Insulated Packaging Market Size, Share, Trends and Forecast by Packaging Type, Material Type, Packaging Form, Application, and Region, 2025-2033

Insulated Packaging Market Size and Share:

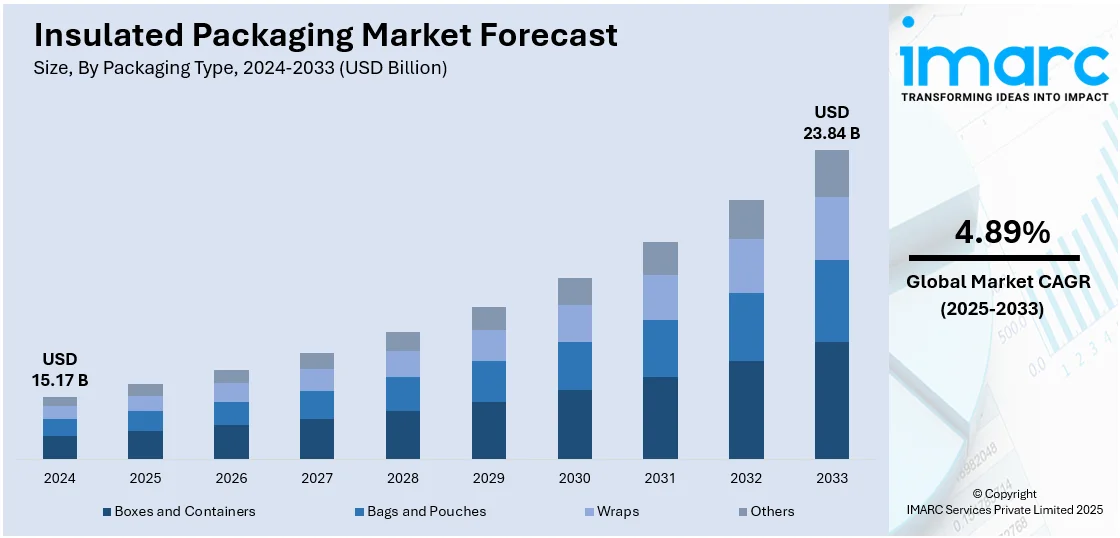

The global insulated packaging market size was valued at USD 15.17 Billion in 2024. It is projected to reach USD 23.84 Billion by 2033, exhibiting a CAGR of 4.89% from 2025-2033. The growth in the market is due to the increasing demand for temperature-sensitive products in pharmaceuticals, biotechnology, and food companies, as well as growth in the e-commerce industry and the growing need for sustainability.

Market Insights:

- Asia-Pacific leads the market, accounting for more than 35.8% of the share in 2024, spurred by high industrialization, urbanization, and need for temperature-sensitive products.

- By Packaging Type, boxes and containers lead the market, holding 45.7% of the share due to their versatility, durability, and robust thermal insulation capabilities.

- By Material Type, plastic holds the largest market share (35%) due to its cost-effectiveness, superior insulation, and versatility in various applications.

- By Packaging Form, flexible packaging holds the largest share at 53.1%, favored for its adaptability and cost-efficiency in food, pharmaceuticals, and e-commerce sectors.

Market Size & Forecast:

- 2024 Market Size: USD 15.17 Billion

- 2033 Projected Market Size: USD 23.84 Billion

- CAGR (2025-2033): 4.89%

- Asia-Pacific: Largest market in 2024

The global market is being driven by the rising demand for temperature-sensitive goods across pharmaceuticals, biotechnology, and food industries. The growth of international cold chain logistics is enhancing the need for advanced insulation solutions that ensure product integrity during transit. Increasing health awareness and consumer preference for fresh and organic products are also compelling manufacturers to adopt packaging that preserves quality and extends shelf life. Additionally, growth in e-commerce and cross-border trade of perishables is generating demand for efficient thermal packaging. Regulatory frameworks mandating quality preservation in pharmaceuticals and biopharmaceuticals further amplify the necessity of insulated materials, positioning them as essential in the global supply chain landscape. For instance, in February 2024, Smurfit Kappa collaborated with Borough Broth to enhance their insulated packaging, transitioning from plain boxes to branded, sustainable solutions. The new packaging eliminated the use of wool insulation, opting for corrugated cardboard that maintains temperature control between 5–8°C during transit. This innovation not only improved thermal performance but also optimized warehouse space and reduced costs. Additionally, the custom-printed boxes reinforced Borough Broth's brand identity and commitment to sustainability. This partnership underscores the growing trend of integrating eco-friendly materials and branding into packaging solutions.

