Iran Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Iran Drones Market Overview:

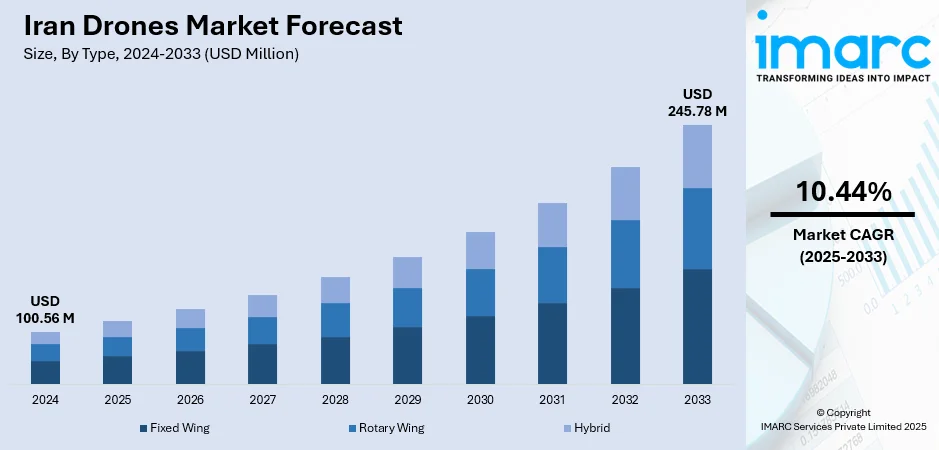

The Iran drones market size reached USD 100.56 Million in 2024. Looking forward, the market is expected to reach USD 245.78 Million by 2033, exhibiting a growth rate (CAGR) of 10.44% during 2025-2033. The market is motivated by continued government investment, robust military emphasis on self-reliance, and necessity to respond to threats from regional actors. Opportunities for export to allied states and non-state actors also generate demand. Ongoing advancement of loitering munitions, reconnaissance UAVs, and long-range attack drones enlarging its global presence, along with Iranian drone battlefield performance in multiple conflicts reinforces their legitimacy and expands foreign interest, which eventually leads to a rise in Iran drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 100.56 Million |

| Market Forecast in 2033 | USD 245.78 Million |

| Market Growth Rate 2025-2033 | 10.44% |

Iran Drones Market Trends:

Autonomous Indigenous Development and Reverse‑Engineering Culture

Iran's drone industry has come a long way through a two-pronged approach of self-dependent design and reverse engineering in an organized fashion. Iran, over time, grew diverse platforms like Mohajer‑6, Mohajer‑10, Shahed‑149 "Gaza," and Kaman‑22, combining reconnaissance, strike, long‑range patrol, and electronic warfare missions. The Mohajer‑10 is an example of indigenous development, providing full‑spectrum capability, 24‑hour endurance, internal payload bays, and extended operational range, which are features designed to suit regional threat environments. The Shahed family, particularly Shahed‑136 and more recent long-endurance variants, demonstrates Iran's focus on indigenous development of effective loitering weapons with increasing lethality and range. The programs highlight Iran's determination to achieve technological independence, even in the face of international sanctions, by developing a local aerospace system that extends to airframes, guidance, propulsion, and warhead integration.

To get more information on this market, Request Sample

Regional Export Influence and Proxy Support Ecosystem

Iran is playing the role of a major player in international drone diplomacy, selling UAV platforms and accompanying technology to state and non‑state actors in the Middle East, Africa, Eastern Europe, and Asia. Buyers have included allied militias, governments, and armies in nations looking for systems unhampered by international constraints. Tehran frequently pairs exports with component packages or assists in the creation of local assembly facilities, facilitating technology transfer and promoting operational autonomy. Numerous countries exhibit expanding interest in Iranian drones for their affordability, battlefield effectiveness, and easy maintenance requirements. This export-based approach enhances Iran's strategic reach among allied partners, enabling them to deploy drone systems where Western vendors are restricted. It also bolsters Iran's defense economy and enhances its geopolitical influence via deepened alliances and in-country partnerships enabled by drone technology, which further supports the Iran drones market growth.

Maritime Projection, Surveillance Integration and Strategic Innovation

Iran has elevated its drone strategy by merging UAV capabilities with sea operations and vital infrastructure surveillance. One example of innovation is transforming civilian ships into drone carriers that can deploy several forms of drones at sea to extend the range of operations. This naval strategy enhances Iran's objective to extend power beyond the limits of its near-coast waters. Drones are applied onshore for infrastructure surveillance, such as pipelines and energy facilities, through imaging and sensor technologies coupled with analytics to implement predictive maintenance. Iran is also advancing future systems with electronic warfare functionality and artificial intelligence. These drones are being converted for reconnaissance and strike operations, often with the capability to operate within electronically contested spaces. These developments reflect Iran's transition toward a networked, multi-domain drone posture that prioritizes regional deterrence, asymmetric warfare capabilities, and technological advancements notwithstanding external constraints.

Iran Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 kilograms, 25-170 kilograms, and >170 kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

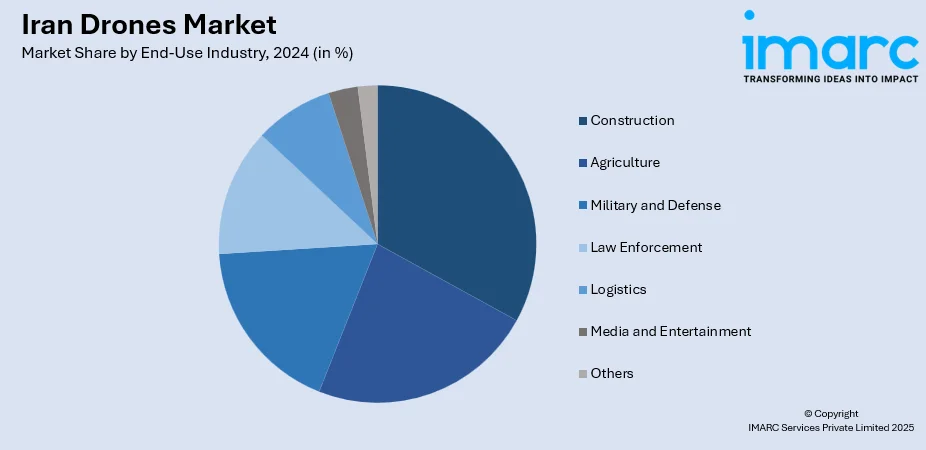

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Drones Market News:

- In January 2025, Iran's military received a thousand new drones as the nation prepared for increased tension with its primary adversaries, Israel and the United States, following the inauguration of U.S. President Donald Trump.

- In January 2025, a leading military leader from Iran stated on Sunday that the nation’s drones are now fitted with domestically developed missiles that utilize artificial intelligence (AI) technology. The commander of the Islamic Revolution Guards Corps (IRGC) Navy, Alireza Tangsiri, shared these comments during a briefing with reporters in Bushehr, a southern province of Iran, while detailing a two-day extensive naval exercise conducted by his forces in the southern waters of Iran.

Iran Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran drones market on the basis of type?

- What is the breakup of the Iran drones market on the basis of component?

- What is the breakup of the Iran drones market on the basis of payload?

- What is the breakup of the Iran drones market on the basis of point of sale?

- What is the breakup of the Iran drones market on the basis of end-use industry?

- What is the breakup of the Iran drones market on the basis of region?

- What are the various stages in the value chain of the Iran drones market?

- What are the key driving factors and challenges in the Iran drones market?

- What is the structure of the Iran drones market and who are the key players?

- What is the degree of competition in the Iran drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)