Inorganic Color Pigments Market Size, Share, Trends and Forecast by Product, Form, Application, and Region, 2025-2033

Inorganic Color Pigments Market Size and Share:

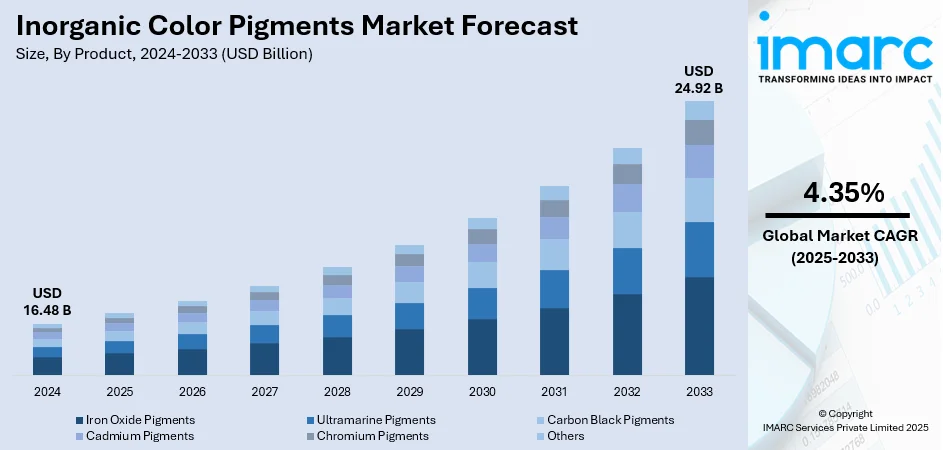

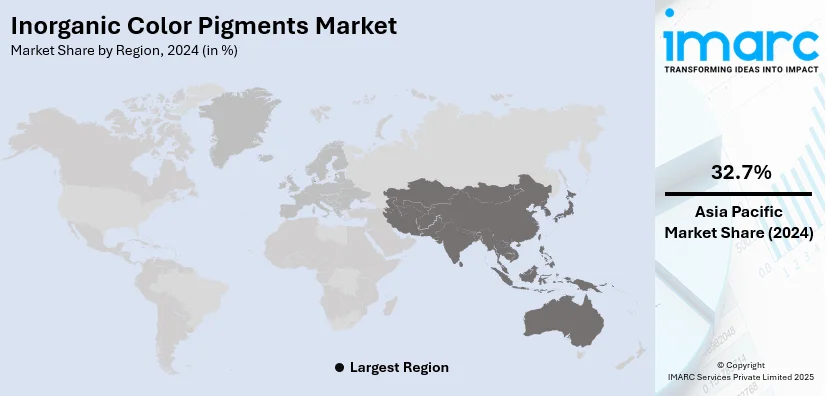

The global inorganic color pigments market size was valued at USD 16.48 Billion in 2024. Looking forward, the market is expected to reach USD 24.92 Billion by 2033, exhibiting a CAGR of 4.35% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of 32.7% in 2024. The market is driven by increasing demand from the construction, automobile, and industrial paints industries owing to their better durability, heat resistance, and UV stability. Technological advancements in pigment processing have improved color consistency and application versatility, which is further contributing to the consistent growth of the inorganic color pigments market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.48 Billion |

| Market Forecast in 2033 | USD 24.92 Billion |

| Market Growth Rate (2025-2033) | 4.35% |

One of the significant drivers of the inorganic color pigments market is strong demand from construction and infrastructure industries in regions like Asia-Pacific, the Middle East, and select areas in Latin America. In nations like India, China, and the UAE, urbanization and infrastructure growth have drastically boosted the consumption of colored concrete, ceramic tiles, pavers, and roof coating materials, all of which have very high dependence on inorganic pigments. These pigments possess excellent heat, UV, and chemical resistance and are suitable for heavy-duty and exterior use in varying climatic conditions. Inorganic pigments such as iron oxide, titanium dioxide, and chromium oxide find extensive applications in architectural coatings, cement products, and protective coatings due to their hardness and weatherproof nature. Additionally, government-supported smart city projects and property investment in emerging economies are driving the inorganic color pigments market demand further for long-lasting, color-rich pigments that are eco-friendly as well as structurally compliant, providing the market with a robust growth path.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by its highly developed technological environment and rigorous environmental regulations. New developments in pigment production, such as the creation of safer, more environmentally friendly, and high-performance pigments, are driven by United States-based firms heavily investing in research and development. The nation's emphasis on minimizing the environmental footprint of pigments is in line with increasing consumer interest in green and toxic-free alternatives, which has driven changes from conventional materials. The US market's embracement of innovative production methods also boosts pigment quality, stability, and application efficiency in industries like automotive, aerospace, and electronics. Safety and compliance regulations are strictly enforced by regulatory agencies in the US, motivating manufacturers to innovate and be sustainable. The impact of these trends world-wide, establishes standards that push conventional pigment markets and stimulate general change in product range and industry procedure on a world-wide basis.

