Instrument Transformer Market Size, Share, Trends and Forecast by Type, Voltage, Enclosure Type, Cooling Method, Application, End User, and Region, 2025-2033

Instrument Transformer Market Size and Share:

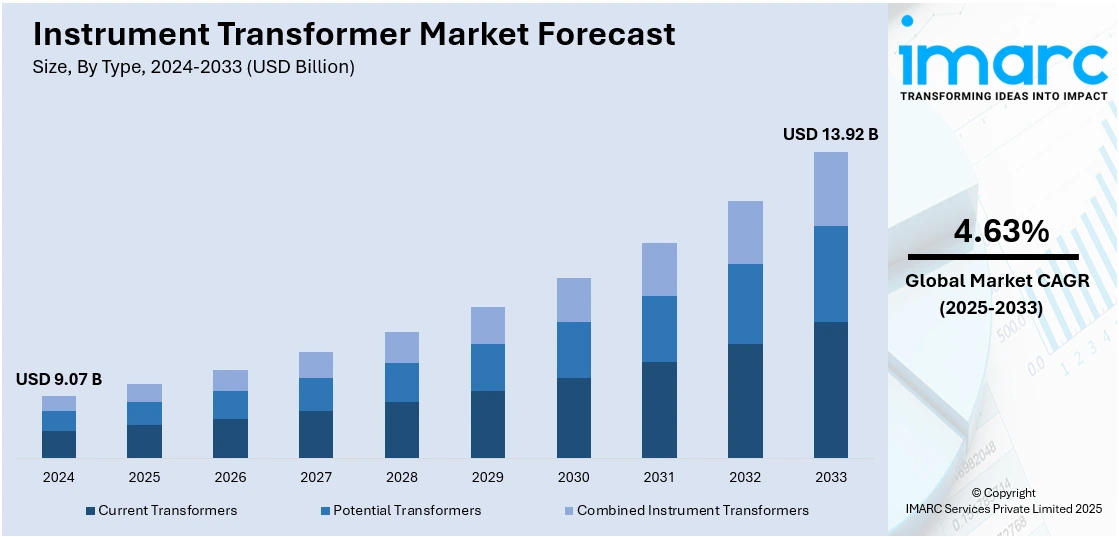

The global instrument transformer market size was valued at USD 9.07 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.92 Billion by 2033, exhibiting a CAGR of 4.63% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 46.5% in 2024. The dominance of the region is accredited to large-scale investments in power generation and transmission infrastructure, especially in countries like India and China. The region’s fast-paced urbanization, rising electricity usage, and strong focus on renewable energy integration are catalyzing the demand for reliable grid components. Government initiatives supporting smart grid expansion and rural electrification further contribute to the increasing instrument transformer market share in the Asia Pacific region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.07 Billion |

|

Market Forecast in 2033

|

USD 13.92 Billion |

| Market Growth Rate 2025-2033 | 4.63% |

Numerous nations are experiencing increasing electricity usage because of urban expansion, industrial progress, and rural electrification initiatives. This trend requires a more extensive and sturdy power infrastructure, comprising new substations, overhead lines, and underground cables. Instrument transformers are critical elements in these networks, delivering precise current and voltage readings for protection and surveillance. In addition, the worldwide shift towards clean energy is resulting in a rise in solar and wind power setups. These renewable sources add variability and intermittency to power systems, necessitating precise sensing and protection devices to ensure grid stability. Instrument transformers assist in handling this complexity by delivering accurate measurements that contribute to control and protection systems within hybrid power systems.

The United States plays a vital role in the market, driven by substantial investments in local manufacturing capabilities, as businesses increase output to satisfy the growing demand from grid upgrades and expansion initiatives. These advancements also indicate a wider effort to localize supply chains and enhance the resilience of energy infrastructure across the country. For example, in 2024, Ritz Instrument Transformers revealed a $28 million investment to establish a new high-voltage instrument transformer plant in Waynesboro, Georgia. The new facility was designed to integrate current operations and facilitate the growth of the US electrical grid. Apart from this, federal and state-level programs are accelerating the rollout of smart grids, which depend on digital substations and automated control systems. Instrument transformers with digital output capabilities and compatibility with intelligent electronic devices (IEDs) are in high demand to support real-time data acquisition and fault response.

