Iran Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033

Iran Aquaculture Market Overview:

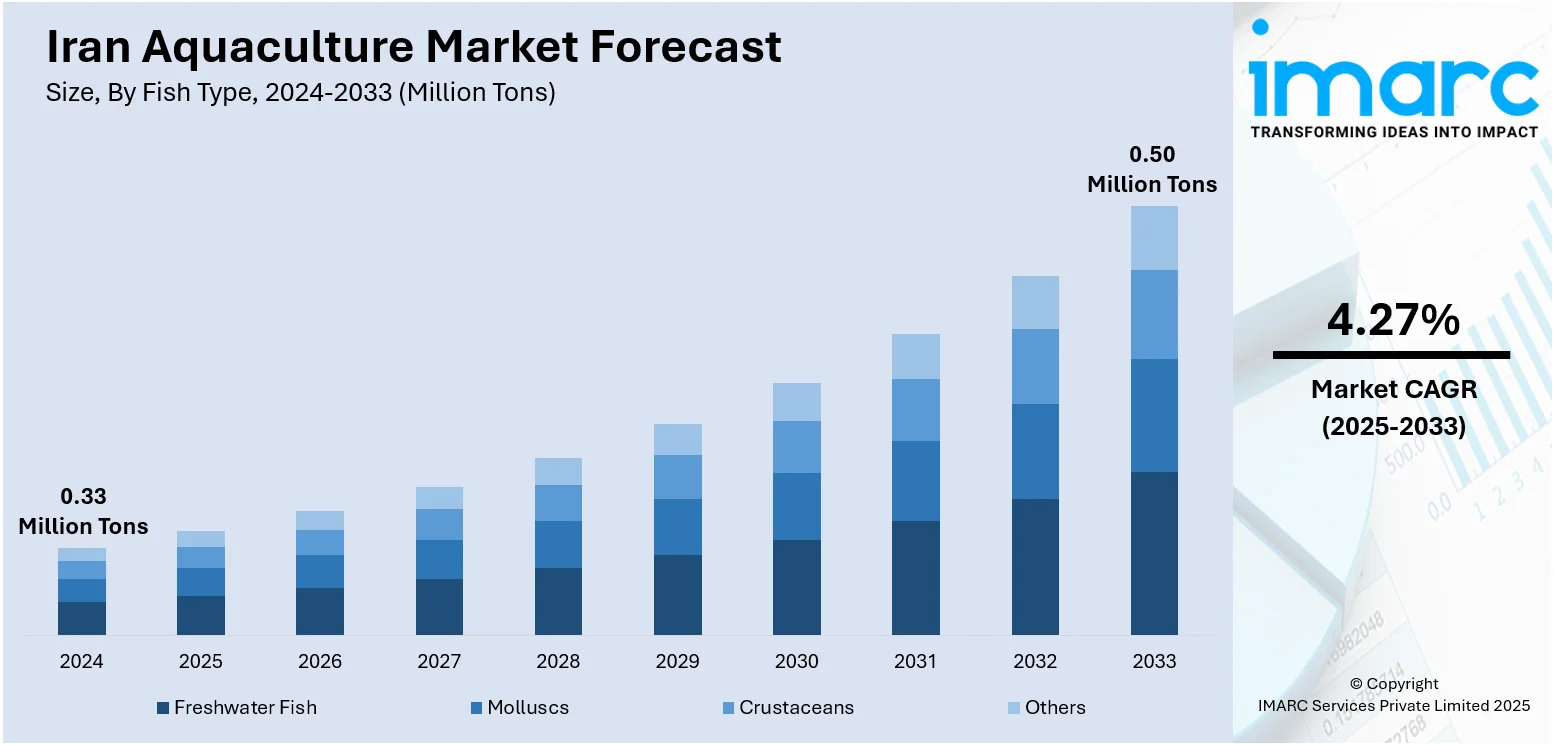

The Iran aquaculture market size reached 0.33 Million Tons in 2024. Looking forward, the market is projected to reach 0.50 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.27% during 2025-2033. The market is growing, driven by increasing domestic fish consumption, government investments in aquaculture infrastructure, and expansion into regional exports. Enhancement in production systems and feed autonomy are key enablers rising the Iran aquaculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 0.33 Million Tons |

| Market Forecast in 2033 | 0.50 Million Tons |

| Market Growth Rate 2025-2033 | 4.27% |

Iran Aquaculture Market Trends:

Inland Intensification and RAS Adoption

Iran is enhancing inland aquaculture via intensified pond systems and Recirculating Aquaculture Systems (RAS), especially for species such as carp and trout. These systems optimize water usage, improve yield, and reduce disease risks. Pilot projects emphasize RAS scalability for resource-constrained regions. Investments in infrastructure, training, and facility design facilitate adoption. These changes directly stimulate Iran aquaculture market growth, aligning local production with demand while conserving ecological resources. For instance, as of 2025, Iran is set to issue its first official license for a cage fish farming value chain in the Caspian Sea, with a 1,500-ton capacity involving 12 stakeholders. This integrated chain includes breeding, nurseries, sea cages, logistics, and exports. Separately, a knowledge-based firm developed nanobubble generators to boost aquaculture efficiency—tripling fish populations, cutting electricity use by 70%, and reducing water pollution with up to 85% efficiency. These innovations support Iran's drive toward sustainable, high-tech aquaculture development.

