Insurance Software Market Size, Share, Trends and Forecast by Type, Deployment Mode, End User, and Region, 2025-2033

Insurance Software Market Size and Share:

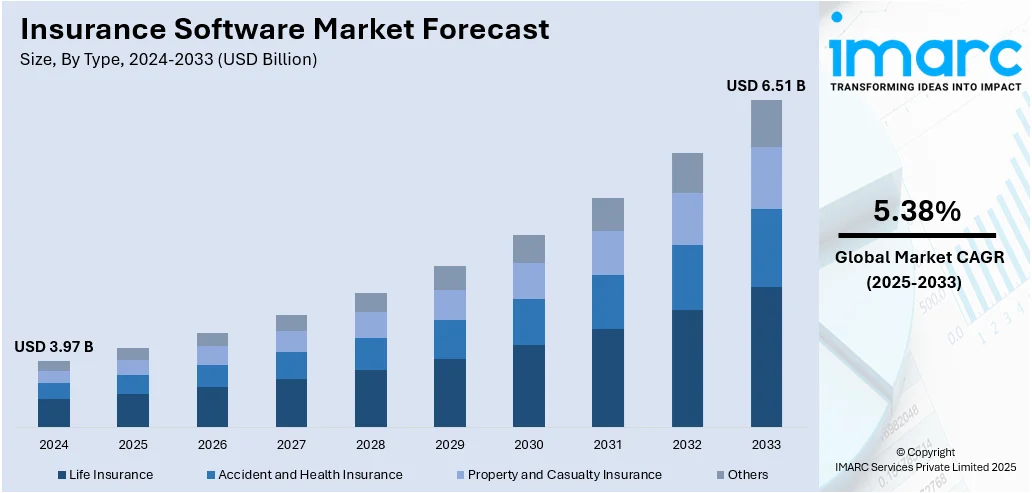

The global insurance software market size was valued at USD 3.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.51 Billion by 2033, exhibiting a CAGR of 5.38% during 2025-2033. North America dominated the market, holding a significant market share of 38.8% in 2024. The increasing need to automate software programs, the rising demand for mobile apps in insurance businesses, and the growing employment of insurance software to collect information about claims represent some of the factors contributing to the insurance software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.97 Billion |

|

Market Forecast in 2033

|

USD 6.51 Billion |

| Market Growth Rate 2025-2033 | 5.38% |

The market is expanding due to several practical and competitive factors. Insurers are under pressure to modernize outdated systems and improve operational efficiency. Automation and cloud-based platforms help reduce manual work, streamline claims processing, and lower costs. Regulatory compliance is another driver, pushing firms to adopt systems that can adapt to evolving rules. With growing concerns over data security, cybersecurity features have become essential. Customer expectations have also shifted; policyholders now prefer digital, self-service options, requiring user-friendly portals and mobile apps. Insurers are also investing in AI and analytics to personalize offerings, detect fraud, and optimize underwriting. Partnerships with insurtech firms are common as traditional players look to stay agile. All of this has led to rising demand for flexible, scalable insurance software that supports both innovation and compliance.

To get more information on this market, Request Sample

In the US, insurers are increasingly adopting SaaS-based solutions through cloud marketplaces to simplify procurement and deployment. By offering core software via established platforms, providers reduce friction in onboarding, updates, and integration. This shift supports faster adoption, operational efficiency, and greater scalability, especially for firms seeking cloud-native tools without complex infrastructure commitments. For instance, in May 2025, DXC Technology officially launched its DXC Assure SaaS insurance solutions package on the AWS Marketplace. With this launch, AWS clients will be able to purchase and administer DXC insurance software solutions with enhanced ease and convenience through the AWS marketplace.

