Infrared Imaging Market Size, Share, Trends and Forecast by Technology, Component, Wavelength, Application, Vertical, and Region, 2025-2033

Infrared Imaging Market Size and Share:

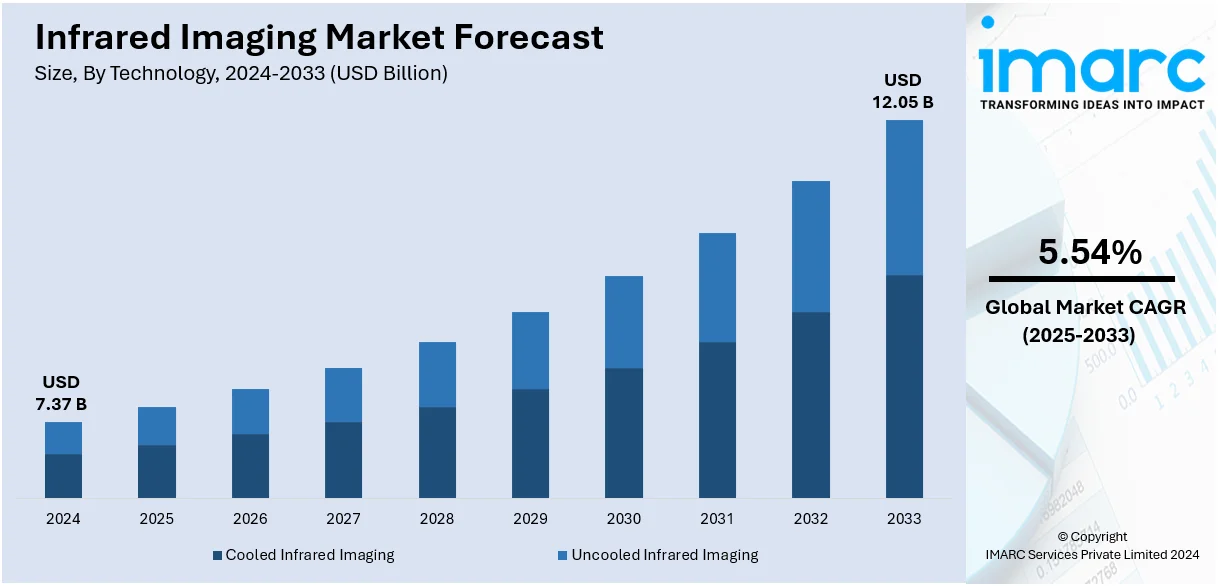

The global infrared imaging market size was valued at USD 7.37 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.05 Billion by 2033, exhibiting a CAGR of 5.54% from 2025-2033. North America currently dominates the market due to the growing demand for security and surveillance, increasing prevalence of various health disorders, rapid technological advancements and rising adoption in the military and defense sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.37 Billion |

|

Market Forecast in 2033

|

USD 12.05 Billion |

| Market Growth Rate (2025-2033) | 5.54% |

The integration of infrared imaging technology in the automotive and consumer electronics sectors is significantly propelling the global infrared imaging market size. In automotive manufacturing, infrared imaging is utilized for monitoring thermomechanical processes such as resistance spot welding and hot stamping, enhancing quality control and production efficiency. The heightened adoption of electric vehicles (EVs) further propels this demand. The EV market globally reached US$ 755 billion in 2024 and it is expected to grow at an annual rate of 21.5% between 2025 and 2033, reaching US$ 4360 billion in 2033. This growth necessitates advanced thermal management systems to ensure battery safety and efficiency, where infrared imaging plays a crucial role. In consumer electronics, the trend towards incorporating advanced sensors, including infrared imaging capabilities, into devices like smartphones and wearables is notable. This integration enhances functionalities such as facial recognition, augmented reality (AR), and health monitoring, meeting the rising consumer demand for multifunctional devices.

