Iran Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Iran Commercial Insurance Market Overview:

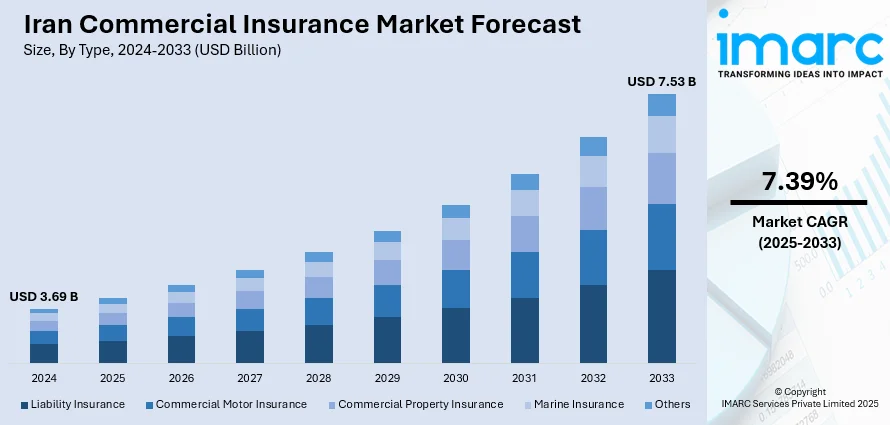

The Iran commercial insurance market size reached USD 3.69 Billion in 2024. The market is projected to reach USD 7.53 Billion by 2033, exhibiting a growth rate (CAGR) of 7.39% during 2025-2033. Economic expansion, rising foreign investments, increased infrastructure projects, regulatory reforms supporting private insurers, and digital adoption are some of the factors contributing to the Iran commercial insurance market share. Higher awareness of risk management, demand for liability and property coverage, and government-backed initiatives for financial stability further accelerate sector growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.69 Billion |

| Market Forecast in 2033 | USD 7.53 Billion |

| Market Growth Rate 2025-2033 | 7.39% |

Iran Commercial Insurance Market Trends:

Digitalization and Technology Integration

Iran’s commercial insurance sector is gradually embracing digital platforms as insurers adapt to changing customer expectations and cost-efficiency pressures. The expansion of mobile penetration and internet usage has encouraged companies to move beyond traditional distribution channels, offering online policy issuance, premium payments, and claims handling. Startups in InsurTech are beginning to introduce AI-driven risk assessment and digital customer service tools, improving both underwriting precision and turnaround times. Although regulatory hurdles and legacy systems still slow down full-scale digital adoption, the direction is clear: insurers are prioritizing automation and data analytics to reduce fraud, personalize products, and cut operational expenses. This technological shift also reflects changing client behavior, as businesses demand faster, more transparent, and tailored coverage. Over the next few years, the insurers who succeed in balancing regulatory compliance with technology-driven models will likely gain competitive advantage, especially in areas like marine, property, and liability insurance where efficient processing is critical for businesses. These factors are intensifying the Iran commercial insurance market growth.

To get more information on this market, Request Sample

Growing Demand from Energy and Infrastructure Sectors

Commercial insurance demand in Iran is increasingly shaped by its energy and infrastructure projects. As one of the world’s largest oil and gas producers, Iran’s reliance on these industries makes risk coverage a necessity, particularly for property, liability, and engineering insurance lines. With ongoing investments in refineries, pipelines, power plants, and transportation networks, insurers are finding growth opportunities in providing specialized coverage tailored to high-value industrial projects. At the same time, sanctions and political uncertainties expose these sectors to unique risks, pushing companies to seek broader and more complex insurance packages. Reinsurance arrangements also play an important role in managing large-scale exposures, though international limitations often force local insurers to assume higher levels of risk retention. This has prompted innovation in product structuring, where insurers adapt policies to balance both client protection and capital management. The trend underscores how closely commercial insurance in Iran is tied to national development priorities, with growth tied heavily to the scale and resilience of the energy and infrastructure landscape.

Iran Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

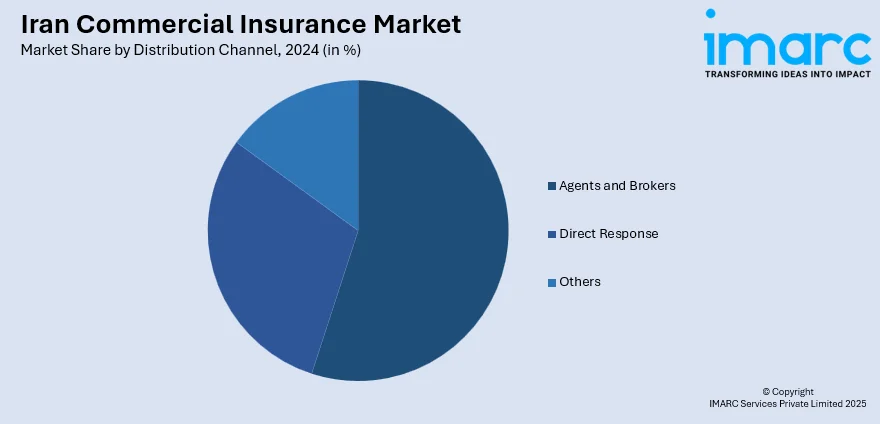

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran commercial insurance market on the basis of type?

- What is the breakup of the Iran commercial insurance market on the basis of enterprise size?

- What is the breakup of the Iran commercial insurance market on the basis of distribution channel?

- What is the breakup of the Iran commercial insurance market on the basis of industry vertical?

- What is the breakup of the Iran commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Iran commercial insurance market?

- What are the key driving factors and challenges in the Iran commercial insurance market?

- What is the structure of the Iran commercial insurance market and who are the key players?

- What is the degree of competition in the Iran commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)