Ion Implanter Market Report by Technology (High-Energy Implanter, Medium-Current Implanter, High-Current Implanter, and Others), Application (Semiconductors, Metal Finishing, and Others), and Region 2025-2033

Market Overview:

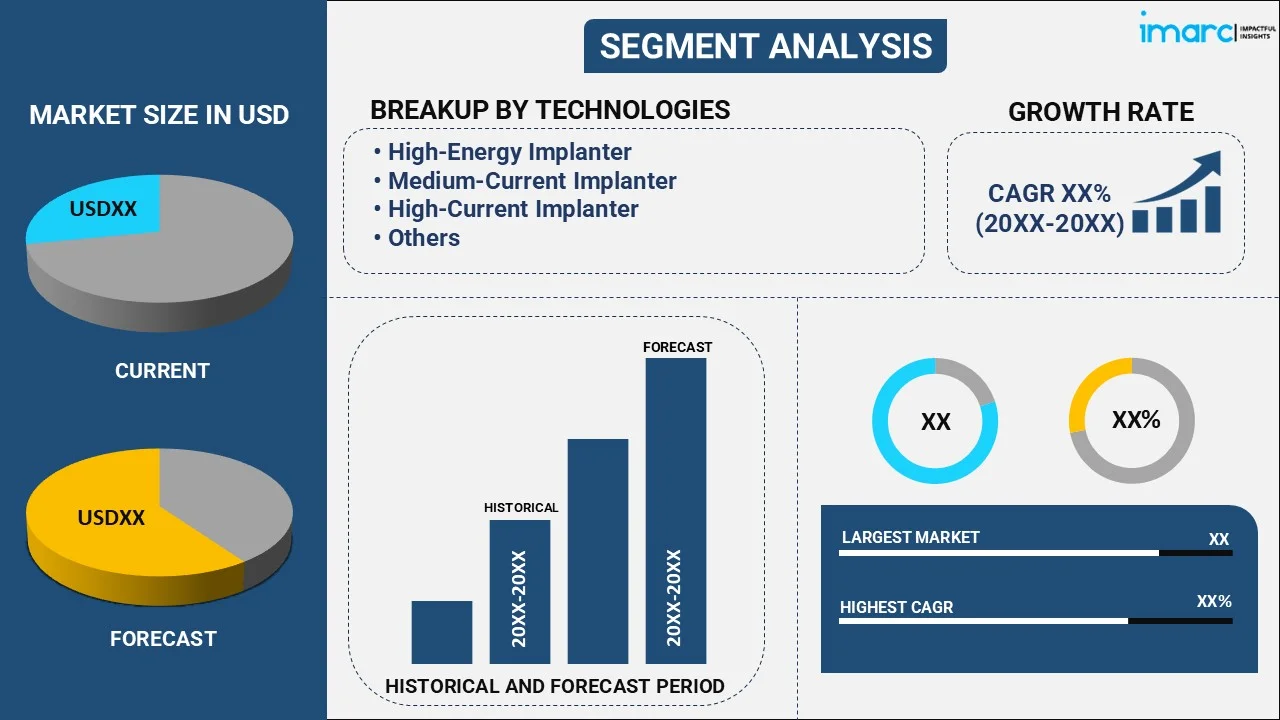

The global ion implanter market size reached USD 1.64 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.38 Billion by 2033, exhibiting a growth rate (CAGR) of 4.21% during 2025-2033. The rapid technological advancements, increasing demand for consumer electronics, significant growth in the automotive industry rising emphasis on renewable energy, widespread utilization of high-performance materials, and favorable government initiatives are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.64 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Market Growth Rate 2025-2033 | 4.21% |

An ion implanter is a device used to fabricate semiconductor materials integral to modern electronics manufacturing. It implants ions into a material to alter its physical, chemical, or electrical properties. The main types of ion implanters are high-current, medium-current, and high-energy implanters. These devices consist of crucial components, such as the ion source, mass analyzer, ion beam accelerator, and end station. Ion implanters are used as doping silicon wafers in semiconductor manufacturing, producing thin films, enhancing wear resistance in metals, modifying biological materials, increasing solar cell efficiency, and surface modification in glasses and research materials. Ion implanters provide precise control over ion placement, uniform distribution of ions, reduced waste of materials, increased process repeatability, compatibility with complex geometries, high production efficiency, and enhanced material performance.

