Iran Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Iran Meat Market Overview:

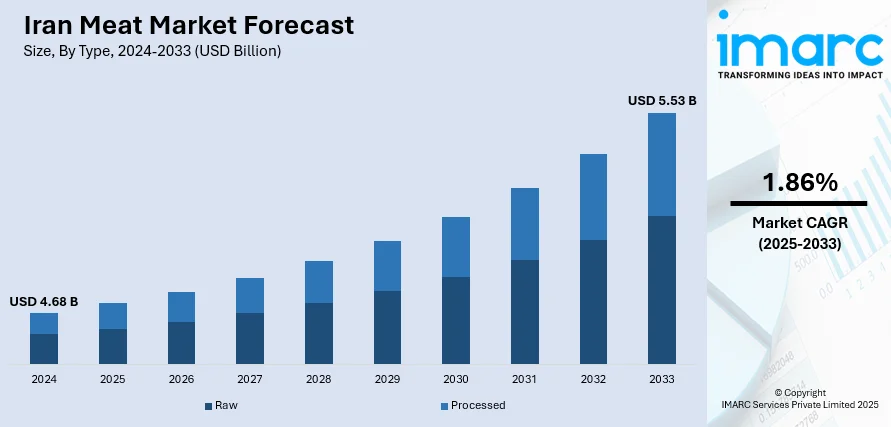

The Iran meat market size reached USD 4.68 Billion in 2024. The market is projected to reach USD 5.53 Billion by 2033, exhibiting a growth rate (CAGR) of 1.86% during 2025-2033. The market is driven by urbanization, economic pressures, and government policies. In the Iran meat market, changing urban lifestyles drive demand for convenient, protein-rich foods. Economic challenges—such as sanctions and currency fluctuations—increase production costs and reduce consumer purchasing power, shifting preferences toward more affordable meats like poultry. At the same time, government-led self-sufficiency policies aim to strengthen domestic production and reduce reliance on imports. These combined factors shape meat consumption patterns, supply chains, and pricing, influencing Iran meat market share and playing a central role in its ongoing transformation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.68 Billion |

| Market Forecast in 2033 | USD 5.53 Billion |

| Market Growth Rate 2025-2033 | 1.86% |

Iran Meat Market Trends:

Population Growth and Urbanization

On of the primary Iran meat market trend is the rising population and shift towards urbanization as more Iranians move to cities, their dietary preferences are shifting accordingly. Urban lifestyles, often busier and more diverse, drive demand for convenient, ready-to-cook (RTC), and hygienically packaged meat products. While traditional meals remain important, younger generations are embracing global food trends and seeking higher protein-rich diets. This shift has made meat, especially poultry, a staple in urban households. However, annual red meat consumption declined to less than 600,000 tons by 2023, reflecting both changing habits and economic pressures. FAO estimates indicate approximately 335,000 tons of lamb and 382,000 tons of beef, showing a decline in per capita intake. Rising urban demand also places pressure on supply chains, prompting improvements in cold storage, logistics, and modern retail systems. These trends highlight how population growth, urbanization, and lifestyle shifts are not only influencing what types of meat are consumed, but also how Iran’s meat market adapts to serve a changing society.

To get more information on this market, Request Sample

Self-Sufficiency Policies and Domestic Production

Iran’s approach to food security places a strong emphasis on enhancing domestic meat production and minimizing dependence on imports. This includes support for livestock farmers, investment in veterinary care, and efforts to improve breeding and feeding techniques. These initiatives are meant to ensure a stable, home-grown supply of meat even when international trade becomes difficult. Domestic production is seen not just as a food issue but as a matter of national resilience. Although environmental and logistical challenges exist—such as limited water and high feed costs—these policies aim to build a self-reliant meat industry. The government and local producers work together to maintain availability, especially for commonly consumed meats like poultry and lamb. Over time, this focus on domestic output shapes the structure of the entire meat market, influencing everything from farm practices to the products available in shops and restaurants thus strengthening the Iran meat market growth.

Economic Sanctions and Currency Fluctuations

The Iranian meat market faces ongoing economic strain due to trade restrictions, currency instability, and rising inflation. Sanctions hinder the import of essential items like livestock feed and veterinary supplies, increasing production costs. As the local currency weakens, importing necessities becomes more expensive, driving up meat prices. In November 2023, red meat inflation exceeded 82% year-on-year, while overall food and beverage inflation exceeded 50% by 2024–25. These sharp cost increases have made meat less affordable, forcing many consumers to shift to cheaper protein sources. Farmers, meanwhile, struggle with higher input costs and limited access to quality supplies. Government interventions, such as price controls, often fail to stabilize the market, resulting in shortages and imbalances. This economic volatility directly shapes how meat is produced, distributed, and consumed, making financial conditions a central driver of both supply and demand in Iran’s evolving meat industry.

Iran Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

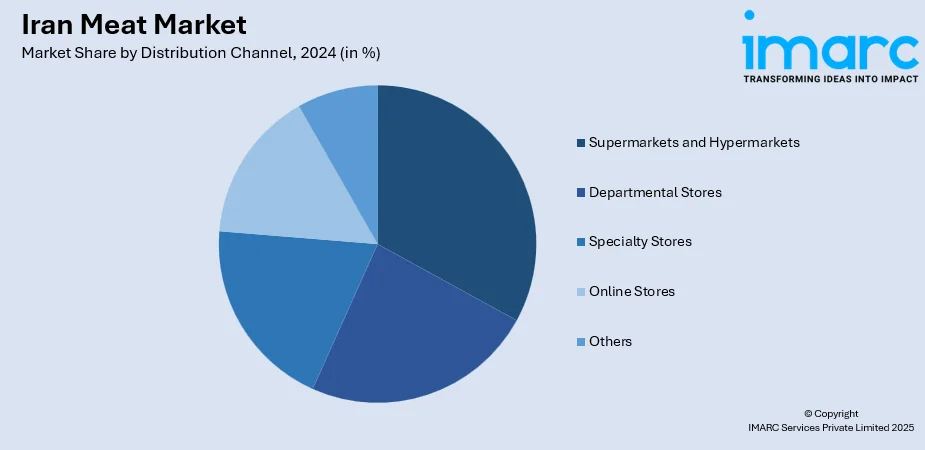

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Meat Market News:

- In March 2025, Kazakhstan's Agroproduct delivered its first batch of Halal-certified beef to Iran, with 60 tonnes already shipped and 200 tonnes planned monthly starting April. The company signed a contract to supply 700 tonnes over four months, with potential demand reaching 1,000 tonnes per month. The meat is vacuum-packed and chilled, meeting Iran's Halal standards. Agroproduct uses modern German equipment to produce high-quality, export-oriented beef from its Akmola Region plant.

Iran Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran meat market on the basis of type?

- What is the breakup of the Iran meat market on the basis of product?

- What is the breakup of the Iran meat market on the basis of distribution channel?

- What is the breakup of the Iran meat market on the basis of region?

- What are the various stages in the value chain of the Iran meat market?

- What are the key driving factors and challenges in the Iran meat market?

- What is the structure of the Iran meat market and who are the key players?

- What is the degree of competition in the Iran meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)