Insurance Software Market Trends:

AI Integration Reshaping Insurance Operations

Insurance software market trends reflect that large insurers are increasingly shifting from fragmented systems to unified platforms that tie together data, workflows, and automation. This shift isn't just about front-end improvements; the focus is now on reducing "process debt" within legacy systems by embedding AI directly into core applications. AI-backed process orchestration, real-time data handling, and simplified interfaces are becoming standard in policy administration, claims management, and customer service. The underlying platforms are no longer just tools but are taking over operational decision-making to cut turnaround times and improve consistency. Insurers aren’t just upgrading tools, they’re rethinking how core systems function. The result is more responsive service and less manual friction across the entire insurance value chain. For example, in March 2025, DXC Technology unveiled new services in collaboration with ServiceNow in an effort to modernize the insurance sector. This partnership intends to integrate DXC's insurance experience and scale with ServiceNow's unified platform and data model. As a result, the DXC Assure BPM insurance software, powered by ServiceNow, will combine AI, data, and workflows to lower process debt, increase operational effectiveness, and enhance overall client satisfaction.

Smarter Tools for Multi-Product Insurance Distribution

Insurance providers are adopting purpose-built platforms that can handle multiple product lines, such as life, disability, and long-term care, within a single interface, shaping the insurance software market outlook. The focus is on giving advisors a unified experience that cuts across product silos and accelerates the sales process. This shift is driven by growing demand for tools that not only quote and compare but also manage workflows, compliance, and client engagement in one place. Interfaces are being rebuilt for speed and clarity with more intuitive navigation and embedded logic that reduces back-and-forth. The end goal is to let advisors focus less on admin and more on selling, while carriers gain greater visibility and faster throughput across their distribution. For instance, in October 2024, Covr Financial Technologies launched Advisor 3.0, the most recent edition of its innovative insurance software. This state-of-the-art software streamlines the business operations of insurance companies across a wide range of product categories, such as long-term care, disability, and life insurance.

Open Platforms Built for Speed and Flexibility

Insurers are moving toward modular platforms that allow faster product design and deployment without overhauling core systems. These new setups rely on open architecture and cloud-native tools to support customization and integration. Machine learning and generative AI are being added directly into workflows, helping insurers fine-tune underwriting, claims, and customer interactions. The emphasis is on flexibility, being able to adapt to changing market demands without long development cycles. Platforms now support real-time data access and digital engagement, allowing companies to test, launch, and adjust offerings quickly. As per the insurance software market forecast, this shift is expected to reflect a broader push to make insurance systems more agile and responsive, not just more automated. For example, in June 2024, Sapiens International Corporation, a renowned international provider of insurance software solutions, introduced its AI-driven, cloud-native, open, integrated platform. The Sapiens Insurance Platform helps insurers easily develop their products and procedures by leveraging machine learning (ML) and GenAI capabilities, digital engagement, data insights, and core business processing technologies.

Insurance Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global insurance software market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, deployment mode, and end user.

Analysis by Type:

- Life Insurance

- Accident and Health Insurance

- Property and Casualty Insurance

- Others

Accident and health insurance stood as the largest type of the market in 2024 due to rising demand for digital tools that streamline claims, underwriting, and policy management. As healthcare costs climb and awareness around personal coverage grows, insurers are under pressure to deliver faster, more accurate services. This has created a need for advanced software solutions that handle high volumes of health claims, automate workflows, and support compliance with evolving regulations. Customers now expect self-service portals, quick reimbursements, and personalized policies, all of which require robust digital infrastructure. Insurers focused on accident and health coverage are investing heavily in modern platforms that integrate AI, data analytics, and mobile access to stay competitive. This steady demand from the health and accident segment is a key driver behind the ongoing expansion of the insurance software market.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

On-premises led the market in 2024 as many insurers, especially large and traditional ones, continue to prioritize control, security, and customization. Handling sensitive customer data and adhering to strict regulatory standards make on-premises deployment attractive for firms seeking direct oversight of their infrastructure. This setup allows tighter integration with legacy systems, which are still common in the sector. Insurers dealing with complex underwriting or large volumes of proprietary data often prefer the stability and predictability of on-premises systems. Despite the rise of cloud-based platforms, organizations with specific compliance or data residency requirements remain committed to on-site solutions. This sustained preference fuels demand for tailored on-premises software, making it a consistent driver in the market, particularly in regions or segments where digital transformation is gradual or tightly regulated.

