Israel Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033

Israel Fintech Market Overview:

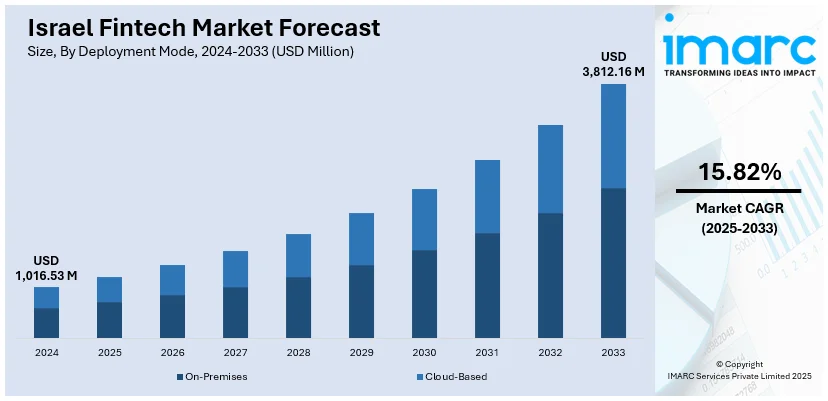

The Israel fintech market size reached USD 1,016.53 Million in 2024. The market is projected to reach USD 3,812.16 Million by 2033, exhibiting a growth rate (CAGR) of 15.82% during 2025-2033. The market continues to thrive, anchored by its innovative startups and deep tech expertise. The sector spans digital payments, AI-powered risk and fraud platforms, insurtech, wealthtech, lending, and blockchain solutions. Regulatory innovation such as open banking and fintech licensing has enabled closer collaboration between traditional banks and emerging fintech firms. Supported by a dynamic ecosystem of accelerators, investors, and military-grade cybersecurity talent, Israel’s fintech market remains globally relevant. These forces collectively shape the trajectory of Israel fintech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,016.53 Million |

| Market Forecast in 2033 | USD 3,812.16 Million |

| Market Growth Rate 2025-2033 | 15.82% |

Israel Fintech Market Trends:

Digital Currency Experimentation Takes Center Stage

Israel’s fintech landscape continues to evolve through bold experimentation in central bank digital currencies (CBDCs). The Bank of Israel’s open testing environment enables developers and regulators to collaborate more closely on the future of digital finance. In October 2024, the central bank concluded its “Digital Shekel Challenge,” a collaborative initiative where fintech participants explored practical CBDC use cases using API-based infrastructure. This sandbox allowed for real-world simulations, testing applications from programmable payments to offline wallets all within a supervised, transparent framework. The initiative demonstrated how structured experimentation can unlock scalable solutions while reinforcing institutional trust. At its core, this reflects a maturing phase of Israel fintech market growth, where innovation is no longer just about launching new tools but building systems that can be trusted, adapted, and scaled. By focusing on interoperability and open access, Israel is laying the foundation for a more inclusive and efficient digital economy. The country’s fintech sector isn’t rushing adoption it’s deliberately shaping the rules, infrastructure, and expectations that will define its financial future.

To get more information on this market, Request Sample

Regulation Driving Long-Term Confidence

Israel is steadily building a fintech environment where innovation and regulation can evolve in tandem. Regulatory authorities have continued shaping frameworks that support agility while preserving clarity for service providers. In June 2024, oversight of payment institutions was formally shifted to the Israeli Securities Authority. This structural move signals a deeper intent to unify how financial technologies are supervised, especially across emerging areas like embedded finance and digital payments. The transition was designed not to restrict fintech growth but to create a clearer regulatory roadmap where startups, platforms, and service providers can operate with better-defined expectations. As a result, fintech companies are becoming more confident in developing services that meet both creative and compliance standards. Sandbox initiatives and cross-sector dialogues further reinforce this shift, helping ensure that the regulatory environment grows alongside the innovation it supports. What’s emerging is not just a regulated space, but one with room to test, adjust, and scale ideas responsibly. These developments are a defining part of Israel fintech market trends, where thoughtful governance is central to future competitiveness.

Global Focus and Deep-Tech Specialization

Israel’s fintech sector is increasingly aligning itself with global financial systems through cross-border collaboration and a focus on infrastructure-driven innovation. In March 2025, national media highlighted how Israeli fintech platforms were expanding partnerships with global institutions particularly around areas like AI-driven fraud analytics, risk scoring, and transaction intelligence. These developments are not just about exporting software but about building foundational technologies that support secure and adaptive financial systems. With a strong tech backbone, the industry is shifting away from rapid product launches toward deeper, long-term platform development. AI, cybersecurity, and real-time data infrastructure are becoming central themes, helping fintech’s align with international expectations for trust and compliance. The shift also reflects a broader maturity in the market: fewer players, and greater technical depth and global relevance. Instead of simply reacting to trends, Israel’s fintech community is contributing to the architecture of modern finance by building tools that anticipate future challenges rather than just solve today’s. This measured, strategic positioning makes it a key player in the evolving global fintech landscape.

Israel Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

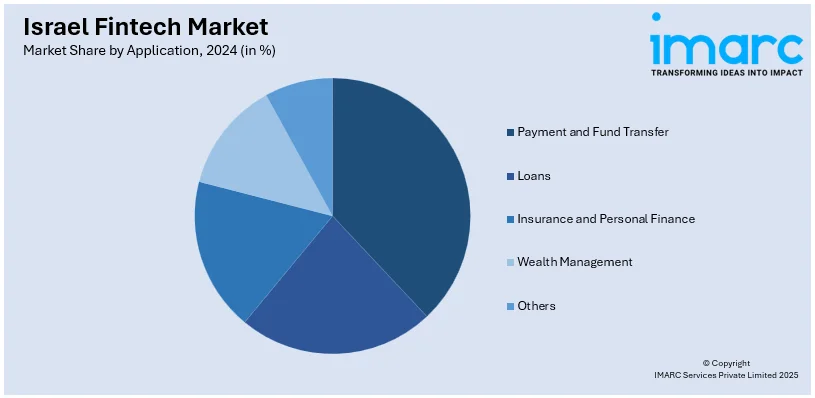

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

- South

- Central

- North

- Haifa

- Tel Aviv

- Jerusalem

The report has also provided a comprehensive analysis of all the major regional markets, which include South, Central, North, Haifa, Tel Aviv, and Jerusalem.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Israel Fintech Market News:

- March 2024: Israel’s venture-creation firm Team8 has secured new funding aimed at building and investing in startups across cybersecurity, data infrastructure, fintech, digital health, and AI. The fresh investment enriches its dual-model approach combining hands-on company creation with traditional venture capital to support both early-stage ventures and sector-defining innovation. Despite regional challenges, the firm remains committed to fostering emerging Israeli tech companies. Team8’s strategic expansion reinforces Israel’s reputation as a cradle for cutting-edge fintech and deep-tech innovation

Israel Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End-Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | South, Central, North, Haifa, Tel Aviv, Jerusalem |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Israel fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the Israel fintech market on the basis of deployment mode?

- What is the breakup of the Israel fintech market on the basis of technology?

- What is the breakup of the Israel fintech market on the basis of application?

- What is the breakup of the Israel fintech market on the basis of end user?

- What is the breakup of the Israel fintech market on the basis of region?

- What are the various stages in the value chain of the Israel fintech market?

- What are the key driving factors and challenges in the Israel fintech market?

- What is the structure of the Israel fintech market and who are the key players?

- What is the degree of competition in the Israel fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Israel fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Israel fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Israel fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)