Iran CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Iran CCTV Camera Market Overview:

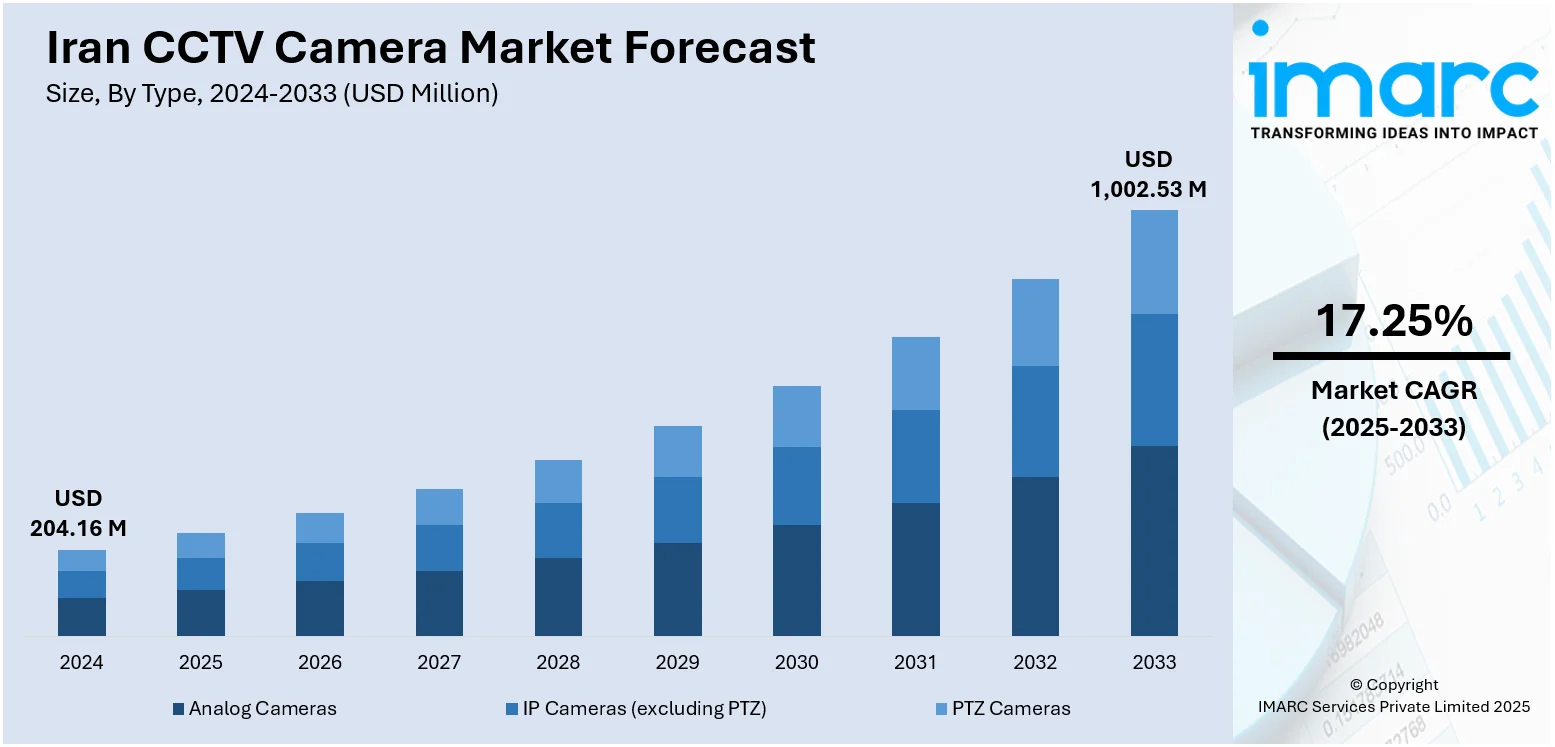

The Iran CCTV camera market size reached USD 204.16 Million in 2024. Looking forward, the market is expected to reach USD 1,002.53 Million by 2033, exhibiting a growth rate (CAGR) of 17.25% during 2025-2033. The market is experiencing steady growth driven by rising security concerns, urban expansion, and increased government initiatives to monitor public spaces. Adoption across commercial, industrial, and residential sectors is also expanding. Technological advancements, such as AI and remote surveillance, are further supporting demand, contributing to the overall rise in the Iran CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 204.16 Million |

| Market Forecast in 2033 | USD 1,002.53 Million |

| Market Growth Rate 2025-2033 | 17.25% |

Iran CCTV Camera Market Trends:

Regulatory Enforcement and Compliance Requirements

Iranian authorities have increasingly mandated the installation of CCTV systems across a wide range of facilities, including retail outlets, government buildings, educational institutions, and industrial sites. Such regulatory actions will increase accountability, minimize crime, and maintain societal order. It has become mandatory that businesses operate under the standards of surveillance that the business should conform to, to secure the maintenance of a license to operate in the urban areas. This regulatory pressure has seen the number of installations increase, including not only high-security areas, but also in daily settings such as parking lots, public transportation terminals, and office buildings. Consequently, this has made the compliance-driven segment a major segment in the growth of the CCTV market in Iran, with vendors gracing such solutions with customized solutions in response to the official demands.