The growth of the infrared imaging market share in the United States is driven by several key factors, including technological advancements, increased demand across various sectors, and supportive government initiatives. Advancements in infrared imaging technologies, such as the development of high-performance sensors at reduced costs, have expanded its applications. The healthcare sector also contributes to market growth, with increasing employment of radiologic and MRI technologists. The U.S. Bureau of Labor Statistics reported a median annual wage of $83,740 for MRI technologists in May 2023, reflecting the growing demand for advanced imaging services. Government policies aimed at reducing carbon emissions further drive the adoption of infrared imaging technologies. The U.S. Energy Information Administration projects a 25% to 38% reduction in energy-related CO₂ emissions by 2030, encouraging the use of infrared imaging for energy efficiency and environmental monitoring.

Infrared Imaging Market Trends:

Rising demand for thermal imaging in defense and security applications

The increasing demand for thermal imaging in defense and security applications is a prominent trend strengthening the infrared imaging market growth. According to Deloitte, in 2024, global defense investments surged, with the aerospace and defense sector overcoming supply chain and talent shortages, while air travel demand grew 11.6% year-on-year, benefiting infrared imaging technologies through increased adoption in surveillance and aviation. Governments and military organizations worldwide are investing in advanced infrared technologies for surveillance, border control, and reconnaissance missions. The ability to detect heat signatures in low-light or obscured conditions makes infrared imaging indispensable in defense operations. In addition to this, law enforcement agencies are increasingly adopting infrared cameras for tracking suspects, monitoring large crowds, and enhancing situational awareness during night-time operations. The rising focus on national security and the need for enhanced surveillance capabilities are contributing to the market expansion.

The growing integration of infrared imaging in healthcare

Another factor influencing market growth is the increasing integration of infrared imaging in healthcare, particularly for diagnostics and medical research. Infrared cameras are being used in medical settings to detect abnormal heat patterns associated with inflammation, circulatory issues, and various diseases. This non-invasive technology is gaining traction for early detection of conditions such as breast cancer, vascular disorders, and diabetic complications. The ability of infrared imaging to provide detailed thermal profiles of patients without exposure to harmful radiation is bolstering its adoption among healthcare providers. Moreover, the surging use of infrared thermography in research areas like neuroscience, where monitoring temperature fluctuations in the brain can provide insights into neurological disorders is aiding in market expansion.

Increasing adoption in industrial applications

The rising product adoption across various industrial applications, particularly in predictive maintenance and quality control is providing an impetus to the market growth. Manufacturing industries are using infrared cameras to monitor the thermal performance of machinery, electrical systems, and production processes. According to reports, the rising investment in manufacturing industries, driven by the smart factories market projected to grow from USD 129.74 Billion in 2022 to USD 321.98 Billion by 2032 at a CAGR of 9.52%, is significantly boosting the adoption of infrared imaging for enhanced process efficiency, real-time monitoring, and quality control. This technology helps identify potential issues like overheating, insulation breakdowns, and mechanical wear before they lead to equipment failure. As industries aim to reduce downtime and optimize operational efficiency, the demand for infrared imaging solutions in predictive maintenance is rising. Besides this, the widespread product adoption in sectors such as automotive and electronics manufacturing, to ensure quality control by detecting defects in components and systems is impelling the market growth. Furthermore, the growing emphasis on reducing operational costs and improving product quality is positively impacting the infrared imaging market outlook.

Infrared Imaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global infrared imaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, component, wavelength, application, and vertical.

Analysis by Technology:

- Cooled Infrared Imaging

- Uncooled Infrared Imaging

Uncooled infrared imaging systems dominate the market due to their affordability, robustness, and wide range of applications. Unlike cooled systems, uncooled sensors operate at ambient temperatures, eliminating the need for cryogenic cooling mechanisms. This reduces production costs and maintenance requirements while enhancing reliability in challenging environments. These systems are extensively used in automotive, surveillance, and industrial applications, where cost-effectiveness and durability are critical. The growing adoption of uncooled infrared sensors in automotive driver assistance systems (ADAS) and smart consumer devices is also driving demand.

