Italy Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Format, Distribution Channel, and Region, 2026-2034

Italy Cheese Market Summary:

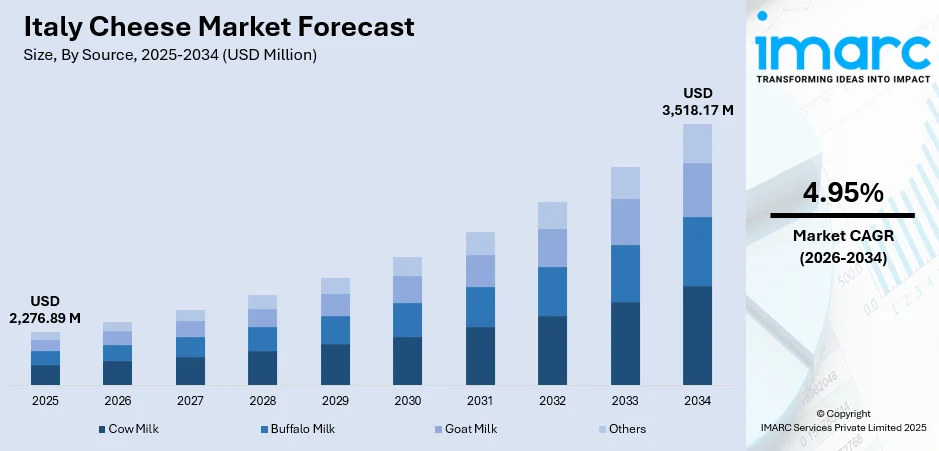

The Italy cheese market size was valued at USD 2,276.89 Million in 2025 and is projected to reach USD 3,518.17 Million by 2034, growing at a compound annual growth rate of 4.95% from 2026-2034.

Italy represents one of Europe's most sophisticated and culturally significant cheese markets, driven by centuries-old artisanal traditions and robust domestic consumption patterns. The market benefits from strong consumer preference for premium quality products, extensive PDO and PGI certification systems, and the country's renowned gastronomy culture that positions cheese as a dietary staple across all demographic segments.

Key Takeaways and Insights:

-

By Source: Cow milk dominates the market with a share of 91.42% in 2025, driven by extensive dairy farming infrastructure across northern regions and suitability for producing Italy's renowned hard cheeses including Grana Padano and Parmigiano Reggiano.

-

By Type: Natural cheese leads the market with a share of 72.95% in 2025, reflecting Italian consumer preference for authentic, traditionally produced varieties with protected designations and minimal processing.

-

By Product: Cheddar represents the largest segment with a market share of 32.41% in 2025, owing to its versatility in culinary applications and growing popularity among younger consumers seeking mild-flavored options.

-

By Format: Slices dominate the market with a share of 31.86% in 2025, supported by convenience-driven consumption patterns and increasing demand from quick-service restaurants and household kitchens.