To get more information on this market, Request Sample

The insulated packaging market growth in the United States is influenced by the expansion of the direct-to-consumer pharmaceutical and meal kit delivery sectors. The rise in online grocery shopping and demand for on-demand food delivery services is accelerating the need for reliable thermal packaging solutions. Furthermore, stringent FDA regulations concerning drug and vaccine transportation have heightened the use of temperature-controlled packaging within the healthcare sector. The country’s well-established logistics and cold chain infrastructure also supports the widespread adoption of insulated packaging. Moreover, growing environmental awareness is encouraging the development of recyclable and biodegradable insulated materials, reinforcing the market’s progression in alignment with sustainable packaging trends.

Insulated Packaging Market Trends:

Surge in E-Commerce Accelerating Insulated Packaging Demand

The rapid growth of global e-commerce, now valued at USD 6.8 trillion and projected to surpass USD 8 trillion by 2027, is significantly influencing the insulated packaging market. Online retail platforms increasingly rely on effective packaging solutions to protect perishable and temperature-sensitive goods such as groceries, pharmaceuticals, and cosmetics during storage and long-distance transit. Insulated packaging ensures thermal stability, reduces product spoilage, and enhances customer satisfaction. As the demand for same-day and next-day delivery rises, the need for packaging that can maintain product integrity during unpredictable environmental exposures is becoming crucial. This shift is driving innovation in thermal materials and smart packaging technologies, reinforcing the indispensable role of insulated packaging in the evolving e-commerce supply chain ecosystem.

Rising RTE Food Exports Fueling Packaging Innovation

The growing demand for ready-to-eat (RTE) food products, driven by shifting consumer lifestyles and dietary preferences, is bolstering the insulated packaging market. India's RTE food exports have grown from USD 765.80 million in 2018–19 to USD 1,435.56 million in 2022–23, highlighting global appetite for processed convenience foods. Insulated packaging plays a vital role in preserving the freshness, flavor, and nutritional value of such products during transportation. It protects against temperature fluctuations and prevents spoilage or leakage. Manufacturers are also responding by developing advanced multilayer insulated materials that extend shelf life and reduce environmental impact. As consumer demand for convenience foods grows, especially across urban populations, insulated packaging is becoming increasingly critical to ensure food safety and quality in global trade.

Eco-Friendly and Custom Solutions Driving Growth

Sustainability and brand differentiation are emerging as key drivers in the insulated packaging market. In response to growing environmental concerns, manufacturers are innovating with recyclable, biodegradable, and reusable packaging materials to reduce waste and carbon footprint. These eco-conscious solutions appeal to environmentally aware consumers and help businesses align with global regulations on sustainable packaging. Simultaneously, customizable insulated packaging options are gaining traction among brands seeking to enhance product presentation and consumer engagement. Companies are incorporating advanced printing technologies, unique structural designs, and interactive elements into their packaging. This dual focus on sustainability and personalization not only supports corporate social responsibility goals but also strengthens market competitiveness. The integration of green practices and tailored designs is reshaping the future of insulated packaging. For instance, Graphic Packaging International, LLC is a leading provider of sustainable paperboard packaging solutions. The company aims to achieve Net Zero greenhouse gas emissions by 2050, with near-term targets validated by the Science Based Targets initiative. In 2023, it achieved its Vision 2025 greenhouse gas emissions and nonrenewable energy intensity goals three years early. The PaperSeal™ Shape tray, developed in partnership with G. Mondini, reduces plastic by 80–90% compared to traditional trays and is recyclable in household streams.

Rising Cold-Chain and Pharmaceutical Demand

The demand for insulated packaging is experiencing significant growth, driven by the rise of cold-chain logistics, particularly within the pharmaceutical sector. The global surge in vaccine distribution, especially due to the COVID-19 pandemic, highlighted the crucial role of temperature-controlled packaging. Pharmaceutical products, including vaccines, biologics, and biologically sensitive drugs, require precise temperature management throughout the supply chain. Regulations such as the FDA and Good Distribution Practices (GDP) have amplified the need for insulated packaging that ensures compliance with strict temperature maintenance standards during transportation. This shift in logistics has sparked the development of advanced, high-performance insulated packaging solutions capable of supporting stringent health and safety requirements. As global demand for temperature-sensitive pharmaceutical products continues to rise, the packaging industry is focusing on more reliable, eco-friendly, and efficient insulated solutions to meet regulatory standards and ensure product integrity.

