Italy Data Center Market Size, Share, Trends and Forecast by Component, Type, Enterprise Size, End User, and Region, 2026-2034

Italy Data Center Market Size and Share:

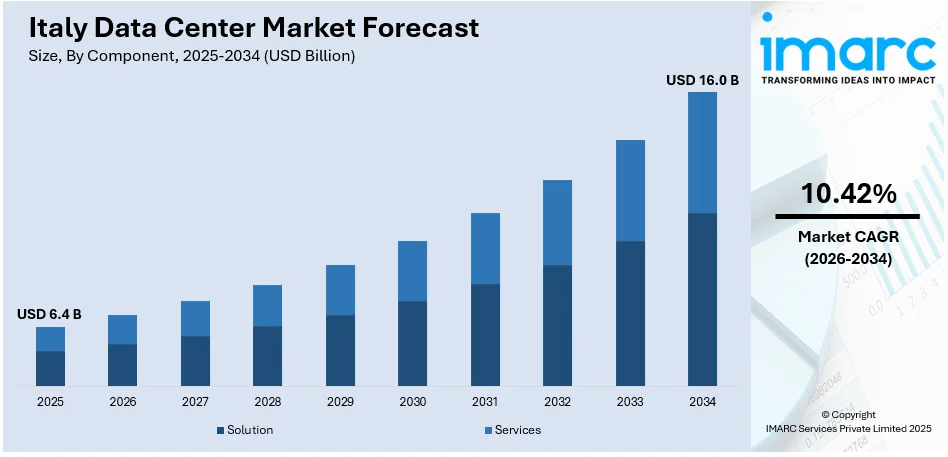

The Italy data center market size was valued at USD 6.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 16.0 Billion by 2034, exhibiting a CAGR of 10.42% during 2026-2034. Northwest dominates the market, holding a significant market share in 2025. The market is fueled by fast digital evolution, increasing cloud, and growing demand for storing and processing data across sectors. Hybrid IT infrastructures adopted by businesses, increasing internet use, IoT applications, and 5G rollout are creating demand for low-latency and high-performance data centers. Italy's strategic position as a connectivity gateway between Europe and other parts of the world boosts its attractiveness, drawing in foreign investments in scalable and energy-efficient data center facilities, further increasing the Italy data center market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.4 Billion |

| Market Forecast in 2034 | USD 16.0 Billion |

| Market Growth Rate (2026-2034) | 10.42% |

The accelerated nature of digitalization in Italy's public and private sectors is the key catalyst to the Italy data center market. Companies are increasingly shifting workloads onto digital platforms in a bid to achieve greater agility, data access, and operational performance. The movement is preceded by increasing dependency on cloud computing with companies preferring hybrid and multi-cloud setups in terms of coping with different IT demands. Industry verticals like banking, healthcare, retail, and manufacturing are utilizing data centers to handle immense amounts of data, facilitate real-time analytics, and provide remote working functions. The digital innovation push by the Italian government through initiatives such as the National Recovery and Resilience Plan (PNRR) further fuels this momentum by investing in public services' digitalization. As more enterprises embrace data-driven strategies, there is increasing demand for secure, scalable, and high-performance data centers, thus bringing digital transformation to the forefront of Italy data center market growth.

To get more information on this market Request Sample

Another major contributor to the Italy data center market is the increase in data consumption and the demand for high-connectivity infrastructure. The extensive adoption of smartphones, streaming services, IoT devices, and cloud applications has generated exponential data traffic growth. In response to this demand, businesses and service providers are investing in data centers that offer fast connectivity, low latency, and high network stability. Italy's favorable geographical location in Southern Europe also renders it an important gateway for intercontinental data traffic, with investments pouring in from international cloud providers and colocation facilities. Submarine cable developments and upgrades in fiber optic networks are increasing Italy's position as a digital transit hub. Moreover, with businesses adopting 5G and edge computing, data centers are being installed near end-users to facilitate quicker data delivery and enhanced application performance. These connectivity developments, together with demand from users, are key to fueling the continued growth of Italy's data center market.

Italy Data Center Market Trends:

Rising Focus on Market Expansion

The increasing focus on expanding data center services due to the digital transformation efforts across various industries is impelling the market growth in the country. In 2024, the Government of Italy assigned €47 Billion Euro, or 26%, of its total Recovery and Resilience Plan (PNRR) allocation, along with €5.5 Billion Euro in EU Cohesion Policy funding, for digital initiatives, as per the International Trade Administration (ITA). There is a rise in the need for scalable and reliable infrastructure to support data storage, processing, and networking requirements. In addition, Italy's strategic location within Europe makes it an attractive destination for data center expansion. Its proximity to major European markets provides access to a larger consumer base while offering connectivity to diverse international networks. Besides this, the adoption of cloud services is catalyzing the demand for data center infrastructure in Italy. Cloud service providers are expanding their presence in the country to cater to the growing demand for cloud-based solutions, thereby driving the market expansion. Furthermore, data center operators are expanding their footprint to deploy edge infrastructure closer to end-users, enabling faster data processing and response times. They are also increasingly focusing on sustainability and environmental responsibility. In May 2024, Amazon's computing unit AWS planned to invest billions of euros in the expansion of its data center business in Italy as a part of the tech giant's effort to enhance its cloud offer in Europe.

