Global E-Commerce Industry Analysis, Latest Innovations and Market Trends

Exploring the Influence of AI, Mobile Commerce, and Shifting Global Landscapes on Digital Shopping

The global e-commerce landscape is rapidly transforming, propelled by several evolving e-commerce industry trends. These fundamental shifts encompass changes in consumer behavior, rapid technological advancements, and increasing internet accessibility worldwide. As a direct result, brands are now prioritizing quick delivery, mobile-centric platforms, and deeply customized digital experiences. Expectations around social commerce, voice-activated shopping, and AI-driven suggestions are no longer novelties but fast becoming standard. Shoppers increasingly desire seamless and engaging interactions, compelling retailers to innovate with augmented reality try-ons, virtual shops, and smooth payment processes. Concurrently, direct-to-consumer approaches are on the rise, eliminating middlemen and enhancing customer engagement. This dynamic growth has led to the consistent expansion of global e-commerce revenue 2025, solidifying its integration into daily life. Cross-border sales and localized strategies are also experiencing notable expansion, reflecting the sector’s broadening reach and long-term potential.

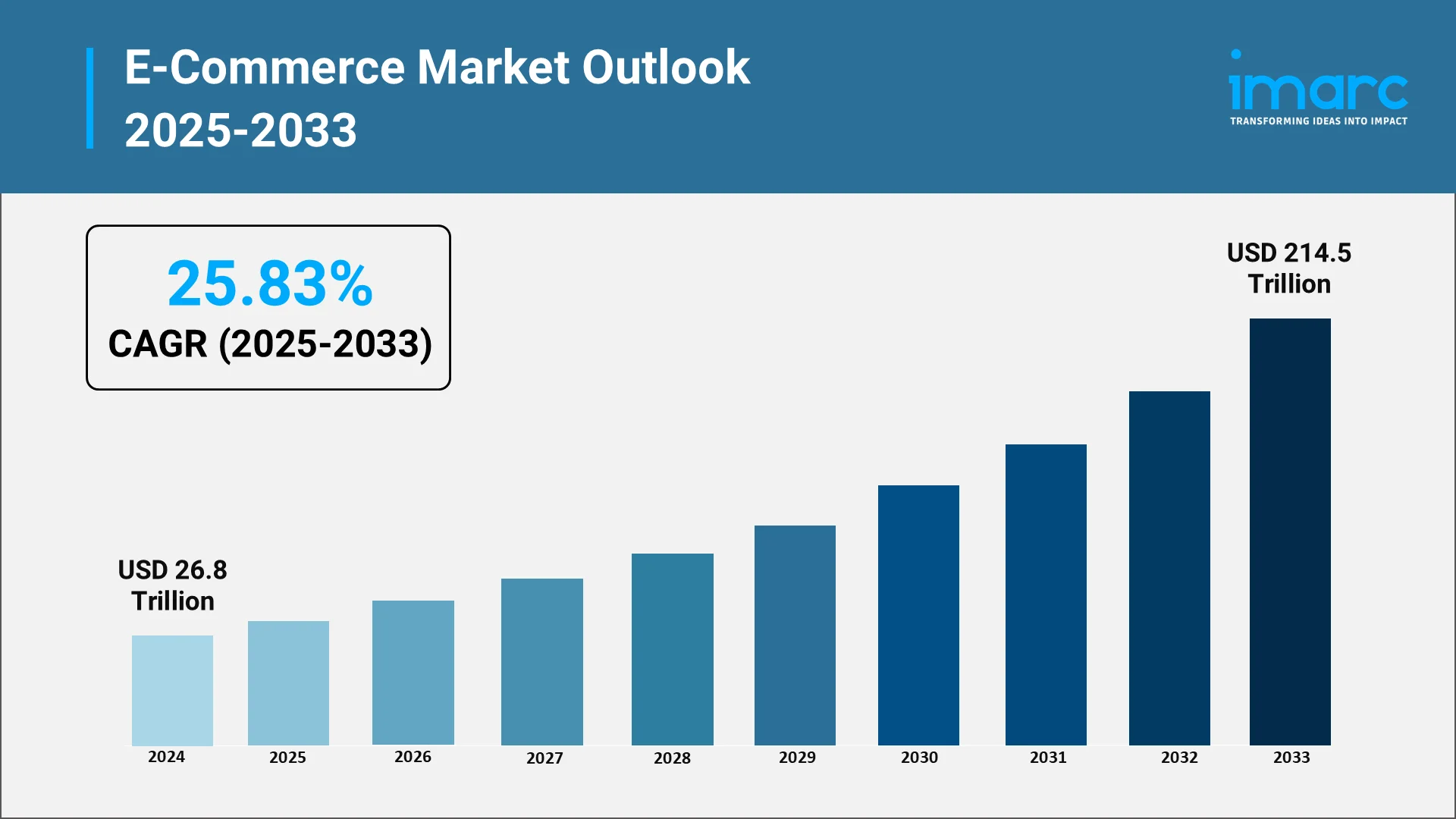

The year 2025 marks a crucial turning point for e-commerce worldwide, driven by the strategic consolidation of platforms and the mainstream acceptance of artificial intelligence (AI) that is revolutionizing personalization and operations. This period will also see a growing wave of regulation fundamentally reshaping the future of digital trade. Nowadays, consumers are increasingly seeking immediate, personalized experiences, compelling brands to implement predictive analytics and real-time supply chain solutions. Emerging markets are simultaneously becoming more influential, shifting the geographic dynamics of online retail. Concurrently, increased focus on data privacy, environmental sustainability, and fair competition is profoundly altering the operational landscape of e-commerce. Retailers are scaling and also adapting to new frameworks that emphasize sustainability, local compliance, and comprehensive post-purchase support. As the market approaches USD 34.13 Trillion in 2025, this milestone serves as a critical assessment for long-term sustainability, maturity, and the future framework of digital commerce. This evolution is also redefining e-commerce by region, with Asia-Pacific continuing to lead in volume, North America refining tech-driven retail models, Europe tightening regulatory oversight, and regions like Latin America and Africa accelerating in digital adoption and mobile-first retail growth.

Global E-commerce Market Forecast for 2025