Insulated Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global insulated packaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on packaging type, material type, packaging form, and application.

Analysis by Packaging Type:

- Boxes and Containers

- Bags and Pouches

- Wraps

- Others

Boxes and containers stand as the largest packaging type in 2024, holding around 45.7% of the market due to their versatility, durability, and ability to provide robust thermal insulation for a wide range of products. These packaging types are widely used across industries such as food and beverage, pharmaceuticals, and e-commerce because they offer structural integrity and effective temperature control during transit and storage. Their stackability, ease of handling, and compatibility with automated logistics systems make them highly efficient for both manufacturers and distributors, furthering a lucrative insulated packaging market outlook in the coming years. Additionally, the growing demand for home delivery and online grocery services has increased the adoption of insulated boxes and containers, which ensure product freshness, prevent leakage, and support sustainability through recyclable and reusable material options.

Analysis by Material Type:

- Corrugated Cardboards

- Metal

- Glass

- Plastic

- Others

Plastic leads the market with around 35.0% of market share in 2024. The insulated packaging market research report suggests growth driven by its favoring properties like superior insulation, cost-effectiveness, and versatility in various applications. Its lightweight nature reduces transportation costs, while its durability ensures effective protection of temperature-sensitive products such as food, beverages, pharmaceuticals, and biological samples. Plastic materials like polystyrene, polyethylene, and polyurethane are widely used to manufacture pouches, wraps, containers, and liners that offer excellent thermal resistance and moisture control. Additionally, the adaptability of plastic to both rigid and flexible packaging formats makes it suitable for a broad range of end-use sectors. Advances in recyclable and biodegradable plastic solutions have also supported its dominance, aligning with evolving regulatory standards and increasing environmental awareness among manufacturers and consumers.

Analysis by Packaging Form:

- Rigid

- Flexible

- Semi-rigid

Flexible leads the market with around 53.1% of market share in 2024, owing to its adaptability, lightweight nature, and cost-efficiency. This format offers superior space optimization, allowing for easier storage and transportation, which significantly reduces logistics costs. It is especially favored in food, pharmaceutical, and e-commerce sectors for its ability to conform to different product shapes while maintaining thermal insulation. Additionally, flexible packaging supports portion control and resealability, enhancing consumer convenience. Its compatibility with advanced barrier materials ensures protection against moisture, oxygen, and temperature fluctuations. Manufacturers are increasingly investing in sustainable flexible packaging solutions made from recyclable or biodegradable materials, further boosting its adoption. The shift toward eco-friendly, compact, and functional packaging formats has cemented flexible packaging’s leading position in the insulated packaging market.

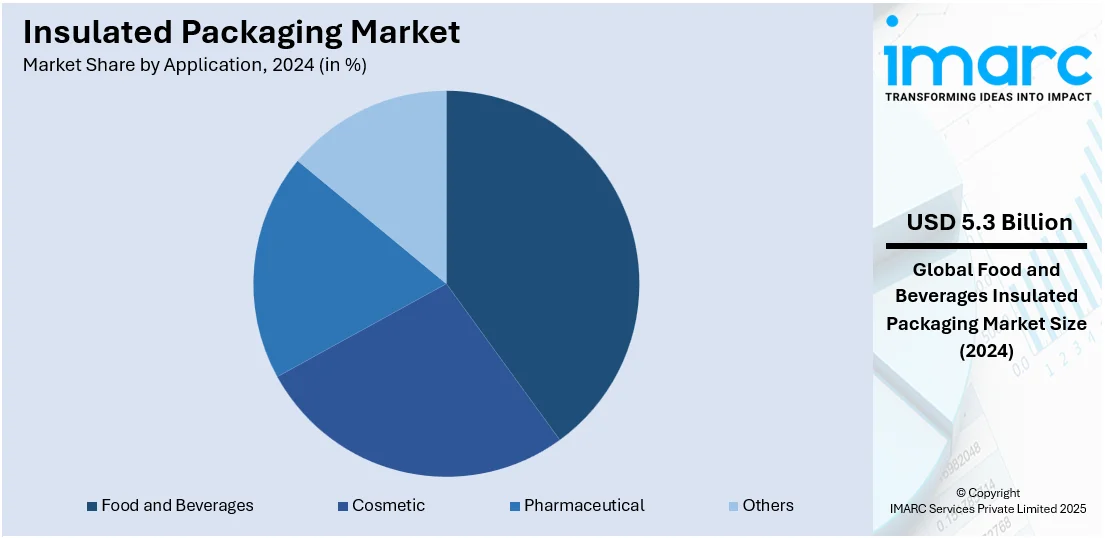

Analysis by Application:

- Cosmetic

- Pharmaceutical

- Food and Beverages

- Others

Food and beverages lead the market with around 35.2% of market share in 2024 due to the sector’s critical need for temperature control and product integrity. Rising global demand for perishable goods, ready-to-eat meals, and frozen foods has significantly increased reliance on insulated packaging to ensure freshness and safety during transit. The surge in online food delivery and grocery e-commerce has further propelled this demand, as these channels require reliable packaging to maintain product quality. Additionally, changing dietary habits and consumer preference for convenience have led to increased consumption of packaged and processed foods. Innovations in packaging technologies that enhance shelf life and minimize spoilage have also strengthened the segment’s dominance in the insulated packaging market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 35.8%. The insulated packaging market forecasts that rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations are fueling market expansion. For instance, according to data by UNEP, as of 2024, Asia continues to be the fastest-growing economic region, home to 60% of the global population and 70% of its largest cities. This rapid growth has driven significant urbanization and industrialization, impacting resource consumption and environmental sustainability. Additionally, the exponential growth of e-commerce and online food delivery services in the region has heightened demand for reliable and efficient packaging solutions. Expanding cold chain infrastructure, coupled with rising disposable incomes and shifting dietary preferences toward convenience foods, further boosts market growth. Government support for sustainable packaging practices also accelerates innovation, solidifying Asia-Pacific’s leadership in the insulated packaging market.

Key Regional Takeaways:

United States Insulated Packaging Market Analysis

In 2024, the United States held a market share of over 88.40% in North America. United States is witnessing rising insulated packaging adoption driven by the expanding e-commerce industry. For instance, in 2024, US eCommerce sales increased by 7.2% as compared to the same quarter last year. With increasing online shopping and the need for timely delivery of temperature-sensitive products, insulated packaging plays a critical role in maintaining product integrity during transit. E-commerce platforms are demanding durable, lightweight, and temperature-resistant solutions to manage the last-mile delivery of groceries, pharmaceuticals, and perishable goods. As consumer expectations grow for faster delivery and better product quality, the e-commerce industry continues to influence innovations in insulated packaging. Efficient thermal insulation, recyclability, and sustainability are also emerging as key criteria for packaging selection. Moreover, logistic service providers are increasingly partnering with packaging companies to enhance cold chain performance, thereby supporting the ongoing insulated packaging adoption across diverse product categories in the United States.

North America Insulated Packaging Market Analysis

The North American insulated packaging market is experiencing robust growth, primarily driven by the increasing demand for temperature-sensitive product transportation within industries like food, pharmaceuticals, and e-commerce. As online shopping continues to surge, particularly for groceries and perishable goods, insulated packaging ensures product integrity by maintaining optimal temperatures during transit. E-commerce companies are increasingly focused on providing fast, reliable, and secure delivery, which boosts the demand for innovative packaging solutions. Additionally, sustainability concerns are prompting a shift towards recyclable and eco-friendly materials. The market is also benefiting from advancements in packaging technology, improving insulation performance while reducing material usage. Partnerships between packaging companies and logistics providers are enhancing the cold chain, further promoting the widespread adoption of insulated packaging across North America. For instance, in February 2025, Graphic Packaging launched Cold&Go™ insulated paper cups, designed to address challenges faced by quick-service restaurants and cafés when serving cold beverages. These cups offer superior insulation, keeping drinks colder for longer, and reducing condensation by over 40%. Cold&Go cups are more durable than plastic cups, providing secure, spill-resistant handling. Ideal for premium drinks and delivery services, they meet growing consumer demand for sustainable packaging alternatives to plastic. With enhanced beverage quality and sustainability, Cold&Go cups support both operational efficiency and consumer experience, making them a premium solution for the cold beverage market.