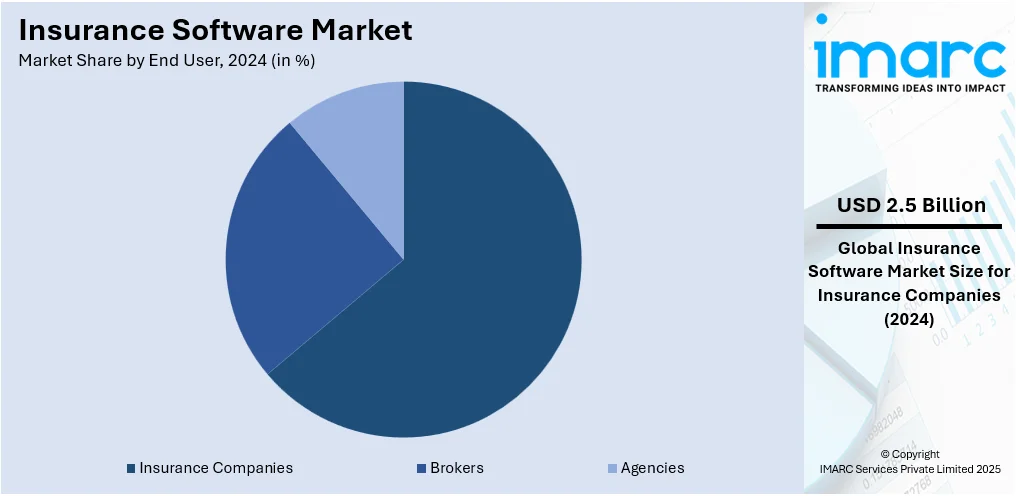

Analysis by End User:

- Brokers

- Agencies

- Insurance Companies

Insurance companies led the market with around 63.6% of market share in 2024, as they actively seek tools to enhance efficiency, reduce operational costs, and improve customer experience. With increasing competition and rising customer expectations, insurers are investing in software solutions for policy administration, claims processing, fraud detection, and customer engagement. Many are upgrading from legacy systems to more flexible, scalable platforms that support automation and real-time data access. The push for faster digital transformation, especially post-pandemic, has intensified software adoption among insurers aiming to streamline workflows and offer seamless omnichannel services. Additionally, regulatory pressure and data management requirements are encouraging insurers to implement advanced compliance and analytics tools. Their consistent need for modernization and innovation makes insurance companies a strong and ongoing driver of insurance software market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 38.8% due to a combination of advanced technological infrastructure, early adoption of digital solutions, and a mature insurance industry. The region is home to several leading insurance and insurtech companies that invest heavily in automation, AI, analytics, and cloud computing. Regulatory frameworks in countries like the US and Canada require detailed compliance and reporting, prompting insurers to adopt robust software systems. High customer expectations for digital engagement have also driven innovation in mobile apps, self-service portals, and personalized policy management tools. Moreover, the competitive landscape pushes insurers to differentiate through technology. The presence of skilled IT professionals and frequent collaboration between tech firms and insurers contribute to the rapid implementation of new tools. Overall, North America’s mix of market size, regulation, and innovation keeps it at the forefront of insurance software adoption.

Key Regional Takeaways:

United States Insurance Software Market Analysis

In 2024, the United States accounted for 86.60% of the market share in North America. The United States insurance software market is primarily driven by digital transformation initiatives, customer expectations, and regulatory demands. The increasing need for automation and operational efficiency among insurers is a key factor fueling growth. As insurance providers seek to reduce manual processes, improve accuracy, and enhance productivity, advanced software solutions are becoming essential tools. For instance, in October 2024, Majesco, a renowned provider of cloud insurance software solutions based in New Jersey, launched its Fall ’24 release equipped with Majesco Copilot, an advanced GenAI core solution. These innovations aim to achieve unprecedented levels of insurer performance by transforming company processes through sophisticated GenAI automation, boosting operational effectiveness, lowering costs, and boosting productivity. In addition to this, the rising demand for personalized insurance products and services is prompting companies to adopt data-driven technologies, including artificial intelligence (AI) and predictive analytics, to better understand customer behavior and tailor offerings. The rise in digital channels, mobile apps, and online platforms is also encouraging insurers to invest in modern, user-friendly software that enhances customer engagement and satisfaction. Other than this, the emergence of insurtech startups is intensifying competition and driving innovation in the market, prompting traditional insurers to modernize their IT infrastructure.

