Rise of a New Fuel: Green Hydrogen's Role in Mobility, Industry, and Power Generation

Introduction:

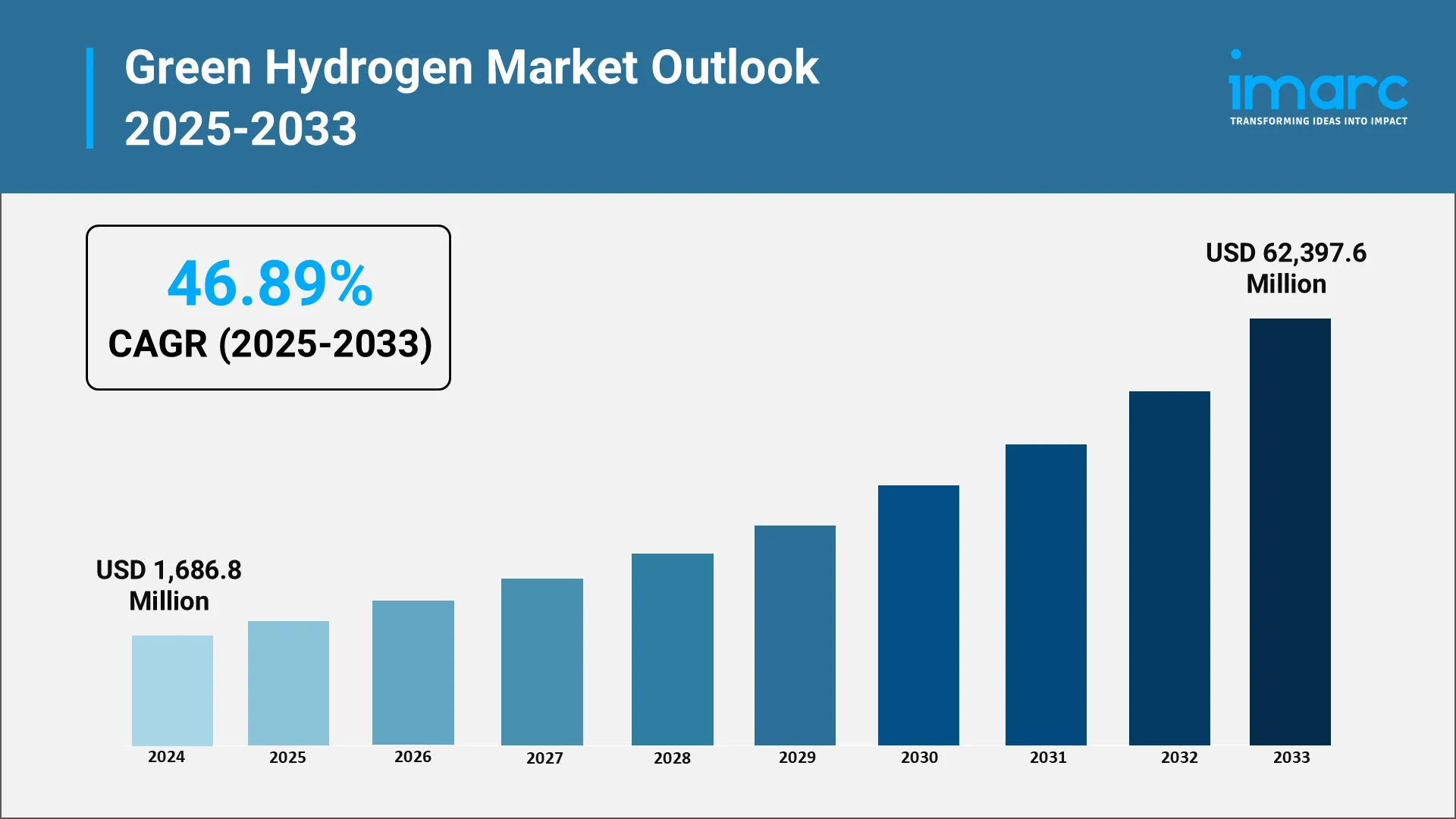

The global energy landscape is undergoing a seismic transformation, with green hydrogen emerging as one of the most promising solutions to achieve deep decarbonization across sectors. Far from a niche technology, green hydrogen is emerging as a critical pillar of the future energy system, offering a pathway to a sustainable and resilient economy. The global green hydrogen market was valued at USD 1,686.8 Million in 2024. This explosive growth underscores green hydrogen’s profound influence on the global energy transition and industrial decarbonization efforts. By offering a carbon-free alternative to fossil fuels, it enhances energy security and drives economic growth by creating new industries and jobs. Its rise is a direct response to the global imperative for a more sustainable future, backed by unprecedented strategic initiatives and technological innovation.

Explore in-depth findings for this market, Request Sample

Key Industry Trends:

- Technological Advancements in Electrolysis

Electrolysis remains the backbone of green hydrogen production, and innovations in this space are central to market expansion. Emerging technologies such as proton exchange membrane (PEM) and solid oxide electrolyzers are enabling higher efficiency and durability while also lowering operational costs. Companies and research institutions are working on scaling up electrolyzer capacity aiming for multi-gigawatt projects that can meet industrial and national energy demands. For instance, in July 2025, Hyundai Motor India alongside IIT Madras and the Tamil Nadu government inaugurated the INR 100 crore HTWO Innovation Centre in Chennai. Opening in 2026, the 65,000 sq ft facility will focus on green hydrogen R&D including electrolyser testing, to support India's decarbonization and self-reliance initiatives.

These advancements are also making green hydrogen production more competitive compared to fossil-based hydrogen. As renewable energy costs decline the combination of low-cost electricity and high efficiency electrolyzers will accelerate the commercial viability of green hydrogen paving the way for widespread adoption.

- Increasing Investments and Government Support

