Iran Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Province, 2025-2033

Iran Air Freight Market Overview:

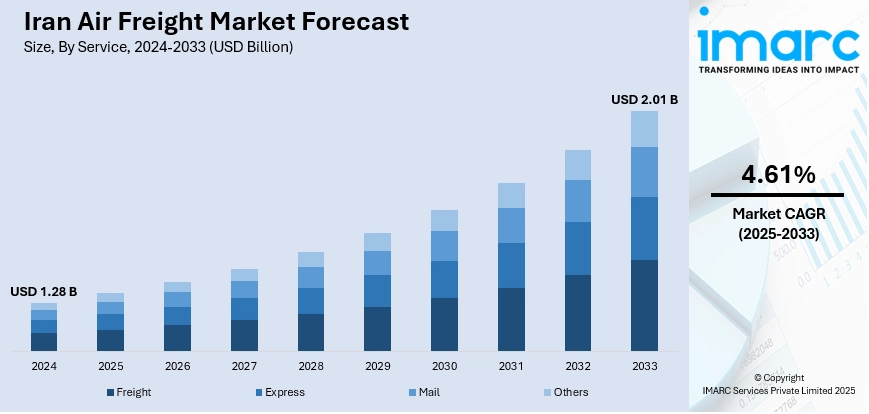

The Iran air freight market size reached USD 1.28 Billion in 2024. The market is projected to reach USD 2.01 Billion by 2033, exhibiting a growth rate (CAGR) of 4.61% during 2025-2033. The market is expanding due to ongoing infrastructure development and potential sanctions relief. Upgrades to airports and cargo terminals are enhancing operational efficiency, while improved trade relations are opening new international routes. Furthermore, these factors are positively influencing the Iran air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.28 Billion |

| Market Forecast in 2033 | USD 2.01 Billion |

| Market Growth Rate 2025-2033 | 4.61% |

Iran Air Freight Market Trends:

Infrastructure Development Helps Air Freight

Iran's air freight industry is undergoing rapid expansion as the nation pursues massive infrastructure projects. The growth of major airports and the construction of stand-alone freight terminals are major drivers in increasing the capability and efficiency of air freight operations. As Iran attempts to diversify its economy, streamlining logistics operations has become vital in ensuring competitiveness in the region. The construction of new freight facilities and the modernization of existing ones are key factors in simplifying operations and eliminating delays, making air freight a more dependable means of transportation. In May 2025, Iran signed a USD 300 Million agreement to create an Imam Khomeini Airport multimodal cargo terminal. This terminal, as part of a wider USD 2.8 Billion airport expansion program, will dramatically boost Iran's freight capacity and facilitate the movement of goods. This project, along with several other initiatives in the region, is helping to expand the Iranian air freight market by providing more efficient and up-to-date infrastructure. These improvements not only render Iran a more desirable center for global cargo but also contribute to solidifying its position in the global logistics sector, facilitating closer ties with major international trade routes.

To get more information on this market, Request Sample

Easing Sanctions Drive International Trade

Current negotiations on easing sanctions are also positively influencing the Iranian air freight industry. The relaxation of Iranian business restrictions, especially in the aviation industry, presents new opportunities for expansion and growth. When the restrictions are relaxed, Iranian firms are likely to access better technologies and aircraft, hence enhancing their air freight services. The ability to access new fleet possibilities from large aircraft manufacturers like Boeing and Airbus will assist Iran Air and other airlines in replacing their fleets with international standards. The creation of new trade routes with Europe and Asia, particularly following the lifting of sanctions, will generate new business opportunities in the air freight market. Furthermore, the government's intention to develop transportation and logistics infrastructure in line with the global trade pattern is driving the industry. With improved trade relations, Iran's geographical position between Europe and Asia will also enhance its air freight potential, facilitating greater connectivity between the two regions. The integration of new infrastructure and enhanced international relations will sustain Iran air freight market growth, positioning the nation as a competitive force in global logistics.

Iran Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

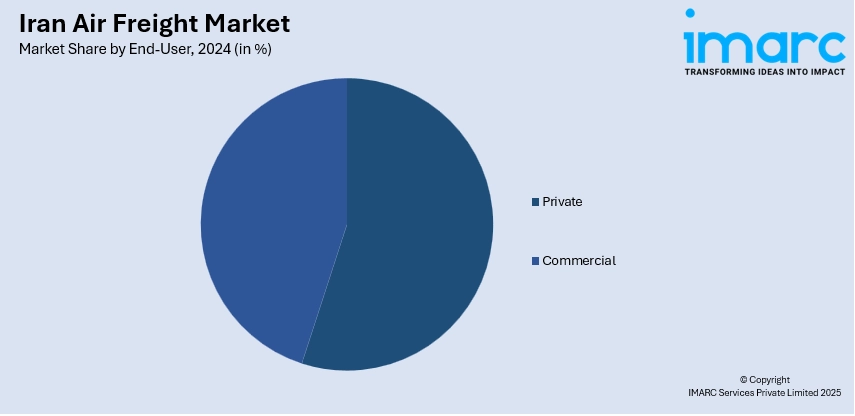

End-User Insights:

- Private

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes private and commercial.

Provincial Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Air Freight Market News:

- May 2025: IranAir signed a USD 300 Million deal with Imam Khomeini Airport City to build a multimodal cargo terminal at Tehran’s airport. This development aimed to boost Iran’s freight capacity, alleviate infrastructure pressure, and enhance its role as a regional air freight hub.

Iran Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Provinces Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran air freight market on the basis of service?

- What is the breakup of the Iran air freight market on the basis of destination?

- What is the breakup of the Iran air freight market on the basis of end user?

- What is the breakup of the Iran air freight market on the basis of province?

- What are the various stages in the value chain of the Iran air freight market?

- What are the key driving factors and challenges in the Iran air freight market?

- What is the structure of the Iran air freight market and who are the key players?

- What is the degree of competition in the Iran air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran air freight market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)