Iron Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Iron Price Trend, Index and Forecast

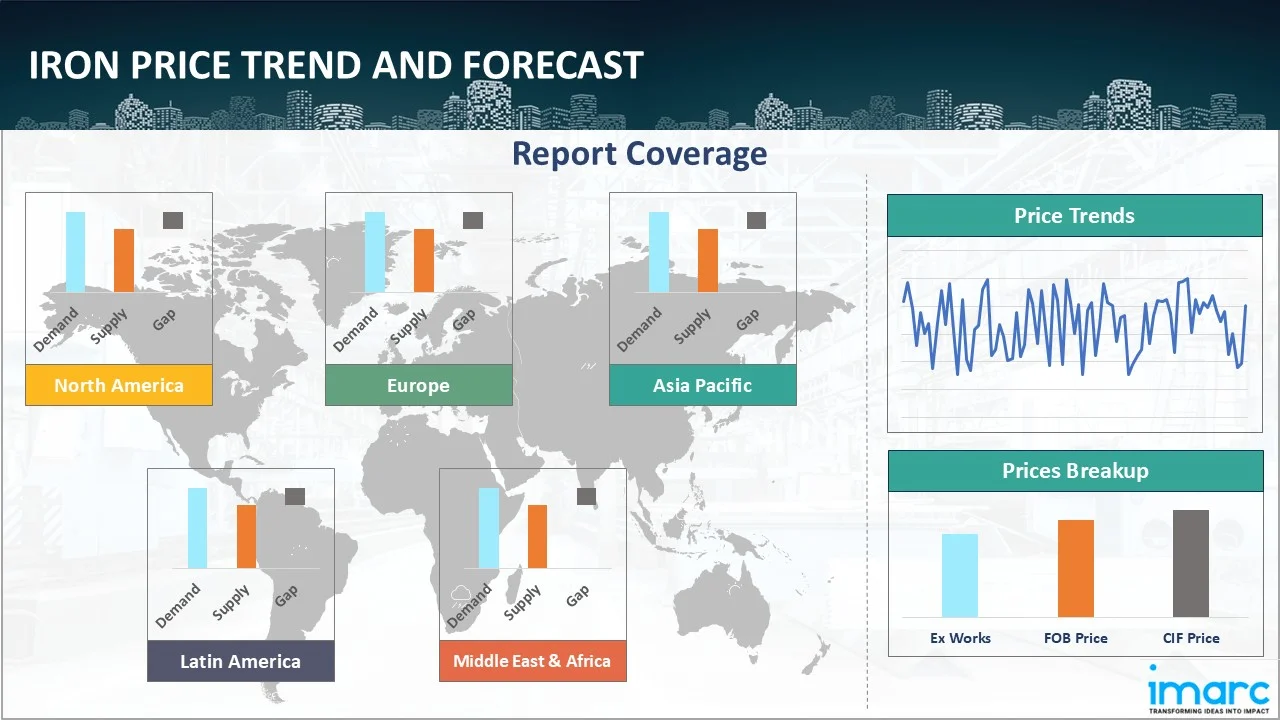

Track the latest insights on iron price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Iron Prices Outlook Q3 2025

- USA: USD 973/MT

- China: USD 740/MT

- Indonesia: USD 808/MT

- Germany: USD 958/MT

- Brazil: USD 1024/MT

Iron Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the iron prices in the USA reached 973 USD/MT in September. Prices increased due to firm demand from the construction, automotive, and machinery sectors. Infrastructure-related activity supported steady consumption, while controlled domestic output and higher input costs influenced supplier pricing. Logistics normalization improved material flow, but procurement remained active as buyers sought to secure supply amid strengthening demand conditions.

During the third quarter of 2025, the iron prices in China reached 740 USD/MT in September. Prices moved upward supported by improved demand from the steelmaking sector and infrastructure projects. Production controls and environmental compliance measures limited supply flexibility. Export demand showed signs of recovery, while restocking activity by mills and traders contributed to a more supportive pricing environment.

