Italy E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2026-2034

Italy E-Invoicing Market Summary:

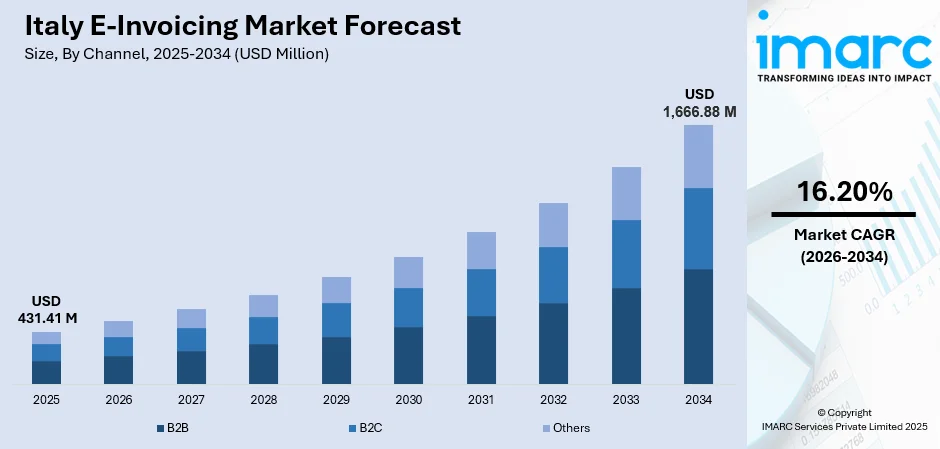

The Italy e-invoicing market size was valued at USD 431.41 Million in 2025 and is projected to reach USD 1,666.88 Million by 2034, growing at a compound annual growth rate of 16.20% from 2026-2034.

The Italy e-invoicing market is experiencing strong growth due to strict regulatory mandates that require electronic invoicing for both business-to-business (B2B) and business-to-consumer (B2C) transactions. These regulations, aimed at increasing transparency, reducing tax evasion, and improving efficiency, are leading to widespread adoption of e-invoicing solutions, encouraging businesses to comply with legal requirements while streamlining invoicing processes and enhancing financial operations.

Key Takeaways and Insights:

-

By Channel: B2B dominates the market with a share of 66.02% in 2025, driven by mandatory electronic invoicing requirements for inter-business transactions and seamless integration with enterprise resource planning (ERP) systems enabling automated invoice processing.

-

By Deployment Type: Cloud-based leads the market with a share of 75.10% in 2025, due to its scalability advantages, reduced infrastructure costs, automatic regulatory updates, and subscription-based pricing models that lower entry barriers for small and medium enterprises.

-

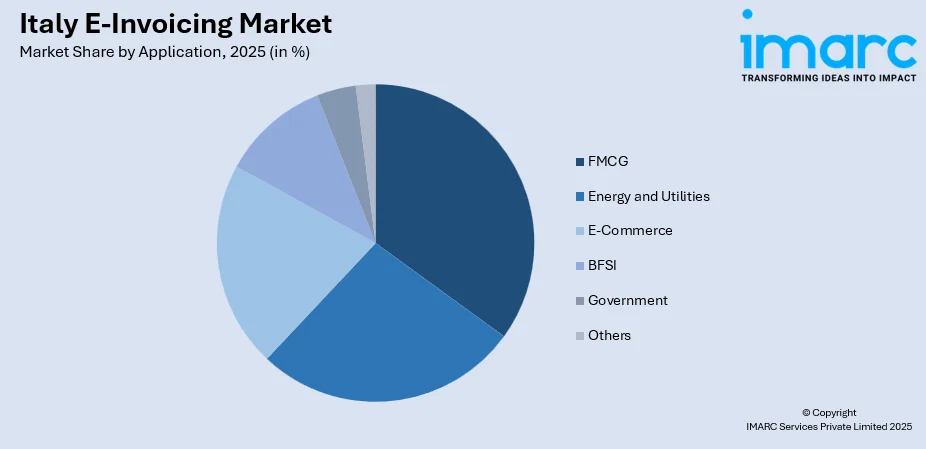

By Application: FMCG represents the largest segment with a market share of 20.08% in 2025, owing to high transaction volumes, complex supply chain networks requiring automated invoicing, and stringent regulatory compliance demands across retail distribution channels.