The global e-commerce market is reflecting its ongoing expansion across various sectors and regions. This expansion is fueled by the rising accessibility of the internet, the prevalent use of smartphones, and improvements in online payment systems. According to the industry reports, as of April 2025, the world population was 8.21 Billion, with 68.7% using the internet and 70.7% as unique mobile users. Consequently, e-commerce has evolved beyond traditional retail to include services, groceries, healthcare and digital goods, allowing even previously underserved areas to engage in online spending. The e-commerce industry analysis indicates that future growth will be fueled by continued technological innovations, better logistics, and an expanding customer base across developing regions.

In 2025, global ecommerce is expected to witness a year-over-year (YoY) growth of 19.1% compared to 2024, supported by rising consumer confidence, enhanced delivery systems, and a shift toward digital-first shopping. Innovations like AI-driven recommendations and flexible return policies are encouraging higher purchase frequency and average order values. Retailers are also expanding cross-border capabilities and customizing experiences for diverse regions, further solidifying ecommerce’s critical role in global trade and consumer activity.

Explore in-depth findings for this market, Request Sample

Regional E-Commerce Revenue Breakdown for 2025

Asia-Pacific E-Commerce Trends 2025

In 2025, the Asia-Pacific region is anticipated to generate USD 18.37 Trillion in ecommerce revenue, reinforcing its status as the largest market globally. It is expected to capture 56.9% of the global market share, with a CAGR of 15.80%, during 2025-2033. This growth is driven by mobile centric consumers, super-app ecosystems, and high population density in countries like China, India, and Southeast Asia. The rise of localized platforms, swift payment adoption, and cross-border trade are propelling regional expansion. Additionally, social commerce and livestream shopping are transforming how consumers find and buy products.

North America E-Commerce Trends 2025

North America is projected to achieve a revenue of USD 6.80 Trillion in ecommerce, accounting for 21.1% of the global market share in 2025. The region anticipates a CAGR of 12.06% during 2025-2033, spurred by a growing reliance on digital channels, enhancements in last-mile logistics, and the widespread use of AI for personalized experiences. According to the report published by the US Census Bureau, in the first quarter of 2025, US retail e-commerce sales were estimated at $300.2 Billion, nearly unchanged from Q4 2024, accounting for 16.2% of total retail sales. E-commerce sales witnessed a 6.1% rise compared to Q1 2024, while total retail sales increased by 4.5% in the same period. Established markets such as the US and Canada are witnessing growth in areas like groceries, healthcare, and subscription services. Omnichannel retailing, which integrates online and physical shopping, remains a key feature of the North American e-commerce scene.