Instrument Transformer Market Trends:

Grid Modernization and Electrification Demand

The upgrade of power infrastructure and the emergence of smart grids are catalyzing the demand for instrument transformers, which are crucial for precise current and voltage measurement. Utilities are modernizing outdated transmission and distribution systems to handle increased voltages, enhance digital monitoring, and integrate renewable energy sources. Instrument transformers offer essential isolation and scaling capabilities that facilitate safe metering and protection of the grid. Their role is becoming more crucial as nations aim for widespread electrification, especially in rural and industrial regions where grid expansion is speeding up. For instance, in 2025, GE Vernova hosted the ‘New Era of Energy’ forum in Riyadh, announcing major investments in local grid equipment manufacturing and digitalization. The company expanded its Dammam facilities and signed an MoU with SEC to modernize Saudi Arabia’s power grid. Such initiatives highlight the increasing significance of instrument transformers in future power systems.

Investment in Rural Electrification Programs

Government and development agency-led rural electrification efforts are driving the demand for instrument transformers, which are vital for providing safe and stable power supply in underserved regions. These initiatives frequently involve new transmission infrastructure, substation installations, and distribution enhancements, which necessitate dependable current and voltage measurements for metering and protection. Instrument transformers designed for harsh environments and minimal upkeep are especially beneficial in rural power systems, which often experience voltage variations and inconsistent loads. In 2025, the Uasin Gishu County Government and REREC introduced the "Stima Mashinani" initiative aimed at increasing electricity accessibility and fostering a 24-hour economy. The initial stage aims to link more than 600 homes in six sub-counties. The initiative aims to raise the county's electrification rate from 65% to 95% by the year 2030. Instrument transformers will be crucial in facilitating this shift by providing dependable measurement and protection features to support network growth.

Rise of Data Centers and High-Density Loads

The swift expansion of data centers to facilitate artificial intelligence (AI), cloud services, and digital platforms is leading to a heightened need for instrument transformers, which are crucial for ensuring electrical reliability in high-demand settings. These facilities have considerable power demands and need to carefully track electrical parameters to maintain steady uptime, identify faults, and manage thermal conditions. Instrument transformers facilitate real-time, high-accuracy monitoring of current and voltage, aiding in energy efficiency, risk management, and adherence to operational standards. In 2025, Engine No. 1 and Crusoe revealed a partnership to construct extensive AI data center campuses throughout the United States, focused on expediting the deployment of sophisticated computing infrastructure. Initiatives of this magnitude emphasize the necessity of dependable power monitoring devices to handle intricate load patterns and enhance power usage efficiency (PUE). With the rise in AI and cloud usage, instrument transformers will continue to be essential in sustaining robust and efficient electrical systems in the digital infrastructure ecosystem.

Instrument Transformer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global instrument transformer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, voltage, enclosure type, cooling method, application, and end user.

Analysis by Type:

- Current Transformers

- Potential Transformers

- Combined Instrument Transformers

Current transformers lead the market, accounting 47.7% market share because of their crucial function in monitoring, protecting, and controlling power systems throughout transmission and distribution networks. They are commonly utilized to reduce high current levels and quantifiable values, allowing for safe and precise current measurement for metering and protective relays. Their widespread use in substations, industrial sites, and utility grids renders them essential for real-time system diagnostics and fault identification. With the growing electricity requirement, grid modernization initiatives, and incorporation of renewable energy sources, the need for precise current measurement is intensifying, catalyzing the demand for current transformers. Their adaptability in design, affordability, and compatibility with digital protection systems render them a favored option compared to other types of transformers. Moreover, progress in technology is improving their precision, size, and efficiency when subjected to varying load conditions, solidifying their status as the top segment in the industry.

