India’s Economic Growth Surpasses Japan: Now 4th Largest Global Economy

.webp)

A Historic Milestone for India’s Economy

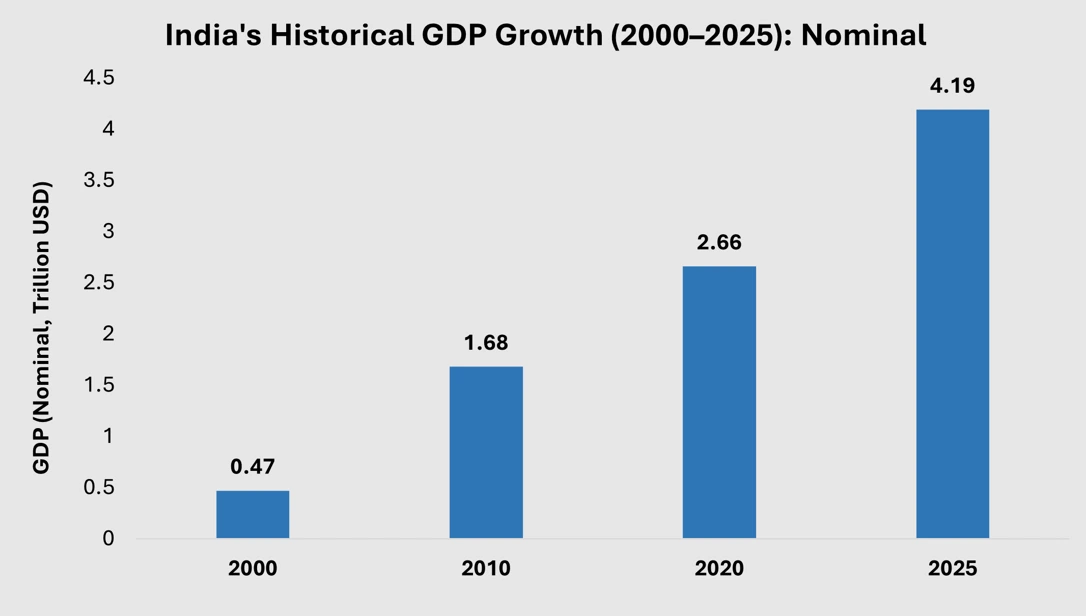

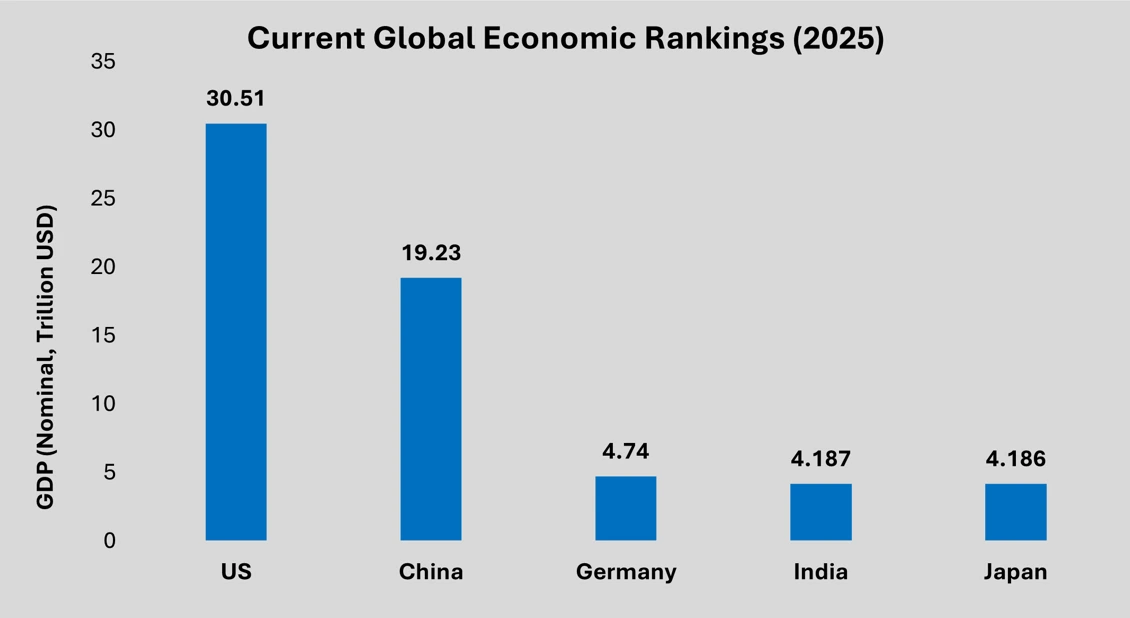

In a landmark achievement, India has surpassed Japan to become the world’s fourth-largest economy in 2025, with a nominal GDP of $4.187 Trillion, according to the International Monetary Fund (IMF). This milestone, driven by robust growth, strategic reforms, and favorable global conditions, positions India as a global economic powerhouse, trailing only the United States, China, and Germany. As India celebrates this ascent, the nation sets its sights on overtaking Germany to claim the third spot by 2028. Join us as we explore the drivers, implications, and future prospects of India’s economic rise.

India Surpasses Japan to Become the World’s 4th Largest Economy

India’s GDP reached $4.187 Trillion in 2025, edging out Japan’s $4.186 Trillion, as per IMF projections. This marks a remarkable journey from the 10th largest economy in 2014 to the 4th in just 11 years, fueled by a 6.2% GDP growth rate—the fastest among major economies. NITI Aayog CEO BVR Subrahmanyam hailed this as a testament to India’s dynamic growth, with projections indicating a $5 Trillion economy by 2027.

Source: IMF

Source: IMF

Key Growth Drivers: Domestic Demand, Digital Push, and Infrastructure Investments

India’s economic surge is powered by:

- Domestic Demand: A young, urbanizing population and rising consumer spending drive sectors like retail and technology.

- Digital Transformation: Initiatives like Digital India and UPI have made India a hub for tech innovation, with the IT sector contributing significantly to GDP.

- Infrastructure Investments: Government schemes like Bharatmala and Sagarmala, alongside $1.5 Trillion in planned infrastructure spending, boost industrial and logistics growth.

Japan’s Economic Stagnation Opens the Door for India’s Rise

Japan’s economy, once valued at $6 Trillion in 2010, has shrunk to $4.186 Trillion due to an aging population, stagnant productivity, and deflation. With a growth rate of just 0.6% in 2025, Japan’s decline contrasts with India’s vibrant 6.2% growth. India’s demographic advantage—a young workforce and increasing urbanization—has enabled it to capitalize on Japan’s slowdown.