The role of government policies and private investments cannot be overstated in driving the green hydrogen sector. Numerous countries have launched national hydrogen strategies allocating billions of dollars in funding and subsidies to stimulate research, infrastructure development, and deployment. Public-private partnerships are also gaining momentum ensuring collaboration across energy companies, manufacturers, and technology providers.

Investors are showing heightened interest in green hydrogen projects as they align with ESG (Environmental, Social, and Governance) criteria, further strengthening financing opportunities. This robust policy and financial ecosystem are creating favorable conditions for rapid scale-up and positioning green hydrogen as a strategic pillar of future energy systems.

- Development of Green Hydrogen Infrastructure

For green hydrogen to achieve its potential, infrastructure development is critical. This includes the establishment of large-scale production plants, storage facilities, distribution pipelines, and refueling stations for mobility applications. Many pilot projects have already demonstrated the technical feasibility of hydrogen integration, and now the focus is shifting toward scaling up.

Australia, Europe, and the Middle East are leading in mega-project announcements, while other regions are catching up by exploring domestic and export opportunities. For instance, in July 2025, the Australian Government awarded Orica USD 432 Million in Hydrogen Headstart funding for the Hunter Valley Hydrogen Hub, aiming to construct a 50MW electrolyser to produce renewable hydrogen. This project supports Orica's decarbonization efforts and the transition of the Hunter region’s economy from coal, enhancing large-scale renewable hydrogen initiatives.

- Emergence of New Applications for Green Hydrogen

Green hydrogen’s versatility is evident in its expanding applications. In mobility, it is being tested for heavy-duty trucks, buses, trains, and even aviation, where battery-electric solutions face limitations. For instance, in July 2025, the UK government allocated £63 Million to 17 projects focusing on green hydrogen-based sustainable aviation fuels, supporting 1,400 jobs. Notable recipients include Essar and Equinor, aiming to enhance e-fuel production. This initiative underscores the UK's commitment to achieving sustainable aviation goals and reducing greenhouse gas emissions. In industry, green hydrogen is emerging as a substitute for coking coal in steelmaking, a cleaner fuel for high-temperature industrial processes, and a sustainable feedstock for chemicals and fertilizers.