During the third quarter of 2025, the iron prices in Indonesia reached 808 USD/MT in September. Prices rose amid strong demand from domestic steel producers and continued investments in downstream metal processing. Export activity remained steady, while regulatory oversight on mining operations influenced supply availability. Logistical constraints and disciplined shipment schedules further supported market firmness.

During the third quarter of 2025, the iron prices in Germany reached 958 USD/MT in September. Prices increased as demand from the construction and industrial manufacturing sectors remained resilient. Steelmakers maintained steady procurement levels, while higher energy and compliance costs affected production economics. Import dependence for certain grades and cautious inventory strategies shaped supplier negotiations across the market.

During the third quarter of 2025, the iron prices in Brazil reached 1024 USD/MT in September. Prices moved higher supported by strong export demand and steady domestic consumption from the steel and infrastructure sectors. Mining activity remained stable, but logistical bottlenecks and transportation costs influenced supply flow. Producers focused on export commitments, which supported firmer pricing conditions domestically.

Iron Prices Outlook Q2 2025

- USA: USD 908/MT

- China: USD 711/MT

- Indonesia: USD 758/MT

- Germany: USD 934/MT

- Brazil: USD 983/MT

During the second quarter of 2025, the iron prices in the USA reached 908 USD/MT in June. As per the iron price chart, a significant driver impacting the prices was the expansion of global iron ore supply. Major producers increased their output, leading to a surplus in the market. This oversupply exerted downward pressure on prices, as the demand from key consumers did not match the elevated production levels. Trade policies also played a crucial role. The US administration implemented substantial tariffs on steel and aluminum imports, aiming to bolster domestic production. However, these tariffs led to trade tensions and retaliatory measures from other countries, disrupting established trade flows and affecting iron ore prices.

During the second quarter of 2025, the iron prices in China reached 711 USD/MT in June. China's domestic iron ore production fell due to several factors, including the weak domestic demand for steel and broader economic challenges. The drop in production was most notable in June, where ore output was lower compared to the same month in the previous year, although it showed a slight monthly increase from May's figures. In the face of declining domestic output, China’s demand for imported iron ore remained relatively stable.

During the second quarter of 2025, iron prices in Indonesia reached 758 USD/MT in June. Exports of downstream products like iron and steel showed substantial growth, with iron and steel exports achieving a marked increase in both value and volume. This shift in export dynamics had a significant impact on the iron market in Indonesia, influencing iron prices both domestically and in international markets.

During the second quarter of 2025, the iron prices in Germany reached 934 USD/MT in June. Germany's iron ore market faced challenges stemming from its broader economic context. The country was grappling with a prolonged recession, characterized by weak industrial activity and declining business sentiment. This economic downturn led to reduced demand for steel in key sectors such as construction and manufacturing, further suppressing iron ore prices. Additionally, trade tensions and environmental regulations played a role in shaping the iron ore market.

During the second quarter of 2025, the iron prices in Brazil reached 983 USD/MT in June. Brazil's iron ore exports were increasing, driven by elevated production and favorable weather conditions. This was largely attributed to enhanced performance at key producing mines. This surge in production contributed to higher export volumes, with shipments exceeding historical levels for the same period.

Iron Prices Outlook Q1 2025

- USA: USD 967/MT

- China: USD 744/MT

- Indonesia: USD 812/MT

- Germany: USD 968/MT

- Brazil: USD 970/MT

During the first quarter of 2025, the iron prices in the USA reached 967 USD/MT in March. As per the iron price chart, rising raw material costs, increased demand from the automotive and construction sectors, and supply chain disruptions influenced pricing trends. Additionally, the implementation of new tariffs on imported steel and aluminum products also contributed to price volatility.

During the first quarter of 2025, iron prices in China reached 744 USD/MT in March. Iron ore prices in China fluctuated due to a mix of factors, including steel industry restructuring and decreases in stocks of finished steel products in major Chinese cities. Changes in demand from major steel-producing countries, along with the imposition of tariffs on certain Chinese steel products, contributed to the volatility.

