Iran Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Iran Steel Tubes Market Overview:

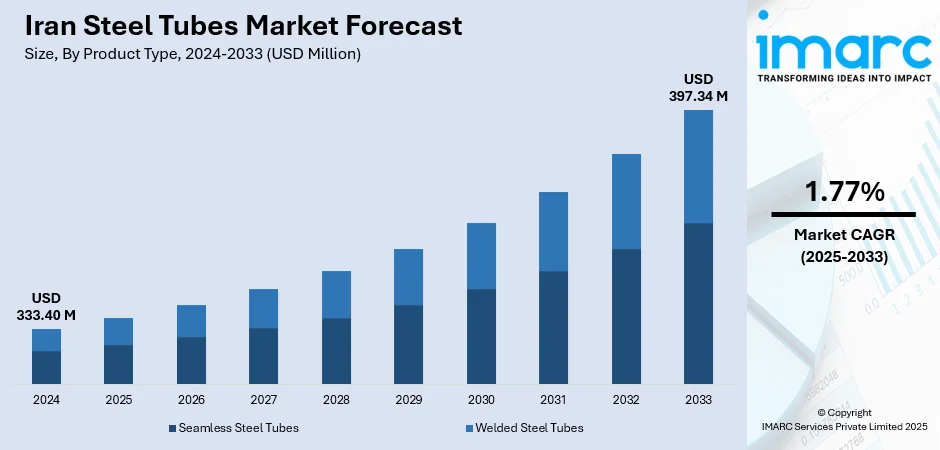

The Iran steel tubes market size reached USD 333.40 Million in 2024. The market is projected to reach USD 397.34 Million by 2033, exhibiting a growth rate (CAGR) of 1.77% during 2025-2033. The market is poised for steady advancement, driven by infrastructure development, industrial modernization, and growing demand within domestic sectors. End-use industries like construction, automotive, and energy are fueling demand for both welded and seamless tubes. The country’s abundant raw materials and expanding production capacities further support market evolution. As Iran aligns its supply chains with regional trade and prioritizes industrial resilience, these dynamics are strengthening the Iran steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 333.40 Million |

| Market Forecast in 2033 | USD 397.34 Million |

| Market Growth Rate 2025-2033 | 1.77% |

Iran Steel Tubes Market Trends:

Domestic Production Recovery Strengthens Foundation

In January 2025, official updates highlighted a steady rebound in Iran’s crude steel sector, signaling renewed momentum for downstream industries, especially tube and pipe manufacturing. This production stability is more than a numbers game. It’s directly improving operational confidence for manufacturers who rely on consistent raw materials. With energy availability improving and facilities returning to normal output levels, steel tube producers now have a clearer runway to plan, produce, and deliver at scale. The impact stretches beyond supply chain convenience. It reduces delays, allows for more predictable pricing models, and supports higher-value custom production. In addition, this local availability lessens dependence on imports, giving the domestic market more resilience and agility in managing demand surges. It’s also encouraging reinvestment in processing capacity, quality control, and technology upgrades across the tube segment. With steel fundamentals stabilizing, the wider ecosystem spanning infrastructure, energy, and utilities can operate with more certainty. All signs point toward a more grounded and scalable path forward for Iran steel tubes market growth.

To get more information on this market, Request Sample

Export Strength Elevates Market Visibility

In August 2024, Iran’s customs administration reported a stronger-than-expected flow of steel-related exports, with tubes and hollow profiles emerging as meaningful contributors to outbound trade. That performance isn’t just encouraging—it speaks volumes about how Iranian manufacturers are meeting demand beyond local borders. With consistent deliveries into neighboring markets and upward visibility across Asia, the steel tube sector is gaining recognition for both reliability and technical quality. Export momentum invites greater operational focus, pushing producers to tighten lead times, refine advanced specifications, and streamline logistics. It also signals to policymakers that nurturing trade-friendly infrastructure and customs processes can yield tangible expansion in manufacturing sub-sectors like tubing. As export pipelines expand, domestic manufacturers are seizing the chance to raise production standards and connect with wider trade networks. This cycle, where overseas demand drives production upgrades which in turn strengthen export capabilities, reflects a clear shift toward greater openness and ambition. These developments underscore the dynamic growth shaping Iran steel tubes market trends.

Infrastructure Demand Anchors Long-Term Potential

In December 2024, national media underscored the steel industry’s integral role in Iran’s broader development story, highlighting its critical links to infrastructure, housing, and transportation initiatives across the country. That insight goes well beyond abstract figures it reflects how steel tubes are woven into the fabric of everyday progress. Whether it’s roads, bridges, energy grids, or urban construction, consistent tubing supply is foundational to building and maintaining essential infrastructure. As public works gain momentum, demand for quality steel tubes is rising in domestic markets and through related supply channels. This consistent, structure-driven need gives tube manufacturers more visibility into future demand, encouraging steadier operational planning and leaner inventory models. The flow of project-driven orders also opens doors to shorten lead times and implement more refined production techniques. With demand anchored in real, ongoing development, the steel tube segment is grounded in a tangible growth path instead of speculative cycles. All in all, these infrastructure tailwinds paint a promising picture for Iran steel tubes market.

Iran Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

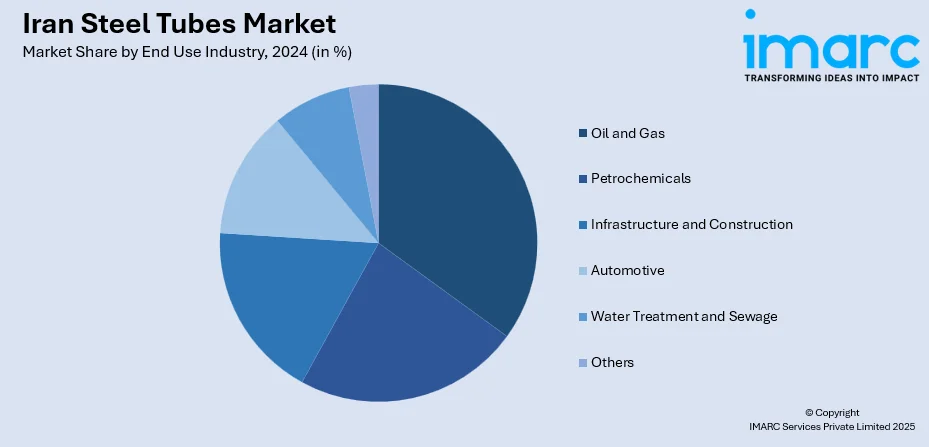

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Steel Tubes Market News:

- January 2024: Iran inaugurated its largest seamless steel pipe plant in Abhar County of Zanjan province, a major achievement in the development of the nation's industrial sector. The plant is a milestone in Iran's manufacturing capacity and a sign of the country's focus on developing its steel-producing industry. The officials underscored the significance of the factory in advancing economic growth and the position of the nation in the steel sector. This progress is anticipated to spur greater industrial development and cooperation in the region.

Iran Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Others |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran steel tubes market on the basis of product type?

- What is the breakup of the Iran steel tubes market on the basis of material type?

- What is the breakup of the Iran steel tubes market on the basis of end use industry?

- What is the breakup of the Iran steel tubes market on the basis of region?

- What are the various stages in the value chain of the Iran steel tubes market?

- What are the key driving factors and challenges in the Iran steel tubes market?

- What is the structure of the Iran steel tubes market and who are the key players?

- What is the degree of competition in the Iran steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)