The power sector is also experimenting with hydrogen blending in natural gas pipelines and its use in fuel cells for backup and off-grid power. These new applications underline the broad potential of green hydrogen to decarbonize multiple industries simultaneously, making it a truly transformative fuel of the future.

- Growing Demand for Decarbonization Across Industries

Global industries are under mounting pressure to decarbonize as governments tighten emission norms and consumers demand sustainable products. Sectors such as shipping, aviation, and heavy manufacturing are increasingly turning to green hydrogen as a viable pathway to achieve deep emissions cuts. At the same time, large corporations are committing to ambitious net-zero targets, boosting adoption across supply chains and shaping key green hydrogen market trends.

This growing demand aligns with broader sustainability agendas, reinforcing green hydrogen’s role as a bridge between renewable energy production and industrial consumption. As decarbonization becomes a business imperative, the adoption of green hydrogen is expected to accelerate, creating long-term opportunities for the sector.

Market Segmentation and Regional Insights:

Market Segmentation:

- By Technology:

- Alkaline Electrolyzers: Alkaline electrolyzers dominate the market with 65.7% share due to their proven technology, low cost, and durability. They enable reliable large-scale hydrogen production, making them ideal for industries. Their long lifespan and cost-effectiveness over newer alternatives ensure strong adoption across global projects, especially in steady-state operations.

- Proton Exchange Membrane Electrolyzers: PEM electrolyzers are gaining traction for their flexibility and efficiency under variable renewable energy loads. They produce high-purity hydrogen and respond quickly to fluctuating power, making them suitable for integration with solar and wind energy. However, higher costs and shorter lifespans compared to alkaline systems limit their immediate scalability.

- By Application:

- Transport: Transport leads with 44.7% market share as hydrogen is increasingly used in hard-to-decarbonize sectors like trucking, shipping, and aviation. Fuel cells offer faster refueling and longer ranges than batteries, making hydrogen a practical choice. Supportive government policies and rapid fuel cell infrastructure development further strengthen its role in zero-emission mobility.

- Power Generation: Green hydrogen is being adopted in power generation for balancing renewable grids and storing excess energy. It provides a long-term, flexible energy solution that supports decarbonization of thermal power plants. Though its market share is smaller than transport, its role in future energy systems continues to expand.

- By Distribution Channel:

- Pipelines: Pipelines dominate with 60.7% share as they provide the most efficient and cost-effective means of transporting hydrogen at scale. Existing natural gas infrastructure can often be repurposed, minimizing new investment. Continuous delivery and lower energy losses make pipelines the preferred choice for industrial and utility-level hydrogen applications.

- Cargo: Cargo transport, including road tankers and ships, plays a key role in flexible hydrogen delivery across regions without pipeline infrastructure. While less efficient for large-scale use, it supports pilot projects, cross-border trade, and small-scale distribution. Advancements in liquid hydrogen and ammonia carriers are expanding this segment’s importance.

Regional Analysis:

- Europe: Europe leads the market with 47.6% share, driven by strong policy support, ambitious climate targets, and heavy investments under the European Green Deal and Hydrogen Strategy. Cross-border initiatives, hydrogen valleys, and partnerships with North Africa enhance supply stability. Falling renewable costs and industrial demand make Europe the global frontrunner. In May 2025, the European Commission designated €992 Million for 15 major renewable hydrogen initiatives in five countries, with the goal of generating 2.2 Million Tons of hydrogen and reducing CO2 emissions by 15 Million Tons over the next ten years. This initiative supports the EU's goal of decarbonizing critical sectors and reducing fossil fuel reliance.

- North America: North America benefits from large-scale renewable energy resources and strong public-private partnerships. The United States, in particular, is advancing projects under federal clean energy incentives, while Canada promotes hydrogen exports.

- Asia Pacific: The Asia Pacific region is demonstrating significant progress, as nations such as Japan, South Korea, China, and Australia are actively investing in hydrogen initiatives. Key areas of focus encompass transportation, industrial applications, and hydrogen exports. With robust government plans and pilot projects in place, this region is poised to be a pivotal player in the worldwide adoption of hydrogen technology.