To get more information on this market, Request Sample

Growth of the Construction and Real Estate Sectors

Iran's expanding construction and real estate markets are fueling demand for integrated security solutions, including CCTV systems, which drives the Iran CCTV camera market growth. As new residential complexes, commercial buildings, shopping centers, and mixed-use developments emerge, developers are prioritizing security as a core component of their infrastructure. Modern building designs often incorporate centralized surveillance systems for asset protection, occupant safety, and facility management. This trend is particularly strong in urbanizing cities where population density is increasing. The integration of CCTV systems during the planning and construction phases has become common practice, helping to reduce future retrofitting costs. This sector-wide approach to surveillance implementation is steadily driving demand for cameras with better coverage, resolution, and scalability, thus stimulating consistent growth in the CCTV market.

Expansion of Critical Infrastructure and Industrial Facilities

Iran is actively investing in the development of critical infrastructure such as energy plants, transportation networks, logistics hubs, and manufacturing units. These strategic assets require robust surveillance systems to ensure operational security, protect against sabotage or theft, and monitor daily activities. In industries such as oil and gas, mining, and logistics, real-time visual monitoring is essential for both safety and productivity. As a result, demand for durable, high-resolution CCTV cameras suited for harsh environments has risen sharply. In addition, many of these facilities are in remote or high-risk areas, increasing the need for advanced, often network-based surveillance solutions. This trend is strengthening the role of the industrial segment in shaping Iran's CCTV camera market dynamics.

Iran CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

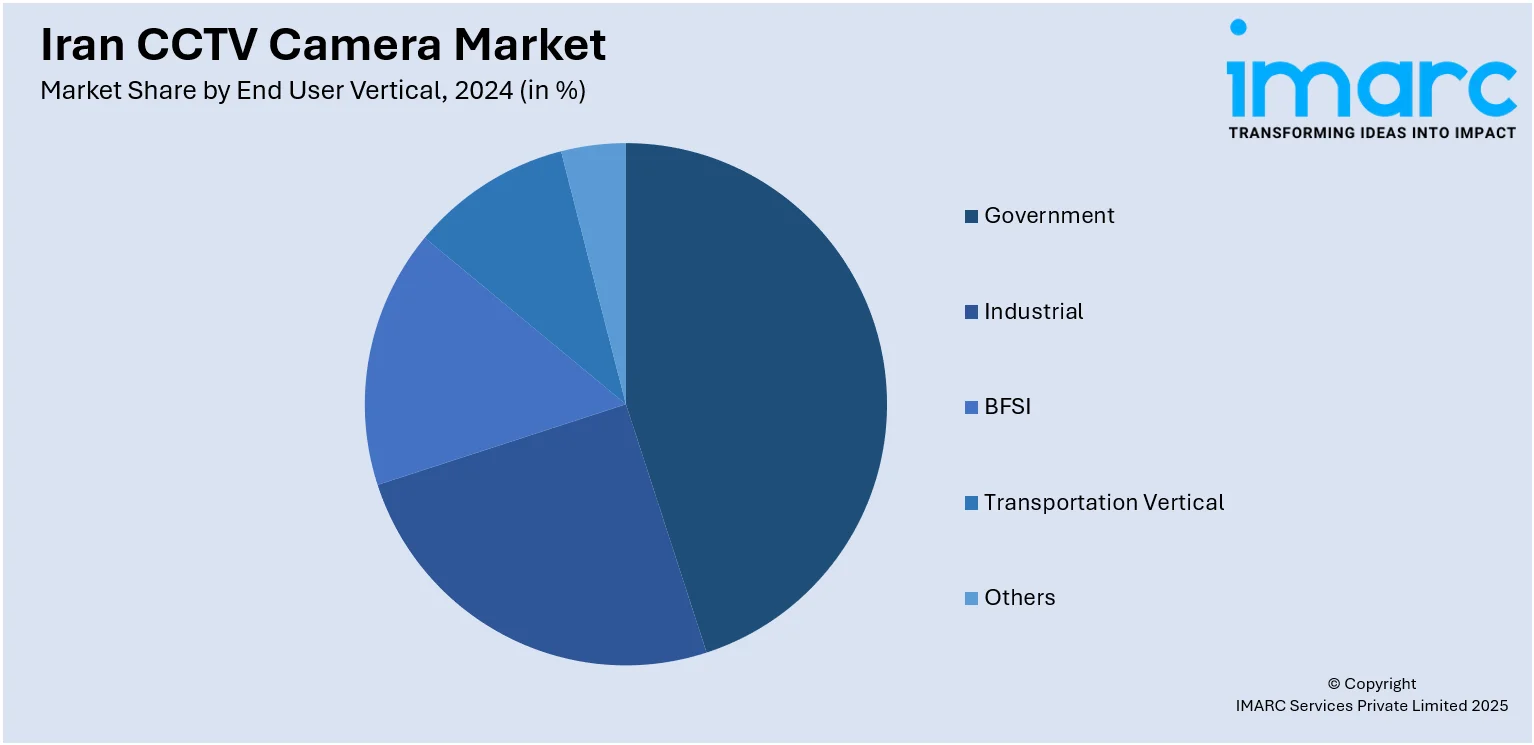

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran CCTV camera market on the basis of type?

- What is the breakup of the Iran CCTV camera market on the basis of end user vertical?

- What is the breakup of the Iran CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Iran CCTV camera market?

- What are the key driving factors and challenges in the Iran CCTV camera market?

- What is the structure of the Iran CCTV camera market and who are the key players?

- What is the degree of competition in the Iran CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)