Asia Pacific Insurance Software Market Analysis

The Asia Pacific insurance software market is expanding due to the rising demand for scalable, cloud-enabled solutions among both emerging and established insurers. With the growing penetration of smartphones, the demand for seamless online experiences is increasing rapidly. For instance, in 2024, the smartphone penetration rate in India reached 46.5%, equating to 660 Million users, as per industry reports. As a result, numerous insurers are investing in user-centric platforms that streamline onboarding, policy issuance, and claims processing through intuitive apps and web portals. Additionally, economic development and urbanization are expanding the customer base, prompting insurers to seek scalable software solutions that can efficiently handle high volumes of new policies and transactions. The growth of small and medium-sized insurance firms is also increasing the demand for cost-effective, customizable software that supports agile operations and localized needs. Besides this, government initiatives promoting financial inclusion and digital infrastructure development are encouraging insurance adoption, further boosting the need for robust digital platforms.

Europe Insurance Software Market Analysis

The growth of the Europe insurance software market is largely fueled by the increasing emphasis on digital transformation and process automation across the region. Numerous European insurers are increasingly seeking advanced solutions to streamline underwriting, claims processing, and policy management, thereby reducing operational costs and enhancing efficiency. For instance, in August 2024, London-based RSA Insurance launched its new and improved broker and customer claims platform. Supported by Guidewire, a renowned provider of insurance software solutions, RSA is the very first insurance company in the United Kingdom to employ the Guidewire Cloud solution to streamline claims management and processing and provide a smoother, faster, and easier experience for clients. In addition to this, growing customer expectations for seamless digital experiences across mobile channels, web portals, and social media are also fueling investments in user-centric, omnichannel interfaces. Moreover, the rise of data-driven insurance models, powered by artificial intelligence (AI), machine learning (ML), telematics, and predictive analytics, is enabling more accurate risk assessment, dynamic pricing, and tailored product offerings. Regulatory pressures, including compliance with data protection laws such as GDPR and emerging Solvency II updates, are further driving demand for robust software platforms that offer enhanced security, transparency, and risk reporting capabilities.

Latin America Insurance Software Market Analysis

The Latin America insurance software market is experiencing robust growth due to the rising demand for digital transformation among insurers seeking to modernize outdated legacy systems and improve operational efficiency. A growing middle class and increasing insurance penetration, particularly in health, auto, and micro‑insurance, are also fueling the need for scalable, cost‑effective platforms. Moreover, the expansion of mobile and internet connectivity is driving investments in digital sales, self‑service portals, and mobile claims processing to meet consumer demand for seamless, anytime, anywhere access. For instance, in 2023, 92.5% of households in Brazil had access to the Internet, equating to 72.5 Million households and underscoring a robust internet penetration rate, as per the Agência de Notícias. Besides this, competition from insurtech startups and fintech partnerships is also encouraging established insurers to implement agile, API‑enabled software that supports rapid product development and integration.

Middle East and Africa Insurance Software Market Analysis

The Middle East and Africa insurance software market is significantly influenced by rapid economic diversification initiatives across the Gulf countries. This is creating a demand for modern, modular insurance platforms that can be quickly configured for new lines and emerging markets. Additionally, insurers are increasingly leveraging AI and automation to improve efficiency in underwriting and claims while dealing with low-penetrated markets and operational hurdles. Furthermore, numerous insurers are investing in cloud-based platforms to reduce infrastructure costs and improve service delivery in remote or rural areas. For instance, in February 2025, ZainTECH entered into a partnership with Diamond and SHAHIN Platform to promote innovation and digital transformation in Saudi Arabia’s insurance sector. This collaboration aims to improve cloud-based infrastructure, cybersecurity, and claims management in order to build a more technologically advanced, safe, and effective insurance environment.

