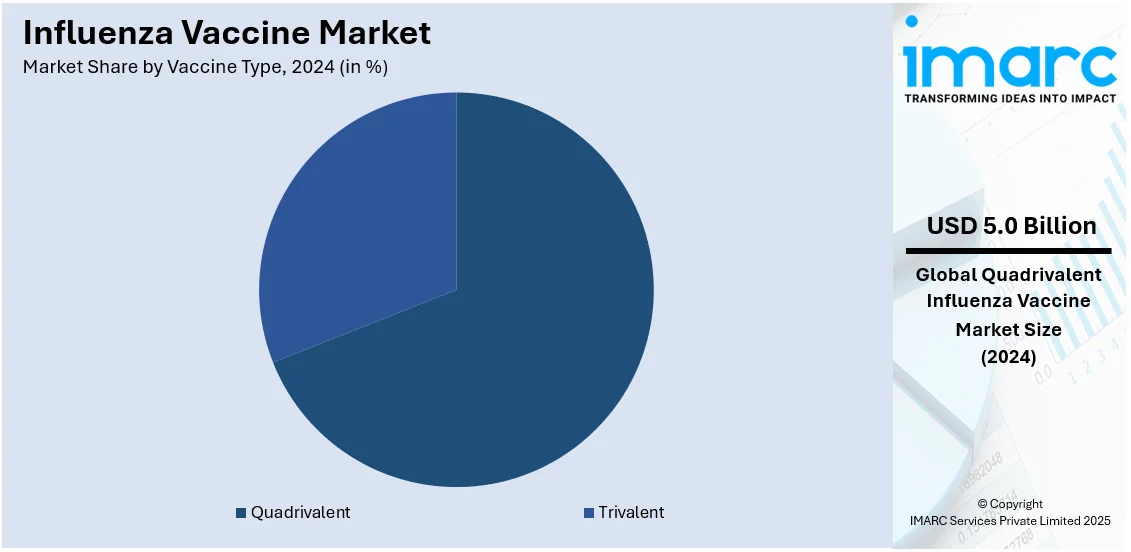

Analysis by Vaccine Type:

- Quadrivalent

- Trivalent

Quadrivalent stands as the largest vaccine type in 2024, holding over 69% of the market. Quadrivalent influenza vaccines are specifically designed to protect against four flu viruses, namely two influenza A viruses and two influenza B viruses. The quadrivalent segment holds a significant share of the influenza vaccine market, owing to its efficacy against viral infections, cost-effectiveness, and easy availability in clinics and hospitals. In addition to this, the fast product approvals for the quadrivalent type of vaccine are also fueling the market growth. For example, in July 2022, the United States FDA approved the request of GlaxoSmithKline for the Fluarix, which is a quadrivalent vaccine. The Fluarix quadrivalent vaccine provides active immunization to prevent disease caused by the influenza A subtype virus and type B virus. Furthermore, key companies are investing in vaccine facilities to elevate the production processes, thereby driving the global market for influenza vaccine. For example, in April 2021, Sanofi invested over € 600 million to build a new vaccine facility in Toronto to increase its supply of influenza vaccines in the United States, Canada, and Europe. The new facility developed quadrivalent influenza vaccines and served its customers with effective vaccinations.

Analysis by Technology:

- Egg-based

- Cell-based

Egg-based leads the market with around 69% of market share in 2024. Egg-based technology refers to one of the conventional methods utilized for vaccine production, wherein the influenza virus strains are grown in chicken eggs before being processed and harvested for vaccine formulation. Moreover, the egg-based method has been extensively adopted, owing to its established safety, scalability, cost-effectiveness, etc. For example, in February 2024, the WHO announced recommendations for the viral composition of influenza vaccines for the 2024-2025 influenza season in the northern hemisphere. The egg-based vaccines that are recommended include an A/Victoria/4897/2022 (H1N1) pdm09-like virus, an A/Thailand/8/2022 (H3N2)-like virus, and a B/Austria/1359417/2021 (B/Victoria lineage)-like virus.

Analysis by Age Group:

- Pediatric

- Adult

Pediatric leads the market with over 72% of market share in 2024. Pediatric vaccines are specifically formulated to enhance the immune systems of children, especially those under the age of five, who are more susceptible to severe flu-related complications. These vaccinations aid in ensuring adequate protection against the disease. Consequently, healthcare providers, government bodies, and parents are recognizing the importance of pediatric influenza vaccination, leading to the escalating demand for pediatric flu vaccines.

Analysis by Route of Administration:

- Injection

- Nasal Spray

The injection segment remains widely used, particularly intramuscular injections. This segment is expected to grow rapidly due to advancements in injection technologies, such as the development of microneedle patches that aim to simplify administration and improve patient compliance.

