Italy Business Process Management Market Size, Share, Trends and Forecast by Component, Deployment Type, Business Function, Organization Size, Vertical, and Region, 2026-2034

Italy Business Process Management Market Summary:

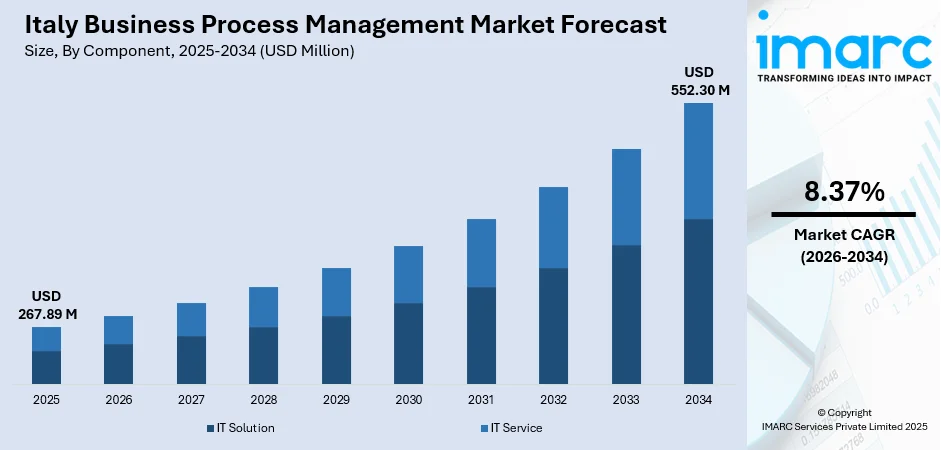

The Italy business process management market size was valued at USD 267.89 Million in 2025 and is projected to reach USD 552.30 Million by 2034, growing at a compound annual growth rate of 8.37% from 2026-2034.

The growth of the Italy business process management market is driven by rapid digital transformation, significant government investments, and increasing demand for workflow automation across enterprises. The integration of artificial intelligence (AI), widespread adoption of cloud-based platforms, and strategic industry acquisitions are reshaping the competitive landscape, opening up substantial opportunities and driving innovation within the market, ultimately enhancing efficiency and scalability for businesses.

Key Takeaways and Insights:

-

By Component: IT solution leads the market with a share of 60.06% in 2025, owing to the growing demand for comprehensive process automation tools, workflow management platforms, and integrated monitoring solutions that enhance operational visibility and decision-making capabilities.

-

By Deployment Type: Cloud dominates the market with a share of 70.09% in 2025, driven by increasing enterprise preference for scalable, cost-effective infrastructure solutions that enable remote accessibility, seamless integration with existing systems, and reduced capital expenditure requirements.

-

By Business Function: Operation and support represent the largest segment with a market share of 25.05% in 2025. This dominance is because of enterprises prioritizing operational efficiency improvements, client service automation, and streamlined support workflows across organizational functions.

-

By Organization Size: SMEs dominate the market with a share of 55.07% in 2025, reflecting the growing adoption of accessible cloud-based business process management solutions that enable smaller enterprises to compete effectively through process optimization without substantial infrastructure investments.

-

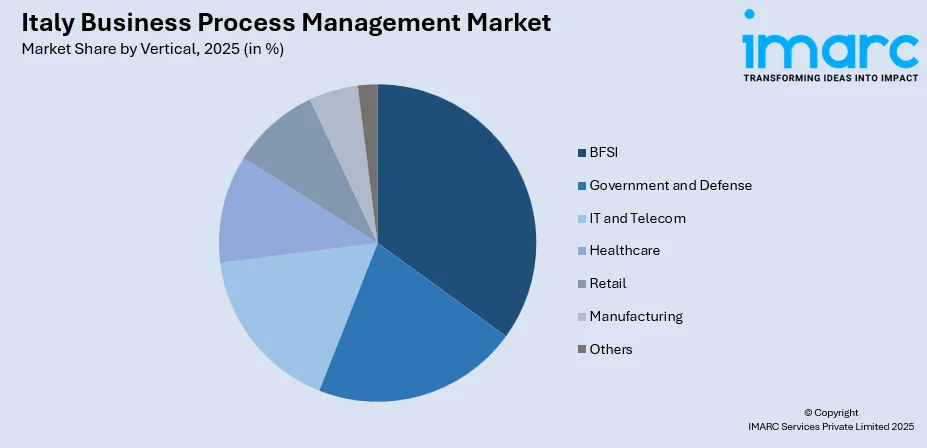

By Vertical: BFSI leads the market with a share of 22.23% in 2025, driven by stringent regulatory compliance requirements, digital banking transformation initiatives, and demand for automated risk management and customer onboarding processes.