Increasing Utilization of Internet Services

The rising utilization of smartphones and internet services is catalyzing the demand for data centers in the country. According to the World Bank Group, in 2023, 87% of the population of Italy had access to the internet. Data centers are essential for efficiently handling and processing large amounts of data. Moreover, the shift towards remote work and online collaboration tools increased the demand for cloud-based productivity suites, video conferencing platforms, and virtual desktop infrastructure (VDI). These services rely on data centers to deliver reliable connectivity, storage, and computing resources to remote users. Additionally, many mobile apps rely on cloud services and data centers for storage, computation, and data processing. As the number of mobile apps and their user base increases, so does the demand for data center resources. Furthermore, the number of internet users in Italy was 51.56 million at the beginning of 2024, as per Ecommerce Italia.

Italy Data Center Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Italy data center market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on component, type, enterprise size, and end user.

Analysis by Component:

- Solution

- Services

Solution stands as the largest component in 2025, holding 67.8% of the market share. The solution category consists of basic infrastructure elements like power management systems, cooling equipment, servers, network equipment, and storage devices. As data traffic increases and there is more dependence on cloud computing, companies are moving towards energy-efficient and scalable technologies. Demand for modular data centers is also increasing, which provides flexibility and quicker deployment. Firms emphasize cutting-edge hardware and integrated systems to provide high performance, data protection, and adherence to local regulations.

Analysis by Type:

- Colocation

- Hyperscale

- Edge

- Others

Colocation stands as the largest component in 2025. Colocation continues to be a major sector according to the Italy data center market forecast, providing space, power, and cooling facilities for businesses looking for secure data hosting without facilities ownership. With increasing data demands and cost pressures, companies prefer colocation to guarantee security, scalability, and uptime. The strategic position of Italy in Europe increases its attractiveness as a colocation hub, with global and regional players opting to locate their facilities there. Demand is most pronounced in financial services, healthcare, and content delivery markets looking to minimize latency and enhance operational resilience.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises lead the market with 67.9% of market share in 2025. Large businesses fuel significant demand in the Italy data center market because they need large-scale data processing, storage, and compliance solutions. These businesses tend to use colocation and hyperscale facilities to enable high-performance computing and global connectivity. Banking, telecommunications, and manufacturing industries need strong infrastructure to provide uptime and data security. As AI, big data, and digital transformation projects see widespread adoption, large businesses continue to invest significantly in scalable and effective data center solutions.

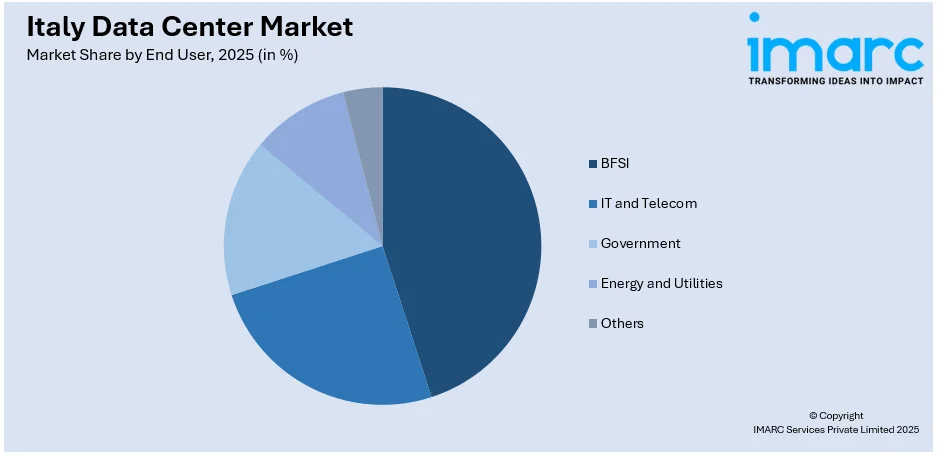

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

BFSI leads the market share in 2025. The BFSI industry is the key sector powering Italy's data center landscape with high demand for secure, compliant, and availability infrastructure. Banks are digitally transforming operations, taking up mobile banking, and dealing with rising numbers of transactions on which they are dependent, to a significant extent, upon robust data centers that can enable them to deal with risk as well as storing data. Tough regulatory environments also demand robust systems, disaster recovery, and immediate data access, so colocation and managed services become imperative to ensure continuity and competitive edge, which further shapes the Italy data center market outlook.