On the other hand, nasal spray influenza vaccines provide a needle-free alternative to traditional injections, delivering the vaccine via the nasal mucosa to stimulate a mucosal immune response. Though less common than injectable vaccines, nasal spray options are increasingly favored by individuals, especially children, who may have a fear of needles. The segment is seeing growth due to ongoing research aimed at improving formulations, expanding eligibility to a broader age range, and refining the delivery technology.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 53%. In North America, the growing prevalence of the influenza virus is propelling the regional market. According to the CDC data, nearly 150,865 influenza-positive cases were reported in December 2022, among which 149,704 cases were influenza A and 1,61 influenza B virus types. In line with this, in December 2022, the Public Health Agency of Canada mentioned that nearly 34,413 influenza cases were reported in Canada from August 2022 to December 2022. Such increased occurrence of influenza cases among the population across North America is expected to drive the need for influenza vaccines. For instance, in June 2021, NIH launched the clinical trials of FluMos-v1, a vaccine candidate in the United States. This vaccine stimulates antibodies against multiple influenza virus strains by displaying part of the influenza virus proteins

Key Regional Takeaways:

United States Influenza Vaccine Market Analysis

In 2024, the Unites States accounts for over 70% of the influenza vaccine market in North America. Strong government initiatives, a strong healthcare system, and an aging population are the main factors propelling the industry. Increasing vaccine uptake is largely dependent on the Centers for Disease Control and Prevention's (CDC) annual vaccination efforts. Between 9 and 45 million influenza cases are estimated to occur in the United States each year, according to the CDC, with related hospitalizations and deaths underscoring the importance of prevention. For vulnerable populations, including the elderly, small children, pregnant women, and people with long-term medical issues, influenza vaccination is strongly advised. Interestingly, more than 16% of Americans are 65 years of age or older, a demographic that has far greater influenza complications and is therefore a prime target for vaccination campaigns.

Additionally, technological developments have fueled market expansion. The effectiveness and coverage of vaccines have increased since the advent of quadrivalent vaccines, which offer protection against four influenza strains. The drawbacks of conventional egg-based vaccinations have been overcome by cell-based and recombinant technologies, which shorten production times and increase scalability during epidemics. Innovations like mRNA-based flu vaccines, which promise increased efficacy and quick adaptation to new strains, are the result of pharmaceutical companies like Sanofi, GlaxoSmithKline, and Moderna investing more in research and development. The industry is further supported by public-private collaborations, such as those made possible by the Biomedical Advanced Research and Development Authority (BARDA). Furthermore, a wider population may now get vaccines because to employer-sponsored immunization programs, pharmacy flu clinics, and growing awareness campaigns. The market for influenza vaccines in the US is expected to expand steadily due to this combination of reasons.

Europe Influenza Vaccine Market Analysis

Adoption of influenza vaccines in Europe is being driven by aging populations, universal healthcare systems, and strict government regulations. Free flu vaccination programs have been put in place in nations including the UK, Germany, and France for vulnerable populations, such as the elderly and children. The demand is being driven by the European Centre for Disease Prevention and Control (ECDC), which places emphasis on reaching a 75% immunization target in high-risk populations. The necessity of vaccination has been further highlighted by the rise in comorbidities such as diabetes and cardiovascular disorders, which exacerbate flu-related consequences. With large expenditures in vaccine production facilities, Europe's emphasis on pandemic preparedness also boosts the industry. Large-scale awareness campaigns and school-based immunization programs that target younger populations boost the industry. The growth of mRNA-based flu vaccines in Europe is another emerging driver, offering improved efficacy and rapid production cycles.

Asia Pacific Influenza Vaccine Market Analysis

Large-scale government vaccination initiatives, growing public awareness, and rising healthcare costs all contribute to the market's growth. Leading nations include China, South Korea, and Japan, with Japan attaining yearly immunization rates of more than 50% among its senior citizens. Due to the great potential for influenza transmission, widespread vaccination campaigns are required in densely populated nations like China and India. To increase vaccine access, especially in remote areas, governments are spending money on distribution networks and cold chain infrastructure. Rapid urbanization in emerging nations increases vulnerability to influenza outbreaks and raises demand for vaccines. Furthermore, partnerships between regional producers and international pharmaceutical firms are stimulating innovation, and current clinical studies for next-generation vaccines—like those based on mRNA and intranasal formulations—are expected to propel further expansion.

Latin America Influenza Vaccine Market Analysis

The growing prevalence of seasonal flu and the government's increased emphasis on public health are driving the influenza vaccination industry in Latin America. Brazil and Mexico are important markets because of their sizable populations and pro-immunization laws. Through national immunization programs, governments frequently give away free vaccines to vulnerable populations, like children and the elderly. According to a report by International Federation on Ageing, Brazil has one of the highest rates of influenza vaccination worldwide among older persons (98.2%) and people with long-term illnesses (86.3%) in 2019. The robust government-led influenza vaccination effort, which depends on both in-person and remote mobilization, is primarily responsible for the target populations' compliance.