-

Key Players: The Italy business process management market displays moderate competitive intensity, with a diverse range of players, including global technology corporations and specialized software providers, competing across various deployment models and industry verticals, each aiming to offer tailored solutions for different business needs.

To get more information on this market Request Sample

The Italy business process management market is driven by the increasing need for businesses to enhance operational efficiency and streamline complex digital workflows. As Italian organizations prioritize large-scale digital transformation, the demand for sophisticated business process management solutions intensifies, as they are essential for task automation, reduction of procedural errors, and enhancement of process transparency. These platforms, often integrating cloud and AI technologies, enable data-driven strategy and superior resource optimization across departmental boundaries. For instance, in 2025, the Government of Italy, alongside UNDP, demonstrated its commitment to digital process modernization by supporting a coordination meeting for Moldova's Ministry of Energy. This effort focused on implementing a digital transformation programme aimed at modernizing the energy sector and significantly boosting its operational efficiency, illustrating Italy's recognized expertise in process-focused digital initiatives. This domestic expertise and international leadership reinforce the value proposition of business process management tools for ensuring regulatory compliance, achieving scalability, and securing flexible growth trajectories across vital sectors like finance, healthcare, and manufacturing.

Italy Business Process Management Market Trends:

Growing Focus on Operational Efficiency

Businesses in Italy face constant pressure to enhance operational efficiency and reduce costs, which is driving the demand for business process management solutions. These platforms help organizations identify inefficiencies, standardize workflows, and automate routine tasks. Business process management improves process visibility and fosters collaboration across departments, enabling businesses to achieve higher productivity and profitability. This operational focus is critical for companies to remain competitive in a globalized market, making business process management adoption essential for long-term success. For example, in 2024, Amadori, Italy's leading agribusiness company, used Appian's business process management capabilities to streamline asset maintenance and order generation, reducing the process time from two weeks to just three days, boosting efficiency and collaboration.

Emphasis on Data-Driven Decision Making

Italy's increasing reliance on data analytics for business decision-making is driving the demand for business process management solutions that provide real-time data insights. Business process management tools offer robust analytics capabilities, enabling organizations to monitor key performance indicators (KPIs) and process metrics, which help identify areas for improvement and facilitate data-driven decisions. By leveraging insights from business process management systems, businesses can continuously refine and optimize processes to enhance efficiency and achieve better outcomes. This emphasis on data-driven decision-making ensures that companies remain competitive and adaptable in a dynamic market. For example, in 2025, Banco BPM, Italy’s third-largest bank, reported higher-than-expected profits driven by its focus on automation and business process management, which enabled operational improvements following its acquisition of Anima Holding.

Integration of Cloud-Based Solutions

Cloud-based business process management platforms offer flexibility, scalability, and cost-efficiency, allowing businesses to scale their processes according to evolving needs. With cloud deployment, organizations can integrate business process management solutions seamlessly into existing systems, ensuring smooth collaboration and data sharing across departments. Furthermore, cloud solutions provide real-time access to data and insights, empowering businesses to make faster, more informed decisions, essential for staying agile in today’s fast-paced business environment. For example, in 2024, Microsoft announced a €4.3 billion investment in Italy to expand its cloud and AI infrastructure, further supporting the country’s digital transformation and enabling businesses to leverage cloud-based business process management for enhanced efficiency and innovation.

Market Outlook 2026-2034:

The Italy business process management market shows notable growth potential, driven by government-supported digital transformation initiatives and the increasing need for operational efficiency across enterprises. The market generated a revenue of USD 267.89 Million in 2025 and is projected to reach a revenue of USD 552.30 Million by 2034, growing at a compound annual growth rate of 8.37% from 2026-2034. This growth reflects the rising adoption of automation, AI-driven solutions, and cloud platforms, positioning businesses to streamline operations and improve productivity.

Italy Business Process Management Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

IT Solution |

60.06% |

|

Deployment Type |

Cloud |

70.09% |

|

Business Function |

Operation and Support |

25.05% |

|

Organization Size |

SMEs |

55.07% |

|

Vertical |

BFSI |

22.23% |

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

IT solution dominates with a share of 60.06% of the total Italy business process management market in 2025.