Asia Pacific Insulated Packaging Market Analysis

Asia-Pacific is experiencing increasing insulated packaging adoption, owing to the shifting consumer preference toward processed and packaged ready-to-eat food products which has been further accelerated by the growing female workforce in the region. Recent data has pointed to a rapid rise in women’s labor force participation in India over the past several years, from just 21.6% in 2018-19 to 35.6% in 2023-24. The demand for convenience foods that require temperature control is influencing food manufacturers to adopt reliable and cost-effective insulated packaging solutions. Urbanization and evolving lifestyles are contributing to increased consumption of frozen meals, dairy products, and ready-to-cook items, all requiring secure and temperature-sensitive packaging. In response, packaging companies in the region are enhancing the insulation efficiency, shelf life, and sustainability of their products. Innovations such as multilayer packaging films and bio-based insulators are becoming increasingly popular. The expansion of food delivery platforms further intensifies the need for effective packaging. Consequently, the preference for processed and packaged ready-to-eat food products is a significant driver of insulated packaging demand in Asia-Pacific.

Europe Insulated Packaging Market Analysis

Europe is seeing heightened insulated packaging adoption due to a robust food processing industry that requires packaging solutions for delivering food and beverages with no wastage and spillage. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. As food processors expand their product offerings, there is a growing emphasis on maintaining freshness and safety during transportation. Stringent regulations concerning food quality and sustainability further push manufacturers to adopt high-performance insulated packaging. These packaging solutions support long-distance and cross-border delivery of perishable products without compromising quality. With rising demand for ready meals, dairy, and specialty beverages, the need for advanced insulation that prevents temperature fluctuations and leakage has become more pronounced. Moreover, the circular economy goals in Europe are encouraging the use of recyclable and reusable insulated packaging materials, aligning with both environmental and industrial requirements in the food processing industry.

Latin America Insulated Packaging Market Analysis

Latin America is witnessing rising insulated packaging adoption fuelled by growing frozen food demand. Mexico frozen food market size reached USD 4.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.6 Billion by 2033. As consumers increasingly turn to frozen meat, seafood, vegetables, and pre-cooked meals, insulated packaging becomes essential to preserve freshness and prevent spoilage. Supermarkets and local distributors are investing in advanced packaging to meet this demand, enhancing the efficiency of cold chain logistics. The need for cost-effective and reliable insulation drives the market for materials that ensure optimal product quality during extended transportation in Latin America.

Middle East and Africa Insulated Packaging Market Analysis

Middle East and Africa are experiencing greater insulated packaging adoption driven by expanding healthcare facilities that require reliable solutions to store vaccines, blood samples, and medicines. According to Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022. As medical infrastructure grows, so does the demand for thermally stable packaging options. Additionally, the adoption of omnichannel distribution across healthcare and pharmaceutical supply chains increases the need for efficient insulated solutions that ensure product integrity during storage and delivery. These factors contribute to rising insulated packaging use in Middle East and Africa.

Competitive Landscape:

The competitive landscape of the insulated packaging market is characterized by the presence of both established global players and emerging regional companies. Key competitors focus on innovation, product differentiation, and sustainability to maintain a competitive edge. Companies are increasingly investing in research and development to create high-performance, cost-effective, and eco-friendly solutions. Strategic partnerships between packaging providers, logistics companies, and e-commerce platforms are also becoming prevalent to optimize cold chain operations and meet growing consumer demands. As consumer preferences shift towards sustainable and recyclable materials, market players are adapting by incorporating green technologies and offering environmentally friendly alternatives. Price competitiveness, along with the ability to meet stringent regulatory standards for temperature-sensitive goods, remains a crucial factor for companies vying for market share. For instance, in December 2024, Graphic Packaging partnered with Elaborados Naturales to introduce the PaperSeal™ Shape paperboard tray in Spain, replacing traditional plastic trays. This innovative tray, designed for use in ovens, microwaves, and air fryers, contains less than 10% plastic and is recyclable in household streams. It offers superior rigidity, ensuring food safety, freshness, and minimal food waste. This collaboration highlights Graphic Packaging's commitment to sustainable, functional packaging solutions.

The report provides a comprehensive analysis of the competitive landscape in the insulated packaging market with detailed profiles of all major companies, including:

- Amcor plc

- Cold Ice Inc.

- Cryopak (Integreon Global)

- Deutsche Post AG

- Drew Foam of Georgia

- DS Smith plc

- DuPont de Nemours Inc.