Middle East and Africa Influenza Vaccine Market Analysis

Growing government initiatives, foreign aid, and growing awareness of preventative healthcare are the main factors propelling the market. To avoid widespread epidemics, nations like Saudi Arabia and the United Arab Emirates have made flu vaccination a priority, especially for pilgrims traveling for events like the Hajj. Accessibility is increased by the WHO's Global Influenza Strategy, which funds immunization campaigns in low- and middle-income African nations. Uptake of the influenza vaccine is increasing in South Africa, where yearly immunization campaigns target vulnerable populations and healthcare staff. Partnerships with international health groups to improve vaccine distribution and awareness are helping to mitigate issues like the lack of adequate healthcare facilities in some areas.

Competitive Landscape:

Key players in the influenza vaccine market are significantly driving the market growth through strategic initiatives. These companies are focusing on enhancing vaccine efficacy with advanced technologies like quadrivalent and mRNA-based vaccines, expanding accessibility through partnerships with governments and healthcare providers, and engaging in extensive research and development. Manufacturers are also responding to rising demand by improving vaccine production capacity, with companies like Moderna and AstraZeneca exploring new formulations and delivery methods, such as microneedle patches, to increase patient compliance. Furthermore, these key players are involved in global vaccine distribution, ensuring greater reach and contributing to the overall market expansion.

The report provides a comprehensive analysis of the competitive landscape in the influenza vaccine market with detailed profiles of all major companies, including:

- Abbott Laboratories

- AstraZeneca plc

- CSL Limited

- Daiichi Sankyo Company Limited

- Emergent BioSolutions Inc.

- F. Hoffmann-La Roche AG

- Gamma Vaccines Pty Ltd

- GlaxoSmithKline plc

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi

- SINOVAC

Latest News and Developments:

- June 2024: Moderna, Inc. announced that its Phase 3 trial for mRNA-1083, an investigational combination vaccine targeting influenza and COVID-19, has successfully achieved its primary endpoints, demonstrating a stronger immune response compared to licensed comparator vaccines used in the study.

- March 2024: Osivax, a biopharmaceutical company, announced that all participants have completed their final visit in the Phase 2a clinical trial (NCT05734040) evaluating OVX836, which was a broad-spectrum influenza A vaccine and quadrivalent influenza vaccines (QIVs) candidate.

- March 2024: Cadila Pharmaceuticals, India launched Cadiflu Tetra Vaccine, an advanced quadrivalent influenza vaccine approved by the DCGI for adults and children. Targeting four influenza strains (A and B subtypes), it uses proprietary nano-particle technology to mimic the virus’s structure without its genetic material.

- February 2024: The Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency has recommended the approval of two vaccines for active immunization against the H5N1 subtype of the influenza A virus, which causes avian influenza or bird flu.

- October 2023: Mylab, in collaboration with Serum Institute of India (SII), introduced Nasovac S4, India’s first needle-free nasal influenza vaccine. The vaccine was made accessible through a nationwide network of healthcare providers and clinics. Nasovac S4 is a live quadrivalent influenza vaccine, incorporating four influenza virus strains in line with WHO recommendations.

Influenza Vaccine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vaccine Types Covered | Quadrivalent, Trivalent |

| Technologies Covered | Egg-based, Cell-based |

| Age Groups Covered | Pediatric, Adult |

| Routes of Administration Covered | Injection, Nasal Spray |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, AstraZeneca plc, CSL Limited, Daiichi Sankyo Company Limited, Emergent BioSolutions Inc., F. Hoffmann-La Roche AG, Gamma Vaccines Pty Ltd, GlaxoSmithKline plc, Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi, SINOVAC. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the influenza vaccine market from 2019-2033.

- The influenza vaccine market research report provides the latest information on the market drivers, challenges, and opportunities in the global influenza vaccine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the influenza vaccine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Key Questions Answered in This Report

An influenza vaccine is a preventive shot that protects against the flu, a contagious viral infection. It works by stimulating the immune system to produce antibodies against specific strains of the influenza virus. Available in injectable and nasal spray forms, it is recommended annually, especially for high-risk populations. The vaccine reduces the severity and spread of flu infections.

The influenza vaccine market was valued at USD 7.2 Billion in 2024.

IMARC estimates the global influenza vaccine market to exhibit a CAGR of 6.7% during 2025-2033.

The market is primarily driven by several factors. Increasing awareness of seasonal flu prevention, heightened by global health campaigns, encourages greater vaccination uptake. The rising prevalence of influenza, particularly among vulnerable population like the elderly, further boosts demand. Additionally, government initiatives and mass immunization programs support widespread vaccine distribution, contributing to market growth.

According to the report, quadrivalent represented the largest segment by vaccine type, driven by its broad effectiveness against multiple strains of the virus. This vaccine offers better protection compared to trivalent vaccines, is cost-effective, and is widely available in clinics and hospitals.

Egg-based leads the market by technology owing to its long-established use and proven track record for producing large quantities of effective vaccines.

Pediatric is the leading segment by age group, driven by the heightened focus on protecting children from flu-related complications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global influenza vaccine market include Abbott Laboratories, AstraZeneca plc, CSL Limited, Daiichi Sankyo Company Limited, Emergent BioSolutions Inc., F. Hoffmann-La Roche AG, Gamma Vaccines Pty Ltd, GlaxoSmithKline plc, Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi, SINOVAC. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)