Iran Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Iran Advertising Market Overview:

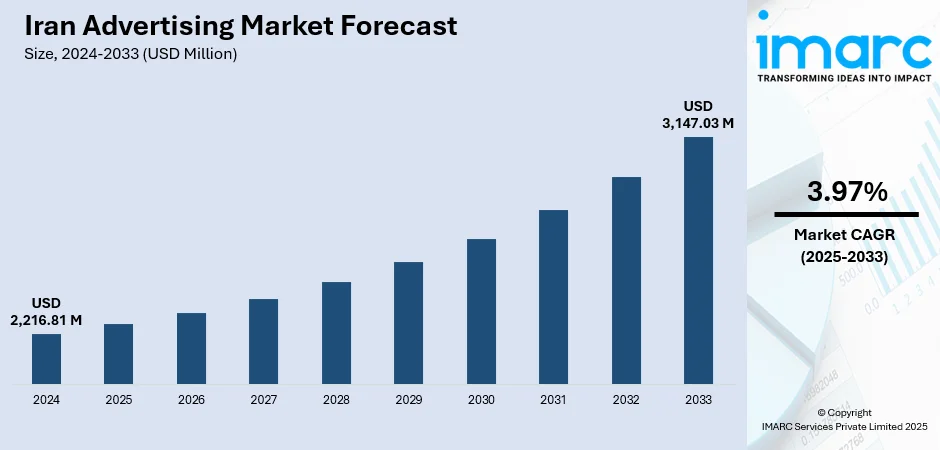

The Iran advertising market size reached USD 2,216.81 Million in 2024. The market is projected to reach USD 3,147.03 Million by 2033, exhibiting a growth rate (CAGR) of 3.97% during 2025-2033. The market is evolving through a blend of traditional media and emerging digital platforms shaped by strict cultural and regulatory frameworks. State oversight influences content approval, while restrictions limit products like alcohol and tobacco from being marketed. Despite barriers, digital channels including domestic social media, programmatic display ads, and influencer-led campaigns are increasingly attractive for advertisers. Local agencies work within censorship and sanction-related constraints to reach audiences through approved ad formats and channels. As these dynamics continue to shift, they redefine Iran advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,216.81 Million |

| Market Forecast in 2033 | USD 3,147.03 Million |

| Market Growth Rate 2025-2033 | 3.97% |

Iran Advertising Market Trends:

Expansion of Contextual Digital Platforms

In 2024, Iran moved toward strengthening contextual advertising as a primary channel within its digital ad ecosystem. As global platforms remain restricted, local contextual ad networks have gained traction by delivering content‑aligned advertising across domestic web publishers. This shift supports more relevant user experiences and better engagement through keyword- and content-based targeting, compensating for limited access to international ad platforms. Advertisers are increasingly embracing these native formats to reach targeted audiences within Iran’s unique regulatory environment. This trend aligns with broader efforts to localize advertising infrastructure and policy. Given rising digital consumption via mobile and domestic apps, advertisers are optimizing budgets toward platforms that reliably deliver contextual messaging while staying compliant. This aligns with consumer demand for culturally resonant content and creates a scalable way to monetize local digital traffic. Advertisers and agencies are adapting strategies around optimized contextual campaigns, performance tracking, and tailored creative. This movement supports sustained Iran advertising market growth by cultivating mature, compliant alternatives to conventional digital channels.

To get more information on this market, Request Sample

New Ban on Cryptocurrency Advertising Online

In February 2025, Iran implemented a nationwide ban prohibiting all cryptocurrency advertising, both online and offline. This regulation stems from a broader effort to regulate digital content and financial promotion, with authorities citing risks around speculative behavior and economic instability. Platforms and media outlets are now barred from hosting crypto-related ads, with enforcement overseen by digital content regulators. This move has multiple implications for advertisers: agencies must reallocate budgets previously assigned to crypto-themed messaging and pivot toward more permissible sectors. The ban also signals greater scrutiny over financial and digital advertising content, with platforms now required to monitor ad classifications and remove disallowed categories proactively. As digital spending shifts away from restricted verticals, advertisers are reevaluating creative direction and message strategy. This regulatory update reflects an emerging governance model that directly affects ad inventory categories and campaign compliance. Taken together, this policy adjustment underscores evolving Iran advertising market trends as regulators tighten control around sensitive digital ad content.

Government Control Over Media Content Licensing

In January 2025, Iran’s Mass Media Regulatory Authority (SATRA) issued updated licensing rules for both traditional and online advertising platforms. These updates require platforms including OTT services, IPTV, and social media channels operating domestically to secure formal permissions and adhere to content classification guidelines enforced by SATRA. The move marks a tightening of oversight over who can publish ads and under what conditions. Platforms must ensure ad content aligns with cultural standards, including mandatory filtering of prohibited themes and alignment with state broadcasting policy. Advertisers and media operators are now expected to maintain compliant workflows, archive approved content, and liaise with regulatory bodies for clearance. This regulatory transformation is reshaping how campaigns are produced and distributed across Iran’s digital and traditional media. Over time, this governance model may influence budget allocation, creative planning, and platform selection as compliance becomes integral to ad execution. With regulatory attention spanning all levels of media licensing, advertisers must navigate an environment where legal approval is central to campaign feasibility.

Iran Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

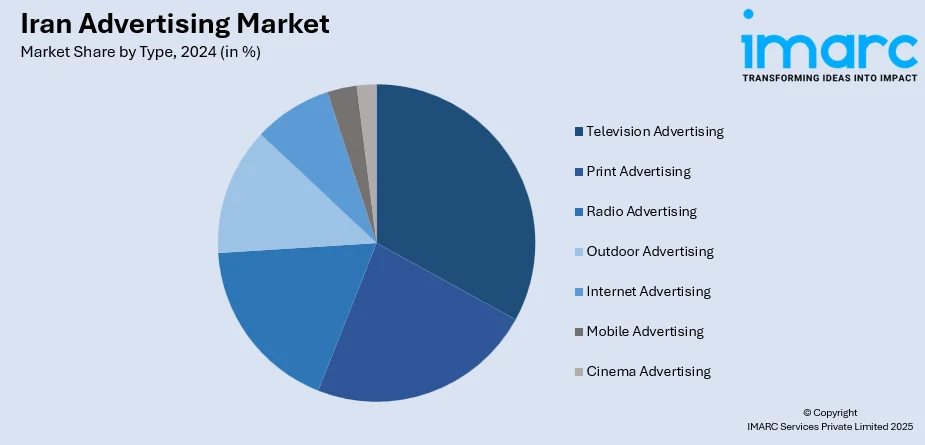

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Advertising Market News:

- December 2024: Iran’s longstanding Kelaket digital agency has joined forces with Dubai-based Lamana International, forming Lamana Iran, a localized branch bringing international marketing expertise to the country. The collaboration preserves Kelaket’s existing team and client services while leveraging Lamana’s experience with global clients in the Middle East. Led by CEO Mohammad Reza Ashrafi, the partnership aims to introduce data-driven, creative campaigns aligned with Iranian culture and market nuances. This move marks a significant step in integrating international digital marketing practices into Iran’s advertising landscape.

Iran Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran advertising market on the basis of type?

- What is the breakup of the Iran advertising market on the basis of region?

- What are the various stages in the value chain of the Iran advertising market?

- What are the key driving factors and challenges in the Iran advertising market?

- What is the structure of the Iran advertising market and who are the key players?

- What is the degree of competition in the Iran advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)