-

Key Players: The Italy e-invoicing market exhibits intense competitive dynamics, with established enterprise software providers competing alongside specialized compliance solution vendors. Market participants are differentiating through advanced automation capabilities, multi-country compliance coverage, and seamless ERP integration features.

To get more information on this market Request Sample

The Italy e-invoicing market is driven by the the regulatory requirement imposed by the Italian Revenue Agency for electronic invoicing in all business-to-business transactions. This stringent measure is designed to enhance tax compliance and mitigate fiscal fraud. This government compulsion acts as a powerful catalyst for enterprise-wide digital transformation as businesses transition to automated e-invoicing solutions to realize substantial savings from paper elimination and streamlined workflows. This need for robust compliance solutions is intensifying the market for IT consulting services. In 2024 Accenture announced its acquisition of Intellera Consulting an Italian firm specializing in the public administration and healthcare sectors. This strategic move directly strengthens Accenture’s capacity to drive digital transformation and support the use of data and AI within Italy's public sector including the critical and complex area of e-invoicing compliance thus affirming the market’s underlying growth trajectory which is also driven by the rising emphasis on data security and real-time financial reporting.

Italy E-Invoicing Market Trends:

Increased Adoption of Digital Transformation

With the increasing adoption of advanced technologies, such as cloud computing, AI, and automation, many companies in Italy are shifting towards e-invoicing solutions. These digital tools enhance operational efficiency by reducing manual processes, improving accuracy, and enabling real-time data access. As businesses continue to embrace digitalization, the transition from traditional invoicing methods to e-invoicing accelerates, contributing to the market growth. For example, in 2025, Vodafone Italy successfully modernized its data architecture by migrating to Google Cloud, integrating AI-driven capabilities and real-time data processing to improve scalability and operational efficiency, further highlighting the benefits of digital transformation.

Globalization and Cross-Border Trade Requirements

Italy is actively participating in global trade, which is leading to the adoption of e-invoicing, particularly for cross-border transactions. As international business practices evolve, compliance with global invoicing standards becomes crucial. E-invoicing offers an efficient solution for managing transactions across different jurisdictions, ensuring adherence to international tax laws and reporting requirements. For Italian businesses engaged in cross-border trade, e-invoicing streamlines the invoicing process, enabling smoother and faster transactions with foreign partners. For instance, in 2025, AP Italian Luxury announced an exclusive B2B distribution agreement with Perricone MD, underscoring the importance of efficient invoicing systems in global business operations.

Government Mandates and Regulatory Compliance

The Italy e-invoicing market is primarily driven by stringent government regulations aimed at enhancing tax compliance and reducing VAT fraud. The Italian Revenue Agency (Agenzia delle Entrate) mandated e-invoicing for all B2B transactions, requiring businesses to adopt digital invoicing solutions. This regulation seeks to improve tax collection transparency and streamline tax processes, positioning e-invoicing as a critical compliance tool for businesses of all sizes. The mandate, which expanded on January 1, 2024, to include micro-businesses with annual revenues up to €25,000, further accelerates adoption. The use of the Sistema di Interscambio (SdI) platform for issuing and receiving invoices has made compliance mandatory, broadening the market across sectors.

Market Outlook 2026-2034:

The Italy e-invoicing market is poised for exceptional growth, driven by regulatory consolidation and technological advancements in digital tax compliance. The market generated a revenue of USD 431.41 Million in 2025 and is projected to reach a revenue of USD 1,666.88 Million by 2034, growing at a compound annual growth rate of 16.20% from 2026-2034. The increasing adoption of e-invoicing solutions, coupled with stricter tax regulations and digitalization efforts, is driving the widespread integration of automated invoicing systems across various sectors, impelling the market growth.

Italy E-Invoicing Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Channel |

B2B |

66.02% |

|

Deployment Type |

Cloud-based |

75.10% |

|

Application |

FMCG |

20.08% |

Channel Insights:

- B2B

- B2C

- Others

B2B dominates with a market share of 66.02% of the total Italy e-invoicing market in 2025.