Inorganic Color Pigments Market Trends:

Expansion of Inorganic Pigments in the Cosmetics Industry

A growing trend in the inorganic color pigments market is their expanding use in the global cosmetics industry. Conventional applications in construction, coatings, and plastics, inorganic pigments are increasingly being sought after in the personal care segment because of their hypoallergenic and stable nature, along with being safe for use. According to the India Brand Equity Foundation (IBEF), the global cosmetics industry is growing at a CAGR of 4.3% and is expected to reach USD 450 Billion by 2025, creating significant opportunities for the application of inorganic pigments in cosmetic formulations. The pigments are also much sought after for their durability to light, heat, and oxidation, thus contributing to color stay in applications such as foundations, eyeshadows, lipsticks, and sunscreens. In markets like Europe and North America, where consumer knowledge of clean beauty and dermatological safety is particularly high, inorganic pigments such as titanium dioxide and iron oxides are favored over their synthetic counterparts. Likewise, in markets like Japan and South Korea in the Asia-Pacific region which are preeminent beauty innovation hubs, there is increasing demand for cosmetics featuring natural or mineral-based pigments. These pigments find good alignment with the inorganic color pigments market trends for safer, more enduring, and environmentally friendly formulations, increasing their pertinence in the changing trends of the international beauty market.

Effect of Urbanization and Development of Infrastructure

Accelerated urbanization and infrastructural development boom are significant international factors fueling the demand for inorganic color pigments, particularly for use in building materials. In India, China, Indonesia, and some African countries, the increased use of colored concrete, pavers, tiles, and façades is being fueled by the large-scale residential and commercial developments. In this regard, global construction activities are on an upward trajectory, with reports forecasting a 2.3% increase in global construction output in 2025, followed by 3.3% growth in 2026. Inorganic pigments impart weather resistance, color stability, and durability necessary in these applications and are hence the popular choice among the organic pigments. Governments are also contributing by initiating programs for the development of infrastructure that includes new housing, transport, and public buildings, further accelerating the use of construction-related coatings and materials. Even in advanced markets like the Middle East and sections of Eastern Europe, where there is emphasis on replacing aging infrastructure with new modern equivalents, demand for dependable and durable pigments for cement and coating applications is high. This continuous growth in construction activities worldwide is a steady growth driver for the inorganic color pigments market outlook.

Transition to Eco-Friendly and Regulator-Friendly Pigments

Another one of the major trends is a transition to eco-friendly and regulator-friendly pigment options. Inorganic pigments are increasingly in demand as they tend to satisfy rigorous environmental and safety requirements, in contrast to certain conventional organic pigments that contain toxic substances. In the cases of Europe, where REACH and other regulations are also established, producers are pressured to remove toxic substances and implement safer alternatives, leading to an increase in demand for iron oxide, ultramarine, and chromium-based pigments. In the United States, this trend is also noticed as a result of greater company responsibility for environmentally friendly production. At the same time, in Asia-Pacific, especially in export industry-expanding countries, conformance with global safety and sustainability standards is essential to gain access to global markets. Such regulatory pressure is compelling pigment manufacturers to make investments in cleaner technologies and sustainable sourcing methods and influencing the inorganic color pigments market growth. The outcome is an increasingly environmentally friendly market, where inorganic pigments are the answers to both performance and compliance.

Inorganic Color Pigments Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global inorganic color pigments market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, form, and application.

Analysis by Product:

- Iron Oxide Pigments

- Ultramarine Pigments

- Carbon Black Pigments

- Cadmium Pigments

- Chromium Pigments

- Others

Iron oxide pigments stand as the largest component in 2024, holding 38.9% of the market share. The dominance of the inorganic color pigments market is held by iron oxide pigments based on their superior versatility, hardness, and safety record. They enjoy widespread application in industries including construction, coatings, plastics, and cosmetics owing to their excellent resistance to heat, UV exposure, and chemical attack. Their natural availability and environmentally friendly nature lead them toward being a first choice over synthetic pigments, fitting well with mounting regulatory pressures for sustainable and non-toxic materials. Iron oxide pigments contribute to the durability of color in concrete, tile, and façade components in construction, and in coatings, they stabilize color and resist corrosion. Iron oxide pigments are also used by the cosmetics industry for safe, hypoallergenic coloring of cosmetics. Its extensive range of colors from reds and yellows to browns and blacks provides numerous options for applications. All these factors together make the iron oxide pigments the dominant product segment in the inorganic color pigments market with steady demand all over the world.