Analysis by Component:

- IR Detectors

- IR Lens Systems

- IR Sensors

- Others

IR detectors are pivotal for converting thermal radiation into electrical signals, making them indispensable in applications ranging from security to industrial maintenance. Advances in uncooled detector technologies have significantly reduced costs, driving widespread adoption. IR lens systems, on the other hand, are essential for focusing infrared radiation onto the detectors. These lenses, often made of germanium or chalcogenide glass, determine the resolution and accuracy of the imaging system. The increasing demand for compact and high-resolution lens systems is propelling innovations in this segment. IR sensors form the backbone of infrared imaging technology, facilitating the detection of heat signatures across a variety of wavelengths. These sensors are integral to applications in automotive, defense, and consumer electronics.

Analysis by Wavelength:

- Near Infrared (NIR)

- Shortwave Infrared (SWIR)

- Mid-Wave Infrared (MWIR)

- Long-Wave Infrared (LWIR)

- Others

Shortwave infrared (SWIR) imaging is the largest segment in the market due to its unique ability to capture high-resolution images in low-light conditions. SWIR sensors are ideal for applications like quality inspection, agricultural monitoring, and medical diagnostics. Their ability to penetrate fog, haze, and certain materials enhances visibility, making them essential for security and defense purposes. The rising integration of SWIR cameras in autonomous vehicles and scientific research contributes significantly to their dominance.

Analysis by Application:

- Security and Surveillance

- Monitoring and Inspection

- Condition Monitoring

- Structural Health Monitoring

- Quality Control

- Detection

- Gas Detection

- Fire/Flare Detection

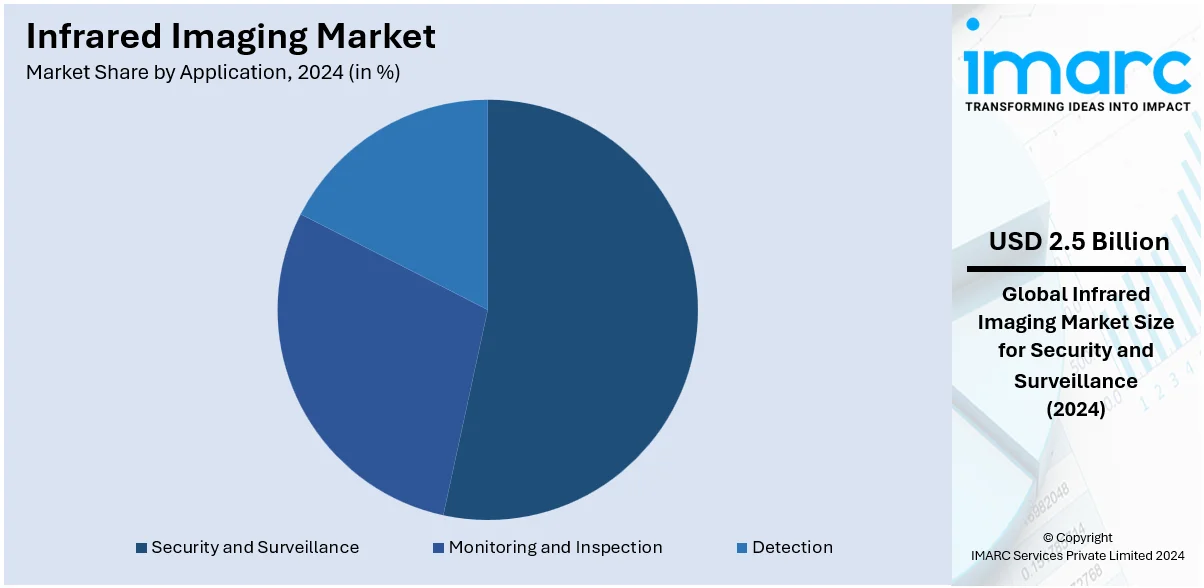

- Body Temperature Measurement

The security and surveillance application leads the global infrared imaging market, fueled by increasing demand for enhanced monitoring solutions across military, commercial, and residential sectors. Infrared imaging’s ability to detect heat signatures in complete darkness makes it indispensable for perimeter security, border surveillance, and intrusion detection. This segment is supported by rising geopolitical tensions and government investments in advanced surveillance systems. The adoption of thermal imaging in civilian security systems, such as smart cameras for home safety, further propels the growth of this segment.