-

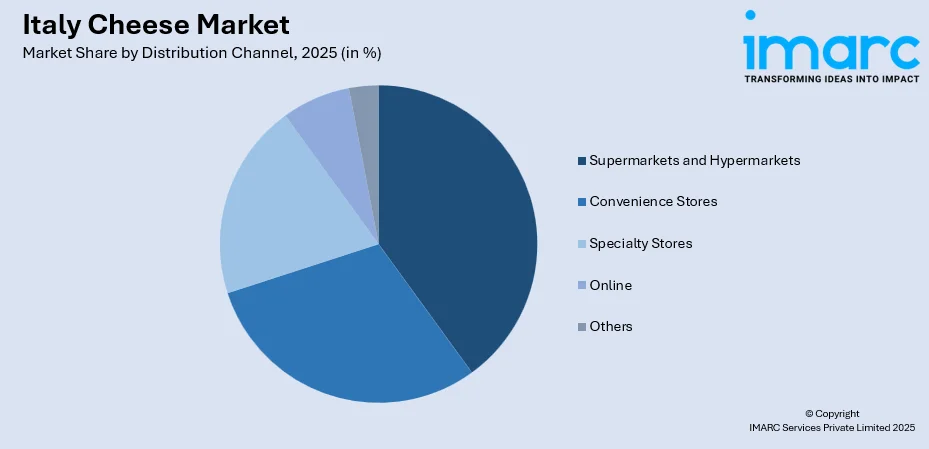

By Distribution Channel: Supermarkets and hypermarkets account for the largest revenue share of 35.82% in 2025, benefiting from wide product assortment, competitive pricing, and convenient one-stop shopping experiences.

-

Key Players: The Italy cheese market exhibits a moderately consolidated competitive landscape, with established domestic dairy cooperatives competing alongside multinational corporations. Market participants emphasize product quality, PDO certifications, and heritage branding to differentiate their offerings.

To get more information on this market Request Sample

The Italian cheese industry represents a cornerstone of the nation's agricultural economy and cultural heritage, with production concentrated in the northern regions of Lombardy, Emilia-Romagna, Veneto, and Piedmont. The market is characterized by strong institutional support through protected designation systems and cooperative dairy structures that ensure quality consistency. In 2025, Granarolo announced the expansion of its premium cheese portfolio with new high-value aged products aimed at boosting international competitiveness. Consumer demand is increasingly influenced by health consciousness, premiumization trends, and growing interest in artisanal and organic varieties. The foodservice sector, particularly the thriving restaurant and hospitality industry, continues to drive significant consumption volumes. Export markets provide additional growth opportunities, with Italian cheese varieties maintaining strong international recognition and demand across European Union member states and global markets.

Italy Cheese Market Trends:

Rising Demand for Artisanal and PDO-Certified Varieties

Italian consumers demonstrate increasing preference for cheese varieties carrying protected designation of origin certifications, reflecting heightened awareness of authenticity and quality assurance. In 2025, Regione Lombardia allocated €3.7 million to support 20 projects focused on strengthening the visibility and promotion of PDO and PGI agri-food products, including key regional cheeses, reinforcing consumer trust and heritage value. This trend is particularly pronounced among affluent urban demographics seeking premium products with verifiable provenance and traditional production methods that support local agricultural communities.

Growing Popularity of Convenience-Oriented Formats

The market witnesses expanding demand for ready-to-use cheese formats including pre-sliced, shredded, and portioned varieties that align with modern lifestyle requirements. In Italy, for example, packaging innovation is evolving to meet demand: Italian firm MasterPack introduced flexible barrier zipper pouches for shredded Grana Padana, a solution designed to keep cheese fresh longer while offering the convenience of a pre-shredded format. Dual-income households and time-constrained consumers increasingly favor convenience packaging that reduces meal preparation time while maintaining product freshness and culinary versatility.

Expansion of Plant-Based and Lactose-Free Alternatives

Health-conscious consumption patterns drive growing interest in lactose-free cheese options and plant-based alternatives among Italian consumers. For example, in 2025, Granarolo, a major Italian dairy group, expanded its “Benessere” line to include lactosefree, highprotein cheeses (e.g., a Burrata with <0.1 % lactose and 40 % less fat than standard) to address demand from health- and nutrition-oriented buyers. Manufacturers respond by expanding product portfolios to include dairy-free formulations that replicate traditional cheese characteristics, targeting consumers with dietary restrictions and those adopting flexitarian or vegan lifestyles.

