Iran Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Iran Insurtech Market Overview:

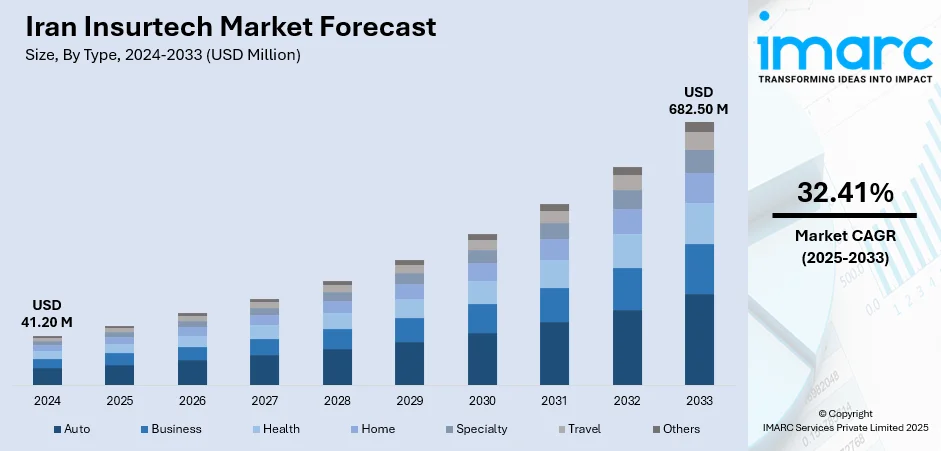

The Iran Insurtech market size reached USD 41.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 682.50 Million by 2033, exhibiting a growth rate (CAGR) of 32.41% during 2025-2033. The growth of e-commerce and mobile internet access is driving the demand for digital-first insurance solutions in Iran. Advances in health and life insurance technologies, including wearable devices and telemedicine, are offering personalized, data-driven coverage. Moreover, increased mobile penetration enables wider outreach, including underserved regions, is expanding the Iran Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 41.20 Million |

| Market Forecast in 2033 | USD 682.50 Million |

| Market Growth Rate 2025-2033 | 32.41% |

Iran Insurtech Market Trends:

Expansion of E-commerce and Online Payment Systems

As more people participate in online shopping, mobile transactions, and digital payments, there is a higher expectation for insurance services to be seamlessly incorporated into these platforms. Insurtech firms are taking advantage of this trend by providing accessible, digital-centric insurance solutions that can be easily acquired via mobile applications, e-wallets, and various online payment methods. The incorporation of insurance services into well-known e-commerce platforms reduces entry barriers for numerous users, enhancing the accessibility and efficiency of insurance. With e-commerce sector in Iran anticipated to reach USD 1,100.21 Billion by 2033 as per IMARC Group, the need for digital insurance products is also growing. This increasing user inclination towards online financial services is driving advancement and acceptance of Insurtech in the area.

To get more information on this market, Request Sample

Growth of Mobile and Internet Penetration

With greater access to budget-friendly smartphones and fast internet, more people are turning to digital platforms for insurance services. This improved connectivity enables Insurtech firms to broaden their outreach to a larger and more varied clientele, encompassing individuals in rural or underserved regions who previously had restricted access to conventional insurance offerings. As mobile apps and online platforms are being the favored method to access services, the need for digital-first insurance options is growing. This shift is further evidenced by data from the Communications Regulatory Authority (CRA), which reported that Iran’s mobile internet penetration rate reached 132% by March 2024, with mobile phone penetration exceeding 179%. Such widespread technological access fosters an environment ripe for innovation, as individuals increasingly manage various aspects of their financial and personal lives digitally.

Advances in Health and Life Insurance Technologies

Innovations in health and life insurance technologies are greatly changing the Insurtech landscape in Iran. The combination of telemedicine, wearable health devices, and digital health monitoring is opening novel possibilities for insurers to provide innovative products that meet the changing demands of individuals. Insurtech firms can deliver more precise health risk evaluations and offer tailored premiums by integrating real-time health data from mobile applications and wearable gadgets. This approach based on data not only results in more cost-effective and personalized coverage for users but also enhances the risk management strategies for insurers. Furthermore, with Iran's population aging, as reported by the National Population Headquarters, where nearly one-third of the population will be aged 60 or older by 2050, the demand for personalized health and life insurance solutions is rising. These technological advancements in health and life insurance are contributing to the Iran Insurtech market growth, as insurers leverage data-driven solutions to meet the growing demand for personalized coverage.

Iran Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

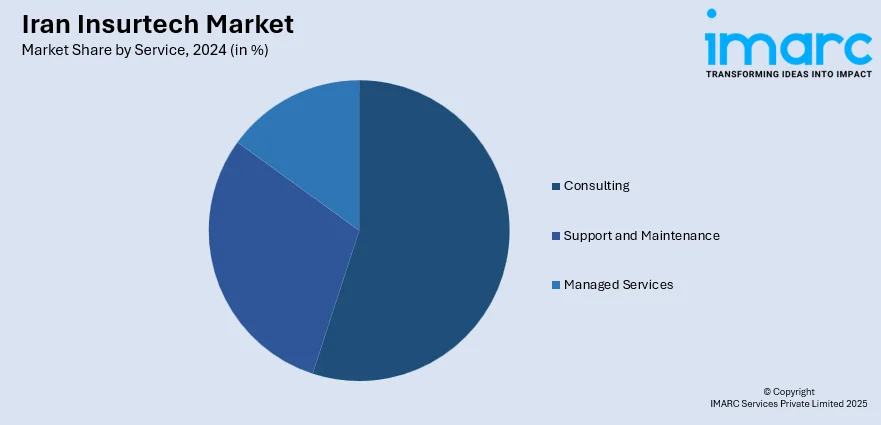

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran Insurtech market on the basis of type?

- What is the breakup of the Iran Insurtech market on the basis of service?

- What is the breakup of the Iran Insurtech market on the basis of technology?

- What is the breakup of the Iran Insurtech market on the basis of region?

- What are the various stages in the value chain of the Iran Insurtech market?

- What are the key driving factors and challenges in the Iran Insurtech market?

- What is the structure of the Iran Insurtech market and who are the key players?

- What is the degree of competition in the Iran Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)