Italy Automotive Wiring Harness Market Size, Share, Trends and Forecast by Application, Material Type, Transmission Type, Vehicle Type, Category, Component, and Region, 2025-2033

Italy Automotive Wiring Harness Market Overview:

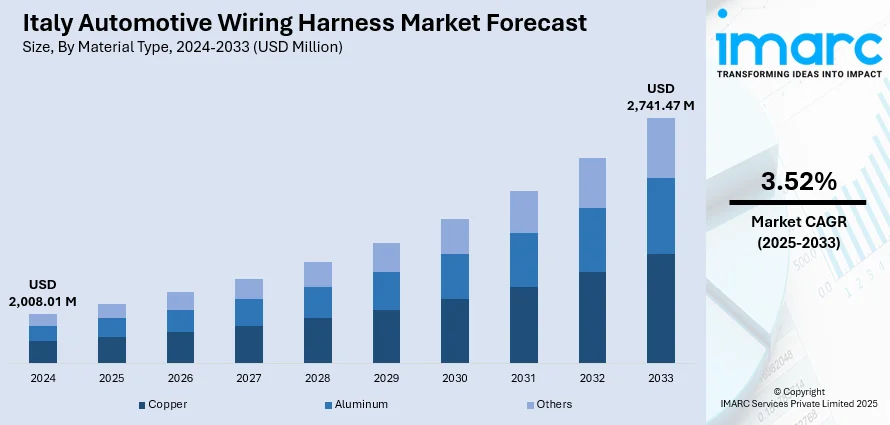

The Italy automotive wiring harness market size reached USD 2,008.01 Million in 2024. Looking forward, the market is expected to reach USD 2,741.47 Million by 2033, exhibiting a growth rate (CAGR) of 3.52% during 2025-2033. Region’s strong automotive manufacturing, particularly in luxury vehicles, and growing EV adoption are driving demand for premium wiring harnesses. Policy support and innovation in lightweight and modular designs further propel Italy automotive wiring harness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,008.01 Million |

| Market Forecast in 2033 | USD 2,741.47 Million |

| Market Growth Rate 2025-2033 | 3.52% |

Italy Automotive Wiring Harness Market Trends:

Lightweight Materials for Premium Vehicles

Luxury vehicle producers in Italy demand harnesses that are simultaneously lightweight and robust. Manufacturers are adopting aluminum-based conductors, composite insulation, and flexible printed circuits to reduce vehicle mass without sacrificing reliability. Designs must withstand performance stress while integrating subtly with premium interiors. These materials enhance curb appeal and efficiency, contributing directly to Italy automotive wiring harness market growth. For instance, Leoni showcased innovative electromobility cable technologies at "The Battery Show Europe" in Stuttgart (June 3-5, 2025). Highlights included liquid-cooled High Power Charging (HPC) cables for fast charging, high-voltage Hivocar® Cool cables with reduced diameter and weight, and the new LEONI exMW extruded magnet wires. These solutions improve charging efficiency, current capacity, and motor performance, supporting electric vehicle advancements with sustainable, high-quality cable systems.

To get more information on this market, Request Sample

Electrification and Integrated Power Systems

The electrification trend necessitates harnesses capable of supporting battery systems, high-voltage wiring, and power electronics while maintaining compact form factors. Integrated harnesses now manage propulsion, thermal control, and charging functions. This complexity requires rigorous design, testing, and cross-functional OEM collaboration. Such advancements are central to Italy automotive wiring harness market growth, responding to evolving vehicle architectures. For instance, in October 2024, the DRÄXLMAIER Group showcased its innovations in low-voltage, high-voltage, and battery systems at the International Supplier Fair (IZB) in Wolfsburg, Germany. Under the theme “Inspiring the Transformation,” the company presented intelligent wiring harnesses for semi-autonomous driving, the dFUSE smart HV for safer high-voltage systems, and advanced battery solutions. These technologies supported e-mobility, sustainability, and manufacturing efficiency. DRÄXLMAIER reinforced its position as a key supplier to premium automakers, emphasizing quality, safety, and system integration.