Analysis by Voltage:

- Distribution Voltage

- Sub-Transmission Voltage

- High Voltage Transmission

- Extra High Voltage Transmission

- Ultra-High Voltage Transmission

High voltage transmission holds the biggest market share with 34.1% in 2024. The dominance of the segment is driven by the increasing demand for effective long-range power transmission and grid reliability in growing energy networks. With rising electricity demand in urban and industrial areas, utilities are progressively depending on high voltage systems to reduce transmission losses and ensure voltage regulation across long distances. Instrument transformers utilized in high voltage settings are crucial for precise monitoring, metering, and safeguarding of equipment in substations and transmission corridors. The worldwide drive for integrating renewable energy, typically situated far from demand centers, increases the need for high voltage transmission infrastructure. Governments and utility companies are investing in ultra-high voltage and smart grid initiatives, increasing the demand for dependable and high-performance instrument transformers. These transformers are built to function under severe electrical stress and harsh environmental conditions, making them essential for maintaining the safe, stable, and efficient operation of contemporary power systems.

Analysis by Enclosure Type:

- Indoor

- Outdoor

Outdoor dominates the market with 64.7% of market share in 2024 because of its extensive application in high-voltage transmission and distribution systems, commonly found in open settings. Outdoor transformer is designed to endure severe weather conditions, temperature changes, and contamination, guaranteeing dependable performance and extended durability. Electric utilities depend significantly on outdoor instrument transformer for extending the grid, setting up substations, and connecting renewable energy sources, particularly in distant or rural locations. The sturdy construction and effective insulation systems of outdoor enclosure make it ideal for essential applications where equipment malfunction might lead to extensive power outages. Additionally, as global electricity demand increases and investments in large-scale utility infrastructure continue, there is an increase in requirement for high-performance, low-maintenance transformers suitable for outdoor use. The instrument transformer market report highlights that this segment is poised for continued growth, fueled by grid modernization initiatives, smart grid development, and accelerating adoption of renewable energy projects.

Analysis by Cooling Method:

- Dry-Type

- Oil Immersion

Dry-type stands as the largest component in 2024, holding 72.3% of the market owing to improved safety, environmental advantages, and its appropriateness for indoor and high-density settings. In contrast to oil-filled transformers, dry-type unit removes the danger of oil leaks or fire risks, making it ideal for use in commercial structures, subterranean substations, and delicate industrial settings. Its streamlined design, reduced upkeep needs, and extended lifespan attract utilities and industries looking to cut operational expenses and minimize downtime. Moreover, increasing environmental worries and regulations on dangerous materials are encouraging the transition towards non-combustible, environment-friendly insulation systems utilized in dry-type transformer. Besides this, technological progress is enhancing the thermal efficiency and voltage handling ability of dry-type system, allowing for extensive application in medium- and high-voltage systems.

Analysis by Application:

- Transformer and Circuit Breaker Bushing

- Switchgear Assemblies

- Relaying

- Metering and Protection

Transformer and circuit breaker bushing represent the largest segment, holding 32.1% of market share in 2024 due to their critical function in the performance and protection of high-voltage equipment. These elements offer insulated routes for electrical conductors to transit safely through grounded barriers, ensuring dependable power transmission in substations and switchyards. As electricity networks grow and function at increased voltages, the need for bushings that ensure reliable, precise current and voltage measurement rises considerably. Instrument transformers incorporated into bushings provide compact, economical solutions by combining measurement and insulation capabilities. Utilities and industries favor these setups for upgrading old systems and enhancing new installations. Moreover, the growing investments in substation automation and the incorporation of renewable energy systems are catalyzing the demand for sophisticated monitoring solutions, which in turn boosts the adoption of bushing-type transformers. These bushings enhance system reliability and safety, making them the ideal choice for environments that demand continuous, high-load operations and consistent grid performance.