Competitive Landscape:

The insurance software market is seeing steady activity across partnerships, product launches, funding announcements, and strategic collaborations. Many firms are enhancing digital capabilities through alliances and tech integrations, while others are expanding platforms with new product features. Venture funding continues to support innovation, especially in automation, data analytics, and AI-driven solutions. Collaborations between insurers and tech providers are becoming more routine, aimed at improving efficiency and customer experience. Some regions are also witnessing supportive government initiatives encouraging digital transformation in the insurance sector. Among all these developments, partnerships and funding activity appear to be the most consistent practices shaping the current direction of the market.

The report provides a comprehensive analysis of the competitive landscape in the insurance software market with detailed profiles of all major companies, including:

- Accenture Plc

- Acturis Ltd.

- Axxis Systems SA

- Buckhill Ltd.

- EIS Software Limited

- Guidewire Software Inc.

- Mitchell International Inc.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- Sapiens International Corporation

- Solartis Technology Services Pvt Ltd.

- Vertafore Inc (Roper Technologies Inc.)

Latest News and Developments:

- June 2025: InsureMO introduced Agentic AI, a state-of-the-art AI-driven platform to transform insurance operations, sales, and service through intelligent automation, real-time performance visibility, and conversational analytics. The novel insurance software offers a consolidated agent dashboard, immediate visual insights, a natural language processing (NLP) assistant, and context-aware AI messaging.

- May 2025: INTX Insurance Software, a renowned provider of a comprehensive, one-stop solution for the whole P&C insurance policy lifecycle, officially expanded its operations into North America. With this launch, numerous businesses in the whole insurance spectrum, including carriers, reinsurers, and MGAs, will be able to instantly access INTX's highly scalable, extensible, and versatile end-to-end P&C policy administration technology.

- April 2025: Sapiens International Corporation, a prominent provider of intelligent insurance software solutions, successfully acquired Candela, a renowned company specializing in intelligent automation technologies. With this acquisition, Sapiens aims to diversify its offerings and widen its reach across the Asia Pacific region.

Insurance Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Life Insurance, Accident and Health Insurance, Property and Casualty Insurance, Others |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Brokers, Agencies, Insurance Companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture Plc, Acturis Ltd., Axxis Systems SA, Buckhill Ltd., EIS Software Limited, Guidewire Software Inc., Mitchell International Inc., Oracle Corporation, Salesforce Inc., SAP SE, Sapiens International Corporation, Solartis Technology Services Pvt Ltd., Vertafore Inc (Roper Technologies Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the insurance software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global insurance software market.

- The study maps the leading as well as the fastest growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the insurance software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insurance software market was valued at USD 3.97 Billion in 2024.

The insurance software market is projected to exhibit a CAGR of 5.38% during 2025-2033, reaching a value of USD 6.51 Billion by 2033.

Key factors driving the insurance software market include digital transformation, growing demand for automation, increased adoption of cloud-based solutions, rising cyber threats, regulatory changes, and customer preference for self-service platforms. Insurers are investing in advanced analytics, AI, and APIs to improve efficiency, reduce costs, and enhance the customer experience.

North America dominated the insurance software market in 2024, accounting for a share of 38.8% due to early tech adoption, strong presence of major insurers, high investment in digital infrastructure, and strict regulatory requirements driving software upgrades.

Some of the major players in the insurance software market include Accenture Plc, Acturis Ltd., Axxis Systems SA, Buckhill Ltd., EIS Software Limited, Guidewire Software Inc., Mitchell International Inc., Oracle Corporation, Salesforce Inc., SAP SE, Sapiens International Corporation, Solartis Technology Services Pvt Ltd., Vertafore Inc (Roper Technologies Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)