Europe E-Commerce Trends 2025

Europe is expected to reach USD 5.13 Trillion in ecommerce revenue in 2025, holding a market share of 15.9% with a CAGR of 10.98% during 2025-2033. The region is characterized by robust regulatory frameworks concerning data privacy and consumer rights, influencing business operations. Western Europe continues to drive the majority of sales, while Eastern Europe is witnessing increased engagement due to improved digital infrastructure and internet access. Cross-border shopping within the EU remains vibrant, aided by multilingual platforms and uniform regulatory frameworks. According to e-commerce industry analysis, Europe’s e-commerce sector is poised for strong growth, driven by factors such as enhanced digital infrastructure, rising consumer confidence in online shopping, and the growing trend of cross-border shopping within the EU.

Latin America E-Commerce Trends 2025

By 2025, Latin America is projected to achieve USD 1.04 Trillion in revenue, contributing approximately 3.2% to the global market with a CAGR 14.42% during 2025-2033, which is among the highest in emerging markets. In this region, mobile commerce dominates, particularly in nations such as Brazil, Mexico, and Colombia. Payment innovations, including local wallets and cash-based digital transactions, are helping to build trust and enhance access. Local platforms are rising alongside global competitors, while investments in logistics are improving challenges related to last-mile delivery.

Middle East & Africa E-Commerce Trends 2025

The Middle East and Africa (MEA) are predicted to generate USD 0.94 Trillion in ecommerce revenue in 2025, representing a market share of 2.9% and an estimated CAGR of 15.22%, during 2025-2033. Although still in the early stages, MEA markets are benefitting from youthful, tech-savvy populations, increased smartphone penetration, and growing interest from international e-commerce players. The Gulf states lead the region, bolstered by high spending power and advanced infrastructure. In Africa, local marketplaces and mobile-centric solutions are broadening access in areas where traditional banking and logistics systems are limited.

Top Countries Contributing to the 2025 Market

| Countries | 2025 Revenue (Billion US$) | CAGR % 2025-33 |

|---|---|---|

| USA | 6,155.56 | 11.90% |

| China | 14835.51 | 15.80% |

| India | 408.5118 | 19.30% |

| UK | 996.4575 | 11.90% |

Top e-commerce countries 2025 include China, the USA, India, and the UK, each with significant contributions to both revenue and growth rate. For instance, China is projected to lead in revenue, reaching USD 14,835.51 Billion in 2025, followed closely by the USA at USD 6,155.56 Billion with a CAGR of 11.90% during 2025-2033. Despite having a lower revenue figure, India stands out with the highest growth rate, expecting a CAGR of 19.30% from 2025-2033, driven by rapid digital adoption in smaller cities and growing mobile penetration. China continues to dominate with a strong CAGR of 15.80% between 2025-2033, bolstered by mobile-first commerce and integrated digital ecosystems. Meanwhile, the UK, expected to reach USD 996.45 Billion in revenue by 2025 with a growth rate of 11.90% during 2025-2033, maintains a strong position due to advancements in omnichannel retail and cross-border sales. These varying growth rates and revenues underline the evolving nature of global e-commerce, where e-commerce leaders are defined by market size, and also by how quickly they adapt to local demand, infrastructure, and technology shifts. Overall, the USA remains a major e-commerce leader in terms of revenue, while India, with a projected revenue of USD 408.51 Billion by 2025, is emerging as a high-growth market with immense potential, setting the stage for a dynamic shift in the global e-commerce landscape.

E-commerce Growth Drivers: Regional Trends & Strategic Imperatives

Mobile Commerce, Cross-Border E-Commerce, and Local Platforms

Mobile commerce continues to be one of the strongest growth drivers globally, particularly in regions like Asia-Pacific, Latin America, and Africa, where smartphones are often the primary device used to access the internet. In these markets, a mobile-first approach designing websites and services specifically for mobile users is crucial for driving consumer engagement. This includes features like app-based shopping (shopping through mobile apps), digital wallets (mobile payment systems like Apple Pay or Google Pay), and optimized mobile interfaces. Meanwhile, cross-border e-commerce, which refers to consumers buying products from businesses in other countries, continues to expand in Europe and North America, with consumers increasingly comfortable purchasing from international brands. This growth is supported by strong logistics networks and secure payment systems. Additionally, local platforms in countries like India, Brazil, and Nigeria are gaining traction. Homegrown e-commerce companies are enhancing user experiences by offering services in local languages and using payment methods suited to the region. These platforms also address the unique challenges of delivering to hard-to-reach areas. Together, these trends are making e-commerce more accessible and fostering competitive, locally responsive markets that attract both first-time buyers and seasoned digital shoppers.