- Latin America: Latin America is emerging as a cost-competitive producer of green hydrogen due to abundant renewable resources, especially in Chile and Brazil. Export-oriented projects targeting Europe and Asia are driving early-stage growth.

- Middle East and Africa: MEA countries are investing in large-scale hydrogen projects to diversify economies and leverage renewable potential. Nations like Saudi Arabia and the UAE are focusing on hydrogen exports, while African countries such as Namibia explore new opportunities. Strategic collaborations could accelerate the region’s growth in global hydrogen trade.

Forecast (2025-2033):

The global green hydrogen market is expected to reach a value of USD 62,397.6 Million by 2033, exhibiting a CAGR of 46.89% during 2025-2033. This strong growth trajectory will be fueled by a combination of several demand drivers:

- Shift Toward Sustainable Energy Sources: Governments and businesses are actively transitioning from fossil fuels to renewable-based energy systems to reduce dependence on carbon-intensive fuels. Green hydrogen has emerged as a key enabler in this transition, offering clean energy solutions for hard-to-abate industries.

- Growing Concerns Over Climate Change: Increasing global temperatures, extreme weather occurrences, and more stringent carbon neutrality goals have heightened the urgency for transitioning to clean energy. Green hydrogen, which produces no carbon emissions during its use, is essential for effective decarbonization efforts.

- Policy Support and Incentives for Green Hydrogen Production: Strong policy backing, including subsidies, tax benefits, and research funding, is accelerating the growth of green hydrogen projects. Governments worldwide are rolling out national hydrogen strategies and roadmaps, giving investors’ confidence in long-term market viability.

- Declining Costs of Renewable Energy: Falling solar photovoltaic and wind energy costs have reduced the overall expenses of powering electrolyzers, making green hydrogen more price competitive. As renewable electricity becomes cheaper and more abundant, the scalability of hydrogen production improves significantly.

Conclusion:

Green hydrogen is rapidly evolving into a cornerstone of the global energy transition, with the potential to decarbonize mobility, industry, and power generation simultaneously. Supported by technological innovation, declining renewable costs, and favorable policy frameworks, the sector is poised for significant expansion. As industries and governments seek reliable pathways to net-zero, hydrogen’s versatility ensures its long-term relevance. According to the green hydrogen market forecast, adoption will accelerate in the near future, driven by infrastructure development and cross-sector applications. Positioned as both an energy carrier and storage solution, green hydrogen stands to reshape economies while advancing global sustainability goals.

How IMARC Group is Driving Innovation in a Rapidly Expanding Green Hydrogen Market:

IMARC Group empowers stakeholders in the rapidly expanding green hydrogen sector with vital intelligence and insights to navigate technological advancements, evolving policies, and decarbonization demands.

- Market Insights: We provide in-depth analysis of trends, including breakthroughs in electrolysis, hydrogen mobility, and increased applications in power and industry. Key insights cover electrolyzer deployment, hydrogen blending in gas grids, and pilot projects for heavy-duty transport.

- Strategic Forecasting: Our forecasting helps clients plan for energy's future by identifying trends such as government roadmaps, carbon neutrality targets, and renewable energy cost reductions, allowing businesses to seize opportunities and mitigate risks.

- Competitive Intelligence: We monitor innovations across the green hydrogen value chain, including new business models, hydrogen storage advancements, and public-private partnerships to enhance supply chain resilience.

- Policy and Regulatory Analysis: Our analysis evaluates the regulatory landscape, including subsidies and carbon pricing, helping companies align with global decarbonization goals and assess project viability.

- Customized Consulting Solutions: We offer tailored consulting services for expanding production, entering new markets, and developing infrastructure, providing actionable solutions for growth.

As the green hydrogen market evolves, IMARC Group remains a trusted partner, delivering insights, forecasts, and strategic support. For detailed market trends and opportunities, access the complete report here: https://www.imarcgroup.com/green-hydrogen-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)