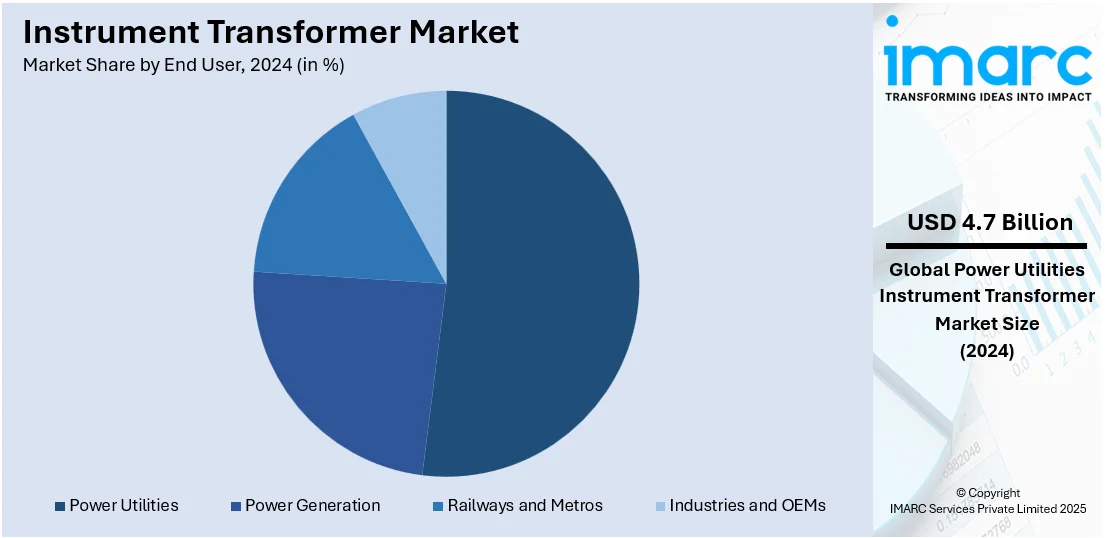

Analysis by End User:

- Power Utilities

- Power Generation

- Railways and Metros

- Industries and OEMs

Power utilities lead the market with 52.2% of market share in 2024 because of their significant involvement in electricity generation, transmission, and distribution in urban and rural regions. These organizations are consistently enhancing and broadening grid infrastructure to accommodate rising electricity needs, guarantee reliability, and incorporate renewable energy resources. Instrument transformers are vital for observing and safeguarding power systems, rendering them indispensable for large-scale utilities. Utility companies are investing in smart grid technologies that necessitate precise voltage and current measurements, thereby catalyzing the demand for high-performance instrument transformers. Aging grid systems in numerous areas are experiencing upgrades, leading utilities to swap out old equipment for more efficient and digitally compatible options. Moreover, government regulations and safety standards for the grid, as well as efficiency and emissions control, are encouraging power utilities to implement advanced transformer technologies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 46.5% due to its swift economic growth, continuous urbanization, and major investments in energy infrastructure. Nations like China, India, and South Korea are experiencing a rise in electricity demand fueled by industrial growth, a growing population, and heightened electrification in rural and semi-urban regions. Governing bodies throughout the area are vigorously encouraging the use of renewable energy, creating a demand for sophisticated grid systems and dependable transmission elements, such as instrument transformers. Additionally, numerous national smart grid projects, infrastructure upgrade initiatives, and international power transmission schemes are driving the installation of cutting-edge transformers. For example, in 2024, India aimed to invest over $360 billion in renewable energy and infrastructure by 2030, aiming for 500 GW of renewable capacity. Additional funds would support electricity transmission, distribution, and storage. Besides this, initiatives aimed at minimizing transmission losses, enhancing grid stability, and facilitating renewable energy integration are catalyzing the demand for instrument transformers in the diverse and changing power landscape of the Asia-Pacific region.

Key Regional Takeaways:

United States Instrument Transformer Market Analysis

In North America, the United States accounted for 91.10% of the market, driven by the growing focus on power quality monitoring and grid reliability. With increasing electricity use, utilities are prioritizing enhancements to grid resilience, where instrument transformers are essential for fault detection, isolation, and load monitoring. The International Energy Agency (IEA) reports that overall electricity generation in the United States hit 4,439,413 GWh in 2023. Federal initiatives that promote energy efficiency and infrastructure improvements are also motivating utilities to implement more accurate and reliable measurement systems. Moreover, the increasing presence of decentralized energy systems and microgrids is driving the demand for smaller and more efficient instrument transformers designed for localized power settings. Additionally, utilities are putting funds into predictive maintenance technologies that depend on precise current and voltage readings, which functions effectively facilitated by contemporary instrument transformers. The growing incorporation of digital twins and AI-driven energy management systems in power networks boosts the need for real-time data collection, further promoting the use of advanced transformer technologies. Apart from this, environmental regulations targeting the reduction of the carbon footprint in power systems are impacting transformer design and material selections, encouraging advancements in dry-type and gas-insulated options.

