Italy Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2025-2033

Italy Animal Health Market Overview:

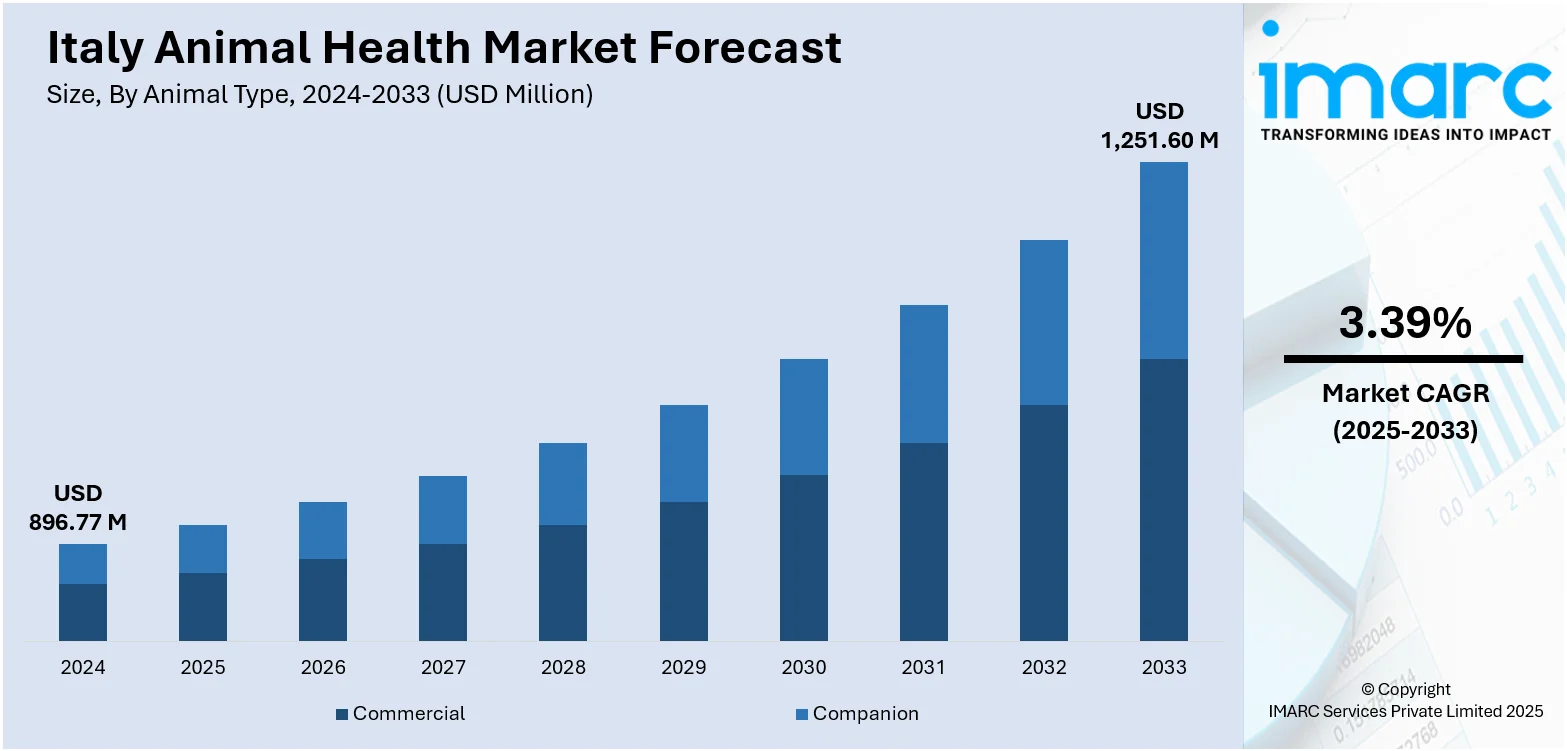

The Italy animal health market size reached USD 896.77 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,251.60 Million by 2033, exhibiting a growth rate (CAGR) of 3.39% during 2025-2033. The Italian market is experiencing rapid growth as a result of the increased popularity of companion animals, especially among people living in urban areas. Moreover, the rising focus on livestock productivity and disease avoidance is contributing to the market growth. Additionally, ongoing development of veterinary healthcare infrastructure on both public and private fronts is expanding the Italy animal health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 896.77 Million |

