Italy Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Italy Cryptocurrency Market Overview:

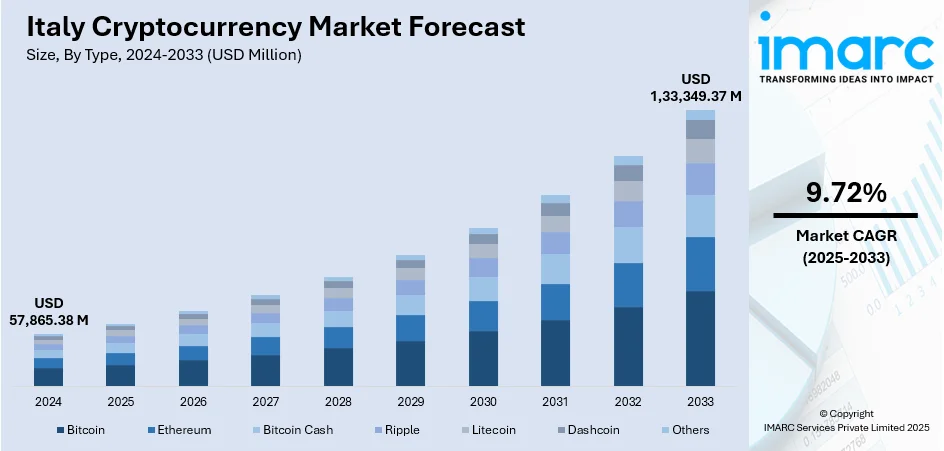

The Italy cryptocurrency market size reached USD 57,865.38 Million in 2024. The market is projected to reach USD 1,33,349.37 Million by 2033, exhibiting a growth rate (CAGR) of 9.72% during 2025-2033. Supportive government policies, including clear tax regulations and blockchain integration, are driving cryptocurrency adoption and innovation in Italy. Besides this, the growing tourism activities are catalyzing the demand for digital payments, encouraging local businesses to accept cryptocurrencies. Government backing is attracting investors and startups, while tourism is boosting digital asset transactions, leading to a steady increase in the Italy cryptocurrency market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 57,865.38 Million |

| Market Forecast in 2033 | USD 1,33,349.37 Million |

| Market Growth Rate 2025-2033 | 9.72% |

Italy Cryptocurrency Market Trends:

Supportive government policies

Supportive government policies are fostering a more transparent, regulated, and innovation-friendly environment in Italy. The Italian government and big financial groups are implementing measures aimed at clarifying the legal and tax frameworks surrounding digital assets, which is enhancing investor confidence and encouraging participation from both individuals and institutions. In March 2025, the Bank of Italy and the financial authority CONSOB implemented new accounting regulations for publicly traded firms that possessed crypto assets. According to the revised regulations, auditing firms and statutory auditors were required to provide more transparent financial disclosures regarding digital assets. By recognizing cryptocurrencies under a legal framework and introducing guidelines for taxation and anti-money laundering compliance, Italy is reducing regulatory uncertainty, attracting blockchain startups and crypto exchanges. Furthermore, Italy’s alignment with broader EU initiatives reflects a proactive approach towards harmonized crypto governance, which is strengthening cross-border trade and investment. Government-led initiatives to integrate blockchain in public services and digital identity systems have also added legitimacy to crypto technologies. Additionally, the availability of licenses for crypto service providers through a centralized registry facilitates smoother market entry and operational clarity. These policies collectively are creating a conducive ecosystem for crypto innovation and adoption, helping Italy position itself as a growing hub in the European digital asset landscape. With increased regulatory clarity, institutional involvement, and government engagement, the supportive policy environment is playing an important role in shaping the trajectory of the Italy cryptocurrency market.

To get more information on this market, Request Sample

Increasing tourism activities

Rising tourism activities are fueling the Italy cryptocurrency market growth. According to industry reports, Italy hosted an unprecedented 65 Million foreign tourists in 2024. As Italy continues to attract millions of international tourists, particularly from regions with high crypto usage, there is increasing pressure on the hospitality, retail, and transportation sectors to offer more flexible and tech-savvy payment solutions. Accepting cryptocurrencies allows businesses to cater to a global clientele, reduce transaction fees, and avoid currency exchange complexities, which enhances customer convenience and operational efficiency. This shift is further amplified in popular tourist cities like Rome, Venice, and Florence, where tech-forward establishments are beginning to integrate digital wallets and blockchain-based systems. The increased footfall from tourists who prefer decentralized finance options acts as a catalyst for local adoption and market expansion. As a result, the tourism sector is stimulating investment, infrastructure development, and public interest in crypto technologies, thereby playing an important role in propelling the growth of the cryptocurrency market across Italy.

Italy Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

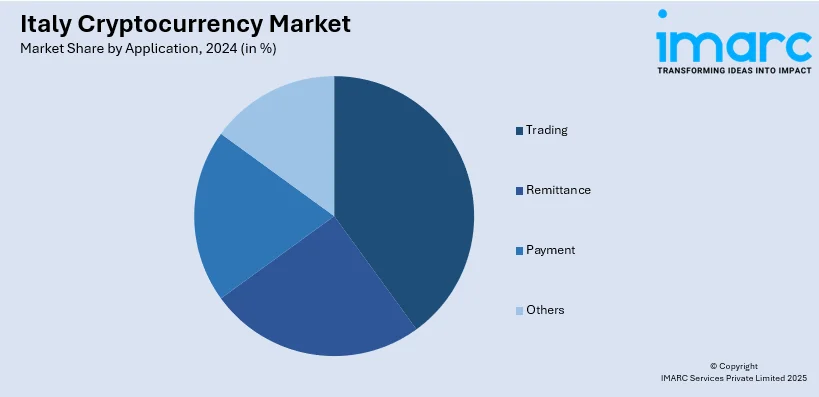

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Cryptocurrency Market News:

- In July 2025, Italian Bank UniCredit SpA declared new investment in BlackRock’s Bitcoin ETF IBIT. The bank aimed to provide professional clients with a five-year structured product that could safeguard against losses while allowing exposure to Bitcoin ETF performance.

- In January 2025, Intesa Sanpaolo, the biggest banking group in Italy, acquired 11 Bitcoins for around 1 Million Euros (USD 1 Million), marking the first direct investment in crypto by an Italian bank. This acquisition signified a significant achievement for the cryptocurrency industry in Italy, as Intesa Sanpaolo positioned itself as a pioneer in embracing digital assets within the country’s conventional financial framework.

Italy Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy cryptocurrency market on the basis of type?

- What is the breakup of the Italy cryptocurrency market on the basis of component?

- What is the breakup of the Italy cryptocurrency market on the basis of process?

- What is the breakup of the Italy cryptocurrency market on the basis of application?

- What is the breakup of the Italy cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the Italy cryptocurrency market?

- What are the key driving factors and challenges in the Italy cryptocurrency market?

- What is the structure of the Italy cryptocurrency market and who are the key players?

- What is the degree of competition in the Italy cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)