Analysis by Vertical:

- Industrial

- Automotive

- Aerospace

- Electronics & Semiconductor

- Oil & Gas

- Military and Defense

- Others

- Non-Industrial

Non-industrial sectors, including defense, healthcare, and public safety, are the largest verticals for infrared imaging, contributing significantly to market growth. Defense applications, such as target acquisition, night vision, and thermal weapon sights, drive substantial demand. Healthcare utilizes infrared imaging for non-invasive diagnostics, such as fever screening and inflammation detection. Public safety uses include fire rescue and emergency response. Government funding and public awareness of these technologies continue to bolster growth in this segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Some of the factors driving the North America infrared imaging market included the growing demand for security and surveillance, rising utilization in the military and defense sector, increasing prevalence of arthritis, breast cancer, and nerve-associated issues among individuals, etc. Furthermore, the market dominance is supported by government initiatives like the Department of Defense’s focus on thermal imaging for border security and combat operations. Aside from that, the presence of leading manufacturers and a robust demand for security and surveillance solutions further solidify North America’s leading position.

Key Regional Takeaways:

United States Infrared Imaging Market Analysis

Infrared imaging adoption is driven by advancements in defense, security, and medical applications. Increasing investments in border surveillance, homeland security, and industrial safety systems contribute to the demand for thermal cameras. For instance, in 2023, U.S. defense spending surged by USD 55 Billion to nearly 40% of global military expenditures, surpassing the next nine countries combined. This growing investment drives advancements in infrared imaging technologies, essential for enhanced military surveillance and operational efficiency. Expanding the use of imaging tools in automotive manufacturing, energy audits, and infrastructure inspection further supports growth. The region’s focus on environmental monitoring and disaster management amplifies the utility of thermal sensors in detecting temperature anomalies. With a well-developed infrastructure for research and development, innovation is accelerated, leading to enhanced product efficiency and affordability. The availability of skilled personnel and a growing inclination toward automation in industries create a favorable ecosystem for the adoption of this technology.

Europe Infrared Imaging Market Analysis

The adoption of infrared imaging cabinets is rising in Europe due to advancements in automation and testing systems, particularly within the automotive sector. According to reports, the surge in EU new car sales by nearly 14%, reaching 10.5 Million units, highlights the growing automotive sector's demand for advanced technologies. This growth accelerates the adoption of infrared imaging systems, enhancing vehicle safety, driver assistance, and thermal diagnostics. The growing need for precision and enhanced quality control in manufacturing processes drives the demand for high-performance imaging solutions. These systems ensure fault detection and thermal monitoring, reducing production errors and enhancing operational efficiency. Additionally, the region’s focus on sustainability is encouraging the adoption of these technologies for energy-efficient vehicle manufacturing. Increasing investment in research and development for emerging vehicle technologies also promotes the integration of infrared imaging in materials testing and prototype evaluations. Regional expertise in engineering and robust industrial policies further strengthen the adoption of such innovations.

Asia Pacific Infrared Imaging Market Analysis

The adoption of infrared imaging cabinets in this region is growing due to advancements in medical diagnostics and research applications. Expanding investments in healthcare infrastructure and a focus on precision diagnostics are enabling increased adoption of such tools. According to reports, the Indian hospital market, valued at USD 99 Billion and projected to reach USD 193 Billion by 2032, is leveraging advancements like AI, and health-tech, driving the adoption of infrared imaging for enhanced diagnostics and patient care efficiency. Additionally, regional manufacturers are integrating user-friendly technologies, making them more accessible for laboratory and clinical applications. The development of specialized imaging solutions supports industries like biotechnology, where rapid and accurate results are essential. This region's focus on modernizing medical facilities and equipping them with high-tech solutions contributes to the demand for such systems. Furthermore, increased government funding for research initiatives promotes the growth of this equipment across diverse sectors.