Europe Instrument Transformer Market Analysis

The instrument transformer market in Europe is witnessing substantial expansion, driven by the European Union’s strict regulations and initiatives encouraging sustainability and energy efficiency. Expenditures on enhancing outdated electrical systems and incorporating renewable energy sources, like wind and solar, are offering a favorable instrument transformer market outlook. Recent industry reports indicate that 16.4 GW of fresh wind power capacity was installed in Europe in 2024. Europe currently possesses 285 GW of wind generating capacity, with 248 GW onshore and 37 GW offshore. Furthermore, between 2025 and 2030, Europe is projected to increase its wind generation capacity by 187 GW. The emphasis on smart grid technology and the necessity for precise relaying, metering, and safeguarding in high voltage applications further strengthen the market growth. Apart from this, the increasing digitalization of the energy sector and the growth of the smart grid in the area are encouraging the use of instrument transformers. Intelligent grids, aided by these transformers, facilitate energy optimization, minimize losses, and improve the overall efficiency of the system. As a result, the need for high-performance transformers capable of managing intricate measurement and monitoring functions is being fueled by investments in digital technologies and smart grid systems.

Asia Pacific Instrument Transformer Market Analysis

The Asia Pacific market for instrument transformers is expanding because of the swift urban development, industrial growth, and the incorporation of renewable energy. Nations like China and India are making significant investments to enhance their power infrastructure to cater to rising electricity needs. For example, in India, the electricity produced in 2022-23 hit 1624.158 BU, marking an increase of about 8.87% compared to 2021-22, which was 1491.859 BU, according to the Indian Ministry of Power. Additionally, China's emphasis on ultra-high voltage (UHV) transmission initiatives and the growth of smart grids are catalyzing the demand for high-voltage instrument transformers crucial for effective energy transmission. Likewise, programs in India like the Revamped Distribution Sector Scheme (RDSS) seek to upgrade power distribution and improve grid efficiency, subsequently increasing the need for sophisticated instrument transformers. In addition to this, government initiatives that encourage energy efficiency and sustainability, along with funding for smart grid technologies, are encouraging the uptake of digital and compact instrument transformers throughout the region.

Latin America Instrument Transformer Market Analysis

The demand for electricity is greatly influencing the instrument transformer market growth in Latin America. This is driven by swift urban growth and industrial development, which is accelerating the growth and modernization of power infrastructure throughout the area. In addition, many governments in the region are funding renewable energy initiatives, including wind and solar farms, that necessitate sophisticated instrument transformers for effective grid integration. For example, nations like Brazil and Mexico are at the forefront of renewable energy adoption, creating a demand for dependable and precise power measurement solutions. In 2023, according to industry reports, 89% of Brazil's electricity production was derived from renewable sources. Efforts to enhance energy efficiency and sustainability are promoting the implementation of smart grids, which is increasing the need for digital instrument transformers.

Middle East and Africa Instrument Transformer Market Analysis

The instrument transformer market in the Middle East and Africa is being significantly driven by swift industrial growth and infrastructure advancement throughout the region, leading to a rising demand for dependable power distribution systems. Nations like the United Arab Emirates are making substantial investments in renewable energy initiatives, requiring sophisticated instrument transformers for effective grid integration. Moreover, the rise of smart grid technologies and the upgrade of current power systems are resulting in higher use of digital instrument transformers. A report from the IMARC Group indicates that the smart grid market in Saudi Arabia is projected to hit USD 3,272.80 Million by 2033, expanding at a CAGR of 14.20% between 2025 and 2033. The area's emphasis on improving energy efficiency and lowering carbon emissions further support the market growth.

Competitive Landscape:

Major participants in the market are concentrating on strategic efforts to enhance their market position and meet changing client needs. These firms are making notable investments in research operations to create innovative, compact, and energy-efficient transformer solutions that facilitate smart grid integration and digital oversight. There is a focus on increasing manufacturing capacity and improving supply chain robustness to address rising global demand. Collaborative alliances, mergers, and acquisitions are being sought to gain entry into new markets and technologies. For example, in 2024, Standex International acquired Amran Instrument Transformers (USA) and Narayan Powertech Pvt. Ltd. (India) for approximately $462 million. The deal is expected to be immediately accretive and boost exposure to fast-growing electrical grid markets. Moreover, major companies are embracing sustainable practices by creating environment-friendly and recyclable products.