- Huhtamäki Oyj

- Innovative Energy Inc.

- Marko Foam Products Inc.

- Sonoco Products Company

- The Wool Packaging Company Limited

- TP Solutions

Latest News and Developments:

- On June 16, 2025, Panasonic Corporation launched rental and overseas transportation services for its VIXELL Container, a vacuum-insulated cooling box capable of keeping cargo refrigerated for up to 10 days without a power source. The container accommodates various pallet sizes, reduces temperature excursion risks, and enables remote monitoring via real-time data loggers.

- On April 9, 2025, DS Smith, now part of International Paper, launched the “GoChill Cooler,” a 100% recyclable, reusable insulated packaging solution crafted from wax-free corrugated board. Designed as a sustainable alternative to plastic and Styrofoam coolers, it features GreenCoat® technology for moisture resistance and food-grade safety. The GoChill Cooler strengthens DS Smith’s commitment to circular economy practices by offering consumers an eco-friendly option for outdoor activities and cold storage.

- On January 7, 2025, DGeo, a division of Labelmaster, partnered with Lifoam Industries to expand its sustainable packaging portfolio with BioEPS®, an eco-friendly alternative to traditional EPS foam. BioEPS® offers temperature-controlled and impact protection while biodegrading by 92% in bio-reactive landfills within four years, leaving no microplastics behind. This high-performance solution helps organizations align with green initiatives without compromising functionality or convenience.

- May 2025: Cold Chain Technologies expanded its insulated packaging offerings with the launch of the curbside recyclable CCT TRUEtemp Naturals Shipper. Designed for parcel-sized, temperature-sensitive deliveries, it provides thermal protection for up to 48 hours and supports sustainability with its eco-friendly, single-use materials.

- April 2025, DS Smith introduced the “GoChill Cooler,” a fully recyclable and reusable product designed as an eco-conscious replacement for traditional plastic and Styrofoam coolers. Made from sustainable, wax-free corrugated cardboard, the cooler offers a portable option for keeping food and drinks cold while helping to minimize environmental impact and carbon output.

- April 2025: Visy launched a recyclable, fibre-based thermal insulation liner called Visycell, aiming to replace expanded polystyrene (EPS) in insulated packaging. Made from cardboard waste offcuts and certified kerbside recyclable by APCO, Visycell retains the thermal and cushioning performance of traditional EPS to protect food and beverages in high temperatures.

Insulated Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Packaging Types Covered | Boxes and Containers, Bags and Pouches, Wraps, Others |

| Material Types Covered | Corrugated Cardboards, Metal, Glass, Plastic, Others |

| Packaging Forms Covered | Rigid, Flexible, Semi-rigid |

| Applications Covered | Cosmetic, Pharmaceutical, Food and Beverages, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor plc, Cold Ice Inc., Cryopak (Integreon Global), Deutsche Post AG, Drew Foam of Georgia, DS Smith plc, DuPont de Nemours Inc., Huhtamäki Oyj, Innovative Energy Inc., Marko Foam Products Inc., Sonoco Products Company, The Wool Packaging Company Limited and TP Solutions |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the insulated packaging market from 2019-2033.

- The insulated packaging market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the insulated packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insulated packaging market was valued at USD 15.17 Billion in 2024.

The insulated packaging market is projected to exhibit a CAGR of 4.89% during 2025-2033, reaching a value of USD 23.84 Billion by 2033.

The insulated packaging market is driven by rising demand for temperature-sensitive goods, growth in e-commerce and food delivery services, expanding pharmaceutical and healthcare sectors, and increasing consumer preference for ready-to-eat meals. Additionally, sustainability trends and innovations in eco-friendly materials are propelling further adoption across various industries and regions.

In 2024, Asia Pacific dominated the insulated packaging market, holding a market share of over 35.8%. This is driven by rapid e-commerce growth, increasing demand for temperature-sensitive food and beverages, expansion of the pharmaceutical sector, and the region's focus on sustainable packaging solutions, contributing to the market's robust growth.

Some of the major players in the insulated packaging market include Amcor plc, Cold Ice Inc., Cryopak (Integreon Global), Deutsche Post AG, Drew Foam of Georgia, DS Smith plc, DuPont de Nemours Inc., Huhtamäki Oyj, Innovative Energy Inc., Marko Foam Products Inc., Sonoco Products Company, The Wool Packaging Company Limited, TP Solutions, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)