Latin America Infrared Imaging Market Analysis

In Latin America, the expanding electronics and semiconductor industries are leveraging infrared imaging cabinets for quality assurance and performance testing. According to reports, the growing Latin American aerospace industry, projected to expand at 4.5% annually by 2034, now contributes 15% to the global fleet, surpassing Europe, while low-cost carriers capture 18.6% market share, creating a robust demand for advanced technologies like infrared imaging for enhanced aviation safety and efficiency. These technologies are used to identify thermal inconsistencies and optimize the functionality of complex electronic circuits and components. The region benefits from ongoing infrastructure growth and skilled labour that supports the development of advanced imaging systems. Moreover, the increasing emphasis on reliable testing methods for next-generation semiconductor production ensures consistent growth in the use of these solutions. Local technological initiatives and collaborative projects contribute to an environment conducive to innovation in imaging technologies.

Middle East and Africa Infrared Imaging Market Analysis

The oil and gas sector in the Middle East and Africa sees increasing adoption of infrared imaging cabinets for thermal diagnostics. These systems are essential for monitoring pipelines and detecting anomalies, ensuring operational reliability in challenging environments. According to ITA, Saudi Arabia, holding 17% of global petroleum reserves and producing 13.6 Million barrels per day in 2022, drives the oil and gas sector's growth, fostering demand for infrared imaging technology to enhance operational efficiency and carbon monitoring in line with net-zero targets by 2050. The region’s focus on efficient resource management boosts demand for precision monitoring tools to minimize maintenance disruptions. Infrared imaging cabinets support predictive maintenance, reducing the likelihood of costly equipment failures. With ongoing investments in energy infrastructure, the role of advanced imaging technologies becomes pivotal for safe and efficient operations. The harsh conditions in extraction and refining processes highlight the value of reliable thermal analysis solutions.

Competitive Landscape:

Leading players in the infrared imaging market are focusing on innovation, strategic partnerships, and expanding their product portfolios to maintain competitive advantages. Companies are heavily investing in research and development (R&D) to create high-resolution, cost-effective infrared sensors. These innovations target emerging applications in autonomous vehicles, smart home security, and predictive maintenance. Various strategic acquisitions and mergers are also reshaping the market landscape. Additionally, partnerships with automotive and electronics manufacturers are enabling market players to integrate infrared imaging into diverse consumer and industrial products. Manufacturers are also expanding their geographic footprint to cater to growing demand in developing regions, where adoption in manufacturing, defense, and public safety is accelerating.

The report provides a comprehensive analysis of the competitive landscape in the infrared imaging market with detailed profiles of all major companies, including:

- Axis Communications

- Cox Communications

- Episensors Inc.

- FLIR Systems

- Fluke Corporation

- L3 Technologies

- Leonardo DRS

- OPGAL Optronics Industries Ltd

- Princeton Infrared Technologies Inc.

- Raptor Photonics Ltd.

- Sensors Unlimited Inc.

- Sofradir

- Tonbo Imaging Pvt. Ltd.

- XenICs

- Zhejiang Dali Technology Co. Ltd.

Latest News and Developments:

- December 2024: Scientists at JNCASR, Bengaluru, have developed flexible near-infrared (NIR) plasmonic devices using cost-effective scandium nitride (ScN) films. This breakthrough enhances wearable sensors, medical imaging, and optoelectronic applications. The innovation addresses key challenges in scalable and adaptable healthcare technologies. It marks a significant leap in advanced sensing and imaging.