Regional Shopping Behaviors and Tech Adoption

Consumer behavior and technology adoption vary significantly across regions, which shapes e-commerce growth in unique ways. In North America and Europe, high levels of digital literacy (comfort and skills with using digital devices) and trust in online platforms encourage repeat purchases, loyalty programs, and a focus on fast, reliable delivery. In Asia-Pacific, consumers are more influenced by social commerce (shopping directly through social media platforms), influencer-driven recommendations (product recommendations from trusted social media figures), and integrated app ecosystems mobile apps that blend messaging, payments, and shopping into one seamless experience. This trend is especially prevalent in China and Southeast Asia. In India and other parts of Southeast Asia, the rise of voice-assisted search (using voice commands to find products), vernacular content (content tailored to local languages and cultural preferences), and cashless payments is unlocking access to e-commerce for rural and semi-urban consumers. In the Middle East, there is a growing interest in luxury e-commerce (shopping for high-end goods online), driven by demand for tech-enabled experiences. Meanwhile, Africa is embracing mobile-first e-commerce through mobile money (payments made through mobile phones) and informal marketplace integration (where traditional, local marketplaces merge with digital platforms). These varied behaviors and technology landscapes require e-commerce platforms to adapt locally while maintaining global scalability.

E-commerce Roadblocks: Understanding Key Challenges & Market Barriers

Logistics, Regulation, Payment Systems, and Digital Divide

Global e-commerce still faces several foundational barriers that limit its full potential in many regions. Logistics remains a challenge, particularly in rural or underdeveloped areas where last-mile delivery is inconsistent or costly. Regulatory complexity, such as cross-border duties, data localization laws and digital tax policies, can slow expansion and increase operational costs for international sellers. Payment systems are another barrier; in markets with low credit card penetration, lack of trust in online payments or insufficient infrastructure can deter transactions. The digital divide, marked by unequal access to reliable internet or digital literacy, especially in parts of Africa, South Asia, and Latin America, prevents large portions of the population from fully participating in online commerce. These combined issues slow down ecommerce adoption and limit scalability in less developed markets.

Region-Specific Barriers

E-commerce industry analysis highlights the distinct challenges faced by different regions in the global market. In Europe, strict privacy regulations like GDPR increase compliance costs and limit personalization. In India, fragmented logistics and varying state tax rules complicate fulfillment. Latin America faces issues with delivery reliability and payment fraud, while Africa struggles with infrastructure gaps and a predominantly cash-based economy. Southeast Asia deals with language diversity, regulatory fragmentation, and inconsistent internet quality across borders. Even in mature markets like the United States, growing concerns about data security and rising return rates are becoming operational pain points. These region-specific barriers require tailored strategies rather than a one-size-fits-all ecommerce model.

Next-Gen E-commerce: Future Outlook for the Post-2025 Landscape

Beyond 2025, the global e-commerce landscape is expected to evolve rapidly, shaped by automation, stricter regulations, and rising demand for personalized, frictionless experiences. Emerging technologies like AI, AR/VR, and voice commerce will become deeply integrated into everyday shopping, while privacy, sustainability, and ethical sourcing will move from optional to essential. Markets such as India, Indonesia, Nigeria, Vietnam, and Colombia will see accelerated growth due to mobile-first behavior, fintech innovation, and expanding digital infrastructure. Regional dynamics will shift as Asia-Pacific continues to lead in scale, North America focuses on AI and efficiency, and Europe drives regulatory standards. Meanwhile, Latin America and Africa will gain prominence through improved connectivity and localized ecommerce models, signaling a more distributed global ecommerce future.

Conclusion:

The global ecommerce market in 2025 stands at a transformative point, shaped by rapid technological adoption, changing consumer behavior, and expanding digital access. With a projected market size of USD 34.13 trillion and a year-over-year growth of 27.16%, ecommerce is no longer limited to traditional retail it spans services, digital goods, healthcare, and cross-border trade. Mobile commerce, AI, social shopping, and frictionless payments are now central to the global ecommerce experience. Direct-to-consumer models, personalized engagement, and regional localization strategies continue to redefine how brands reach and retain customers.

Among all regions, Asia-Pacific leads in volume, driven by mobile-first users, high digital engagement, and strong platform ecosystems. India stands out with the fastest growth, showing a CAGR of 19.70% from 2025 to 2033, fueled by expanding internet penetration and rising adoption in non-metro areas. Meanwhile, North America and Europe continue to innovate in logistics, AI, and omnichannel strategies, while Latin America and Africa represent high-potential frontiers with accelerating digital adoption. These diverse growth patterns underscore the need for region-specific strategies, agile platforms, and scalable infrastructure to navigate the evolving ecommerce landscape beyond 2025.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)