| Market Forecast in 2033 | USD 1,251.60 Million |

| Market Growth Rate 2025-2033 | 3.39% |

Italy Animal Health Market Trends:

Escalated Demand for Companion Animals

The Italian market is experiencing rapid growth as a result of the increased popularity of companion animals, especially among people living in urban areas. This is driven by shifting socio-demographic patterns, including declining household sizes, aging, and an increasing perception of pets as family members. As per World Population Review, in 2025, dog adoption rate is recorded as 8.8M, and cat population reached 10.2M in Italy. As more Italians are now keeping dogs, cats, and other small animals as pets for companionship, demand for veterinary care, preventive care, and high-end pet food products is on a rise. Pet parents are demanding advanced medical care, such as vaccination, dental care, and chronic disease management. Moreover, the role of social media and greater awareness about pet welfare is promoting responsible pet adoption. This change in behavior is driving increased expenditure on pet health and wellness that is catalyzing the need for pharmaceuticals, diagnostics, and wellness-related services within the companion animal division. As a result, the companion animal division is emerging as a key driver in the larger Italian animal health sector.

To get more information on this market, Request Sample

Increased Investment in Livestock Productivity and Biosecurity

The Italian animal health market is experiencing robust growth as players in the entire agricultural industry are placing top priority on livestock productivity and disease avoidance. Producers and farmers are embracing advanced husbandry techniques, sophisticated feed formulations, and veterinary health procedures to maintain the well-being of food-producing animals like cattle, pigs, poultry, and sheep. This is in response to increasing domestic consumption and strict export controls on food safety and animal well-being. Italian government and industry organizations are also making investments in disease surveillance programs, vaccination, and antimicrobial stewardship to counter zoonotic diseases and minimize antibiotic use. Adoption of digital technologies in monitoring livestock and precision agriculture is also furthering biosecurity. These collective efforts are not only enhancing animal health results but also promoting the economic viability of livestock activities. The livestock health sector consequently remains an essential aspect in the acceleration of the Italian animal health industry.

Continuous Improvements in Veterinary Healthcare Infrastructure

The ongoing development of veterinary healthcare infrastructure on both public and private fronts is supporting the Italy animal healthcare market growth. Increasing numbers of contemporary veterinary clinics, specialty hospitals, and diagnostic labs are being set up in urban and semi-urban areas. These are being equipped with cutting-edge technologies like digital imaging, ultrasound, and molecular diagnostics that are improving the efficacy and precision of animal care. In addition, more specialized education and training are being given to veterinary professionals so that they can provide high-quality services as per international standards. The regulatory agencies are also strengthening the frameworks for veterinary pharmaceuticals, diagnostics, and treatment protocols, which are ensuring safe and consistent healthcare provision. Furthermore, interactive associations between industry participants, universities, and research institutions are promoting innovation in animal vaccines, biologics, and treatment processes. In 2024, Veterinary Hospital of Conegliano (TV) inaugurated an extension integrated with distinct waiting areas to enhance patient comfort and alleviate the stress linked to the hospital setting. A significant advancement of the new veterinary hospital was the implementation of the NEWTOM 7G VET with Cone Beam technology.