To get more information on this market, Request Sample

Logistics Enhancement and Regional Outreach

Enhanced transportation networks and cold storage infrastructure have significantly expanded the distribution of aquaculture products within Iran and to neighboring export markets. Both public and private stakeholders are investing in cold chain systems to preserve product freshness and quality, thereby increasing market reach and pricing leverage. These logistical improvements are crucial to Iran’s aquaculture market growth, effectively connecting production hubs with regional demand centers. Notably, in the first five months of 2024, Iran exported 68,000 tons of fishery products worth $138 Million, a 24% increase in value and 32% rise in volume year-on-year. Shrimp exports alone surpassed $31.3 Million, accounting for 32% of total fishery export value. Iran aims to reach 206,000 tons in fishery production within two years.

Iran Aquaculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fish type, environment, and distribution channel.

Fish Type Insights:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

The report has provided a detailed breakup and analysis of the market based on the fish type. This includes freshwater fish, molluscs, crustaceans, and others.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

A detailed breakup and analysis of the market based on the environment have also been provided in the report. This includes fresh water, marine water, and brackish water.

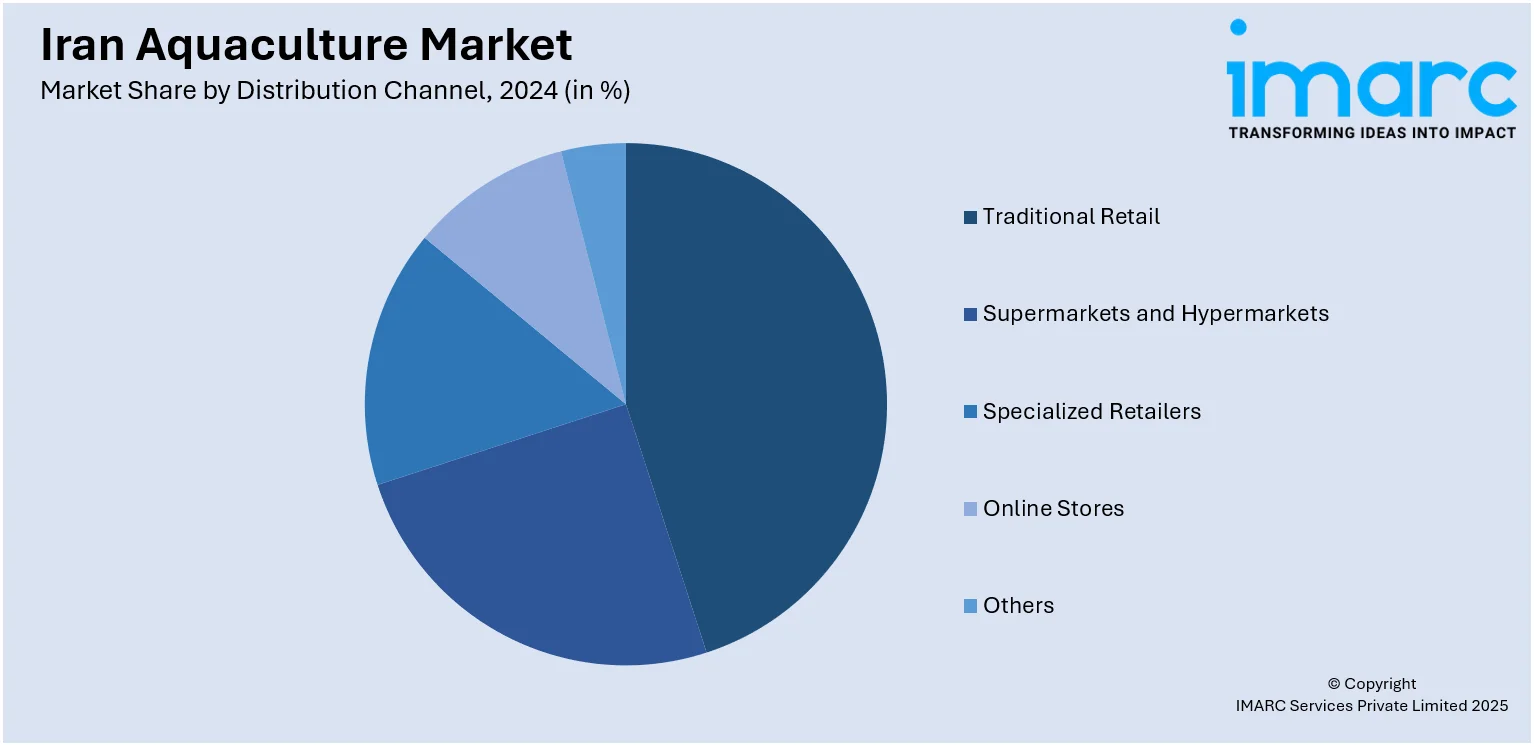

Distribution Channel Insights:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Aquaculture Market News:

- In October 2024, Afarinesh Samaneh Mehr Engineering Co. implemented Libelium’s IoT-based smart water monitoring system in fish breeding ponds across Iran’s Caspian region. The setup includes four solar-powered sensor nodes that track key water quality parameters—pH, dissolved oxygen, ammonium, nitrite, and temperature—using LoRaWAN and 3G connectivity. This solution has helped reduce fish mortality by 30–40%, lower operational costs, and improve productivity. It also supports compliance with international standards and aligns with Iran’s vision for a sustainable, technology-driven aquaculture sector.

Iran Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran aquaculture market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran aquaculture market on the basis of fish type?

- What is the breakup of the Iran aquaculture market on the basis of environment?

- What is the breakup of the Iran aquaculture market on the basis of distribution channel?

- What is the breakup of the Iran aquaculture market on the basis of region?

- What are the various stages in the value chain of the Iran aquaculture market?

- What are the key driving factors and challenges in the Iran aquaculture market?

- What is the structure of the Iran aquaculture market and who are the key players?

- What is the degree of competition in the Iran aquaculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran aquaculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)