Market Outlook 2026-2034:

The Italy cheese market is positioned for sustained growth throughout the forecast period, supported by resilient domestic consumption, expanding export opportunities, and continuous product innovation across premium segments. Rising global appreciation for authentic Italian cheese varieties, including mozzarella, Parmigiano Reggiano, and Gorgonzola, continues to strengthen the country’s export momentum. The industry’s emphasis on quality certifications, sustainable production practices, and heritage preservation further enhances competitive positioning in international markets. Additionally, increasing investments in modern processing facilities, diversification into value-added and specialty products, and strong demand from the foodservice and retail sectors are contributing to steady market expansion. Growing consumer interest in artisanal, organic, and PDO-certified cheeses also supports premiumization trends, ensuring long-term opportunities for producers across Italy’s regional cheese clusters. The market generated a revenue of USD 2,276.89 Million in 2025 and is projected to reach a revenue of USD 3,518.17 Million by 2034, growing at a compound annual growth rate of 4.95% from 2026-2034.

Italy Cheese Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Source | Cow Milk | 91.42% |

| Type | Natural | 72.95% |

| Product | Cheddar | 32.41% |

| Format | Slices | 31.86% |

| Distribution Channel | Supermarkets and Hypermarkets | 35.82% |

Source Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

The cow milk dominates with a market share of 91.42% of the total Italy cheese market in 2025.

Italy's extensive dairy farming infrastructure, concentrated primarily in the Po Valley and northern alpine regions, ensures abundant cow milk supply for cheese production. In 2024, approximately 75% of Italy’s milk came from northern regions such as Lombardy, Emilia-Romagna, Veneto, and Piedmont, highlighting the strategic importance of these areas for high-quality cheese production. The nutritional composition of cow milk, characterized by optimal protein and fat ratios, facilitates the manufacture of Italy's most celebrated hard and semi-hard cheese varieties including Grana Padano and Gorgonzola.

The cow milk segment benefits from established cooperative dairy structures that aggregate production from thousands of farms, ensuring consistent quality standards and year-round availability. Technological advancements in dairy farming, including automated milking systems and improved animal husbandry practices, continue enhancing productivity while maintaining the quality parameters essential for premium cheese production.

Type Insights:

- Natural

- Processed

The natural leads with a share of 72.95% of the total Italy cheese market in 2025.

The natural cheese segment's dominance reflects Italy's deeply rooted culinary traditions that prioritize authenticity and minimal processing. For instance, in October 2025, Intesa Sanpaolo committed €1.5 billion in new credit to support the Italian dairy supply chain, explicitly including measures to “enhance quality and business continuity, to ensure product distinctiveness, certified origin, and protection of PDO status.” Italian consumers demonstrate strong preference for cheese varieties produced through traditional methods, often carrying protected designation certifications that guarantee adherence to established production protocols and regional authenticity.

The regulatory framework supporting PDO and PGI certifications reinforces natural cheese consumption by providing consumers with quality assurance and traceability. Market participants emphasize heritage branding and artisanal production narratives that resonate with consumer values centered on food authenticity, cultural preservation, and superior organoleptic characteristics.

Product Insights:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

The cheddar dominates with a market share of 32.41% of the total Italy cheese market in 2025.

Cheddar cheese has gained significant traction in the Italian market owing to its mild flavor profile and exceptional melting characteristics that suit diverse culinary applications. In 2023, Cathedral City, widely regarded as a top-quality Cheddar, was introduced into the Italian market through exclusive distribution by Atlante, illustrating increased retail availability and growing consumer access to Cheddar in Italy. The product's versatility makes it particularly popular among younger demographics and quick-service restaurant operators seeking consistent performance across various menu preparations.

The growing influence of international cuisine and globalized food preferences contributes to cheddar's market position, with Italian consumers increasingly incorporating the variety into contemporary recipes. Manufacturers have responded by developing locally-produced cheddar variants that combine international cheese characteristics with Italian quality standards.

Format Insights:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Spreads

- Liquid

- Others

The slices lead with a share of 31.86% of the total Italy cheese market in 2025.

The sliced cheese format addresses modern consumer demands for convenience and portion control, facilitating quick meal preparation for sandwiches, burgers, and various culinary applications. The format's popularity extends across both household consumption and foodservice channels where operational efficiency and consistent portioning are prioritized. In fact, according to a 2023 report by Amcor, surveying hardcheese consumers across several European countries including Italy, 89% of buyers said transparent packaging was important when purchasing cheese, and 53% flagged “reclosability/resealable packaging” as a key factor influencing repeat purchases, underlining the importance of packaging design in sliced or prepackaged cheese appeal.