During the first quarter of 2025, the iron prices in Indonesia reached 812 USD/MT in March. Prices were experiencing fluctuations due to a combination of factors, including changes in government regulations, adjustments to the Mineral Metal Reference Price (HMA), and shifts in global market dynamics.

During the first quarter of 2025, the iron prices in Germany reached 968 USD/MT in March. Iron prices in Germany were influenced by a combination of factors, including rising demand for certain steel products, elevated costs for key materials like nickel, and ongoing concerns about imports. While some iron products saw price increases due to factors like car sales and material costs, others were affected by lower demand and potential trade impacts.

During the first quarter of 2025, the iron prices in Brazil reached 970 USD/MT in March. Prices in Brazil rose during the quarter as it faced weather-related logistical issues in Q1, including delays at ports and lower output from some mills. Besides, the USA revised tariff treatment on certain steel-related imports, including pig iron, which reduced Brazilian cargo competitiveness.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the iron prices.

Europe Iron Price Trend

Q3 2025:

As per the iron price index, Europe witnessed upward price movement, primarily shaped by conditions in Germany. Steel producers across Germany increased procurement amid steady construction activity and resilient demand from automotive manufacturing hubs. Elevated energy costs and stricter environmental regulations raised operating expenses for blast furnace operators, influencing upstream iron procurement strategies. Cross-border material flows within the region remained stable, but buyers maintained disciplined inventory levels due to cost pressures and cautious demand planning.

Q2 2025:

In the second quarter of 2025, iron ore prices in Europe experienced downward pressure due to a combination of supply surpluses and weakening demand. A significant factor contributing to this trend was the global oversupply of iron ore. Major mining companies faced challenges such as extreme weather events and regulatory constraints, leading to increased production costs and reduced profit margins. Geopolitical factors also played a role in influencing iron ore prices. Within Europe, the demand for iron ore remained subdued. Sluggish construction activity and modest automotive demand kept buying interest low. Although some support came from restocking by mills, it was insufficient to drive significant price hikes. The combination of these factors resulted in a cautious market sentiment, with stakeholders monitoring developments closely to navigate the challenges posed by the evolving supply and demand dynamics.

Q1 2025:

As per the iron price index, prices in Europe were experiencing a mix of upward and downward pressures. Demand was generally weak, particularly in the construction and consumer goods sectors, leading to lower prices for some products. However, there were also factors contributing to price increases, such as rising costs for raw materials and energy and limited scrap availability. Additionally, the global political landscape and potential trade tariffs added uncertainty to the market.

This analysis can be extended to include detailed iron price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Iron Price Trend

Q3 2025:

As per the iron price index, North America recorded upward price movement, driven by developments in the USA. Infrastructure spending linked to public works and transportation projects supported iron consumption, while manufacturing activity in machinery and equipment production remained firm. Domestic supply discipline and higher freight and labor-related costs influenced supplier pricing decisions. Buyers prioritized contractual sourcing to ensure supply continuity amid sustained industrial activity.

Q2 2025:

North American steelmakers contended with challenges stemming from trade policies and economic conditions. The reinstatement of US steel import tariffs aimed at boosting domestic production inadvertently led to higher input costs, affecting profitability and the iron price index. Additionally, a slowdown in the US manufacturing sector, particularly in the automotive industry, reduced the demand for steel, thereby impacting iron ore consumption.

Q1 2025:

Iron prices in North America experienced volatility, with an initial increase followed by a decline. This was due to a combination of factors, including supply chain issues, trade disruptions, and fluctuating demand from key industries like construction and manufacturing. While some sectors initially saw price hikes due to higher import costs and anticipation of tariffs, weakening demand and improved supply conditions ultimately led to a price fluctuation by the end of the quarter.

Specific iron prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Iron Price Trend

Q3 2025:

As per iron price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q2 2025:

The report explores the iron pricing trends and iron price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on iron prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Iron Price Trend

Q3 2025:

In the Asia Pacific region, iron prices increased across major markets, reflecting developments in China and Indonesia. In China, stronger steel mill utilization supported iron demand, while production controls and environmental inspections influenced supply-side behavior. In Indonesia, rising domestic steel capacity and ongoing investments in downstream metal processing increased iron consumption. Export-oriented trade flows adjusted as regional buyers balanced domestic needs with overseas shipment commitments.