Italy Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

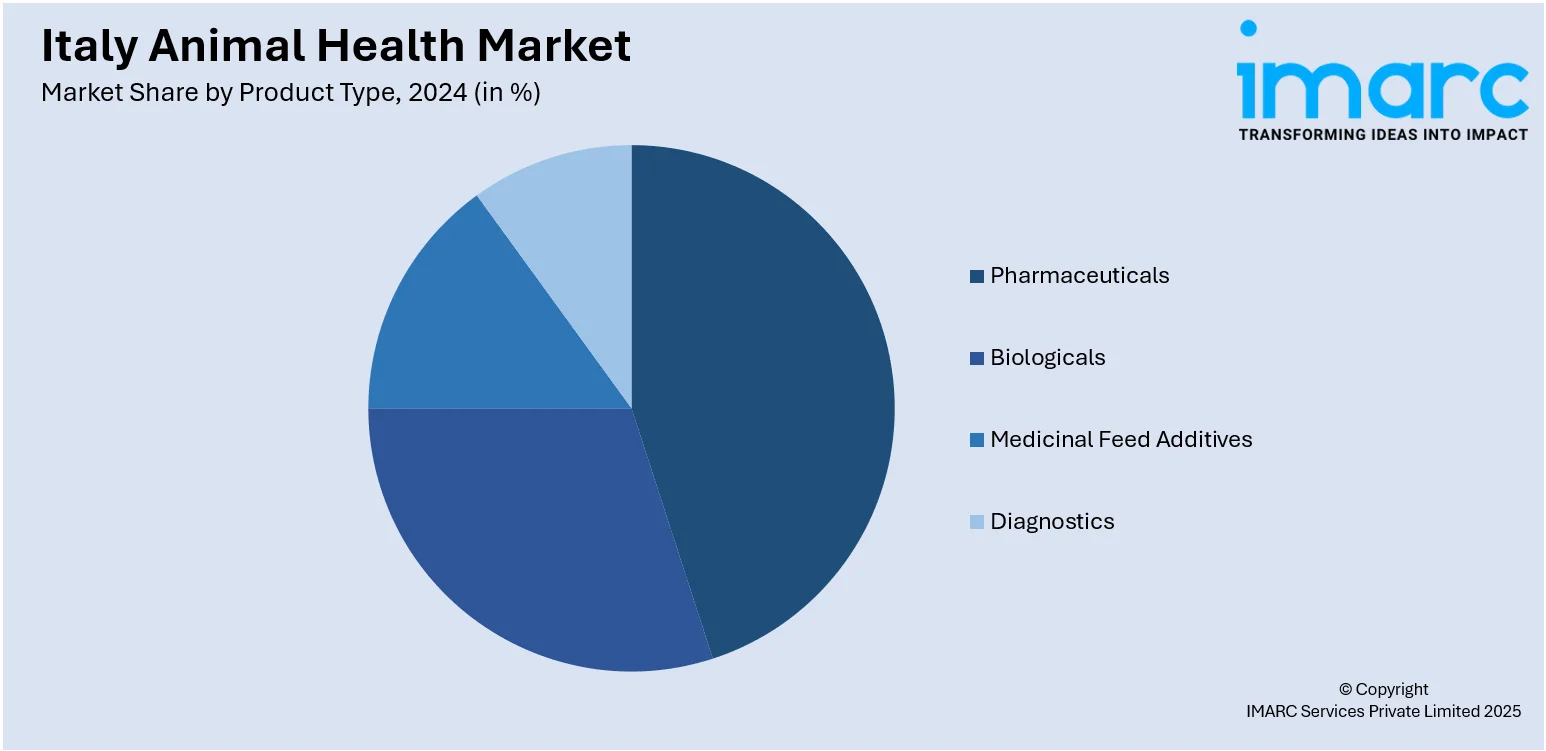

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy animal health market on the basis of animal type?

- What is the breakup of the Italy animal health market on the basis of product type?

- What is the breakup of the Italy animal health market on the basis of region?

- What are the various stages in the value chain of the Italy animal health market?

- What are the key driving factors and challenges in the Italy animal health market?

- What is the structure of the Italy animal health market and who are the key players?

- What is the degree of competition in the Italy animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)