Iran Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Iran Running Gear Market Overview:

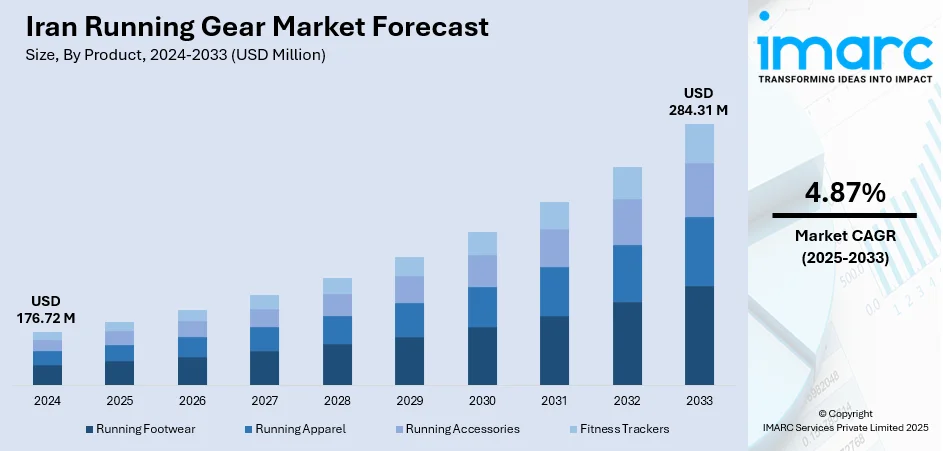

The Iran running gear market size reached USD 176.72 Million in 2024. Looking forward, the market is projected to reach USD 284.31 Million by 2033, exhibiting a growth rate (CAGR) of 4.87% during 2025-2033. The market is driven by diversified retail networks combining domestic affordability and convenient access across urban and indie channels. A growing culture of community events, marathons and shared training initiatives stimulates demand for climate-adapted, functional gear. Meanwhile, partnerships between global brand concepts and local manufacturing offer access to technical design at lower cost, further augmenting the Iran running gear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 176.72 Million |

| Market Forecast in 2033 | USD 284.31 Million |

| Market Growth Rate 2025-2033 | 4.87% |

Iran Running Gear Market Trends:

Localized Brand Networks and Price-Sensitive Retail Channels

Iran’s market features a competitive retail landscape wherein consumers seek performance running gear through hybrid channels including bazaars, independent sports stores, local brand outlets, and growing online platforms. Domestic brands offer technical footwear and apparel at lower price points compared to global names, often tailoring product lines for foot shapes common among the Iranian population. This focus on accessibility and performance aligns with recent national achievements in athletics, as highlighted by Iran’s medal-winning performances at major athletic events. For instance, in May 2025, Iranian athlete Ali Amiryian won a silver medal in the men’s 800m at the 26th Asian Athletics Championships in South Korea, clocking 1:44.97. Many retailers bundle shoes with accessories like moisture-wicking socks or UV-protective hats to attract cost-conscious runners. Subscription refill models and loyalty stamps in local chains encourage repeat engagement. While premium imported brands occupy mall-based stores in Tehran and regional capitals, the majority of market turnover occurs through affordability-focused outlets in urban and suburban areas. Influencer-led e-commerce promotions and live shopping streams further enhance visibility of competitively priced lines. These local retail dynamics and price-sensitive purchasing patterns form the backbone of sustained consumer activity and accessibility. After more than eighty words, it is clear that flexible retail access and targeted affordability are critical engines of Iran running gear market growth.

To get more information on this market, Request Sample

Community Sport Culture and Regional Race Networks

Iran is home to a vibrant grassroots fitness community and an expanding calendar of city marathons, desert runs, and community events in cities like Tehran, Shiraz and Isfahan. Government-backed initiatives and corporate wellness programs have fueled participation by diverse age groups and encouraged gear upgrades following race registrations. At Paris 2024, Iran achieved its best Olympic finish since Tokyo by ranking 21st, a medal haul of three gold, six silver, and three bronze across wrestling, taekwondo, and shooting, with a delegation of 41 athletes competing in 14 disciplines. Social media health groups and fitness influencers promote event participation and share recommendations on climate-suitable gear, leading to higher regular purchasing. Consumers demand gear built for hot, dry conditions—breathable, sweat-resistant footwear and apparel that balances comfort and moisture control. Even in more humid coastal areas, lightweight and ventilated designs are favored. Club-led group training often includes bulk gear purchases or sponsorships. This culture of shared running experiences and frequent race participation establishes a stable base of demand for performance gear suited to Iran’s regional climate zones.

Hybrid International Adoption and Local Manufacturing Synergies

Iran’s market exhibits a blend of global influence and emerging local manufacturing capacity. Consumers increasingly show preference for imported styles and global brand innovation, lightweight cushioning, breathable fabric, and reflective design, but face currency limitations and import restrictions that raise prices. In response, local manufacturers and distributors form partnerships or licensing agreements with foreign brands to produce affordable versions adapted to local conditions. This results in hybrid product offerings: design attributes inspired by global standards, combined with materials sourced domestically to lower costs. Retailers often stock mixed assortments enabling consumers to access technical gear at various price tiers. Climate-appropriate designs, UV‑reflective textiles, fast-dry layers, sweat-absorbent linings, are now locally produced. These cross-border collaborations also facilitate limited-edition drops tied to local sports festivals or national events. This integration of international style with local production capacity helps expand access, reduce price barriers, and lift design quality, sustaining consistent consumer demand across market segments.

Iran Running Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

The report has provided a detailed breakup and analysis of the market based on the product. This includes running footwear, running apparel, running accessories, and fitness trackers.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on gender. This includes male, female, and unisex.

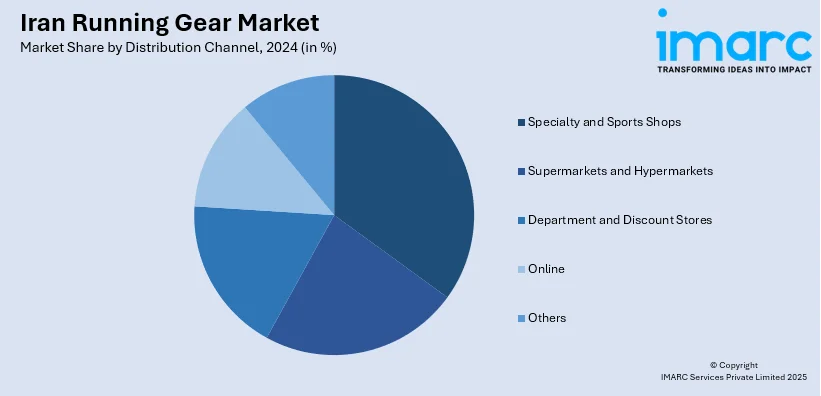

Distribution Channel Insights:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran running gear market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran running gear market on the basis of product?

- What is the breakup of the Iran running gear market on the basis of gender?

- What is the breakup of the Iran running gear market on the basis of distribution channel?

- What is the breakup of the Iran running gear market on the basis of region?

- What are the various stages in the value chain of the Iran running gear market?

- What are the key driving factors and challenges in the Iran running gear market?

- What is the structure of the Iran running gear market and who are the key players?

- What is the degree of competition in the Iran running gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran running gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran running gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)