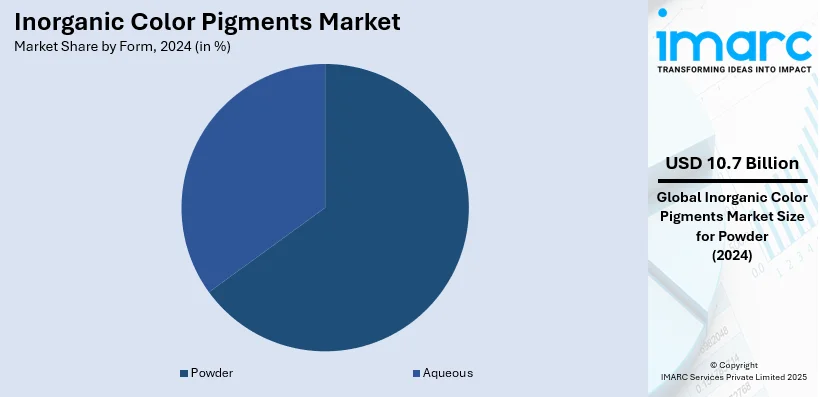

Analysis by Form:

- Aqueous

- Powder

Powder leads the market, with 65.0% of the market share in 2024. According to the inorganic color pigments market analysis, powder form is still the dominant segmentation in the inorganic color pigments market, as it is versatile, easy to handle, and applicable to a wide range of industries. Due to their outstanding dispersion properties, powder pigments allow manufacturers to evenly spread color in products including paints, varnishes, polymers, and building materials. Long shelf life and resistance to climatic factors including heat, moisture, and UV light are provided by their stability, which makes them ideal for demanding applications. In building construction, powder pigments are widely applied for coloring cement, tiles, and mortar, resulting in strong and bright finishes. In the coatings market, powders allow accurate formulation of colors and reliable performance. Moreover, the powder form allows flexibility in customization and mixing, allowing the production to accommodate unique color specifications. Their economic advantage and versatility in accommodating various manufacturing processes further reinforce the supremacy of powder pigments, making this format the preferred option in the global inorganic color pigments market.

Analysis by Application:

- Plastics

- Paints and Coatings

- Printing Inks

- Construction Materials

- Textiles

- Others

Paints and coatings lead the market, with 37.8% of the market share in 2024. Paints and coatings are the dominant application area as per the inorganic color pigments market forecast owing to their pivotal function of delivering color, protection, and durability in numerous industries. Inorganic pigments are preferred in paints and coatings owing to their superior heat, UV radiation, and chemical corrosion resistance, providing long-lasting bright colors. These inorganic pigments improve the performance of architectural coatings, industrial finishes, automotive colors, and protective coatings to make surfaces more durable and visually pleasing. In tough climates or industrial locations like the Middle East and Asia-Pacific regions, demand for inorganic pigment-based high-performance coatings is especially high. Additionally, increasing environmental regulations promote using non-toxic, environmentally friendly inorganic pigments in waterborne and powder coatings. This blend of functionality, regulatory compliance, and design adaptability secures paints and coatings as the pre-eminent application, fueling long-term growth and innovation in the inorganic color pigments market worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of 32.7%. The Asia Pacific region is fueled by accelerating industrialization, urbanization, and growing infrastructure initiatives. The need for long-lasting and high-performing pigments in the manufacturing, automotive, and building construction sectors is also growing in countries like China, India, Japan, and South Korea. The exploding real estate development in the region and government plans for building intelligent cities and green urbanization drive consumption of inorganic pigments for paints, coatings, and construction materials. Moreover, increasing concerns regarding environmental regulations spur the use of environment-friendly inorganic pigments, consistent with worldwide sustainability patterns. The development of the cosmetics and plastics markets in Asia Pacific also plays a major role in the growth of the market. Additionally, enhanced manufacturing capabilities and rising R&D investments enhance innovation and the availability of new pigment products. These conditions individually place Asia Pacific in a leading position, contributing a significant percentage to the world market of inorganic color pigments.