IT solution (process improvement, automation, content and document management, integration, and monitoring and optimization) represents the largest segment, as it provides organizations with the necessary tools to automate workflows, improve operational efficiency, and enhance collaboration. It integrates seamlessly with existing systems, enabling businesses to optimize processes and reduce manual tasks.

Moreover, IT solution enables businesses to scale their operations while maintaining consistency and control. The growing demand for data-driven decision-making and real-time analytics further drives the adoption of IT solution, which provides enhanced visibility, performance tracking, and insights to drive continuous improvement in business processes.

Deployment Type Insights:

- On-premises

- Cloud

Cloud leads with a share of 70.09% of the total Italy business process management market in 2025.

Cloud holds the biggest market share due to its scalability, flexibility, and cost-efficiency. Cloud allows businesses to quickly adapt to changing demands, eliminate the need for expensive on-premises infrastructure, and reduce maintenance costs.

Additionally, cloud enables seamless integration across various departments and geographies, improving collaboration and communication. With real-time access to data and automated updates, organizations can streamline their processes and ensure compliance with regulatory requirements, making cloud deployment the preferred choice for many Italian businesses.

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

Operation and support exhibit a clear dominance with a 25.05% share of the total Italy business process management market in 2025.

Operation and support lead the market, driven by the growing need for businesses to streamline day-to-day operations. By automating routine tasks and providing ongoing support, companies can enhance productivity, reduce errors, and optimize resource utilization.

Additionally, operation and support are critical for ensuring seamless business continuity. These services help businesses quickly address operational issues, implement process improvements, and adapt to changes in the market. As a result, Italian companies are increasingly focusing on these functions to drive efficiency and maintain competitiveness.

Organization Size Insights:

- SMEs

- Large Enterprises

SMEs dominate with a share of 55.07% of the total Italy business process management market in 2025.

SMEs dominate the market owing to their need for cost-effective solutions that streamline operations and improve efficiency. The growing adoption of business process management systems by these enterprises, aimed at automating processes, reducing overhead, and enhancing overall productivity, has coincided with tangible economic results, as evidenced by the government data showing that Italian SME employment grew by 2.2% in 2024.

Additionally, SMEs are leveraging business process management solutions to remain competitive and agile. By optimizing workflows and improving collaboration, these businesses can scale more efficiently, better manage client relationships, and respond quickly to market changes.

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

BFSI leads with a share of 22.23% of the total Italy business process management market in 2025.

BFSI represents the largest segment due to its complex operational needs and stringent regulatory requirements. The sector requires efficient process automation to manage vast volumes of transactions, ensure compliance, and deliver superior client service, driving significant business process management adoption.

Additionally, the BFSI sector's focus on data security, risk management, and compliance makes business process management solutions essential. These systems help streamline workflows, improve data accuracy, and enable real-time decision-making, making them integral to optimizing operations and maintaining competitiveness in the highly regulated financial environment.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

Northwest, home to major industrial centers, is experiencing strong growth in business process management adoption. The region’s robust manufacturing and technology sectors drive the need for efficient process automation, streamlining operations and improving productivity.

Northeast, known for its vibrant SME sector, is embracing business process management solutions to improve operational efficiency. As companies in sectors like manufacturing and retail grow, business process management systems help streamline workflows and enhance overall business performance.

Central, with its mix of public and private enterprises, is adopting business process management solutions to optimize operations. The region’s focus on digital transformation is driving the business process management growth, particularly in sectors like finance, healthcare, and government services.

South is witnessing an increase in business process management adoption as businesses seek to modernize operations and improve efficiency. The growing infrastructure development and increased digital awareness are encouraging companies in this region to invest in process optimization technologies.

Others are gradually adopting business process management solutions, supported by local digital initiatives and increasing awareness of the benefits. As businesses across various sectors seek to improve efficiency, business process management adoption is expected to rise across these areas.

Market Dynamics:

Growth Drivers:

Why is the Italy Business Process Management Market Growing?

Digital Transformation Initiatives

The rising adoption of digital transformation strategies across enterprises is propelling the market growth, as businesses increasingly seek to integrate emerging technologies for optimized workflows. Business process management solutions are essential for coordinating and governing the processes impacted by technologies like AI and cloud computing. The launch of Microsoft Elevate in Italy in 2025, an initiative to provide AI training to 400,000 people, underscores the national commitment to digital skill enhancement. This strategic effort to foster an AI-driven economy, coupled with the introduction of the AI Skills 4 Agents Observatory, directly accelerates the readiness of organizations to deploy sophisticated, AI-enabled BPM platforms, consequently driving market expansion.