- December 2024: PxE Holographic Imaging will unveil its groundbreaking Holographic RGB-IR-Depth Camera at CES 2025, enabling 3D imaging on standard 2D devices like smartphones and laptops. This innovation combines color, infrared, and depth imaging on a single sensor, revolutionizing consumer electronics, automotive, robotics, and more. As a CES 2025 Innovation Awards honoree, PxE aims to redefine digital imaging technology.

- October 2024: Lynred, a leader in infrared sensors for aerospace, defense, and commercial markets, acquired New Imaging Technologies (NIT), a Paris-based provider of shortwave infrared (SWIR) imaging modules. This strategic move expands Lynred's product portfolio to include high-definition SWIR sensors and patents, enhancing capabilities in AI and multispectral imaging. The acquisition aims to boost growth, improve time-to-market, and leverage synergies in production, reinforcing Lynred's leadership in infrared technology.

- July 2024: Teledyne FLIR has enhanced its Boson+ infrared thermal camera with next-gen embedded software, boosting thermal sensitivity to ≤20 mK. The upgrade delivers sharper imaging and improved spatial filtering, ideal for defense, firefighting, automotive, and surveillance applications. With low-risk integration, Boson+ supports unmanned platforms, handhelds, wearables, and thermal sights. This upgrade reinforces its market-leading reliability and performance in diverse security and thermal imaging solutions.

- February 2024: FLIR, a Teledyne Technologies company, launched the FLIR CM276 professional clamp meter with infrared imaging and DC solar PV capabilities. Featuring Infrared Guided Measurement (IGM™) and radiometric MSX technology, it overlays visible and thermal images for enhanced safety and hazard detection. The device is designed to streamline electrical inspections while minimizing physical contact risks.

Infrared Imaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Cooled Infrared Imaging, Uncooled Infrared Imaging |

| Components Covered | IR Detectors, IR Lens Systems, IR Sensors, Others |

| Wavelengths Covered | Near Infrared (NIR), Shortwave Infrared (SWIR), Mid-Wave Infrared (MWIR), Long-Wave Infrared (LWIR), Others |

| Applications Covered |

|

| Verticals Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Axis Communications, Cox Communications, Episensors Inc., FLIR Systems, Fluke Corporation, L3 Technologies, Leonardo DRS, OPGAL Optronics Industries Ltd, Princeton Infrared Technologies Inc., Raptor Photonics Ltd., Sensors Unlimited Inc., Sofradir, Tonbo Imaging Pvt. Ltd., XenICs and Zhejiang Dali Technology Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the infrared imaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global infrared imaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the infrared imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Infrared imaging is a technology that uses infrared light to capture images of objects based on their emitted thermal radiation. Infrared light, which lies beyond the visible spectrum, detects heat energy instead of visible light. This allows infrared imaging to visualize temperature differences across objects or environments, often referred to as a "thermal map."

The infrared imaging market was valued at USD 7.37 Billion in 2024.

IMARC estimates the global infrared imaging market to exhibit a CAGR of 5.54% during 2025-2033.

The growing demand for security and surveillance, increasing prevalence of various health disorders, and rising adoption in the military and defense sectors represent some of the key factors driving the market.

In 2024, uncooled infrared imaging represented the largest segment by technology due to their affordability, robustness, and wide range of applications.

Shortwave infrared leads the market by wavelength owing to its unique ability to capture high-resolution images in low-light conditions.

The security and surveillance is the leading segment by application, driven by increasing demand for enhanced monitoring solutions across military, commercial, and residential sectors.

The non-industrial is the leading segment by vertical, as they widely use infrared imaging for weapons, non-invasive diagnostics, and public safety purposes.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global infrared imaging market include Axis Communications, Cox Communications, Episensors Inc., FLIR Systems, Fluke Corporation, L3 Technologies, Leonardo DRS, OPGAL Optronics Industries Ltd, Princeton Infrared Technologies Inc., Raptor Photonics Ltd., Sensors Unlimited Inc., Sofradir, Tonbo Imaging Pvt. Ltd., XenICs, Zhejiang Dali Technology Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)