Italy Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Italy Agribusiness Market Overview:

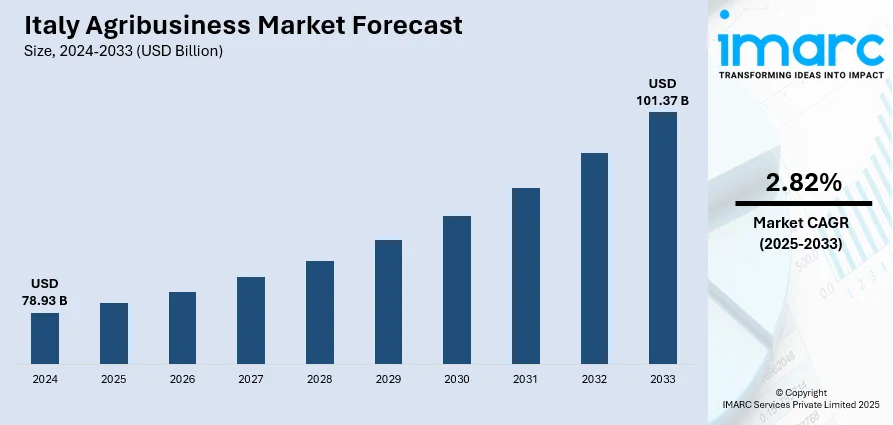

The Italy agribusiness market size reached USD 78.93 Billion in 2024. The market is projected to reach USD 101.37 Billion by 2033, exhibiting a growth rate (CAGR) of 2.82% during 2025-2033. Rising adoption of solar energy is reshaping Italy’s agribusiness sector by combining renewable energy development with agricultural productivity, thus creating a model of sustainable growth that enhances competitiveness and resilience in both domestic and export markets. Besides this, increasing investments in packaging and cold chain infrastructure are contributing to the expansion of the Italy agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 78.93 Billion |

| Market Forecast in 2033 | USD 101.37 Billion |

| Market Growth Rate 2025-2033 | 2.82% |

Italy Agribusiness Market Trends:

Increasing export activities

Rising export activities are playing a crucial role in fueling the growth of the market in Italy, as the country is recognized for its premium food and beverage (F&B) products, including wine, olive oil, pasta, cheese, and fresh items. As per the report published by the Research Center of Rome Business School, in 2024, exports of Italian agri-food reached a record peak, surpassing €70 Billion, an increase of +7.5%, and representing 11% of total national exports. Agri-food districts produced €28 Billion, marking a +7.1% rise, exceeding the typical growth in manufacturing. Italy’s agribusiness sector benefits from strong international demand for high-quality, authentic, and traditional food items, which boosts production and creates opportunities for farmers and food processors to expand operations. Exports not only bring in significant revenue but also encourage innovations, product diversification, and adherence to global quality standards. The rising popularity of Mediterranean diets is further catalyzing the demand for Italian agricultural products, positioning the country as a key supplier in global markets. With heightened emphasis on branding, geographical indications, and sustainable farming practices, Italian agribusinesses can differentiate their products and capture premium pricing abroad. Export growth is also driving investments in packaging, logistics, and cold chain infrastructure to maintain item quality during transportation, thereby strengthening supply chains. Additionally, trade agreements and stronger integration with European and international markets are enhancing market access, further propelling export opportunities.

To get more information on this market, Request Sample

Growing adoption of solar energy

Rising adoption of solar energy is bolstering the Italy agribusiness market growth, as it fosters a more sustainable, cost-efficient, and resilient agricultural ecosystem while supporting the country’s broader renewable energy goals. Farmers and agribusiness operators are turning to solar energy systems, particularly Agri-Photovoltaic (Agri-PV) technologies, to reduce reliance on conventional energy sources, lower operational costs, and ensure stable power supply for irrigation, storage, and processing activities. In December 2024, RWE engaged in Italy’s Resilience and Recovery Plan auction, obtaining a contract-for-difference rate and as much as a 40% return on investment for its innovative Agri-PV initiatives. The projects consisted of the Morcone plant with 9.8 MWac and the Acquafredda plant with 9.3 MWac, both found in the Benevento province of Campania, Italy. The systems utilized advanced tracker technology, where solar panels were positioned on three-meter-tall frameworks with adjustable axes to improve energy production. Under the panels, combined agricultural practices would enable crop production, enhancing land utilization efficiency. This integration of clean energy and farming ensures efficient land utilization, strengthens food security, and reduces greenhouse gas emissions, aligning with Italy’s climate targets. For agribusinesses, solar adoption not only cuts electricity costs but also enables investments in modern irrigation systems, cold storage, and smart farming technologies powered by renewable energy.

Italy Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

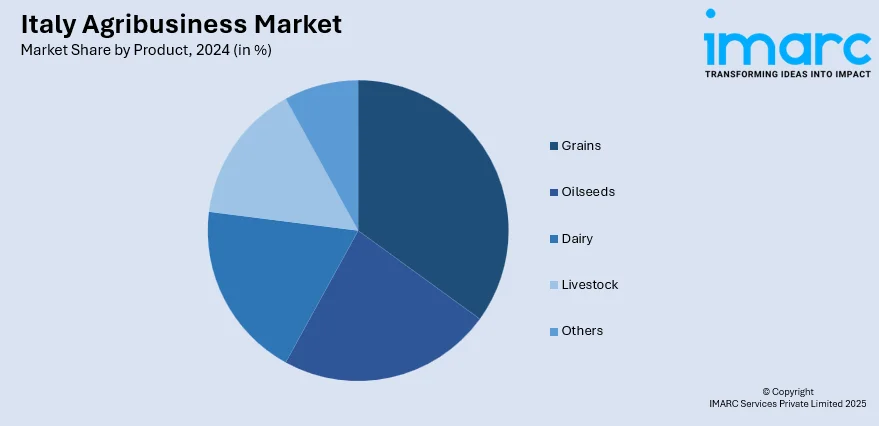

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Agribusiness Market News:

- In August 2025, Zenith Energy Ltd revealed the purchase of five agrivoltaic solar projects at the development stage in Italy's Piedmont region, contributing a total capacity of approximately 30 MWp. The initiatives aimed to combine farming practices with solar energy generation through single-axis tracking systems on agricultural land.

- In June 2025, India and Italy agreed to enhance collaboration in agriculture and food processing during Indian Minister Piyush Goyal's two-day trip to Italy. The two leaders and their groups pinpointed various chances for cooperation in sustainable agricultural value chains, agricultural machinery, food packaging innovations, and renewable energy.

Italy Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy agribusiness market on the basis of product?

- What is the breakup of the Italy agribusiness market on the basis of region?

- What are the various stages in the value chain of the Italy agribusiness market?

- What are the key driving factors and challenges in the Italy agribusiness market?

- What is the structure of the Italy agribusiness market and who are the key players?

- What is the degree of competition in the Italy agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)