Italy Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Italy Commercial Insurance Market Overview:

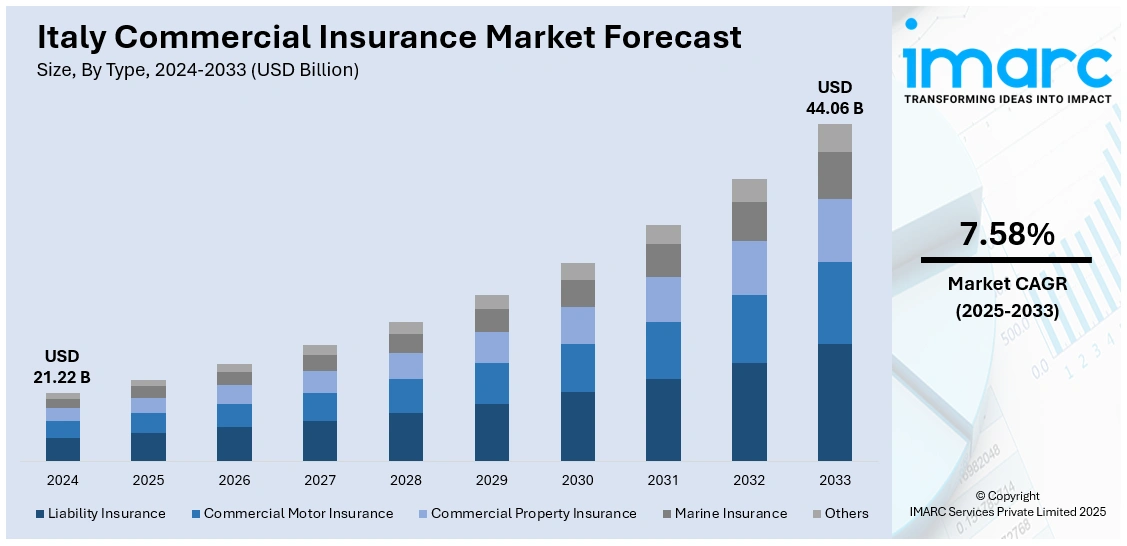

The Italy commercial insurance market size reached USD 21.22 Billion in 2024. The market is projected to reach USD 44.06 Billion by 2033, exhibiting a growth rate (CAGR) of 7.58% during 2025-2033. Rising SME demand, digital transformation of customer touchpoints, regulatory innovation, and prioritization of cyber and liability coverage drive market development. Tailored, technology‑enabled products and claims processing improvements shape emerging Brazil commercial insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.22 Billion |

| Market Forecast in 2033 | USD 44.06 Billion |

| Market Growth Rate 2025-2033 | 7.58% |

Italy Commercial Insurance Market Trends:

Demand for tailored SME coverage

Italy’s SME sector is driving demand for tailor‑made commercial insurance products. Small and medium enterprises across manufacturing, tourism, and services increasingly seek modular packages addressing liability, cyber‑risk, and business interruption—advancing Italy commercial insurance market growth. Insurers respond by offering customizable coverage modules that clients can mix to match exposure profiles. Digital platforms simplify selection and purchasing, contributing to user adoption. Close collaboration with regional business associations enables co‑design of niche products suitable for specific industries. As Italian businesses grapple with regulatory changes and market fluctuations, insurers are positioning themselves through personalization, flexibility, and streamlined digital experiences to meet evolving demand. For instance, in August 2025, J.C. Flowers & Co. acquired Milan-based brokerage Caleas Srl, marking its fifth Italian insurance deal since May 2025 as part of a roll-up strategy. Caleas serves corporate and SME clients, offering commercial, home, and life insurance. The firm plans to build on Caleas’ operations while ensuring continuity for staff and clients.