The continuous innovations in semiconductor technology and the growing demand for sophisticated ion implantation techniques are major factors driving the market growth. Additionally, the increasing demand for consumer electronics owing to the rising utilization of smartphones, tablets, and other electronic gadgets is propelling the market growth. Moreover, the integration of advanced electronics in automotive systems is fueling the market growth. In addition to this, the growing utilization of ion implanters for the fabrication of solar cells due to the rising emphasis on renewable energy is creating a positive outlook for the market growth. Besides this, the development and expansion of communication infrastructure, including fifth generation (5G), leading to an increased need for semiconductors, is supporting the market growth. Furthermore, the increasing government and private investments in research and development (R&D) in the semiconductor industry are positively impacting the market growth. Apart from this, the widespread application of ion implanters in medical and industrial applications is providing remunerative growth opportunities for the market.

Ion Implanter Market Trends/Drivers:

Rapid technological advancements

The rapid technological advancements in semiconductor manufacturing are major factors driving the market growth. Besides this, the increasing computational needs for devices that are becoming more compact and powerful, necessitating greater precision and efficiency in manufacturing, is propelling the market growth. Ion implantation provides such precision in doping materials, enabling the development of smaller and more complex components. Additionally, the rising development of new materials and processes that require ion implantation is supporting the market growth. Moreover, rapid innovation in implantation technology, such as high-throughput implanters and advancements in ion beam focusing, expanding its applicability in cutting-edge applications is positively impacting the market growth. In line with this, the increasing application of ion implanters due to the technology's ability to meet the dynamic and evolving needs of semiconductor fabrication is creating a positive outlook for the market growth.

Increasing demand for consumer electronics

The increasing utilization of ion implanters due to the rising digital connectivity and the growing demand for consumer electronics like smartphones, tablets, laptops, and smart televisions (TVs) are propelling the market growth. Moreover, the rising need for more advanced and efficient semiconductor components utilized in consumer electronics is fueling the market growth. Besides this, the increasing demand for creating highly customized semiconductor materials as manufacturers strive to produce more powerful, energy-efficient, and cost-effective devices is supporting the market growth. Additionally, the sudden shift toward remote work and increased digital communication, accelerating the demand for consumer electronics, is favoring the market growth. Moreover, the increasing application of advanced semiconductors in affordable gadgets is strengthening the market growth.

Growing automotive industry

The automotive industry has undergone a significant transformation by integrating advanced electronic systems in vehicles. Modern cars are equipped with numerous electronic components for safety, entertainment, navigation, and efficiency. Ion implants are widely used in the manufacturing of semiconductor components are widely used in features like advanced driver assistance systems (ADAS), electric powertrains, and infotainment systems. Besides this, the shift towards electric and autonomous vehicles further amplifies this demand, as these technologies require sophisticated semiconductor devices. Government regulations encouraging fuel efficiency and emission reductions are also contributing to the growth of electronic systems in vehicles, subsequently driving the ion implanter market. The automotive industry's ongoing evolution towards more technologically advanced and interconnected vehicles ensures a sustained demand for ion implanters.

Ion Implanter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ion implanter market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology and application.

Breakup by Technology:

- High-Energy Implanter

- Medium-Current Implanter

- High-Current Implanter

- Others

High-current implanter dominate the market

The report has provided a detailed breakup and analysis of the market based on the technology. This includes high-energy implanter, medium-current implanter, high-current implanter and others. According to the report, high-current implanter represented the largest segment.