Enhanced Global Influence and Investment Attractiveness for India

India’s ascent strengthens its global influence, making it a prime destination for foreign direct investment (FDI). In 2024, India attracted $81 Billion in FDI, driven by its stable policies and growing market. The nation’s role in global trade, bolstered by pacts like the India-ASEAN FTA, enhances its geopolitical clout. Investors are drawn to India’s tech ecosystem, manufacturing growth, and renewable energy push, including the 280 GW solar target by 2030.

High-Growth Sectors Fueling India’s Economic Momentum

Key sectors driving India’s growth include:

- Manufacturing: The Production-Linked Incentive (PLI) scheme boosts electronics and steel production, with companies like Tata Steel supporting solar infrastructure.

- Technology: India’s IT and startup ecosystem, with over 100 unicorns, drives innovation and exports.

- Renewable Energy: Solar and wind projects, backed by the National Solar Mission, align with India’s net-zero goals.

- Services: The financial and hospitality sectors thrive on domestic demand and digital adoption.

India Eyes the 3rd Spot: Strong Macroeconomic Fundamentals at Play

India is poised to overtake Germany by 2028, with a projected GDP of $5.584 Trillion. Strong fundamentals include:

- Stable Growth: IMF forecasts 6.2%–6.3% growth in 2025–26, outpacing global peers.

- Reforms: Policies like GST and Make in India enhance competitiveness.

- Demographic Dividend: A workforce of 600 Million by 2030 supports long-term growth.

Looking Ahead: Opportunities for Stakeholders

India’s rise to the 4th largest economy opens doors for investors, manufacturers, and policymakers. The nation’s focus on infrastructure, digital innovation, and sustainability—including its solar market expansion—creates opportunities across sectors. However, addressing income inequality and boosting per capita GDP remain critical for inclusive growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)