Rubber Seed Oil Cost Model: From Agro-Waste to Industrial Value

_11zon.webp)

What is Rubber Seed Oil?

Rubber seed oil (RSO) is an inedible vegetable oil derived from the seeds of the rubber tree (Hevea brasiliensis), long regarded as a natural rubber plantation agricultural by-product.

Key Applications Across Industries:

The oil is distinguished by a very high percentage of unsaturated fatty acids, mostly linoleic and linolenic acids, with small proportions of palmitic, oleic, and stearic acids. With its golden-yellow hue, moderate viscosity, and oxidative drying characteristics, rubber seed oil finds application in various industrial uses. The oil is usually acquired using mechanical pressing or solvent extraction of dried rubber seeds. Though not fit for direct human consumption owing to its anti-nutritional factors, RSO is much sought after as a feedstock in biodiesel manufacturing, surface coating, alkyd resins, and lubricants. Its use minimizes waste from rubber estates as well as provides a renewable substitute for petro-based inputs. It is economically viable since it uses current agro-resources at low additional cultivation cost, thus promoting circular and sustainable practices. In the future, rubber seed oil will have great potential in the international bio-based chemicals market, catering to growing trends in renewable energy, green paints, and sustainable polymer industries.

What the Expert Says: Market Overview & Growth Drivers

The global rubber seed oil market size reached USD 1,252 Million in 2024. According to IMARC Group, the market is projected to reach USD 1,937 Million by 2033, at a projected CAGR of 4.9% during 2025-2033. Demand for rubber seed oil is primarily fueled by the worldwide transition towards sustainable and renewable raw materials.

The prime driver is the production of biodiesel, with RSO's fatty acid composition qualifying it as a valuable non-edible oil feedstock, thus steering clear of the food-versus-fuel dilemma. Another key consumer is the coatings and paints sector, tapping its drying oil properties to produce alkyd resin. Increasing demand for biolubricants and sustainable surfactants further consolidates the market base. RSO is a low-cost, abundant feedstock due to an abundance of underutilized rubber seeds in Southeast Asia and Africa. Future trends involve its use in bio-based polymers, green composites, and specialty oleochemicals. Advances in the technology of solvent extraction and refining are likely to enhance yields and product quality. Competitive strengths are low raw material price and sustainability. Challenges include uneven seed gathering, seasonal availability, and lower oxidative stability than edible oils. Sustainability aspects are high in that RSO capitalizes on crop waste and diminishes fossil-based resource reliance. Industry reactions are organized collection networks, pilot-plant biodiesel facilities, and research to enhance oil stability by chemical modification.

Case Study on Cost Model of Rubber Seed Oil Manufacturing Plant:

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a large-scale rubber seed oil manufacturing plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed rubber seed oil manufacturing plant in Côte d'Ivoire. This plant is designed to produce 300,000 tons of rubber seed oil annually.

Manufacturing Process: The production of rubber seed oil is initiated with the purchase of raw materials, mainly pure copper scrap, industrial-grade sulfuric acid, and distilled water. Scrap needs to be oil-free, free from oxidation, or brass/bronze contamination to facilitate efficient dissolution. Industrial-grade sulfuric acid (66° Baumé) is diluted to a nominal concentration of ~20% in acid-resistant vessels, with controlled heat to maximize reaction kinetics. The acid is then diluted and loaded into a lead-lined reactor that houses copper scrap. To speed up the process, compressed air is sometimes oxygen or ozone-enriched is sparged at the bottom of the reactor while mechanical agitation maintains even mixing. Copper is oxidized in a controlled manner at 50–60°C to produce Rubber Seed Oil in solution. Progress of the reaction is followed by measuring free acid concentration and visual scrap consumption. After completion of dissolution, the mixture is filtered through acid-resistant units to eliminate undissolved residues. The solution is then evaporated gently in lead-lined pans to produce supersaturation without unnecessary crystallization. On controlled cooling, Rubber Seed Oil crystals precipitate out from the mother liquor. These are separated by filtration or centrifugation, distilled water is used for washing, and then they are dried to the extent of desired moisture. Lastly, the product is packaged in HDPE bags or drums with anti-moisture protection and good labelling. This process guarantees product integrity while being stored and shipped to agricultural, chemical, and industrial consumers.