Advanced packaging technologies ensure extended shelf life and freshness retention for sliced cheese products, enhancing consumer appeal. Manufacturers continue innovating with resealable packaging solutions and individually wrapped portions that minimize waste while accommodating diverse usage occasions.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The supermarkets and hypermarkets dominate with a market share of 35.82% of the total Italy cheese market in 2025.

Large-format retail channels dominate cheese distribution owing to their extensive product assortments, competitive pricing strategies, and convenient shopping environments. These outlets offer comprehensive cheese selections ranging from economy options to premium artisanal varieties, serving diverse consumer segments within single shopping destinations.

Retailers leverage dedicated cheese counters staffed by trained personnel who provide product recommendations and facilitate sampling experiences. Private label cheese offerings from major supermarket chains provide value-oriented alternatives while promotional activities and loyalty programs drive repeat purchases.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The Northwest region, encompassing Lombardy, Piedmont, and Liguria, represents Italy's dominant cheese production hub accounting for approximately half of national output. This area hosts extensive dairy farming operations and is home to globally renowned varieties including Grana Padano, Gorgonzola, and Taleggio, supported by established cooperative structures and advanced processing infrastructure.

The Northeast region, including Emilia-Romagna, Veneto, and Friuli-Venezia Giulia, constitutes a major cheese production center celebrated for Parmigiano Reggiano, Asiago, and Montasio varieties. The area benefits from fertile agricultural lands, strong dairy cooperative traditions, and rigorous PDO certification systems that maintain premium quality standards across production facilities.

The Central region, comprising Tuscany, Umbria, Lazio, and Marche, is distinguished by its pecorino cheese heritage dating back to Etruscan and Roman periods. The area specializes in sheep's milk cheese production, particularly Pecorino Toscano and Pecorino Romano, leveraging traditional pastoral practices and favorable grazing conditions across rolling hillsides.

The South region, including Campania, Calabria, Puglia, and Basilicata, is renowned for fresh cheese specialties, particularly Mozzarella di Bufala Campana that carries PDO protection. This area maintains unique buffalo farming traditions concentrated in coastal plains, producing distinctive soft cheeses prized for their creamy texture and delicate flavor profiles.

The remaining regions, including Sicily, Sardinia, and smaller island territories, contribute distinctive cheese varieties reflecting local pastoral traditions and indigenous sheep breeds. These areas produce celebrated varieties including Pecorino Sardo and Sicilian Caciocavallo, maintaining artisanal production methods that preserve regional culinary heritage and support rural economies.

Market Dynamics:

Growth Drivers:

Why is the Italy Cheese Market Growing?

Strong Domestic Consumption Culture and Culinary Heritage

Italy's deeply embedded culinary traditions position cheese as an essential dietary component across all meal occasions, from breakfast through evening aperitivo customs. The Mediterranean diet's emphasis on cheese consumption supports consistent demand, while generational transmission of food preparation knowledge ensures sustained appreciation for diverse cheese varieties. Italian households maintain among Europe's highest per capita cheese consumption rates, reflecting cultural attitudes that prioritize quality dairy products. The integration of cheese across traditional recipes, from pasta dishes to antipasti presentations, creates diverse usage occasions that support market volume growth.

Robust Protected Designation System Supporting Premium Positioning

Italy's comprehensive framework of PDO and PGI certifications provides institutional support for premium cheese positioning and quality assurance. Recently, a new AfiDOPbacked scientific monitoring initiative was expanded in 2025 to cover all PDO and PGI cheese producers, with academic collaboration from Università Cattolica del Sacro Cuore, aimed at safeguarding authenticity and countering labproduced imitations. This backing helps ensure traditional production methods are upheld and traceability maintained, enabling producers to command price premiums based on verified authenticity and regional provenance. The certification system enhances consumer confidence and facilitates differentiation in competitive markets. Export opportunities expand as international consumers increasingly recognize and value protected Italian cheese designations, supporting revenue growth across domestic production facilities.