To get more information on this market, Request Sample

Digital claims and customer engagement

Italy’s commercial insurance market is intensifying focus on digital claims handling and customer engagement tools, stimulating Italy commercial insurance market growth. Insurers introduce mobile apps and web portals that enable swift claim submission, documentation upload, and status tracking. Automated notifications and chatbot support further improve user experience. Integration of AI‑based damage assessment tools streamlines claim validation and reduces settlement time. Insurers also deploy predictive modeling to preempt risks and engage proactively with clients. Strategic partnerships with digital agents and brokers extend distribution reach. This shift toward responsive, user‑centric digital services enhances operational efficiency, increases customer satisfaction, and strengthens Italy’s commercial insurance ecosystem. For instance, in June 2025, UniCredit took full control of its Italian life insurance business by acquiring stakes from CNP Assurances and Allianz. The new entities, UniCredit Life Insurance and UniCredit Vita Assicurazioni, will merge in 2026. This move is expected to boost UniCredit’s insurance revenue by €400 Million annually by 2027.

Italy Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

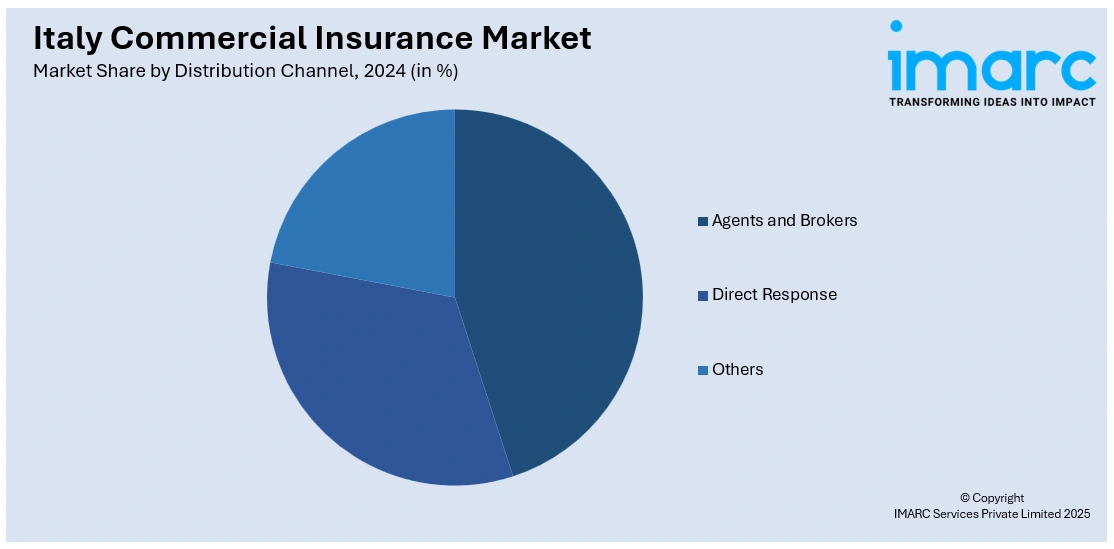

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Commercial Insurance Market News:

- In August 2025, French insurer AXA announced the acquisition of a 51% stake in Italian direct insurer Prima for €500 million. The move aims to strengthen AXA's presence in Italy’s motor insurance market, where Prima holds a 10% retail share. The deal includes options for AXA to acquire the remaining 49% by 2029 or 2030.

- In April 2024, the Ardonagh Group agreed to acquire Mansutti S.r.l., the commercial lines arm of Italian broker Mansutti S.p.A. The Milan-based firm serves 8,000 SME clients across various lines, with €45.5 Million in gross written premiums. This move follows acquisitions of Mediass and Teksure, reinforcing Ardonagh Italia’s position. The deal, subject to regulatory approval, aligns with Ardonagh’s strategy to expand its presence through premium, independent brokers across Europe.

Italy Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy commercial insurance market on the basis of type?

- What is the breakup of the Italy commercial insurance market on the basis of enterprise size?

- What is the breakup of the Italy commercial insurance market on the basis of distribution channel?

- What is the breakup of the Italy commercial insurance market on the basis of industry vertical?

- What is the breakup of the Italy commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Italy commercial insurance market?

- What are the key driving factors and challenges in the Italy commercial insurance market?

- What is the structure of the Italy commercial insurance market and who are the key players?

- What is the degree of competition in the Italy commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)