B2B represents the largest segment owing to the mandatory regulatory requirements for electronic invoicing between businesses. The widespread adoption of e-invoicing solutions in the B2B sector is driven by the need for compliance, transparency, and efficiency in managing business transactions.

Furthermore, B2B transactions involve larger volumes and higher-value invoices, making automation and digital solutions essential. E-invoicing streamlines the process, reduces manual errors, and ensures faster processing times, making it the preferred choice for businesses to manage invoicing efficiently and comply with tax regulations.

Deployment Type Insights:

- Cloud-based

- On-premises

Cloud-based dominates with a market share of 75.10% of the total Italy e-invoicing market in 2025.

Cloud-based holds the biggest market share due to its scalability, flexibility, and cost efficiency. Businesses can easily scale their e-invoicing systems to accommodate growing transaction volumes without investing in expensive infrastructure, making cloud solutions highly attractive for companies of all sizes.

Additionally, cloud-based system offers real-time updates, automatic tax regulation compliance, and seamless integration with existing business software. This ease of access and low maintenance requirements make cloud deployment the preferred choice for organizations looking to streamline invoicing processes and enhance operational efficiency in a secure environment.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

FMCG exhibits a clear dominance with a 20.08% share of the total Italy e-invoicing market in 2025.

FMCG leads the market, driven by the high volume of transactions and the need for efficient invoicing systems. The sector requires fast, automated solutions to handle large numbers of daily invoices, making e-invoicing essential for streamlining operations and ensuring compliance.

Additionally, FMCG companies often operate across multiple regions and deal with a vast network of suppliers and customers. E-invoicing systems allow for seamless integration across the supply chain, improving transparency, reducing processing times, and minimizing errors, which is crucial in this fast-paced industry.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

Northwest is known for its strong industrial base, particularly in manufacturing and technology sectors. As businesses in this area increasingly adopt digital solutions, the demand for e-invoicing systems is growing, driven by efficiency and regulatory compliance needs.

Northeast is a hub for small to medium-sized enterprises (SMEs), especially in sectors like machinery, electronics, and textiles. These businesses are rapidly adopting e-invoicing solutions to streamline invoicing processes, enhance productivity, and meet regulatory requirements.

Central, including regions like Tuscany and Lazio, is witnessing higher adoption of e-invoicing, driven by a strong mix of public and private sector businesses. The region’s diverse economy encourages the integration of e-invoicing systems to improve operational efficiency and ensure compliance.

South, with its expanding digital infrastructure, is seeing an increase in the demand for e-invoicing. Local businesses are adopting these solutions to modernize operations, reduce administrative costs, and comply with Italy’s growing e-invoicing regulations, contributing to market expansion.

Others are experiencing gradual growth in e-invoicing adoption as digital transformation efforts extend beyond major urban centers. As more businesses seek streamlined, efficient invoicing solutions, the demand for e-invoicing systems continues to rise across the country.

Market Dynamics:

Growth Drivers:

Why is the Italy E-Invoicing Market Growing?

Growth of E-Commerce and Digital Business Models

The expansion of e-commerce and digital business models in Italy is significantly influencing the e-invoicing market. As more businesses operate online, digital invoicing becomes essential for managing transactions efficiently and complying with tax regulations. According to the IMARC Group, Italy's e-commerce market size reached USD 622.1 million in 2024. E-invoicing facilitates seamless and automated billing for e-commerce platforms, enabling quicker and more secure financial transactions. With the rise of digital businesses, particularly in sectors such as retail, services, and technology, e-invoicing adoption is set to continue growing as a key component of online business operations.

Support for Small and Medium Enterprises (SMEs)

E-invoicing offers significant advantages for small and medium enterprises (SMEs) in Italy, helping them tackle challenges such as cash flow management, high administrative costs, and tax compliance. As per government data, Italian SME employment grew by 2.2% in 2024, slightly surpassing the 1.9% growth in 2023. This growth reflects the growing need for e-invoicing to provide an affordable, scalable solution to streamline invoicing processes, reduce operational costs, and minimize the risk of errors. Government incentives and support programs are further encouraging SMEs to transition to e-invoicing, making it a valuable tool for remaining competitive.