Expanding Tourism and Hospitality Sector Driving Foodservice Demand

Italy's position as a premier global tourism destination generates substantial cheese consumption through restaurant, hotel, and catering channels serving international visitors. The Italy travel and tourism market size was valued at USD 26.90 Billion in 2024, and IMARC Group estimates it will reach USD 33.59 Billion by 2033, exhibiting a CAGR of 2.38% from 20252033, highlighting the sector's ongoing growth and its role in driving demand for local gastronomic products. Gastronomic tourism specifically targeting cheese-producing regions contributes to direct sales at production facilities and heightened product awareness. The hospitality sector's emphasis on authentic Italian cuisine ensures consistent cheese procurement across menu preparations. Culinary tourism experiences including cheese-making demonstrations and tasting tours strengthen consumer engagement while supporting producer revenues.

Market Restraints:

What Challenges the Italy Cheese Market is Facing?

Rising Production Costs and Input Price Volatility

Cheese producers face increasing pressures from rising costs for animal feed, energy, and labor that compress profit margins. Volatile commodity prices create planning uncertainties, particularly for aged cheese varieties requiring extended production cycles. Smaller artisanal producers experience disproportionate impacts from cost escalation.

Competition from International Cheese Imports

The Italian market faces growing competitive pressure from imported cheese varieties, particularly economy-priced options from other European producers. International brands leverage scale economies to offer competitive pricing that challenges domestic producers. Imitation products using Italian-style branding create consumer confusion and market fragmentation.

Changing Dietary Preferences and Health Concerns

Evolving consumer attitudes toward dairy consumption, particularly concerns regarding saturated fat intake and lactose intolerance, influence purchasing patterns. Younger demographics demonstrate increased interest in plant-based alternatives. Shifting dietary guidelines and wellness trends create headwinds for traditional cheese consumption growth.

Competitive Landscape:

The Italy cheese market features a moderately consolidated competitive structure characterized by the coexistence of large dairy cooperatives, multinational corporations, and numerous artisanal producers. Market leaders leverage extensive distribution networks, established brand recognition, and diverse product portfolios spanning multiple cheese categories. Cooperative structures, particularly prominent in northern production regions, aggregate output from thousands of dairy farms while maintaining quality standards through collective governance. Competition intensifies around premium segments where differentiation through PDO certifications, heritage narratives, and superior organoleptic qualities enables price premiums. Strategic initiatives focus on product innovation, sustainability commitments, and digital channel development.

Recent Developments:

-

In May 2025, Granarolo opened a €25 million cheese plant in Gioia del Colle, boosting production of Apulian-style cheeses for global markets. The facility will process 60,000 tonnes of milk into 10,000 tonnes of cheese, with jobs set to double by 2027. New launches include frozen burrata, “Baking Burrata,” and “Truffle Burrata,” alongside an expanded PDO portfolio.

Italy Cheese Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalo Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered | Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Spreads, Liquid, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Italy cheese market size was valued at USD 2,276.89 Million in 2025.

The Italy cheese market is expected to grow at a compound annual growth rate of 4.95% from 2026-2034 to reach USD 3,518.17 Million by 2034.

Cow milk dominated the Italy cheese market with a share of 91.42%, driven by extensive dairy farming infrastructure in northern regions and suitability for producing renowned Italian hard cheese varieties.

Key factors driving the Italy cheese market include strong domestic consumption culture, robust PDO certification systems supporting premium positioning, expanding tourism-driven foodservice demand, and continuous product innovation.

Major challenges include rising production costs and input price volatility, competitive pressure from international cheese imports, changing dietary preferences toward plant-based alternatives, and concerns regarding health implications of dairy consumption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)