High-current implanters are dominating the market as they are primarily utilized for doping processes in semiconductor manufacturing. These implanters are employed in manufacturing solar cells, LEDs, and other electronic components, making it an essential technology in various segments of the electronics market. Moreover, they are designed to handle larger wafer sizes and provide high throughput, making them suitable for mass production. This efficiency of high-current implanters translates to cost savings and faster production cycles, which are crucial in the competitive electronics manufacturing industry. Apart from this, high-current implanters have evolved to meet the increasing demand for more complex and miniaturized electronic components, leading to innovations in beamline design and process control, enabling them to offer precise control over dopant distribution and concentration and accommodating the latest trends in device design. Besides this, the precise control and efficiency provided by high-current implanters also contribute to reduced waste and energy consumption, aligning with sustainability goals.

Breakup by Application:

- Semiconductors

- Metal Finishing

- Others

Semiconductors hold the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes semiconductors, metal finishing and others. According to the report, semiconductors accounted for the largest market share.

Ion implantation is an essential process in semiconductor manufacturing, allowing the controlled introduction of impurities into silicon wafers to modify their electrical properties, which is critical in creating the transistors that form the building blocks of all electronic devices. Besides this, the ability of ion implanters to manipulate materials at the atomic level enables the creation of advanced and intricate semiconductor structures. Moreover, semiconductors are utilized in various industries, including consumer electronics, automotive, healthcare, and communication, translating to a strong and consistent demand for ion implanters. Apart from this, the sudden shift towards energy-efficient and environmentally friendly technologies has spurred the development of advanced semiconductors, further driving the need for precise ion implantation techniques. Furthermore, the global move towards digitization and connectivity is dependent on advanced semiconductor technology that ensures sustained growth in the demand for ion implantation in semiconductor manufacturing.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest ion implanter market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific region is home to several rapidly developing economies, such as China, India, and South Korea. These countries are increasingly investing in sectors like semiconductors and electronics, key industries requiring ion implantation technology, which, in turn, is fueling the market growth. Additionally, the availability of skilled labor and advanced manufacturing facilities in the Asia Pacific as this region continuously advances in the production of semiconductors, attracting both local and international companies, is positively impacting the market growth. Besides this, the increasing supportive government policies such as tax incentives, grants, and ease of doing business are among the facilitators encouraging companies to invest in advanced technologies, propelling market growth. Furthermore, the region benefits from strong supply chain networks, enabling efficient production and distribution of ion implanters, thus strengthening the region's dominance in the market.

Competitive Landscape:

The leading companies in the ion implanters market are heavily investing in research and development (R&D) to create more advanced, efficient, and precise ion implanters. Additionally, some companies are focusing on expanding their operations into emerging markets where demand for semiconductors is growing, which includes setting up manufacturing facilities sales offices, or entering into partnerships with local entities. Moreover, the key players are constantly improving their product lines to offer a broader range of solutions. They are incorporating new technologies, enhancing features, and customizing solutions to fit the specific needs of different industries. Besides this, companies are forming strategic alliances with other industry players, research institutions, or technology companies that help in sharing expertise, cost reduction, and faster development of new products. In addition, some businesses are pursuing mergers and acquisitions to quickly gain access to new technologies and markets or eliminate competition. Apart from this, several key players are focusing on providing exceptional post-sale support, including maintenance, repairs, and training, to enhance customer satisfaction and loyalty. Furthermore, companies are working on making their products and operations more sustainable, including reducing energy consumption and minimizing waste.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Applied Materials Inc

- Axcelis Technologies

- Intevac Inc.

- Ion Beam Services SA

- Sumitomo Heavy Industries Ltd

- ULVAC Inc.

Ion Implanter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | High-Energy Implanter, Medium-Current Implanter, High-Current Implanter, Others |

| Applications Covered | Semiconductors, Metal Finishing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Applied Materials Inc, Axcelis Technologies, Intevac Inc., Ion Beam Services SA, Sumitomo Heavy Industries Ltd, ULVAC Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global ion implanter market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global ion implanter market?

- What is the impact of each driver, restraint, and opportunity on the global ion implanter market?

- What are the key regional markets?

- Which countries represent the most attractive ion implanter market?

- What is the breakup of the market based on the technology?

- Which is the most attractive technology in the ion implanter market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the ion implanter market?

- What is the competitive structure of the global ion implanter market?

- Who are the key players/companies in the global ion implanter market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ion implanter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global ion implanter market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ion implanter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)