Regional Analysis:

- Northwest

- Northeast

- Central

- South

- Others

In 2025, Northwest accounted for the largest market share. Northwest Italy, is a major player according to the Italy data center market, owing to its strong infrastructure, with high grid reliability and access to green energy sources, positioning itself as a prime location for investing in data centers. Northwest Italy's position also provides greater connectivity, enabling seamless data transfer both within Europe and further afield. Government efforts, including tax breaks and expedited permitting procedures, further facilitate the creation of data centers within the region. Such a concatenation of factors places Northwest Italy as an emerging hub for digital infrastructure in Europe.

Competitive Landscape:

Major players in the Italy data center market are pushing growth through strategic investment, technological advancements, and expansion of infrastructure. Leading companies are developing new data center facilities in prime locations like Milan and Rome by taking advantage of Italy's favorable position as a connectivity point between Europe, Africa, and the Middle East. These operators are concentrating on putting up sustainable and energy-efficient data centers, employing the latest cooling technology and renewable resources to drive eco-friendly objectives. Collaborations and tie-ups with cloud service providers, telecommunication services, and local governments are also fueling market expansion and growth in capacity. Top operators are also committing to hyperscale and edge facilities to address the increasing demand from BFSI, health care, and e-commerce segments. Improved cybersecurity, European data protection compliance, and tailor-made colocation facilities are becoming market priorities. Moreover, the use of automation, AI, and software-defined infrastructure is enhancing operational efficiency. As Italy's digitalization grows across public and private sectors, players are taking roles as indispensable national and regional data resilience enablers. Their emphasis on customer-centricity, connectivity, and sustainability is playing a very influential role in shaping the competitive environment and long-term growth of the market.

The report provides a comprehensive analysis of the competitive landscape in the Italy data center market with detailed profiles of all major companies, including:

Latest News and Developments:

- April 2025: Italian AI startup iGenius, in collaboration with Vertiv and NVIDIA, launched Colosseum—one of the world’s largest sovereign AI data centers—in southern Italy. Designed for regulated sectors like finance and healthcare, Colosseum integrates Vertiv's 360AI infrastructure with NVIDIA's DGX SuperPOD and Grace Blackwell Superchips, ensuring exceptional computational power, energy efficiency, and stringent data sovereignty.

- April 2025: APL Data Center expanded into Italy by opening a Milan branch. This move supports its European growth strategy, particularly catering to hyperscaler clients. The Milan team is managing large-scale projects totaling 75MW IT power (approximately 150,000 servers).

- April 2025: CyrusOne revealed plans to construct MIL2, its second data center in Milan, with 18,000 sq. m of technological area across three levels and up to 54 megawatts of IT capability. The disclosure comes after the purchase of a 19.68-acre property near Linate Airport, strategically situated inside the municipalities of Milan and Segrate.

- February 2025: Italian oil and gas company Eni inked a Letter of Intent with the investment firms MGX and G42 to build up to 1GW of new data centers in Italy. The electricity for these facilities will be provided by Eni’s blue power, which is produced by natural gas power plants that absorb and store CO2 emissions.

- February 2025: VIRTUS Data Centers announced that it would be establishing its first Italian facility in Cornaredo, Milan. Set on a 71,000 sqm brownfield site, the data center will offer 70MW of grid power, catering to hyperscalers, enterprises, and service providers.

Italy Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Colocation, Hyperscale, Edge, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | BFSI, IT And Telecom, Government, Energy and Utilities, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy data center market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Italy data center market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Italy data center market was valued at USD 6.4 Billion in 2025.

The Italy data center market is projected to exhibit a CAGR of 10.42% during 2026-2034, reaching a value of USD 16.0 Billion by 2034.

Italy’s data center market is driven by increased cloud adoption, digital transformation across sectors, and the growing demand for data storage and processing. The expansion of 5G, IoT, and edge computing, combined with government digital initiatives and strategic geographic positioning, further fuels infrastructure development and market growth.

Northwest currently dominates the Italy data center market, driven by its robust infrastructure, including high grid reliability and access to renewable energy sources, making it an attractive destination for data center investments. Additionally, Northwest Italy's strategic location offers enhanced connectivity, facilitating seamless data flow across Europe and beyond. Government initiatives, such as tax incentives and streamlined permitting processes, further encourage the development of data centers in the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)