Italy Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Italy Carbon Black Market Overview:

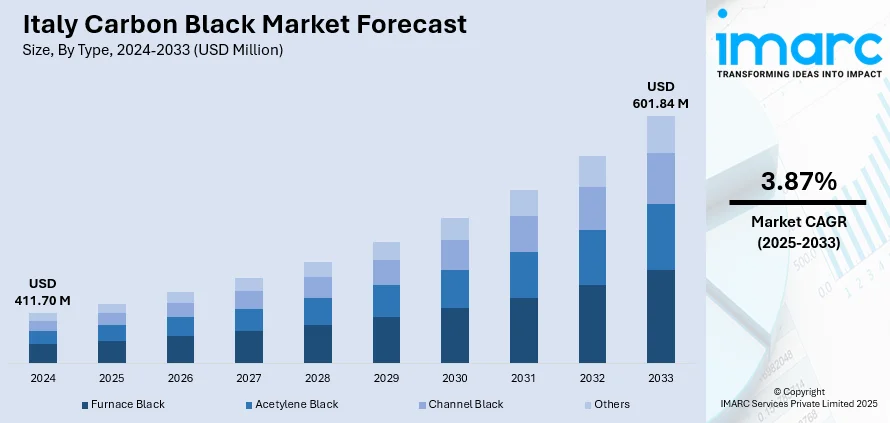

The Italy carbon black market size reached USD 411.70 Million in 2024. Looking forward, the market is projected to reach USD 601.84 Million by 2033, exhibiting a growth rate (CAGR) of 3.87% during 2025-2033. The market is driven by Italy’s specialized rubber goods sector, masterbatch innovations, and precision coatings industry. Italian manufacturers emphasize high-quality formulations and compliance with EU regulations, sustaining demand for premium carbon black grades. With increasing exports and product specialization, the additive remains integral to high-value manufacturing, further augmenting the Italy carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 411.70 Million |

| Market Forecast in 2033 | USD 601.84 Million |

| Market Growth Rate 2025-2033 | 3.87% |

Italy Carbon Black Market Trends:

Specialty Rubber Demand from Automotive and Industrial Sectors

Italy is home to a well-developed automotive components industry, particularly in regions like Piedmont, Lombardy, and Emilia-Romagna. While the country does not lead in mass car manufacturing, it excels in producing high-value parts, specialty tires, and precision rubber goods. Carbon black is extensively used in anti-vibration mounts, seals, gaskets, belts, and hoses, products essential for both domestic manufacturing and export across the EU. Major Italian producers of performance tires and technical rubber, such as Pirelli, depend on high-dispersion, low-residue carbon black grades for optimized strength, durability, and heat resistance. These applications are critical in performance automotive, motorsport, and commercial vehicle segments. Moreover, Italy’s export-oriented industrial base drives demand for carbon black in molded rubber used across appliances, hydraulics, and packaging machinery. As high-performance material standards tighten across Europe, manufacturers in Italy are focusing on more consistent and clean carbon black sources, which are increasingly integrated into technical rubber compounding strategies. For instance, in September 2024, Bridgestone EMEA, Grupo BB&G, and Versalis announced an agreement to create a closed-loop ecosystem to recycle end-of-life tires in Italy. The partnership aims to develop innovative pyrolysis technology to transform end-of-life tires into tire pyrolysis oil (TPO), enabling the production of high-quality elastomers for new tires. The Italy carbon black market growth is fundamentally linked to the country’s high-precision industrial rubber applications, where performance, compliance, and specialization are top priorities.

To get more information on this market, Request Sample

Demand from Coatings, Inks, and Architectural Applications

Italy’s legacy in furniture, fashion, and design extends into its coatings and pigment industry, where carbon black plays an essential role in both functional and aesthetic formulations. Deep-black architectural paints, industrial metal coatings, and decorative finishes use carbon black to deliver opacity, UV protection, and gloss control. Italian manufacturers also produce a wide range of printing inks for textiles, packaging, and publishing, segments that require consistent dispersion, high tinting strength, and compatibility with solvent- and water-based systems. Carbon black is used in gravure, flexographic, and offset inks where precision and color depth are vital. Additionally, the expansion of energy-efficient infrastructure, solar installations, electrical conduits, and high-spec roofing membranes, has spurred demand for carbon black–reinforced coatings and polymer systems designed to endure outdoor exposure and thermal cycling. For instance, in February 2024, AkzoNobel completed a €21 Million expansion of its Como powder coatings facility, installing four new manufacturing lines for automotive primers and architectural coatings. The Como site also achieved IATF 16949 certification, marking the highest quality standard for automotive industry suppliers. In this context, Italy’s emphasis on craftsmanship, quality, and regulatory conformity keeps carbon black in steady demand as a core ingredient across multiple engineered surfaces and material systems.

Italy Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

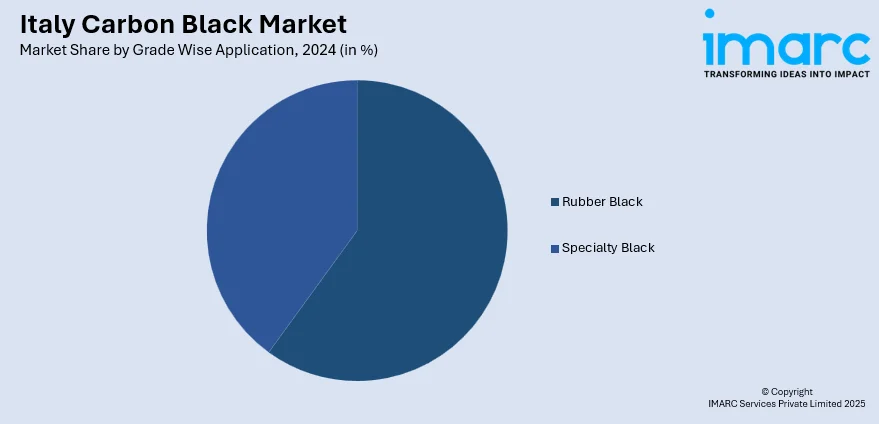

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy carbon black market on the basis of type?

- What is the breakup of the Italy carbon black market on the basis of grade wise application?

- What is the breakup of the Italy carbon black market on the basis of region?

- What are the various stages in the value chain of the Italy carbon black market?

- What are the key driving factors and challenges in the Italy carbon black market?

- What is the structure of the Italy carbon black market and who are the key players?

- What is the degree of competition in the Italy carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)