Italy Automotive Wiring Harness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on application, material type, transmission type, vehicle type, category, and component.

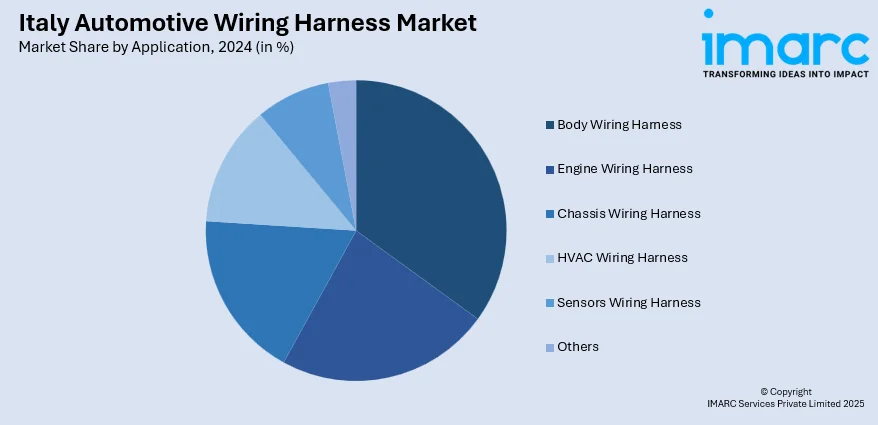

Application Insights:

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes body wiring harness, engine wiring harness, chassis wiring harness, HVAC wiring harness, sensors wiring harness, and others.

Material Type Insights:

- Copper

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes copper, aluminum, and others.

Transmission Type Insights:

- Data Transmission

- Electrical Wiring

The report has provided a detailed breakup and analysis of the market based on the transmission type. This includes data transmission and electrical wiring.

Vehicle Type Insights:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type has also been provided in the report. This includes two wheelers, passenger cars, and commercial vehicles.

Category Insights:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

The report has provided a detailed breakup and analysis of the market based on the category. This includes general wires, heat resistant wires, shielded wires, and tubed wires.

Component Insights:

- Connectors

- Wires

- Terminals

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes connectors, wires, terminals, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Automotive Wiring Harness Market News:

- In May 2024, Yazaki Corporation and Toray Industries jointly developed a chemically recycled polybutylene terephthalate (PBT) resin, called Ecouse TORAYCON™, for automotive wiring harness connectors. Produced by depolymerizing and repolymerizing manufacturing scrap, this recycled PBT maintains the same performance, moldability, and quality stability as virgin material, while reducing carbon dioxide emissions during production. The resin overcame contamination and quality control challenges and supports the industry’s move toward carbon neutrality and circularity.

Italy Automotive Wiring Harness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Body Wiring Harness, Engine Wiring Harness, Chassis Wiring Harness, HVAC Wiring Harness, Sensors Wiring Harness, Others |

| Material Types Covered | Copper, Aluminum, Others |

| Transmission Types Covered | Data Transmission, Electrical Wiring |

| Vehicle Types Covered | Two Wheelers, Passenger Cars, Commercial Vehicles |

| Categories Covered | General Wires, Heat Resistant Wires, Shielded Wires, Tubed Wires |

| Components Covered | Connectors, Wires, Terminals, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy automotive wiring harness market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy automotive wiring harness market on the basis of application?

- What is the breakup of the Italy automotive wiring harness market on the basis of material type?

- What is the breakup of the Italy automotive wiring harness market on the basis of transmission type?

- What is the breakup of the Italy automotive wiring harness market on the basis of vehicle type?

- What is the breakup of the Italy automotive wiring harness market on the basis of category?

- What is the breakup of the Italy automotive wiring harness market on the basis of component?

- What is the breakup of the Italy automotive wiring harness market on the basis of region?

- What are the various stages in the value chain of the Italy automotive wiring harness market?

- What are the key driving factors and challenges in the Italy automotive wiring harness market?

- What is the structure of the Italy automotive wiring harness market and who are the key players?

- What is the degree of competition in the Italy automotive wiring harness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy automotive wiring harness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy automotive wiring harness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy automotive wiring harness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)