Key Regional Takeaways:

United States Inorganic Color Pigments Market Analysis

In 2024, the United States accounts for 84.30% of the inorganic color pigments market in North America. The United States inorganic color pigments market is witnessing steady growth, supported by increased demand across the construction and automotive industries. The expanding infrastructure renovation projects and residential housing developments are driving the need for durable and UV-stable pigments, especially in paints and coatings. According to reports, Americans are projected to spend over USD 1.2 Trillion on home renovations in 2025, driven by economic shifts, evolving lifestyles, and the rising demand for personalized and sustainable living spaces. This substantial investment is significantly boosting the use of high-performance pigments in interior and exterior coatings. Rising interest in green building materials is also promoting the use of non-toxic and thermally stable pigments in architectural coatings. Additionally, the growth of ceramic and glass manufacturing industries, driven by modern interior aesthetics, is fostering pigment consumption. Advances in pigment dispersion technology are enhancing application efficiency in plastics and composites, further supporting market expansion. A notable trend is the development of sustainable and custom-toned inorganic pigment solutions for advanced coating formulations. Furthermore, the increasing usage of colored concrete in urban landscaping and commercial structures is creating new avenues for product usage.

North America Inorganic Color Pigments Market Analysis

The North America inorganic color pigments market is marked by consistent growth due to demand from major industries including construction, automotive, and plastics. Industry reports indicate that in 2024, the North America automotive market was valued at USD 1,163.77 Billion. According to IMARC Group's forecast, the market would increase at a compound annual growth rate (CAGR) of 5.70% from 2025 to 2033, reaching USD 1,916.64 Billion. Due to their durability, heat stability, and light and chemical resistance, inorganic pigments are largely applied in coatings, paints, and in concrete applications throughout the region. The building materials industry, especially in the United States and Canada, is a large user, applying these pigments in roofing, bricks, pavers, and other building materials. The recovery of manufacturing in North America also aids in the usage of inorganic pigments for industrial coatings and plastics. Industry standards for environmental protection and non-toxicity are driving product development, where there is a shift toward environmentally friendly formulations of pigments. Market participants are also seeking individualized pigment solutions to address performance and aesthetic requirements. The market is competitive, and opportunities for growth relate highly to infrastructure construction, renovation, and changing industrial and consumer demand.

Europe Inorganic Color Pigments Market Analysis

The inorganic color pigments market in Europe is benefitting from the region’s focus on sustainable urban development and eco-friendly materials in the construction sector. Growing investments in heritage restoration and architectural conservation are boosting demand for stable pigments that retain color under harsh climatic conditions. As per reports, seasonally adjusted construction production increased by 1.7% in the euro area and by 1.4% in the EU in April 2025 compared to March 2025, indicating growing momentum in the building sector. This upward trend is reinforcing the demand for inorganic pigments in architectural coatings, tiles, and engineered stone. The region’s mature ceramic and tile industry utilizes these pigments for intricate design and durable finishes. The shift toward energy-efficient building envelopes is driving the adoption of reflective coatings incorporating high-performance inorganic pigments. Industrial design trends favoring natural and earthy tones have further elevated the importance of iron oxide and manganese-based pigments in coatings and plastics.

Latin America Inorganic Color Pigments Market Analysis

The Latin American inorganic color pigments market is growing, driven by the revival of residential construction and the expansion of decorative coatings. The adoption of colored pavements, urban furniture, and garden decor is supporting pigment use in pre-cast concrete applications. According to industrial reports, Brazil’s tile production is projected to grow 2.6% annually, reaching 903 Million sqm by 2028, up from 793 Million sqm in 2023, with domestic demand expected to reach 896 million sqm. This surge in demand is reinforcing the use of high-performance pigments that provide long-lasting color and thermal resistance in tile surfaces. Long-lasting pigments are in high demand due to local tile production, textured exterior coatings, affordable architectural finishes, and a growing preference for aesthetically enhanced industrial buildings and retail outlets.

Middle East and Africa Inorganic Color Pigments Market Analysis

The inorganic color pigments market in the Middle East and Africa is gaining traction due to the region’s increased investments in large-scale infrastructure and hospitality projects. According to the Saudi British Joint Business Council, the infrastructure sector in Saudi Arabia was estimated to be worth USD 36 billion in 2024 and is expected to grow to USD 44.81 billion by 2029, indicating enormous potential for construction throughout the region. This creates growing demand for pigments that offer heat-reflective and colorfast qualities for desert climates. The popularity of decorative concrete, mosaic tiles, and facade coatings with vibrant, enduring colors is stimulating pigment consumption. Expanding local production of sanitaryware and ceramics, supported by industrial diversification initiatives, is also driving pigment usage.