Investment in Technological Innovation

The growing focus on technological innovation, particularly within the burgeoning Italian fintech sector like buy now, pay later (BNPL), is a crucial factor driving the business process management adoption. As companies scale and introduce new products, they require advanced business process management solutions to manage the complexity of high-volume digital transactions, enhanced user experience, and stringent compliance requirements. The €70 million Scale-Up Debt financing secured by the Italian BNPL leader, Scalapay, from the European Investment Bank (EIB) in 2025 exemplifies this trend. This capital infusion, aligned with the EIB's TechEU initiative, directly accelerates the fintech's ability to invest in sophisticated process automation and platform expansion, thereby catalyzing the demand.

Government Support for SME Growth

Government policies focused on empowering micro, small, and medium-sized enterprises (SMEs) are influencing the market, particularly by enhancing their digital capabilities. Strategic state-backed measures, such as the introduction of “Mini Development Contracts” for the fashion sector and new tax incentives under the 2025 draft law, directly encourage SMEs to invest in modernizing their operations. This institutional support facilitates the adoption of business process management solutions to foster innovation, streamline processes, and improve competitiveness. The resultant push for enhanced process efficiency and digital transformation among the vast number of Italian SMEs significantly drives the demand for business process management software and services.

Market Restraints:

What Challenges the Italy Business Process Management Market is Facing?

High Implementation Costs and Resource Requirements

Implementation costs represent a fundamental challenge constraining broader business process management adoption among Italian enterprises, particularly smaller organizations with limited technology budgets. Comprehensive business process management deployment requires substantial investment in software licensing, system integration, customization, and ongoing maintenance that may exceed immediate financial capabilities. Resource constraints extend beyond direct costs to include personnel requirements for implementation management and ongoing system administration.

Workforce Digital Skills Gap Limiting Adoption

Italy's digital skills gap poses significant challenges for business process management adoption as organizations struggle to recruit and retain personnel capable of implementing, managing, and optimizing process management platforms. Despite government training initiatives, only a small number of enterprises have adopted AI technologies, reflecting broader technology adoption challenges. The relatively low share of ICT specialists in total employment compared to European averages constrains enterprise capacity to fully leverage advanced business process management capabilities.

Legacy System Integration Complexity

Integration with existing legacy systems presents substantial technical challenges that impede seamless business process management implementation across enterprises in Italy. Many organizations operate complex technology environments with outdated infrastructure that lacks modern integration capabilities. Modernizing core applications while maintaining operational continuity requires careful planning and substantial technical expertise that many organizations lack internally.

Competitive Landscape:

The Italy business process management market exhibits moderate competitive intensity characterized by the presence of global technology corporations alongside specialized software providers competing across deployment models and industry verticals. Market dynamics reflect strategic positioning ranging from comprehensive enterprise platforms offering integrated AI and analytics capabilities to targeted solutions addressing specific industry requirements. The competitive landscape is increasingly shaped by cloud platform capabilities, AI integration, partnership strategies, and ability to address regulatory compliance requirements. Major players are expanding Italian presence through direct investment, strategic acquisitions, and partnership arrangements with local technology providers and system integrators that enhance market access and delivery capabilities.

Recent Developments:

-

In December 2025, Salt Edge launched its bulk payments solution in Italy, offering fintechs, SaaS platforms, and high-volume enterprises a fast, secure, and compliant method for mass payouts. Built on PSD2-compliant API infrastructure, it enables businesses to process multiple payments simultaneously, eliminating outdated batch payment inefficiencies. The solution provides real-time tracking, cost optimization, and improved automation, helping companies save time and reduce errors.

Italy Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | On-premises, Cloud |

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Italy business process management market size was valued at USD 267.89 Million in 2025.

The Italy business process management market is expected to grow at a compound annual growth rate of 8.37% from 2026-2034 to reach USD 552.30 Million by 2034.

Cloud dominates the market with a share of 70.09% in 2025, driven by enterprise preference for scalable infrastructure, cost efficiency, and seamless remote accessibility.

Key factors driving the Italy business process management market include the increasing reliance on data analytics for decision-making, which require business process management solutions that provide real-time insights. These tools help businesses monitor KPIs, identify areas for improvement, and optimize processes. For example, in 2025, Banco BPM reported higher-than-expected profits driven by its focus on automation and BPM, enabling operational improvements following its acquisition of Anima Holding.

Major challenges include high implementation costs constraining smaller enterprise adoption, workforce digital skills gaps limiting technology utilization, legacy system integration complexity, and data privacy concerns impacting cloud adoption decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)