_11zon.webp)

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials used in the rubber seed oil producing plant are rubber seed, n-Hexane, and water. For a plant producing 1 ton of rubber seed oil, 4.0 ton of rubber seed, 0.010 ton of n-Hexane, and 0.5 ton of water is required.

Machineries Required:

- Rubber preparation and pressing line (with Disc Sheller and Kernel-Shell Separators)

- Drag Chain & Double Negative Pressure Evaporation Extraction

- Rubber Seed Oil Refining Equipment

- Rubber Seed Oil Fractionation Equipment

- Automatic weighing filling machine for large packages

- Steam boiler included

- Automation control system

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

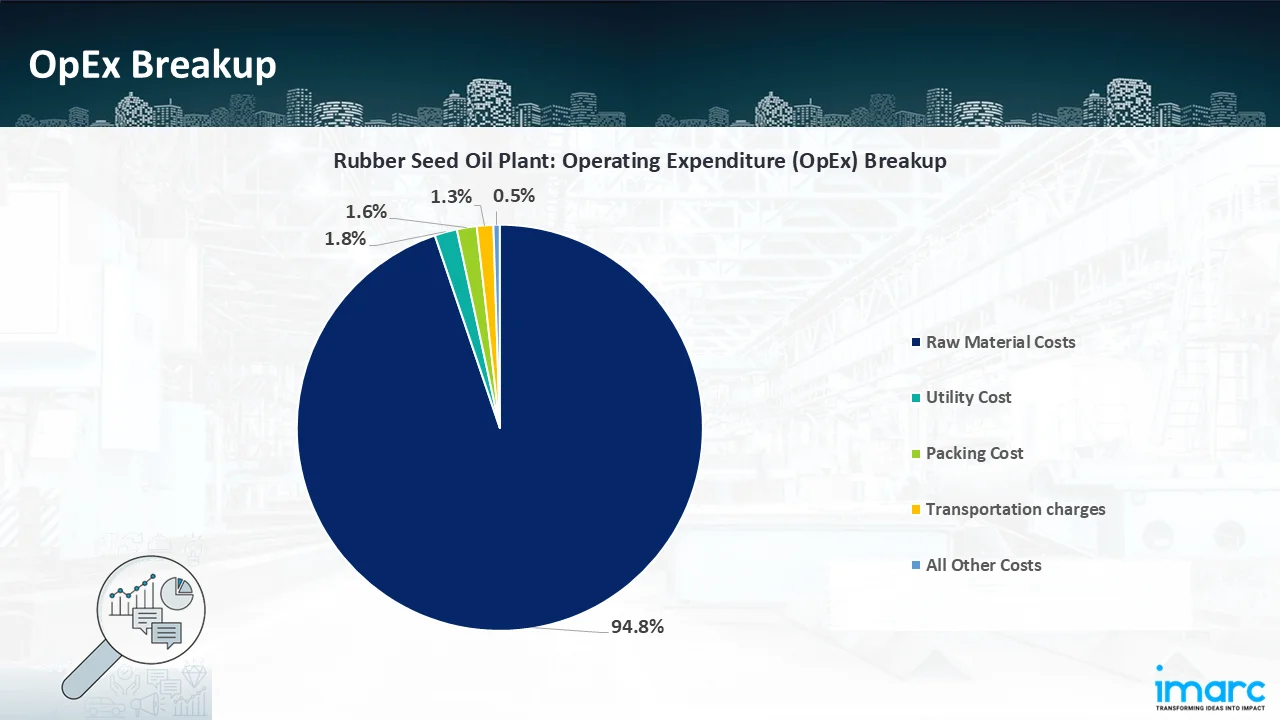

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

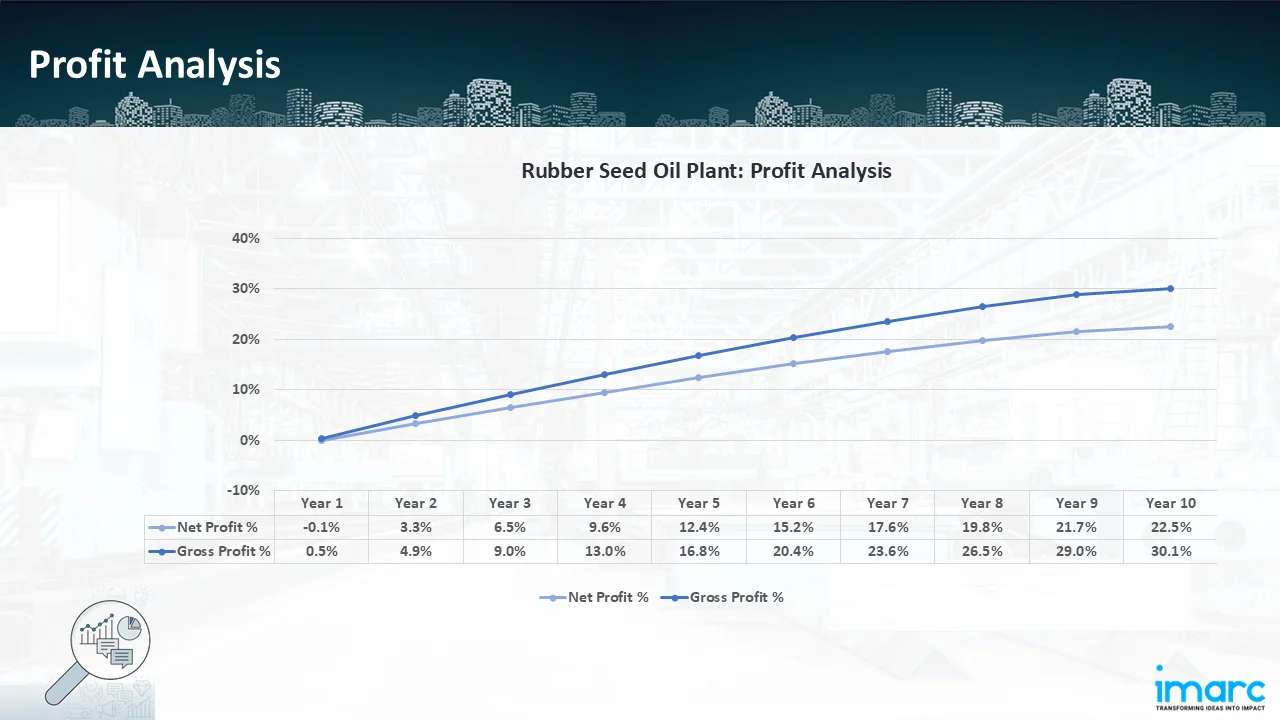

- Profitability Analysis Year on Year Basis: The proposed rubber seed oil plant, with a capacity of 300,000 tons of rubber seed oil annually, achieved an impressive revenue of US$ 346.4 Million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins improve from 0.5% to 30.1% by year 10, and net profit rises from a negative of 0.1% to a positive of 22.5%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the rubber seed oil manufacturing plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of producing 300,000 tons of rubber seed oil annually, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

Latest News and Developments:

- In June 2025, Eni announced the first export of vegetable oil made from rubber tree leftovers from Côte d'Ivoire, in keeping with the company's decarbonisation goal and the sustainable growth of regional agricultural supply chains. Côte d'Ivoire is home to a large rubber plantation, and the industrialisation of its byproducts is a tangible illustration of the circular economy that benefits farming communities by generating revenue and diversifying their economies.

- In May 2025, the first Joint Coordination Committee (JCC) meeting under the SATREPS project on "Development of Utilisation Technology of Rubber Seeds for Green Products to Mitigate Global Warming and Plastic Pollution" was preceded by a plenary session attended by the National Energy Technology Centre (ENTEC), which is part of the National Science and Technology Development Agency (NSTDA). Supported by the Japan Science and Technology Agency (JST) and the Japan International Cooperation Agency (JICA), this project is a five-year bilateral research partnership between Thailand and Japan (2024–2029).

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.