Competitive Landscape:

Major companies in the market for inorganic color pigments are investing heavily in research, sustainability, and international growth to remain competitive and address changing industry needs. Manufacturers are creating more sophisticated pigment solutions that provide enhanced heat stability, weather resistance, and color performance to meet high-growth industries such as automotive, construction, and industrial coatings. Significant emphasis has been on developing environmentally friendly and non-toxic substitutes meeting strict environmental legislations, particularly in Europe and North America. In support of this, some manufacturers have shifted to cleaner production technologies, minimize heavy metal content, and adopt closed-loop systems in order to reduce waste. Strategic alliances and acquisitions are also assisting leading players in expanding their product lines and entering new geographies, especially in Asia Pacific, where demand is growing at a fast rate. Key companies are also increasing manufacturing bases and strengthening distribution channels to maintain timely delivery and local product customization. R&D activities are being increased to manufacture pigments with specific properties, including infrared reflectance and anti-corrosive properties, to meet niche industrial requirements. Collectively, these efforts show a strategic approach to innovation, compliance, and customer attention that is driving growth and influencing the direction of the global market for inorganic color pigments.

The report provides a comprehensive analysis of the competitive landscape in the inorganic color pigments market with detailed profiles of all major companies, including:

- BASF SE

- Cathay Industries

- DCL Corporation

- Ferro Corporation (Prince International Corporation)

- Hunan Sanhuan Pigment Co. Ltd.

- KRONOS Worldwide Inc.

- Lanxess AG

- Venator Materials PLC

Latest News and Developments:

- February 2025: LANXESS launched a new line of sustainable micronised iron oxide yellow pigments under its BAYFERROX® Scopeblue label. These pigments featured a 35% lower product carbon footprint, verified by TÜV Rheinland. Made with eco-efficient raw materials and renewable energy, they maintained the same quality, colour, and performance as conventional variants.

- March 2025: Sudarshan Chemical Industries Limited (SCIL) today announced the successful completion of its acquisition of Heubach Group, a Germany-based company, through its wholly owned subsidiary, Sudarshan Europe B.V. The transaction, which combines both asset and share deals, significantly expands Sudarshan’s global operations, with a presence now across 19 sites in major regions worldwide. This acquisition bolsters Sudarshan’s pigment portfolio, adding advanced technologies and a broad range of high-quality products. With this strategic move, Sudarshan is well-positioned to cater to growing demand in key global markets, including Europe and the Americas.

Inorganic Color Pigments Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Iron Oxide Pigments, Ultramarine Pigments, Carbon Black Pigments, Cadmium Pigments, Chromium Pigments, Others |

| Forms Covered | Aqueous, Powder |

| Applications Covered | Plastics, Paints and Coatings, Printing Inks, Construction Materials, Textiles, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Cathay Industries, DCL Corporation, Ferro Corporation (Prince International Corporation), Hunan Sanhuan Pigment Co. Ltd., KRONOS Worldwide Inc., Lanxess AG and Venator Materials PLC |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the inorganic color pigments market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global inorganic color pigments market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the inorganic color pigments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The inorganic color pigments market was valued at USD 16.48 Billion in 2024.

The inorganic color pigments market is projected to exhibit a CAGR of 4.35% during 2025-2033, reaching a value of USD 24.92 Billion by 2033.

The inorganic color pigments market is driven by rising demand from construction, automotive, and industrial coatings sectors due to their durability, heat resistance, and UV stability. Increasing infrastructure projects, environmental regulations promoting eco-friendly pigments, and advancements in pigment technology further propel market growth worldwide.

Asia Pacific currently dominates the inorganic color pigments market, driven by rapid urbanization, booming construction activities, and expanding automotive and manufacturing sectors. Government infrastructure projects and increasing demand for durable, eco-friendly pigments in paints and coatings further fuel growth. Rising consumer awareness about sustainability also supports market expansion in the region.

Some of the major players in the inorganic color pigments market include BASF SE, Cathay Industries, DCL Corporation, Ferro Corporation (Prince International Corporation), Hunan Sanhuan Pigment Co. Ltd., KRONOS Worldwide Inc., Lanxess AG, Venator Materials PLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)