User Demand for Faster, Transparent Transactions

Individuals are demanding for faster and more transparent transactions, which is encouraging businesses in Italy to adopt e-invoicing solutions. As people increasingly expect prompt billing and clear transaction records, companies must implement technology that ensures faster processing, digital receipts, and secure payments. In 2025, Salt Edge launched its innovative bulk payments solution in Italy, designed to streamline mass payouts for fintechs, SaaS platforms, and high-volume enterprises. This service replaces outdated batch methods, enabling faster, more cost-effective financial operations. E-invoicing meets these demands by reducing delays and providing transparency, enhancing the overall customer experience and prompting widespread adoption across industries.

Market Restraints:

What Challenges the Italy E-Invoicing Market is Facing?

Integration Complexity with Legacy Enterprise Systems

Many long-established enterprises in Italy rely on outdated accounting and enterprise resource planning systems, which require significant customization to integrate seamlessly with the new electronic invoicing system. Overcoming technical challenges such as format compliance, implementing digital signatures, and ensuring compatibility with real-time transmission protocols introduces obstacles. These issues extend the timeline for implementation, increase costs, and complicate the transition process for organizations.

Initial Implementation Costs Constraining Small Enterprise Adoption

Despite the availability of cloud platforms, the initial financial outlay for system integration, staff training, and process reconfiguration presents a significant barrier for small businesses and sole proprietors. With limited technology budgets, these businesses struggle to meet the costs associated with implementing compliance requirements. The removal of turnover-based exemptions adds pressure, intensifying the financial burden on smaller enterprises and reducing their ability to adopt the new system.

Data Security and Privacy Compliance Concerns

The transmission of electronic invoices through government-controlled platforms raises significant concerns about the protection of sensitive commercial data and competitive information. With privacy issues at the forefront, businesses face challenges in ensuring that their data is safeguarded. The ongoing prohibition of e-invoicing within certain sectors, designed to protect confidentiality, highlights the difficulty of balancing strict compliance requirements with the need to maintain robust data security across industries.

Competitive Landscape:

The Italy e-invoicing market exhibits dynamic competitive intensity characterized by established enterprise software providers competing alongside specialized compliance solution vendors and emerging fintech platforms. Market participants differentiate through multi-country compliance coverage, advanced automation capabilities utilizing AI, and seamless integration with major ERP ecosystems. Competition increasingly centers on value-added services beyond basic compliance, including embedded finance integration, real-time analytics, and predictive cash flow management. Strategic partnerships between global compliance specialists and regional platform providers are accelerating as cross-border requirements intensify and European harmonization initiatives advance.

Recent Developments:

-

In February 2025, Italy introduced version 1.9 of its e-invoicing technical specifications, set to take effect on April 1, 2025. The update includes new requirements for reporting invoicing irregularities, changes in the cross-border VAT exemption regime, and updated error codes. These updates aim to improve the country's digital tax systems and enhance efficiency in invoicing practices for businesses and public administrations.

-

In December 2024, the European Union published the Council's decision authorizing Italy to extend its mandatory e-invoicing system until December 31, 2027. The decision, published in the EU Official Journal, ensures the continuation of this digital invoicing initiative, aimed at increasing transparency and efficiency in the taxation system. This extension highlighted Italy's commitment to enhancing its digital infrastructure and fiscal accountability.

Italy E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Italy e-invoicing market size was valued at USD 431.41 Million in 2025.

The Italy e-invoicing market is expected to grow at a compound annual growth rate of 16.20% from 2026-2034 to reach USD 1,666.88 Million by 2034.

B2B holds the largest revenue share at 66.02% in 2025, driven by mandatory electronic invoicing requirements for inter-business transactions and seamless ERP integration enabling automated invoice processing across supply chains.

Key factors driving the Italy e-invoicing market include the implementation of mandatory regulations from the Italian Revenue Agency, aiming to improve tax compliance and reduce VAT fraud. In 2024, the mandate expanded to include micro-businesses, requiring the use of the Sistema di Interscambio (SdI) platform, further boosting adoption.

Major challenges include integration complexity with legacy enterprise systems requiring significant customization, initial implementation costs constraining micro-enterprise adoption, data security concerns regarding sensitive commercial information transmission, and technical adaptation challenges for cross-border invoice format compliance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)