The report provides a comprehensive analysis of the competitive landscape in the instrument transformer market with detailed profiles of all major companies, including:

- ABB Ltd.

- Amran Inc

- CG Power and Industrial Solutions Limited (Murugappa Group)

- Eaton Corporation plc

- EMEK Electrical Industry Inc

- Indian Transformers and Electricals PVt. Ltd

- Instrument Transformer Equipment Corporation (Power Grid Components Inc.)

- Mehru Electrical & Mechanical Engineers (P) Ltd

- Mitsubishi Electric Corporation

- Pfiffner Instrument Transformers Ltd

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

Latest News and Developments:

- March 2025: Quality Power Electrical Equipments Ltd. acquired a majority stake in Mehru Electrical and Mechanical Engineers Pvt. Ltd. Mehru specialized in high-voltage instrument transformers, including current and potential transformers, serving utilities and power transmission networks.

- February 2025: Hioki E.E. Corporation launched the Partial Discharge Detector ST4200, a device created to improve the precision and effectiveness of motor testing. The ST4200 featured a high-frequency current transformer (CT), which is a type of instrument transformer, delivering noise-resistant capabilities and guaranteeing precise PD detection even in high-interference manufacturing conditions.

- October 2024: Standex International acquired US-based Amran Instrument Transformers and India's Narayan Powertech Pvt. Ltd. for a combined USD 462 million. Both companies specialized in low- and medium-voltage instrument transformers used in electrical grid applications. This strategic move significantly expanded Standex's presence in the high-growth electrical grid market, which is driven by infrastructure upgrades, data center demand, and renewable energy initiatives.

Instrument Transformer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Current Transformers, Potential Transformers, Combined Instrument Transformers |

| Voltages Covered | Distribution Voltage, Sub-Transmission Voltage, High Voltage Transmission, Extra High Voltage Transmission, Ultra-High Voltage Transmission |

| Enclosure Types Covered | Indoor, Outdoor |

| Cooling Methods Covered | Dry-Type, Oil Immersion |

| Applications Covered | Transformer and Circuit Breaker Bushing, Switchgear Assemblies, Relaying, Metering and Protection |

| End Users Covered | Power Utilities, Power Generation, Railways and Metros, Industries and OEMs |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Amran Inc, CG Power and Industrial Solutions Limited (Murugappa Group), Eaton Corporation plc, EMEK Electrical Industry Inc, Indian Transformers and Electricals PVt. Ltd, Instrument Transformer Equipment Corporation (Power Grid Components Inc.), Mehru Electrical & Mechanical Engineers (P) Ltd, Mitsubishi Electric Corporation, Pfiffner Instrument Transformers Ltd, Schneider Electric SE, Siemens AG, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the instrument transformer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global instrument transformer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the instrument transformer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The instrument transformer market was valued at USD 9.07 Billion in 2024.

The instrument transformer market is projected to exhibit a CAGR of 4.63% during 2025-2033, reaching a value of USD 13.92 Billion by 2033.

The instrument transformer market is driven by increasing investments in power infrastructure, the expansion of smart grids, rising electricity demand, and growing focus on grid reliability and safety. Additionally, renewable energy integration and ongoing industrial automation support market growth across transmission and distribution networks.

Asia Pacific currently dominates the instrument transformer market, accounting for a share of 46.5%. The dominance of the region is attributed to rapid urbanization, expanding power infrastructure, increasing industrialization, and significant investments in renewable energy and smart grid development projects.

Some of the major players in the instrument transformer market include ABB Ltd., Amran Inc, CG Power and Industrial Solutions Limited (Murugappa Group), Eaton Corporation plc, EMEK Electrical Industry Inc, Indian Transformers and Electricals PVt. Ltd, Instrument Transformer Equipment Corporation (Power Grid Components Inc.), Mehru Electrical & Mechanical Engineers (P) Ltd, Mitsubishi Electric Corporation, Pfiffner Instrument Transformers Ltd, Schneider Electric SE, Siemens AG, Toshiba Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)