Iran Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Iran Carbon Black Market Overview:

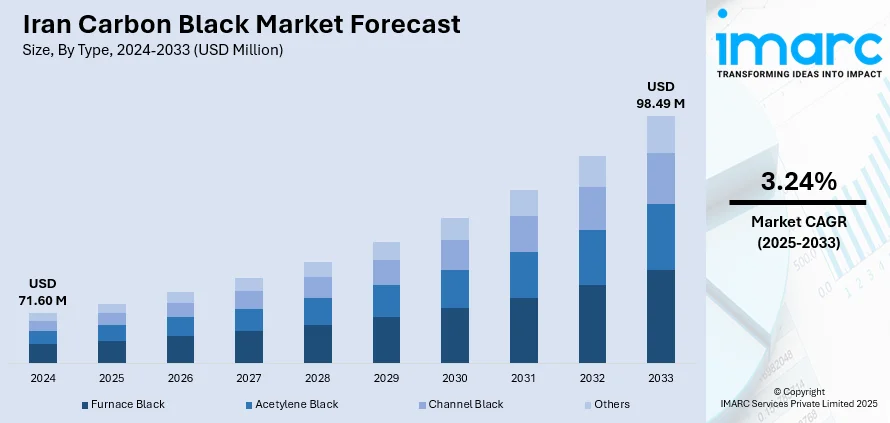

The Iran carbon black market size reached USD 71.60 Million in 2024. Looking forward, the market is projected to reach USD 98.49 Million by 2033, exhibiting a growth rate (CAGR) of 3.24% during 2025-2033. The market is driven by Iran’s domestic tire production, agricultural modernization, and infrastructure development. Ongoing efforts to reduce import dependency through domestic production, alongside resilient regional exports of rubber and plastic goods, sustain steady demand. Industries focused on automotive, farming, and construction applications continue to value carbon black’s functionality under Iran’s climatic and economic conditions, steadily augmenting the Iran carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 71.60 Million |

| Market Forecast in 2033 | USD 98.49 Million |

| Market Growth Rate 2025-2033 | 3.24% |

Iran Carbon Black Market Trends:

Domestic Tire Production and Automotive Resilience

Iran maintains one of the largest automotive markets in the Middle East, driven primarily by strong domestic demand and limited reliance on imports due to long-standing sanctions. Major local manufacturers such as Iran Khodro and SAIPA continue to produce millions of vehicles annually, while domestic tire producers meet the country’s needs across passenger cars, commercial vehicles, and agriculture. The Iran Tire factory in Semnan province commenced the operation of its first phase by mid-2024, with an annual production capacity of 4,000 tons. This development was backed by significant financing (1,000 Billion Tomans) through capital market mechanisms, demonstrating strong investment and growth in Iran's tire manufacturing sector. Carbon black is indispensable in tire treads, sidewalls, and inner liners, offering durability and abrasion resistance in extreme climates and poor road conditions. While much of Iran’s carbon black supply is still imported, state-backed efforts to localize production, especially in provinces like Kerman and Khuzestan, are underway to reduce dependency and ensure stable access. Industrial policy favors vertical integration, enabling tire companies to secure in-house or domestic carbon black sourcing for strategic autonomy. Therefore, domestic vehicle manufacturing, sanctions-induced self-sufficiency, and growing production localization are primary drivers shaping Iran carbon black market growth across the tire and rubber ecosystem.

To get more information on this market, Request Sample

Polymer Additives for Agriculture and Infrastructure

Iran’s reliance on agriculture, supported by vast arid regions and irrigation-dependent farming, drives significant demand for UV-resistant plastics and films. The 18th Iran Plast Exhibition was held successfully in Tehran from September 17 to 20, 2024, attracting 855 companies from various countries. The event showcased the latest in plastics machinery, raw materials, molds, and technologies, including innovations with a focus on sustainability and eco-friendly solutions such as UV-resistant plastics for various applications. Carbon black is commonly used as a UV stabilizer in greenhouse films, irrigation pipes, mulch sheets, and seedling trays. These materials must endure intense sunlight and high temperatures, especially in provinces like Fars, Yazd, and Khorasan. As Iran invests in greenhouse-based farming and water management systems, demand for carbon-black-reinforced polyethylene and polypropylene products continues to rise. In addition, carbon black plays a critical role in plastic conduits and cable sheathing for infrastructure and utility networks. Development projects tied to energy, construction, and transport require reliable polymer components resistant to photodegradation and environmental wear. Iranian plastic processors, many concentrated in industrial zones near Tehran and Isfahan, are ramping up black masterbatch production tailored for agro-infrastructure needs. The performance, longevity, and cost-efficiency of these carbon black applications make them central to Iran’s efforts to strengthen its agricultural and infrastructure sectors under resource-constrained conditions.

Iran Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

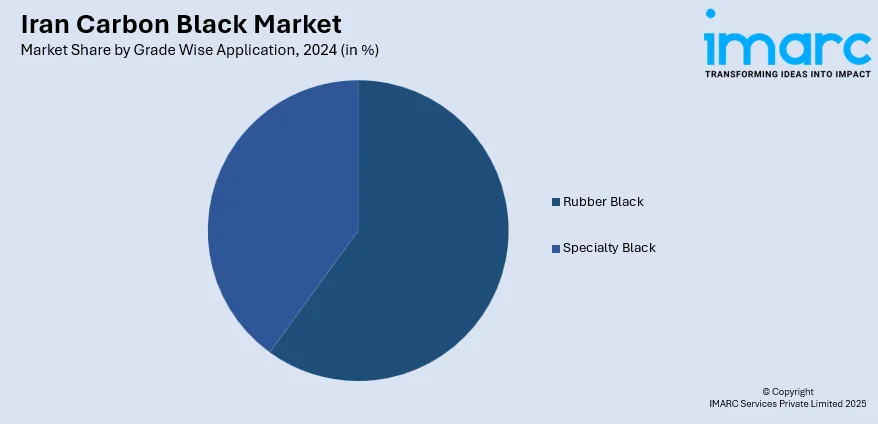

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Carbon Black Market News:

- In June 2024, The Tehran Sewage Company announced a pioneering program to produce diesel and black carbon from de-watered sludge during wastewater treatment. This innovative initiative aims to convert 120 tons of sludge daily into valuable diesel and black carbon, which can be used as raw materials in industries like tire manufacturing. This effort addresses environmental pollution issues in Tehran by turning sewage threats into opportunities.

Iran Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran carbon black market on the basis of type?

- What is the breakup of the Iran carbon black market on the basis of grade wise application?

- What is the breakup of the Iran carbon black market on the basis of region?

- What are the various stages in the value chain of the Iran carbon black market?

- What are the key driving factors and challenges in the Iran carbon black market?

- What is the structure of the Iran carbon black market and who are the key players?

- What is the degree of competition in the Iran carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)