Q2 2025:

In the second quarter of 2025, the iron ore market in the Asia Pacific region was significantly influenced by developments in China, the largest consumer of iron ore globally. A reduction in domestic mining production, coupled with fluctuating import prices, shaped the dynamics of the iron ore market in the region. Chinese mining companies reduced their iron ore production by a notable margin. This fall was reflected in June, where the country's ore output saw a drop. This drop in production contributed to the tightening of domestic supply, which exerted upward pressure on the prices of iron ore. Mining companies were under increasing pressure to adjust to weaker domestic demand, especially as steel production in the country also witnessed a decline.

Q1 2025:

In the first quarter of 2025, iron prices in the Asia Pacific region experienced fluctuations due to a combination of factors, including seasonal demand shifts, the impact of the Chinese Lunar New Year, and varying downstream demand. Specifically, grey cast iron prices saw mixed trends, with an initial increase in January due to stronger pig iron output and stable iron concentrate costs.

This iron price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Iron Price Trend

Q3 2025:

In Latin America, iron prices moved higher, shaped largely by conditions in Brazil. Mining output remained steady, but strong export demand from global steel producers absorbed significant volumes. Domestic steelmakers maintained consistent procurement amid infrastructure-related demand. Logistical considerations, including inland transportation and port handling efficiency, influenced supply movement and procurement planning across the region.

Q2 2025:

As per the iron price index, prices in Latin America were shaped by several factors, including production dynamics, global demand shifts, and regional economic policies. Brazil's iron ore production saw an uptick during this period. Additionally, infrastructure and logistical issues within the region affected supply chains. Despite efforts to enhance transportation networks and port facilities, inefficiencies persisted, impacting the timely delivery of iron ore to international markets. These challenges contributed to price volatility.

Q1 2025:

As per the iron price index, iron ore prices in Latin America were likely influenced by a combination of factors, including fluctuating supply and global economic uncertainty. Chinese buyers increased iron ore purchases from Brazil, while disruptions in Australian iron ore exports due to cyclones and quality issues with some products also impacted prices. Additionally, broader economic trends, such as slowing global growth and potential impacts from tariffs, contributed to the price fluctuations.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin America countries. |

Iron Pricing Report, Market Analysis, and News

IMARC's latest publication, “Iron Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the iron market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of iron at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed iron prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting iron pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Iron Industry Analysis

The global iron industry size reached 2.59 Billion Tons in 2025. By 2034, IMARC Group expects the market to reach 3.52 Billion Tons, at a projected CAGR of 3.47% during 2026-2034. Market growth is supported by expanding infrastructure development, sustained demand from the steel manufacturing sector, rising urbanization, and continued investments in industrial and transportation projects across both developed and emerging economies.

Latest News and Developments:

- October 2025: Electra unveiled a demonstration facility designed to produce clean iron using a low-temperature electrochemical process and announced advanced purchase commitments for both clean iron and associated environmental attributes. The initiative is intended to accelerate commercialization of its technology, strengthen the clean iron supply chain, and support industrial customers seeking lower-carbon alternatives to conventional iron production, directly advancing innovations in the iron sector.

Product Description

Iron is a naturally occurring metallic element, symbolized by ‘Fe’ on the periodic table, and is one of the most abundant elements on Earth. It is primarily extracted from iron ores such as hematite and magnetite through smelting in blast furnaces, where it is converted into various forms like pig iron, wrought iron, or steel. Renowned for its strength, malleability, and magnetic properties, iron serves as the foundational material for numerous industrial applications.

Iron is a critical component in the production of steel, which is created by combining iron with carbon and other alloying elements. Steel’s versatility makes iron indispensable in construction, transportation, infrastructure, machinery, and household products. In its pure form, iron is relatively soft, but its properties can be enhanced significantly through alloying and heat treatment.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Iron |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Iron Price Analysis, and Segment-Wise Assessment |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of iron pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting iron price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The iron price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)